Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 30 October 2019 01:54 - - {{hitsCtrl.values.hits}}

The Sri Lankan economy faces numerous challenges. While global economic and financial conditions have a material impact on an export-oriented small economy such as Sri Lanka, many of the impediments to economic development have been created by the lack of commitment to make necessary policy changes and their implementation on the part of Sri Lanka. Some of the main challenges and opportunities are briefly discussed below.

Policy uncertainty

Policy uncertainty

First and foremost, the high degree of policy uncertainty is one of the main issues. In regard to most economic matters, Sri Lanka does not have robust and clear policies. This is further exacerbated by frequent, ad-hoc changes to existing policies. To ensure policy certainly, Sri Lanka must create a robust policy making system, draft long-term economic policies, and establish an effective institutional mechanism for their implementation.

Political uncertainty

Policy uncertainly is also closely correlated with political uncertainty. In the recent years, there have been multiple political events that have led to increased policy uncertainty. Frequent changes in the size and the composition of the Cabinet of Ministers and the oversized Cabinet of Ministers have been noteworthy. This is a real constraint to developing, sustaining and implementing economic, financial and social policies in order to address significant economic problems faced by the country.

In this regard, Sri Lanka must take measures to define and limit the size of the Cabinet, perhaps constitutionally, to a reasonably low number that is appropriate for the discharge of government responsibilities and commensurate with the size and the resources of the country. Recognising the possibility of frequent Cabinet changes, decoupling policy formulation and implementation mechanism from the political process as far as feasible can help ensure policy stability to a greater extent.

Global economic conditions

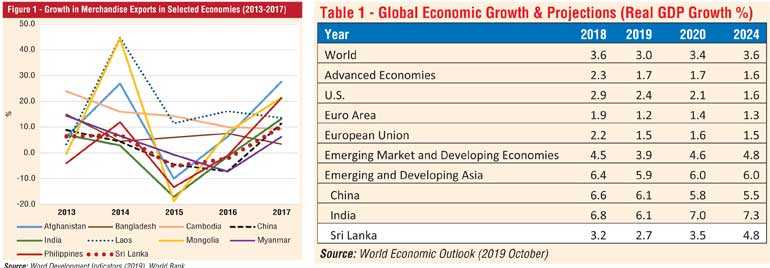

According to the latest World Economic Outlook, global economic growth decelerated from 3.8% in 2007 to 3.6% in 2018 and is projected to moderate to 3.0% in 2019 (Table 1). Growth in advanced economies is important for Sri Lanka because of its export markets. Growth in advanced economics is also projected to decline from 2.3% in 2018 to 1.7% in 2019 and continues to maintain low growth in the medium term.

Sri Lanka’s largest export destinations are the European Union countries and the United States and their growth in 2019 is projected to decline to 1.5% and 2.4% respectively. This expected slowdown in global growth coupled with trade tensions between the US, China, European Union and Mexico will likely cause global trade to moderate as well. These global conditions have the potential to affect Sri Lanka’s external sector negatively.

Sustained high economic growth

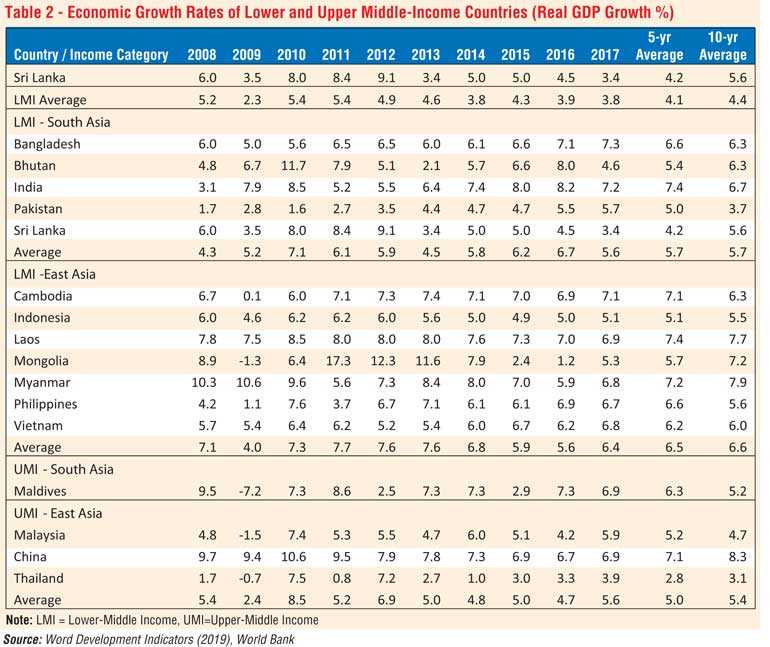

The greatest challenge for Sri Lanka is to stem the deteriorating growth that has been evident in the recent years and to reignite the economy with a concerted effort to reach higher single digit growth in the next decade. This requires a closer analysis of growth dynamics of the Sri Lankan economy taking into account experiences in other lower-middle income (LMI) and upper-middle income (UMI) economies (Table 2).

Clearly, when Sri Lanka averaged a growth of 4.2% in the 2013-2017 five-year period, South Asia grew at 5.7% and every country in the South Asian region recorded higher average growth than Sri Lanka. The notable stars were India with an average growth of 7.4%, Bangladesh with 6.6% and Maldives with 6.3%. The average growth in East Asia was 6.5% with growth exceeding 7% in China, Cambodia, Laos and Myanmar. While it may not be possible to exactly replicate the growth paths of these high growth Asian economies, their growth experiences clearly suggest opportunities for growth. Economic reforms are absolutely essential for Sri Lanka to unleash its growth potential.

Agricultural sector modernisation and productivity improvement

The share of the agriculture in the Sri Lankan economy (8%) is smaller compared to LMI countries (11%) and less than half of the agriculture share in LMI countries in Asia (17%) (Table 3). In fact, Sri Lanka’s agriculture share is the same as that in UMI countries and UMI countries in Asia. This suggests that the share of the agriculture sector in Sri Lanka has already reached that of UMI countries and there is likely to be little gain in reducing its relative size further. What is needed is modernisation of agriculture, and diversification and promotion of export-oriented agriculture in order increase productivity and achieve stable and high growth in the agriculture sector.

Export-oriented industrial development

The share of the industry sector of Sri Lanka (27%) is fairly at par with LMI and UMI countries (Table 3). However, a comparison with UMI countries in Asia, where the industry share is about 38% of the economy, suggests that Sri Lanka needs to expand industry sector as a growth driver. This requires targeted expansion of existing industries and development of new industries with a special focus on export markets.

Development of new and competitive services sector

Development of new and competitive services sector

The services sector of the Sri Lankan economy exceeds that in LMI economies (53%) and is comparable to the share in UMI economies (57%). However, given Sri Lanka’s geographical location and the availability of highly educated workforce, Sri Lanka has great potential to increase the services sector in line with high income economy (HI) average of 64%.

Increasing share of trade in GDP

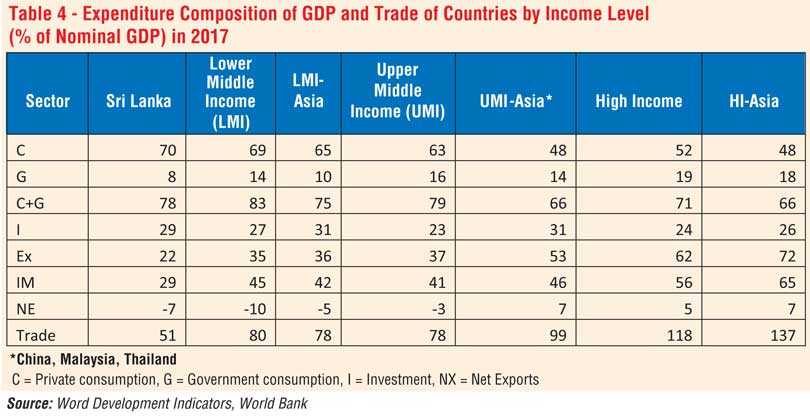

Sri Lanka’s exports are only 22% of the economy whereas it is 35% of LMI countries and 37% in UMI countries (Table 4). Sri Lanka’s exports as a proportion of the economy is less than half that in UMI economies in Asia (53%) suggesting the need to expand exports significantly in order to achieve high growth. Imports as a percent of the economy are 29% and much lower than that of LMI economies (45%) and UMI economies (46%). Reflecting higher imports than exports, net exports contributed -7% to the economy of Sri Lanka in 2017. Although the contribution of net exports is much more negative (-10%) in LMI economies in general, it accounts for only -5% in LMI economies in Asia and -3% in UMI economies. Further, UMI and HI economies in Asia show a positive 7% contribution of net exports suggesting the important role of played by net exports in their economies.

Overall, trade, which is the sum of exports and imports, as a percent of the economy was 51% in Sri Lanka whereas trade has played a much bigger role in LMI economies (80%) and UMI economies (78%). Trade is 99% in UMI economies of Asia which comprise of China, Malaysia and Thailand.

Sustained high exports growth

Many of the export-oriented Asian economies saw their exports grow at much higher rates during the same period (Figure 1). Some countries with which Sri Lanka must compete for inward investments and markets have recorded much higher export growth. For example, export growth rate was 17.9% in Laos, 14.7% in Cambodia, 13.4% in Vietnam, and 7.3% in Bangladesh. This highlights the overall weak export performance of Sri Lanka and the need to a robust policy framework to increase exports.

Increased Foreign Direct Investments

FDI flows in some of the main LMI and UMI economies in Asia are much larger (Table 5). FDI in 2017 was $ 9.5 billion in Malaysia, $ 8 billion in Thailand, $ 10 billion in Philippines, and $ 14 billion in Vietnam. India attracted $ 40 billion while China’s FDI was $ 168 billion. In relative terms, FDI was about 3% in Malaysia and Thailand, 6% in Vietnam and 13% in Cambodia. Sri Lanka will need to attract substantially more FDIs in the range of 3% to 6% of GDP in the medium-term in order to increase export-oriented manufacturing industries.

Increasing labour force participation

Sri Lankan’s labour force participation of 54% is one of the lowest in the lower-middle and upper-middle income economies in Asia where it is 65%. South Asia in general has lower labour force participation with an average of 58%. Involving more of the economically inactive population, particularly women, in the labour force is a challenge that Sri Lanka to consider in its development strategy.

Addressing the higher unemployment among female, youth and the educated must be considered key policy priorities. A sizeable share of the youth unemployment is graduates and individuals with other post-secondary education and generating employment opportunities for them and absorbing them into the workforce must be a top priority.

Fiscal consolidation

In order to achieve a sustained fiscal balance, Sri Lanka needs to increase government revenue and rationalise government expenditure.

Increase in government revenue will critically depend on improved economic growth. However, measures are needed to improve tax administration and collection as a top a priority. As for expenditures, a complete rationalisation of government expenditure is required and must involve significance reduction in wasteful and unnecessary government expenditure and allocation of resources to more productive and job-creating initiatives which will contribute to increased economic growth. Beyond the medium-term, the budget deficit needs to be contained at about 3% of GDP.

A large part of the inefficiencies of the economy and budgetary pressures can be attributed to unnecessarily large and in some cases duplicative government ministries, departments, institution, and commercially and financially unviable and poorly-managed State-Owned Enterprises (SOE).

The government must implement a concrete program of SOE reforms which will include sale, divestiture, and restructuring as appropriate. Further, Sri Lanka has built up an inefficient and disproportionality large government bureaucracy and governance system which for the most part is incapable of supporting economic development. Reforms are essential to reduce the size of the government.

Debt sustainability

Debt sustainability

The high level of public debt amounting to 83% of the GDP is not sustainable in the long-run.

Given the continued fiscal deficit, the government will be forced to continue to rollover existing debt as they mature and, as a result, reduction of existing debt will be a significant challenge.

The government projects that debt will decline to 70% of the GDP by 2023 and this will require substantial economic growth.

Leveraging private sector investments

Sri Lanka needs to re-orient its growth model to leverage private capital for long-term investment projects including infrastructure investments. The fiscal and public debt constrains facing the economy only allow very limited fiscal space for large investments and borrowings by the government. Domestic private sector should be encouraged to partner with foreign investors for large capital investment projects.

Developing domestic capital markets

Although various capital market development plans and policies have been proposed, the government has not given adequate attention to developing local capital markets and the investor base. Sri Lanka’s equity and corporate debt markets have to be developed in size and liquidity in order to attract more domestic savings to stock and bond market investments, provide more dynamic and efficient markets to raise funds domestically and increase private sector capital formation for investment projects.

Exploiting geographical location advantages

Sri Lanka as an island centred between the East and the West and located in the East-West maritime route has enormous opportunity to develop into one of the best aviation, port, commercial and services hubs in the region. The Colombo Port City can be developed as a vibrant and dynamic financial centre in the region and Hambantota Harbour, which is a pivotal link in the Chinese Belt and Road Initiative, as an active trans-shipment hub and a port.

Conclusions

Sri Lanka’s recent economic performance has been mixed. The country is trapped in a growth conundrum. While the economy has continued to expand, growth has been low and decelerating in recent years. The country lags in making policy, structural and other reforms that are necessary and critical to unlock impediments to growth. Low growth risks continued efforts to contain budget deficit and may lead to worsening of the current account deficit. Policy measures to address the twin deficits are vital since countries with persistent twin deficits tend to have weak growth and their currencies tend to depreciate more.

Sri Lanka’s public debt is high and unsustainable under the prevailing economic policy and growth prospects. Further deterioration of fiscal balance could lead to more borrowings by the government and build-up of more debt. Sri Lanka is highly vulnerable to tightening of global financial conditions when accessing international financial markets to borrow funds to service and refinance its foreign debt which has continued to rise over time. Export-oriented industrial development financed by private capital, particularly foreign direct investments, is key to higher economic growth. In this context, Sri Lanka needs to have a robust exports growth strategy and a regionally competitive incentive framework for attracting foreign direct investments on a larger scale. Significant reforms are needed to modernise and diversify the agricultural sector in order to increase productivity and its contribution to growth. Private capital needs to be leveraged for infrastructure development as growth driver. The country’s high-level of human development and highly educated workforce should be harnessed to expand existing and new service industries which have greater potential for contribution to the overall growth. Overall, achieving sustained high single digit economic growth is necessary to overcome fundamental economic imbalances. Besides economic policy and structural reforms, ensuring policy certainty and political stability are vital to spur investments and growth.

(Lalith Samarakoon is a Professor of Finance and Financial Economist. He is also a Chartered Accountant and a Certified Financial Analyst. He served as the Secretary-General and Chief Economist of the National Economic Council of Sri Lanka for the past two years. Follow Perspective at www.lalithsamarakoon.com and Twitter @LSamarakoon. Email feedback and comments at [email protected].)