Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 17 February 2022 00:10 - - {{hitsCtrl.values.hits}}

Sri Lankan housewife struggling to keep the home fires burning

The political rhetoric intrigues me – from the elated announcement that Sri Lanka has honoured the $ 500 million debt bill in January to the promise ‘next 3 years we will rebuild the country’ and today the theme being ‘the president protected the country with the vaccination drive.’ All are interesting strategies from a marketing perspective to keep a brand alive when the product life is declining daily. In the world of business, we call these survival behaviour strategies as the writing is clear on the wall – Sri Lanka is heading for an accident that even a specialist doctor will find it hard to cure.

The political rhetoric intrigues me – from the elated announcement that Sri Lanka has honoured the $ 500 million debt bill in January to the promise ‘next 3 years we will rebuild the country’ and today the theme being ‘the president protected the country with the vaccination drive.’ All are interesting strategies from a marketing perspective to keep a brand alive when the product life is declining daily. In the world of business, we call these survival behaviour strategies as the writing is clear on the wall – Sri Lanka is heading for an accident that even a specialist doctor will find it hard to cure.

Global pick up

A point to note is that the current challenging situation Sri Lanka is up against is very similar to many other countries globally. Spiralling inflationary pressure, COVID-19 Omicron variant is rampaging across the nation (though the ICU occupancy being low) whilst many supply chain disruptions leading to a rising unpopularity of the ruling party.

However, the global pick up is that country leaders that have gone through structural training – meaning a good education backed with strong economic management insights are equipped better to lead, than the leaders that have got elected on power play only. Sri Lanka clearly falls into the latter and hence, we hear aggressive statements like ‘We don’t need the IMF as the homegrown solution can solve the current issues’. Sadly, this behaviour is not what the academics and hardcore practitioners advocate for Sri Lanka. The logic being simple – $ 6 billion debt to be paid annually for the next four years, in the backdrop of a Balance of Payment number hitting $ 3.6 billion deficit, means that we are heading for a harsh landing.

But, sadly the Government of Sri Lanka continues printing notes to the tune of Rs. 1.6 trillion just to keep home fires burning which is a cyclic trap a nation must not get into – as this course of action fuel inflation. Countries like Argentina and Ecuador who had a prudent leadership took the hard decision to restructure the economy and today, they are back on track with a strong economic growth. Sadly, Sri Lanka leadership say that they will teach world a new economic order.

SL inflation sky rockets

So, what is the reality? Hard data as per the Central Bank of Sri Lanka reveal that annual inflation had climbed to 14.2% in January of 2022 from the 12.1% registered in the previous month. Many are not aware that it was the highest inflation rate since November of 2008 and the second consecutive double-digit growth in consumer prices as prices skyrocketed for food products (25% vs 22.1% in December) and surged for non-food products (9.2% vs 7.5%). This supports the argument discussed before on how printing notes fuels inflation. But sadly, the Central Bank turns a blind eye.

On a monthly basis, consumer prices have gone up by 2.4%, slowing from a 2.7% rise in December but February will be a disaster is what we see in the market place. This price increase has pushed many in to the poverty belt as announced by the World Bank. The estimated number is as high as 500,000 household. What the Central Bank must understand is that in Sri Lanka even though poverty is at 5.8%, many households are scattered around the poverty belt and even a mild economic shock can even jolt many into poverty threshold. This is what is happening now and the leadership is oblivion to this reality.

What amazes me is when the Central Bank boasts of the dollar reserves it possesses whilst the Colombo traders say how essential commodities are stuck in the Colombo port due to shortage of dollars. The latest being 1,770 containers which is a sizable quantity given the many products being out of stock at the retail end. Even the tourists are complaining that their favourite wines and specific brands of cheese are not available in the hotels.

What the Central Bank forgets is that the situation like this is ideal for a ‘black market’ to emerge in a country which contradicts to President Rajapaksa’s statement ‘In the next 3 years the election promises will be delivered and Sri Lanka will emerge victorious just like the war with the LTTE’. In the business world we call this behaviour similar to a successful Sales Director being appointed as a CEO. This is what has happened to Sri Lanka, to put it bluntly.

Deep dive

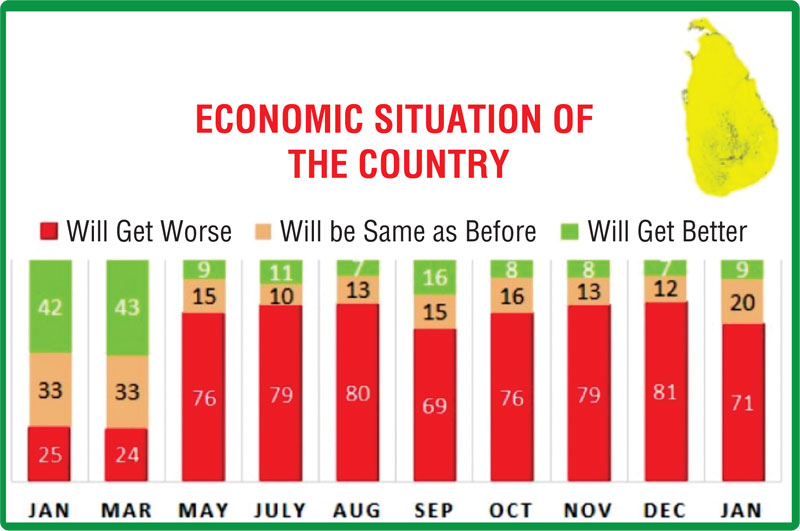

To give a context to the issue at hand, if one does a deep dive, we see that the Consumer Price Index constitutes two groups. One being food items that account for 41% of the total bill and non-food accounting for a 59% chunk. The latter comprise of housing, water, electricity, gas and other fuel that is registering a 23.7% increase. Hence, we see the pressure that a typical housewife is under pressure to keep the family fires burning. Research done in January reveal that almost 80% of the household say that they will not buy any furniture and electronic items in the near future as they cannot make ends meet. Almost 71% housewives say that the economic condition in the country will get worse which is the absolute truth that sadly the leadership of the country fails to understand.

Failed strategy

The brutal truth is that the Port City investment drive to Chinese entrepreneurs did not materialise to attract the dollars. Even with sweeping reforms, the opportunity was not attractive. The cut down in taxes last November could not create the momentum for the incremental business to cover the fiscal deficit. We have failed Sir, and let’s accept this.

We have to change course now as a country if we are to protect the current successful companies that are chocking as we speak.

Next steps

I do not want to recommend a strategy for Sri Lanka, but, the way that I have been trained in business – when you are ill, go meet a specialist doctor who will cure you.

Do not meet a medical doctor to address an agricultural issue – sadly this is what the Government did on the ‘banning of chemical fertiliser’ and today we are spending Rs. 40 billion of taxpayers’ money to pay compensation to the paddy farmers. What a sad state of affairs when the cost of importing chemical fertiliser was around 36 billion a year as per the experts at Peradeniya University. So, the net is that the Sri Lankan consumer is sinking due to bad decisions by the Government. All I know is that printing money is definitely not the answer.

(The writer heads an Artificial Intelligence-AI company which is a top 50 ranked emerging Entity in the South Asian region.)