Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 13 November 2023 00:00 - - {{hitsCtrl.values.hits}}

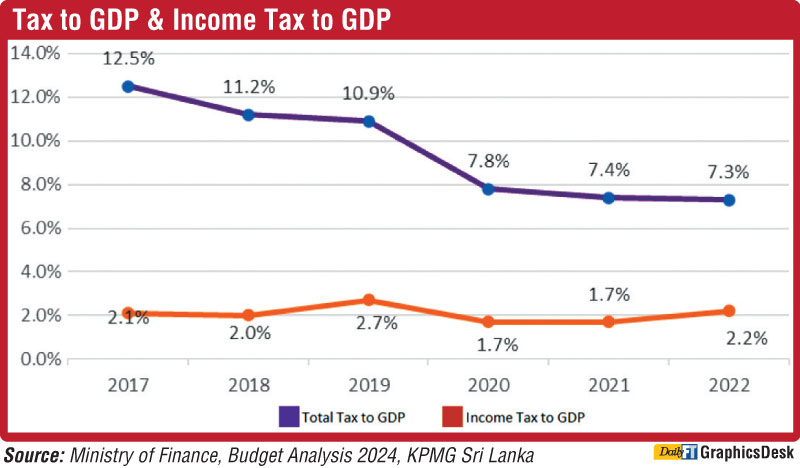

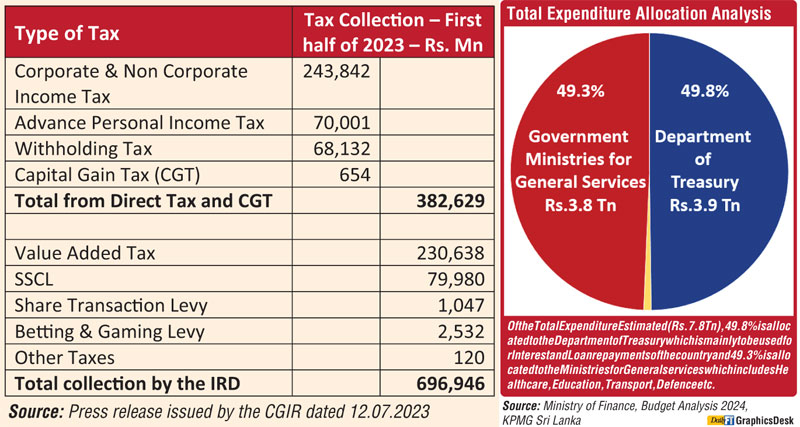

The Budget 2023 included ambitious targets for Government tax revenue and expenditure, as a percentage of GDP, of 10.3% and 19.2%, respectively (as per Budget Speech 2023). Due to tax policy changes effective 1 January 2023, the tax revenue collection by the Inland Revenue Department (IRD) for the first six months of 2023 was reported as Rs. 696,946 million as per press release issued on 12 July 2023. The total estimated tax revenue for the year 2023 as per the National Budget Speech 2023 was Rs. 3,130 billion out of which estimated income tax revenue was Rs. 912 billion.

The Budget 2023 included ambitious targets for Government tax revenue and expenditure, as a percentage of GDP, of 10.3% and 19.2%, respectively (as per Budget Speech 2023). Due to tax policy changes effective 1 January 2023, the tax revenue collection by the Inland Revenue Department (IRD) for the first six months of 2023 was reported as Rs. 696,946 million as per press release issued on 12 July 2023. The total estimated tax revenue for the year 2023 as per the National Budget Speech 2023 was Rs. 3,130 billion out of which estimated income tax revenue was Rs. 912 billion.

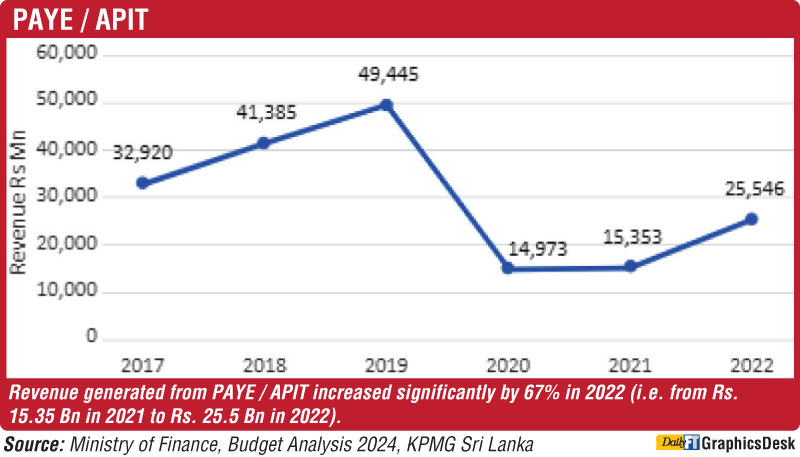

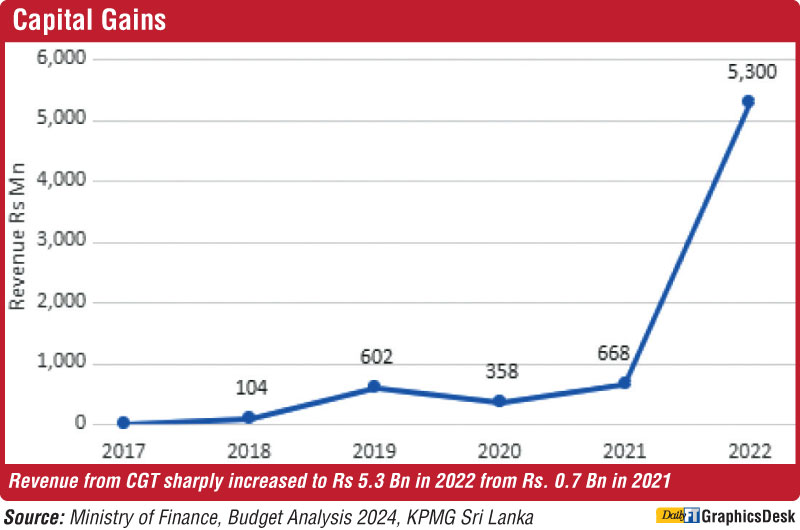

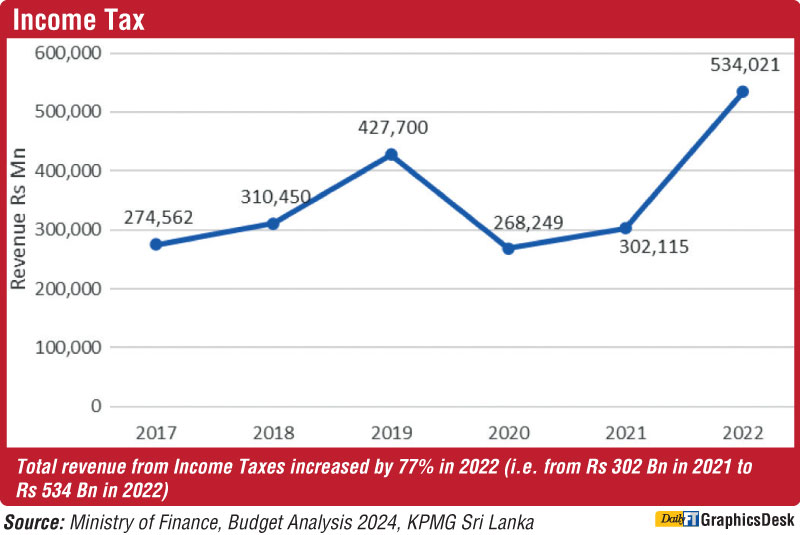

Income Tax collection in the first six months of 2023 has increased significantly when compared to the year 2022 due to WHT deductions, AIT and APIT on employment income being made mandatory. The total actual income tax collection in the year 2022 was Rs. 534 billion while in the first six months of 2023, the CGIR has already collected Rs. 382 billion. The taxes collected at source together with the changes in individual tax-free threshold, tax rates and slab revisions may have contributed for the increased collection.

The details of the tax revenue collection by the Inland Revenue Department for the first six months of 2023 is as follows.

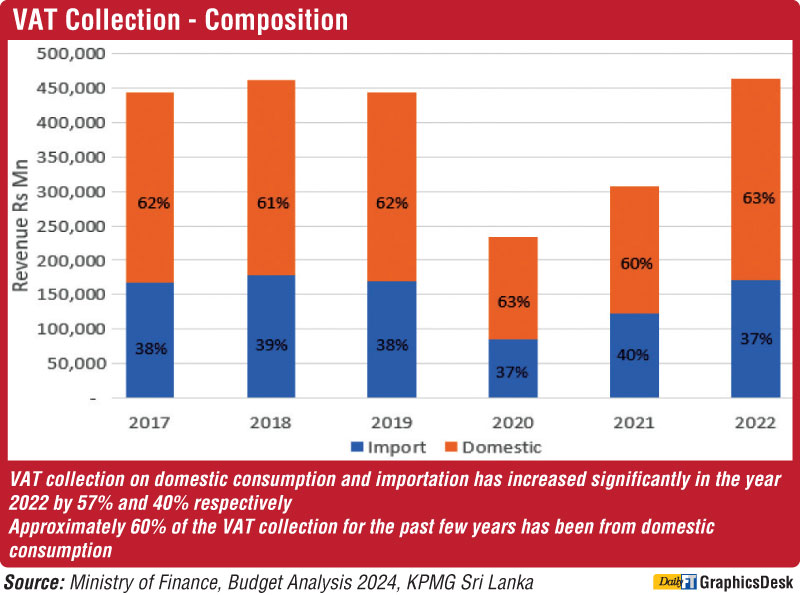

The tax revenue collections at the point of importation by the Sri Lanka Customs and the Department of Excise for the year 2023 are not publicly available hence not covered above.

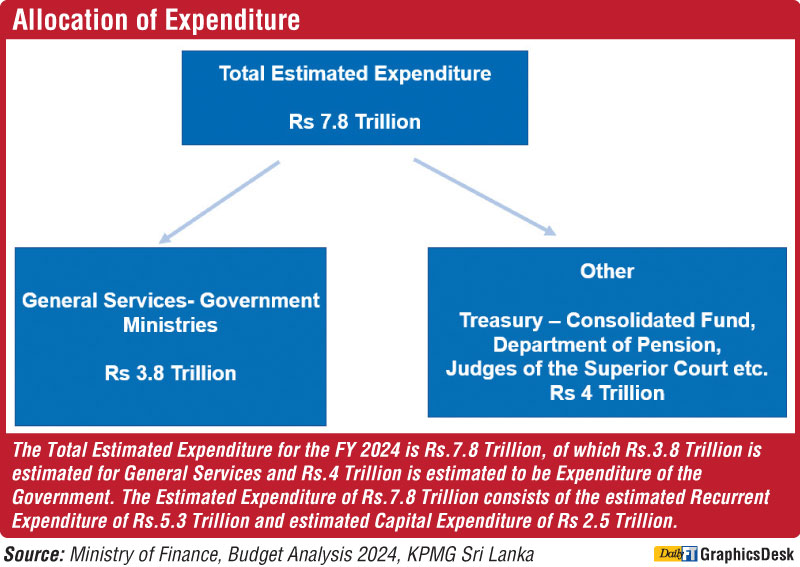

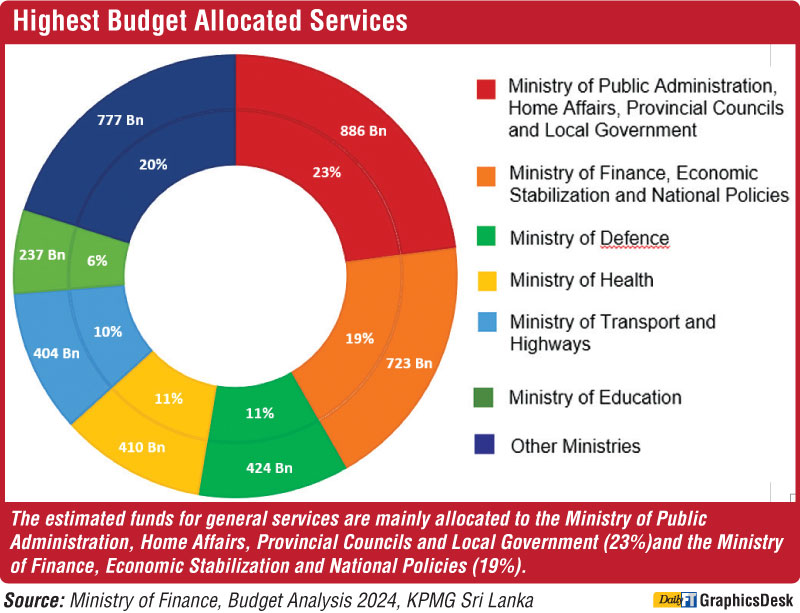

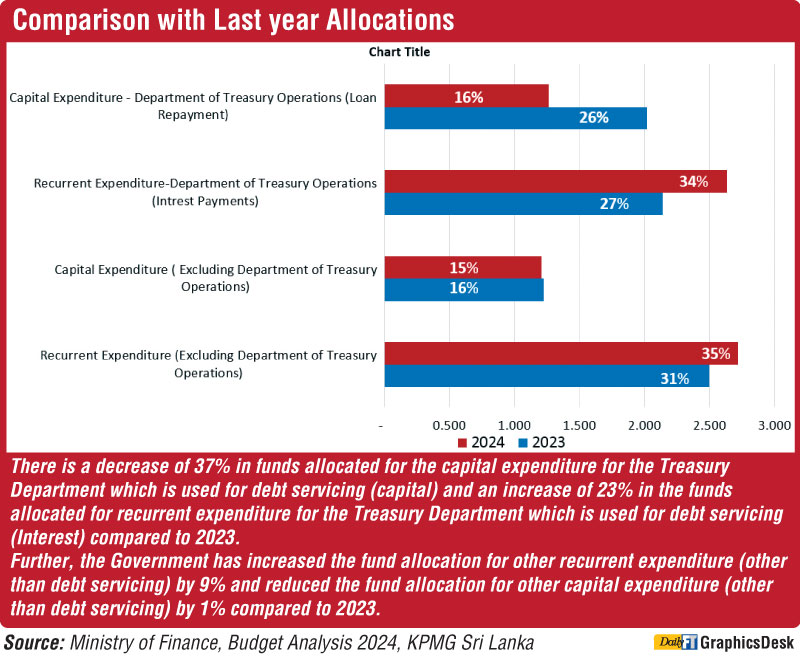

As per the Appropriation Bill 2024 the total estimated expenditure for the year 2024 is Rs. 7.8 trillion. It is interesting to see the revenue proposals the Government will embrace to meet the total expenditure. While anticipating the budget speech to be read in the Parliament on Monday 13 November, KPMG has shared pre budget tax facts based on the Annual Performance Reports issued by the Ministry of Finance and the Inland Revenue Department up to the year 2022.

(The writer is Principal - Tax and Regulatory at KPMG Sri Lanka)