Sunday Apr 20, 2025

Sunday Apr 20, 2025

Friday, 22 November 2024 01:09 - - {{hitsCtrl.values.hits}}

It appears that FDIs most probably have deliberately avoided investing in SL mainly due to the poor political instability prevailing in the country from about 1956

|

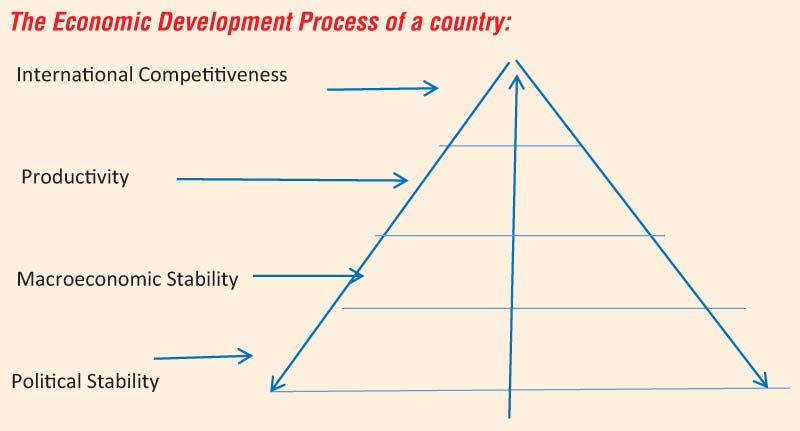

The intention of this paper is to indicate the pathway that Si Lanka could take to achieve prosperity and poverty alleviation, as suggested by my Sinhala book titled ‘Directing the Sri Lankan economy on to a correct path’ published a couple of months ago. See the given figure.

The intention of this paper is to indicate the pathway that Si Lanka could take to achieve prosperity and poverty alleviation, as suggested by my Sinhala book titled ‘Directing the Sri Lankan economy on to a correct path’ published a couple of months ago. See the given figure.

As shown in the figure, the economic development process of a country like some of those in South East Asia starts from the establishment of an enabling environment of political stability actively promoted by a dynamic leader.

Table 1 shows how the Foreign Direct Investment (FDI) attracted by some of the countries of South East Asia, unlike in Sri Lanka (SL), enabled by their capital, technologies, skills and international market access, that has apparently boosted exports, which in turn have created jobs that have helped to reduce poverty.

Similarly FDIs are needed for the development of Sri Lanka as its savings are small (about 29% per year), it does not have sufficient advanced skills, technologies and adequate international market access for its goods and services. But FDI inflows to SL have been minimal when compared to the other countries mentioned in Table 1.

It appears that FDIs most probably have deliberately avoided investing in SL mainly due to the poor political instability prevailing in the country from about 1956. Political instability can be described as conditions prevailing in the country including the absence of ethnic unity, the rule of law and leaders capable of correcting such a situation. So it is up to the Government to resort to even changes to the constitution to correct this situation to be capable of attracting FDI.

Macroeconomic stability

Macroeconomic stability exists when key economic relationships such as government’s revenue and expenditure are in balance, inflation is low, investment is positive, public debts especially foreign debts are low, there is a positive balance of payments and when the economy is growing, etc. Sri Lanka’s position has been negative much of the time with regard to all these economic features. In other words macroeconomic stability has been absent in SL, so that Economic development and poverty alleviation have failed. So much so that the International Monitory Fund (IMF) has been called in to help.

Productivity

Productivity measured in output per man hour is the relationship between the output of an economic unit and the factor inputs such as labour, capital and technology, that have been included in producing that output. An example is that if it takes 10 workers to assemble a car within 10 days using simple instruments such as spanners, it would be possible for the same 10 workers to produce 10 cars per day if they are supplemented by using modern technological instruments such as an assembly line with automatically controlled machines. In fact Michael E Porter, the author of the book “The Competitive Advantage of Nations” says “The only meaningful concept of competitiveness at the national level is national productivity”.

It should be added that the main contributors to the productivity of a nation are its private sector firms as their management is more efficient than that of its state owned enterprises especially in Sri Lanka. So the Government has to encourage the private sector firms to compete among themselves so that prices could come down and quality along with productivity can be improved. Table 2 shows per worker labour productivity of selected Asian nations and Sri Lanka mentioned in Table 1 in American $ pertaining to the year 2020 and their International Competitiveness for 2022.

International competitiveness

So far SL has not made an effort to be a major exporter of products and services to earn considerable foreign exchange to meet its own needs and for inputs but also for payment of our foreign debts. Instead it has sought to protect its enterprises by imposing high import duties. But now has apparently realised it needs to export in a big way by not only lowering import tariffs gradually but also by formulating an export development strategy of converting its goods and services for meeting the needs of consumers abroad in competition with existing suppliers from other nations. An essential part of this strategy is creating political stability by leaders to enable the attraction of FDI. See Table 1 which shows how this has happened in some East Asian nations in comparison to SL. See also the high level of productivity and competiveness of these nations in Table 2. It may be noted that the competitiveness of a nation is arrived by dividing the average wage in that country by the rate of productivity of the same country.

Conclusion

The path to prosperity of Sri Lanka starts from political stability to enable it to attract mainly FDI as it lacks the capital, skills, technologies and the required international market access to start an export-led strategy of economic development to achieve higher growth and reduce poverty. In this strategy it is important to emphasise on promoting especially the productivity (of the private sector, (which has been described as the ‘the engine of growth’) apart from upgrading the macroeconomic stability of the country and the international market access as shown in the given figure.

(The writer is a Development Economist.)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.