Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 14 September 2024 00:00 - - {{hitsCtrl.values.hits}}

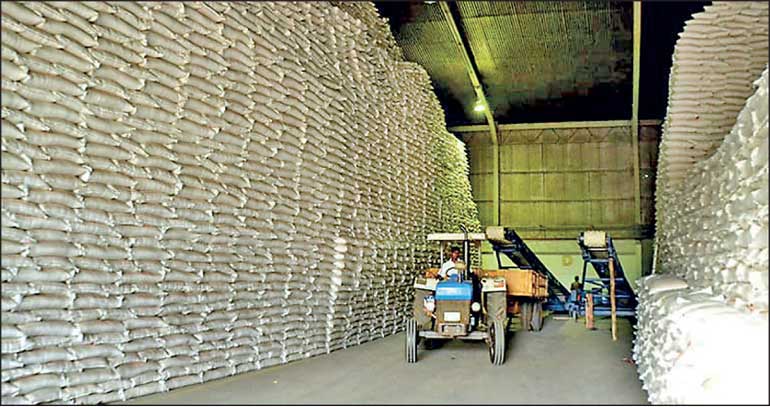

Pelwatte and Sevenagala sugar factories are supposed to carry a stock of 1.3 million litres unable to sell

A friend had sent me an extract of a statement made by State Minister for Investment Promotion Dilum Amunugama titled ‘Sri Lanka state sugar firms drowned in unsold ethanol’.

A friend had sent me an extract of a statement made by State Minister for Investment Promotion Dilum Amunugama titled ‘Sri Lanka state sugar firms drowned in unsold ethanol’.

The two sugar firms referred to are Pelwatte and Sevenagala sugar factories. They are supposed to carry a stock of 1.3 million litres unable to sell.

He attributes this problem to the economic crisis and tax hikes.

In 1968 I took over as Distillery Manager at the then Government-owned distillery at the Kantale Sugar Factory. That is the reason for my friend to refer this to me to comment.

There were other comments that he had made. (i) Legal alcohol companies showed that some have suffered sales falls as much as 70% at times (ii) In Sri Lanka sugar and ethanol is protected by import taxes and domestic production is price competitive (iii) We cannot export as our cost of production is high (iv) Due to the high taxes illegal alcohol sales have appeared to have gone up (v) Sri Lanka’s alcohol demand usually recovers as disposable income recovers about two years after the currency crisis ends. This time however the rupee fell from 200 to around 300.

Mr. Minister, I regret to say that whoever provided the above information had misled you. All this indicates the lack of professionalism among those who decide on the country’s economic policy. See “Legal alcohol companies showed that some have suffered sales falls as much as 70 percent at times”. The loss of income to the Government as excise taxes, VAT and other must have run into trillions of rupees already.

Where the problem started

From 1956 to about 1995, the country had a unit to plan the country’s economic policy. It was composed of technocrats from varying specialities. In mid 1990s this unit was disbanded and was staffed with officers of one speciality. That is where the problem started.

Another factor that contributed would have been providing power to the ministers to appoint and discipline public servants.

Since the departure of Ronnie de Mel, the ministry itself was manned by politicians with no known background in economic theory. Resulting from the above ad-hoc decisions had been taken, which had led to the present pathetic pass.

The information I have is that about four years ago the Government decided to ban the import of alcohol forcing those that bottle – the so called legal alcohol – to purchase their requirements from the local manufacturers. The local manufacturers are supposed to have raised their prices to Rs. 1,000 a litre. Though the prices had been reduced recently the damage had been done.

It is useless to blame the State Owned Enterprises, this decision had been taken by the political masters. These are decisions that should be taken after an in depth study of the proposal. That does not seem to have been the case.

I for one do not think this problem has any connection with the currency crisis. An individual who wishes to have a drink will buy his drink – even a smaller quantity than usual.

Developed countries that this country is attempting to ape, provide for individuals to produce their liquor subject to limits – the home produced brew cannot be sold. This is very good, because (i) I wonder how many could remember the incidence where 32 imbibers fell sick or passed away after imbibing Methyl alcohol. I remember this to have happened in Batticaloa. (ii) The same unfortunate incident took place at Matara and the hospital authorities were searching for an anti-dote – Brandy.

Bogus explanation

We cannot export as our cost of production is high. That is a bogus explanation.

The biggest cost centre at an alcohol distillery (high strength alcohol as those produced at Pelwatte and Sevenagala) is the cost of fuel.

The cost to the Lanka Sugar Company Distilleries (Pelwatte and Sevenagala) in the purchase of fuel oil must be in the region of Rs. 1,000,000,000 per year.

Ethanol at high strength (purity in the 90% or above) could be produced where fuel oil requirement would be at Rs. ZERO or there about.

Since I joined the distillery at Kantale I have been searching for ways and means of reducing or completely eliminating the fuel oil requirement at the distillery. I found that most if not all the oil burnt was going down the drain as effluent.

About seven years ago I joined a university to conduct doctoral studies, to reduce the requirement of fuel oil to near Rs. Zero or thereabout. This work required funds for the equipment and for supporting staff (the work will have to proceed 24 hours a day, may be two weeks at least).

The university sought funds from parties, that would be beneficiaries, but nothing came. They directed the university to another institution that had connected interest.

The Director of this institute claimed, on two occasions, that he had no chance to read the request. Well he has had no chance through the past seven years.

That is the interest that our institutions pay to such research.

This study would have made our alcohol highly exportable. With this process proposed the quality would not have been a problem.

Taxes on alcohol are based on four grounds – (i) Income to the state (ii) To discourage people from imbibing alcohol (iii) On religious grounds (iv) Objections from the spouse. Dear Mr. Minister (ii) and (iii) has no relationship to the ground situation. The objections from the spouse is irrelevant from the day I developed the “Islander’s Red Rum”. When one consumes Arrack, Whisky, Vodka, Gin Rum or even Kasippu, one will find one’s breath smelling of alcohol. Islander’s Red Rum freed one from this exposure. Ladies were reported be very appreciative of this character, both sophisticated Colombo crowd and rural crowd. The clientele for Islander’s Red Rum were the female imbibers. It was introduced during the harvesting period, with the highest sales being reported from Anuradhapura. It also sold well at the hotels.

No body sings the song “Sealed Botale…” now.

This is Sri Lanka – please do not grumble.

(The writer can be reached at [email protected].)