Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 12 February 2020 00:00 - - {{hitsCtrl.values.hits}}

Last week shocked every Sri Lankan when the global media revealed the Rs. 17 billion scandal at SriLankan airlines on the purchase of aircrafts from Airbus.

Given that the investigation was done at a global level, the credibility of the facts are strong on the $ 2 million irregular payment that was highlighted. The answer to the issue is not the arrests that were made but how some quartets of the public sector continuously rob people’s money on a cyclical basis and the culprits get away. The general sentiments mentioned in the weekend media by the people was ‘I feel very let down’ by the public sector.

The SriLankan airlines scandal comes in the hot heels of the revelation by parliamentarian ‘Ranjan Ramanayake’ where Sri Lanka was exposed to the Governance issue of the judiciary and the alleged 2.8 billion spent by the previous ‘Yahapalanaya Government’ on luxury vehicles.

This was yet another case in point where some quartets in the public sector without serving the people, blatantly go through the agenda of making money bringing disrepute to the total sector. Let’s accept this, end of the day the money that has been squandered is tax payers’ money. Given the trust by the political hierarchy being to build a ‘corrupt free Sri Lanka’ the general vibe in the country is ‘let us see what action the Government will take on this case’. I guess time will tell.

IMFcautions

In the backdrop of the SriLankan airlines scandal that hit global media, the IMF announced that the Sri Lankan economy is gradually recovering from the Easter terror attack and the economy is set to bounce back from the estimated 2.6% GDP growth to around 3.7% which was good news to many of us. The report goes on to say that the core sectors of manufacturing and tourism sectors will see a turning around.

Corona implication

However, the key issue is that the IMF had not factored in the probable ramifications of the coronavirus given than Sri Lanka has already been hit with a 15% decline in the Chinese tourists in the month of January and that many companies in the manufacturing sector purchase raw material from China hence production coming to a standstill.

If one does a deep dive on the tourism numbers the overall decline in January post the coronavirus outbreak is a - 6.5% in January compared with January 2019. The number of Indian arrivals up by 3.5%, Chinese arrivals fell by 15.3%, UK fell by 18.8%, Russian up 45.6%, Germany fell by 18.1%, French fell by 21.4%. I guess February numbers will give a better indication of the short-term ramifications of the tourism sector to the country and the implication to the predicted growth of 3.7% by IMF.

Private sector bullish

The private sector that accounts for almost 70% of the $ 90 billion Sri Lankan economy, remains very optimistic of Sri Lanka. The latest research done by Nielsen reveals that almost two-thirds of respondents (74% to be specific) was expecting economic conditions to improve in the next 12 months and 79% stating that the company’s sales will increase. What was interesting is that from the respondents surveyed, almost 70% state that in the next three months the company’s business will get better which means that the time is right for the General Elections to be staged. A point to note is that this research study was done prior to the coronavirus revelation globally. Which means that the Chinese economic fallout was not known and we must keep our ear to ground on the new reality unfolding.

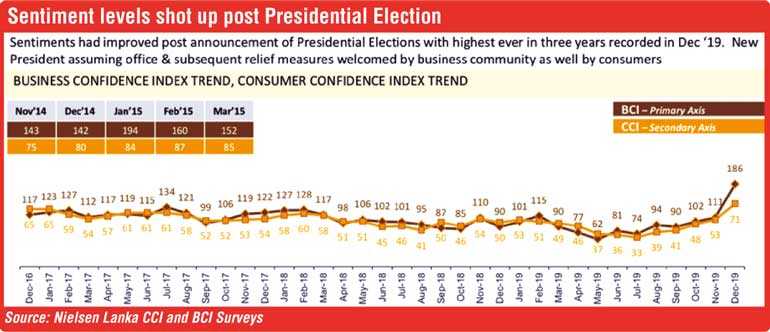

Confidence level highest

The Nielsen report goes on to mention that the overall confidence level has hit an all-time high in December 2019, which is the best that the country has experienced since 2009. Whilst some were cautious to comment citing “It’s hard to correctly anticipate where the economy is heading because the Government is still new”, some went on to state, “The fundamentals of the economy are not right and  the tax breaks and debt moratoriums will not be able to be sustained”. The predictions are coming right as the banks are finding it hard to operationalise the Government policy on SME debt payment. The regional tea plantation companies are also on a catch 22 situation as they have also indicated that the Rs. 1,000 wage rate cannot be absorbed by the companies and hence it is also at a halt. By the way the January business confidence level has dipped and some are already speculating that the positive sentiments are waning.

the tax breaks and debt moratoriums will not be able to be sustained”. The predictions are coming right as the banks are finding it hard to operationalise the Government policy on SME debt payment. The regional tea plantation companies are also on a catch 22 situation as they have also indicated that the Rs. 1,000 wage rate cannot be absorbed by the companies and hence it is also at a halt. By the way the January business confidence level has dipped and some are already speculating that the positive sentiments are waning.

However, the private sector remains bullish in the market with almost Rs. 125 billion invested on advertising at rack rates in the year 2019. Top marketing companies like Unilever, Hemas, Dialog, Nestle and Ceylon Biscuits continue to invest in the country even though trading conditions remain challenging, overall consumption in the FMCG sector declined by 4.7%. A point to note is that the numbers in the ‘advertising spend’ chart are at rack rates and the actual numbers can be lesser by 30-50% of the rates.

Market reality – 2019

If I track back to Q1-2018 the overall FMCG consumption registered at +2.7% in volume. 2018-Q2 GDP household consumption slowed down to +1.3%. From Q3 and Q4, 2019 the FMCG consumption at the household end declined in volume by -1.3% and -4.9% respectively which was the first indication that the Sri Lanka consumer was in trouble. By the way this was the time that Provincial Council Elections were staged and 43% of the votes were won by SLPP signalling to the then Yahapalanaya Government that things were not right.

Sadly, the Yahapalana did not do any changes to the product even after the voters’ warning on 18 February 2018. By 2019 at the household end things were getting even tougher with the consumption of milk powder declining by almost 7%. There were categories like ‘soups’ where the penetration at household end had dropped by almost 8% (which was almost 400,000 homes).

The specific numbers were Q1 and Q2 – 2019, 3.7% household consumption volume continued to decline by -3.9% and a staggering -4.7% respectively. Toilet soap consumption declined by 9% on the urban and 6% in the rural. Toothpaste consumption has contracted by 2%, shampoos at a staggering -12% decline in the urban areas and -5% in the rural which is frightening as this means the quality of life was deteriorating. However, the adverts tiny support by the private sector continued which signify the positive sentiments communicated by the private sector whilst the public sector continued to falter.

Conclusion

The key take out is that the private sector remains committed to driving the Sri Lankan economy with all the challenges thrown to the industry but sadly the public sector commitment to serve remains a question given the many revelations on corruption. But, a point that needs to be highlighted is that the majority of the public sector are honest to the task as the current president stated last week. It is only a handful that are in question.

(The thoughts are strictly the views of the author and not the views of the organisations he serves in Sri Lanka or overseas.)