Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 20 September 2023 00:15 - - {{hitsCtrl.values.hits}}

President Ranil Wickremesinghe addressing the private sector

Last week data was released that the Sri Lankan economy has contracted by -3.1% in Quarter 2-2023, stacking up to the -11.5% decline in Quarter 1,2023 which means chances are that we will be at a -4.3% contraction as per that latest update of the World Bank.

Last week data was released that the Sri Lankan economy has contracted by -3.1% in Quarter 2-2023, stacking up to the -11.5% decline in Quarter 1,2023 which means chances are that we will be at a -4.3% contraction as per that latest update of the World Bank.

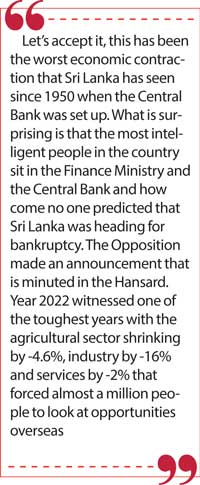

There have been reported job losses touching over half a million, and increasing poverty levels to an all-time high of 7 million people as per the study done by LirneAsia. Another study by Nielsen IQ revealed that disposable income is being squeezed due to the increasing cost of living which has resulted in almost 75% of households reducing consumption on grocery and personal care items. In simple words the economic crisis has had a deep impact on a Sri Lankan household never witnessed before.

Sri Lanka 2023

The -7.8% contraction of the economy in 2022 made the Sri Lankan economy valued at $72.9 billion and debt increasing to 115.2% of GDP. This means, 2023 will be a tough year to manage. The recession in the EU and the US markets will have an impact on the export industry in the lines of a billion loss in business on apparel alone, while the overall export sector is estimated to decline by -14% in 2023 which is a double whammy.

Due to the increasing revenue mobilisation, effects which are integral to achieve fiscal sustainability, safety nets for the poor will be challenging. This would have an impact on the planned elections in the year ahead.

Speculation last week was that General Elections will be held prior to the Presidential bout. A very prudent move, given that the majority in Parliament are out of sync to the reality at the ground end. Coupled with corruption allegations across ministries, the popularity of the Government is further challenged. The only option to protect the vulnerable is by way of targeted social nets which can be used for vote gathering but it’s a luxury that Sri Lanka cannot afford now.

Worst contraction

Let’s accept it, this has been the worst economic contraction that Sri Lanka has seen since 1950 when the Central Bank was set up. What is surprising is that the most intelligent people in the country sit in the Finance Ministry and the Central Bank and how come no one predicted that Sri Lanka was heading for bankruptcy. The Opposition made an announcement that is minuted in the Hansard. Year 2022 witnessed one of the toughest years with the agricultural sector shrinking by -4.6%, industry by -16% and services by -2% that forced almost a million people to look at opportunities overseas. A recent survey has revealed that almost 40% of IT skilled people have migrated.

If one does a sector wise deep-dive to the GDP contribution for Sri Lanka in 2022, the fisheries sector has declined by -13%, manufacturing sector by -16%, construction by -21%, financial and insurance by -23% just to name a few. Sadly, we do not see any constructive actions on the ground to rebuild the economy, other than media rhetoric by the President across different platforms.

Private sector positive

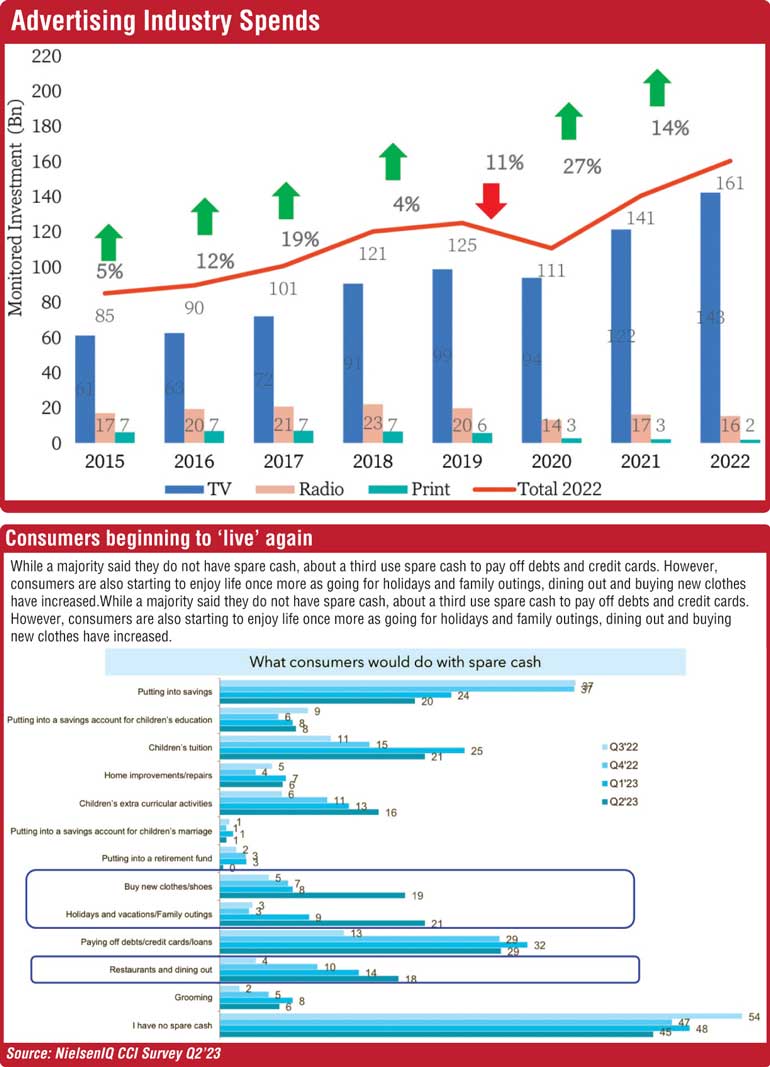

Even with all the above issues, we see how the private sector continues to have confidence in the country and goes on to invest in brand building and developing equity at the consumer end. The monitored advertising spend in 2022 is at a mine blogging value of Rs. 162 billion at a +14# growth over last year. This is only on the above-the -line data. If we capture the below the line activity such as, consumer promotions, advertising on billboards and PR this value can increase by another one hundred billion rupees, meaning the total spend by Sri Lankan companies can touch Rs. 250 billion.

Even with all the above issues, we see how the private sector continues to have confidence in the country and goes on to invest in brand building and developing equity at the consumer end. The monitored advertising spend in 2022 is at a mine blogging value of Rs. 162 billion at a +14# growth over last year. This is only on the above-the -line data. If we capture the below the line activity such as, consumer promotions, advertising on billboards and PR this value can increase by another one hundred billion rupees, meaning the total spend by Sri Lankan companies can touch Rs. 250 billion.

Essentially the last year advertising spend has been driven by the TV medium by +17% growth, radio advertising spend has dropped by -5% while print media advertising is at -10%. However, a point to note is that research reveals that it is the print media that builds opinions in the marketplace while digital and TV media help build brand equity. Hence, if one wants to get the attention and opinion forming in the marketplace a combination of media must be used.

If we look at 2023, the best estimates coming in from media agencies is that we will cross 190 billion rupees plus in the year on media investment by the private sector. This is a good vibe to have, even if the effective spend can be cut by almost 30 % due to contractual deals and bulk pricing. I guess the notion that, ‘best surfers arrive during the most rough waters’, and hence the top marketing companies are aware this is the best time to indulge in brand equity building work. Thus the thrust continues.

Living again

In this backdrop we also see that certain consumer segments are beginning to live again as per the recent Nielsen IQ study done with a typical family visiting relations and going on family trips, even though there is a crunch on disposable income. I am not talking about the urban households of A+ Socio economic groups who frequent the restaurants in Colombo. This is the middle income segment that is just about breathing again, purchasing new clothes from typical mass market fashion outlets. However, they are also paying credit card debt that they had taken during the last one year. Some are redeeming the gold jewelry pawned for house improvements or a child’s higher education within the borders of Sri Lanka.

But a point to note is that subsequent to the study data being released, the prices of petrol and diesel hiked while utility prices such as water and gas prices were also increased. It means that from September onwards there will be another hit on household disposable income. Some fast moving consumer marketing companies are also feeling the pinch due to reduced consumption from the month of August.

Next steps

While we see a spike in private sector investment on consumer awareness building, the hard truth is that we must drive exports harder to reach the magical mark of $28 billion and we would have no option but drive CEPA (Comprehensive economic partnership) with India for a deeper trade integration with the 84 flights to India from Colombo and the daily flights from  Palaly to Chennai connecting the North of Sri Lanka with India. The ferry service set to commence shortly would further drive Indo-Lanka trade. The new Indian ambassador coming in has the experience to drive this agenda even though Sri Lankan businessmen will be uncomfortable. Let’s accept it, India is the fifth largest economy globally today and will be the third largest in the next few years growing at 6+ growth. We have no option but to integrate to make Sri Lanka move from a $70 billion economy to a $100 billion within the next five years. The million dollar question is who will drive the ground activation. As of today it’s only rhetoric.

Palaly to Chennai connecting the North of Sri Lanka with India. The ferry service set to commence shortly would further drive Indo-Lanka trade. The new Indian ambassador coming in has the experience to drive this agenda even though Sri Lankan businessmen will be uncomfortable. Let’s accept it, India is the fifth largest economy globally today and will be the third largest in the next few years growing at 6+ growth. We have no option but to integrate to make Sri Lanka move from a $70 billion economy to a $100 billion within the next five years. The million dollar question is who will drive the ground activation. As of today it’s only rhetoric.

(The thoughts are strictly the personal views of the author and not the views of the organisations he serve in Sri Lanka or in the South Asian region)