Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 27 June 2018 00:00 - - {{hitsCtrl.values.hits}}

Introduction

It was only a few weeks back that I wrote about (i) how the oil we consume will make us more and more debt-ridden and (ii) a probable solution to get over this debacle. Then I find the Chairman of CPC giving an interview to  Daily FT to explain what he plans for the corporation.

Daily FT to explain what he plans for the corporation.

It is not every day that we see corporation chairmen explaining how they plan to take their organisations forward. And I was very happy about the vision he has demonstrated for the corporation. Although he had mixed up the first two questions about refinery expansion and CPSTL expansion, he has explained how he plans to introduce computerised data processing to enhance the efficiency of the corporation’s stock level maintenance and so on.

What caught my attention the most, of course, was his plans for refinery expansion. I had mentioned in my own article that (i) Fortune magazine had mentioned oil refining as one industry one should not invest in and (ii) it is more prudent for us to move away from oil-driven transportation to vehicle electrification.

These are issues I have been studying and researching for the last 10 years and every passing day only strengthens my conviction about these. I also wanted CPC itself to spearhead that transition and I thought that it was like what Hewlett Packard was doing a decade or so ago; i.e. making their own products obsolete, before others start doing it.

What oil has done to us

Ever since the early 1970s, oil has been a silent contributor to our economic misery. When I started doing research on climate change, I studied how oil price escalations managed to nullify all the benefits we were planning to enjoy from our increased exports.

We were exporting Rs. 155 billion worth apparel in 1999 and importing only Rs. 28 billion worth of oil. With a lot of effort and determination we increased our apparel exports to nearly Rs. 583 billion by 2013; but found Rs. 532 billion of that been consumed for the import of oil. That was the beginning of an era of Lamborghinis and Mustangs and even when we decided to do R&D on vehicle electrification we wanted to work on racing cars. That trend may not have left us yet.

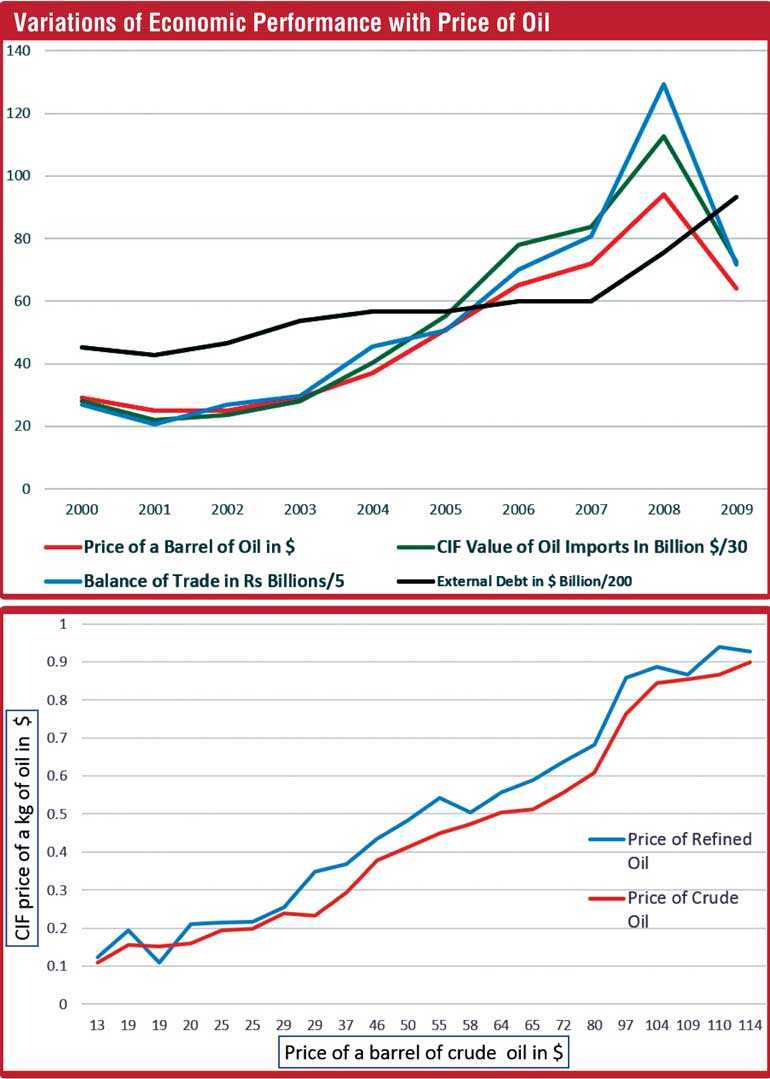

I was studying how oil price and our external debt had been increasing together and some of the graphs I had sent to former Secretary to the Treasury, Dr. P.B. Jayasundera are combined in the graph shown. Then I indicated how our exports and imports increased in near tandem only to leave us so many billions of rupees indebted. Writing to Daily FT in August 2014, I showed how oil import bill has been increasing faster than the export revenues and any economic emancipation need to be planned bearing in mind our vulnerabilities to this behemoth.

It is for this reason that Dr. Sarath Amunugama, a former Finance Minister, mentioned that if the oil price hikes and inclement weather do not disturb us, preparing the Sri Lankan Budget is like a walk in a park of roses. So, if we want to achieve true economic prosperity, then we need to plan a strategy to tame this behemoth and my earlier article was based on that approach.

CPC Chairman thinks differently

But now the CPC Chairman wants to take CPC on a different route to greatness. In his interview he has spelt out how he sees it. I do not intend to refer to all the things he had mentioned in that interview because I have not studied them adequately.

I have been studying the energy mix in Sri Lanka for the last 10 years and that was not only in terms of barrels of oil and tons of coal; but, also in terms of Mega Joules of energy, Mega tons of CO2 generated, Mega Joules of energy wasted, dollars sent out and rupees burnt and their ratio to the inputs of the proper mix to make Sri Lanka a prosperous country. So, while I appreciate and admire the dedication with which the Chairman seems to be carrying out his work, I would like him to consider the following facts as well in arriving at appropriate decisions.

Since most of these decisions would depend on projections for the demand for oil, we need to look at this first. It was mentioned that petroleum is going to be the lowest priced energy product in the market place. Today, in the Sri Lankan set up, petrol is the most expensive fuel when calculated as Rupees paid by the consumer or dollars sent overseas for a kWhr of energy the consumer has actually used. In 2017, a motorist has sent abroad Rs. 32 per every kWhr actually used by him. This is a very pertinent aspect as you can’t have economic prosperity while paying the most for an actual unit of energy used.

Also note that I am not talking about a sector which uses only 10% of CPC’s turnover, but the sector which consumes 60% of local consumption. So, one could see that oil for transport is not one of the cheapest energy products in the market place and it will never become so.

Any new oil that will come to the petrol station will be more expensive, because it has to come from lower depth, and correspondingly all related costs will be higher. If that sort of easy oil is available, Exxon would not have tried to explore beyond Alaska in the Northern Seas. In fact, their initial plan to do exploration covered by a cylindrical hood failed as that hood could not be retained at that depth.

Then comes the demand side of the industry. This demand will definitely shrink and this is what everybody says and nobody has disputed the same. There was a time in this century when senior executives of oil companies would say that it will take at least 30 years for renewables like solar to enjoy even 5% of the energy market. Today nobody would say that.

It was in Daily FT of the 13th instant that CMTA officials were talking about KPMG’s Global Automotive Executive Summary – 2018, highlighting that cars in the future will be electrically powered. They also mentioned that all big players Volkswagen, Toyota, GM, Ford, BMW etc. announcing their changeovers of some models to be electric.

The case for a new refinery

Then the Chairman talks about the benefit of having a modernised and/or expanded refinery. This project has been in the limelight for some years now. In fact, it was in October, 2010 KBC Advanced Technology submitted a feasibility report for the Sapugaskanda Oil Refinery Expansion and Modernisation Project (SOREMPRO) with a capacity of 70,000 barrels per day.

I beg to disagree with the contention that we could save $400 or $450 million per year with a new refinery. This statement has two very dangerous connotations in that one might believe in this value and the other is how you would relate it to the investment you would make on this project and all related cash flows.

In fact, we studied this in great detail in January 2015 when Dr. Tilak Siyambalapitiya wrote a two part article on energy set up in Sri Lanka to the Island paper wherein he had promoted expediting the establishment of this expanded refinery at Sapugaskanda. We are lucky that sanity prevailed and we have not worked on same.

The graph given could be used to calculate this anticipated saving for any crude oil price up to $114 per barrel. Here we assume that our officials have ordered the right quantities of the two grades to suit the local requirement and the crude oil imported when refined would give any shortfall between total refined oil requirement and the refined oil quantity imported. Any inability of the refinery to provide the right mix for the balance will only reduce the projected saving.

What we have done in this graph is we have calculated (a) CIF price we have paid for a kg of imported refined oil and (b) cost we would have incurred if we imported the crude oil and refined it at the refinery. To obtain the cost through refining of crude oil route, we have multiplied the CIF cost of crude oil by 1.07 to account for the 7% of crude that would be lost in the refinery to the sulphur content gone into waste and fuel used in the refinery utilities etc. We have used data in CBSL annual reports for years from 1996 to 2017. This gives an average margin of only $0.05 per kg for this period/crude oil price range and this margin at 100,000 barrels per day with 365 days running will give you a margin of only $260 million per year.

Then, accommodate about $70 million for operational costs for manpower, maintenance, catalysts, chemicals, insurance, etc. which will also keep on increasing. So, the net benefit will be around only $190 million. Please note that you might lose a few days for the maintenance shutdown as well. But also remember that in 2017, this margin was only $0.03 per kg yielding only a $ 100 million for 100,000 barrels per day, 365 days.

We also computed what it would have cost us (a) if we imported the total requirement as refined oil and (b) if we imported the total requirement as crude oil and lost 7% during refining and incurred $ 70 million as operational costs of the refinery. This gave us a saving of $ 266 million for 2016 quantities and prices and $ 125 million for 2017 quantities and prices.

So, this is nowhere near $450 million per year saving mentioned. The other aspect is that as demand for oil in transportation decreases due to vehicle electrification as all knowledgeable personnel predict, owners of existing refineries will opt to sell their refined oil at lower margins.

You will also notice that the margin of refined oil price over crude oil does not increase in the same fashion as crude oil price increases. The implication is that when crude oil price increases cost of the crude oil in stock will increase. In case refinery has 30 days stock in storage and being processed, increase in its value may be an unexpected increase in the investment and it will not be possible for you to increase the margin to accommodate that increase as seen from the graph, like what you do in other industries. This may be one reason why Fortune magazine identified investment in refineries as an investment not worth to be pursued.

My letter to the CEO, American Petroleum Institute

I have been writing to leaders in the US administration on the damage petroleum does to both USA, an individual country, as well as to the global community. Similarly, I wrote on 11 August 2011 to Jack Gerrard, the then Chief Executive Officer of American Petroleum Institute (API).

I wrote to him and said that in case he or API wants to prevent their mission of ‘Powering Global Mobility’ being high-jacked by power producers in the world, through vehicle electrification, API members need to implement highway solarisation (defined as the infrastructure to generate electricity for powering battery electric vehicles or the grid using solar energy collected by PV solar panels installed along and above the highways as a solution for climate change) on American highways and sell that electricity to Battery Electric Vehicle (BEV) owners. I said that it would be much better than digging thousands of feet into Mother Earth and destroying the services Nature provides to us.

His attorney rang me up and said that he was unable to move in this matter and wanted me to pursue it with the individual oil companies.

So what I am communicating to our own oil company is the same thing. Sri Lankan oil company cannot prevent the global movement of transportation towards electrification and the better thing to do will be to generate electricity on the highway, provide the same to BEVs and retain their mission of ‘Powering Mobility in Sri Lanka’. After all, the Minister in Charge is best known in UK as Captain Cool who mastered the game of the Britishers and if he implements Highway Solarisation and power transportation, the Britishers would admire him more. They are already planning to provide BEV charging in petrol sheds as per their throne speech – 2018.

Making CPC profitable

The Chairman has also addressed this aspect of making CPC profitable. According to him losses are incurred due to Government pressing them to sell at subsidised prices when oil price goes up. Neither the Chairman nor CPC nor the Government nor the Central Bank can do anything about it. When the price of oil goes up, we have to send more dollars out and CPC can’t sell the product at cost + margin pricing policy. And my expectation is that oil prices will only go up as all those who have it would like to make the maximum while there is still a demand. I wish I were wrong.

As this price of oil in the local market will influence the price of everything else in the market place, Government would like to keep the local price as low as possible even if Government/corporation has to incur a loss and become more indebted. Does it imply that keeping oil companies happy is more important than making Sri Lankans happy? Making our economy independent of this behemoth is a prerequisite for economic prosperity.

We addressed this issue somewhat holistically when we wrote that article titled ‘Making both CEB and CPC profitable at the same time’ in December 2013. I strongly believe that it is the only way to ensure CPC remains profitable independent of oil prices. Otherwise, every Chairman of CPC will utter, once in five years or so, that it is not his fault, he is very efficient, but the government wants him to incur this loss.

But the issue is that CPC Chairman can blame the Government and the Government in turn can blame the oil companies for increasing the price of oil as if they did not expect these prices to go up. If one looks at the horizontal axis of the graph shown one could see that at one point of time, that is 1998, a barrel of oil has been only $13 a barrel. We have waited for 12 years, till 2010, without having a solution and at that time it was $ 80 a barrel.

It was in 2010 or so that we came out with our solution – highway solarisation – and even for the last eight years we have been blind to this solution and kept on importing oil and making losses and burdening the future generations with the task of settling them. Prime ministers will come and blame the previous prime minister and the new one also increases the debt burden because he has to settle the predecessor’s loans and interest and the story goes on.

Conclusion

I don’t expect a newcomer to this Chairman’s seat to fathom all this out in a matter of a few months; I, having studied chemical engineering and spent nearly 15 years in energy intensive industries, had to give up everything else and spend another 10 years at nearly 12 hours a day to develop this understanding.

So the only way to make CPC profitable is implement highway solarisation and arrange for it to be used for BEVs and thus make the bulk of the Sri Lankan economy independent of oil price hikes and that’s the one and only way to economic prosperity. Anything else will amount to living in a dream world for a couple of years during which oil prices will remain subdued.

(The writer is Managing Director of Somaratna Consultants Ltd.)