Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 27 December 2024 00:20 - - {{hitsCtrl.values.hits}}

Having macroeconomic and financial system stability being restored, the focus should shift towards enhancing growth prospects that are both inclusive and sustainable

2024 is a year to be remembered in Sri Lanka’s economic journey since many challenges faced by the country have significantly eased. Sri Lanka is returning to normal after recurring economic shocks since 2019, including the Easter Sunday attack, the pandemic, and the economic crisis. The global economy also exhibited economic resilience amidst multiple challenges, with a soft landing compared to what was feared. Meanwhile, geopolitical conditions became unfavourable. Let’s dive deeper into these.

2024 is a year to be remembered in Sri Lanka’s economic journey since many challenges faced by the country have significantly eased. Sri Lanka is returning to normal after recurring economic shocks since 2019, including the Easter Sunday attack, the pandemic, and the economic crisis. The global economy also exhibited economic resilience amidst multiple challenges, with a soft landing compared to what was feared. Meanwhile, geopolitical conditions became unfavourable. Let’s dive deeper into these.

Economic updates for Sri Lanka in 2024

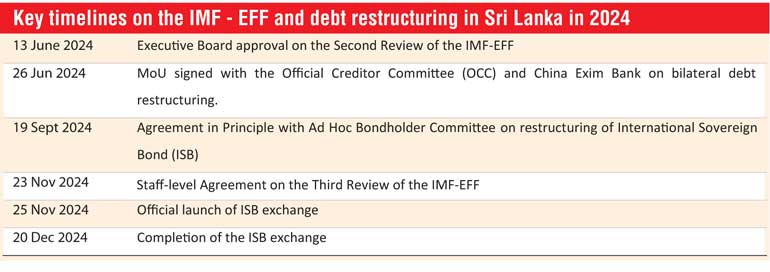

In 2024, Sri Lanka made notable progress in restoring macroeconomic and financial system stability. Following a selective debt-standstill announcement in 2022, external debt restructuring negotiations were concluded in 2024. Subsequently, the country exited the restricted default status it had experienced over two and a half years. Further, the sovereign rating was upgraded by several notches, thus reducing the country’s risk premium substantially. The Extend Fund Facility of the International Monetary Fund (IMF) continued successfully and the Executive Board's approval for the second review and staff-level agreement for the third review were reached in 2024. These developments, along with political stability built on a stronger mandate, helped ease market conditions and enhance bullish market sentiments during the latter part of the year.

The key macroeconomic indicators improved compared to alarming levels that prevailed in recent years. Inflationary pressures eased notably, and the country recorded temporary deflation after several years. This allowed the easing of monetary conditions further during the year to support credit expansion and economic activity. Moreover, economic growth recovered at a faster pace, facilitated by low interest rates, improved economic sentiments, reviving domestic and external demand, and a lower statistical base of growth in 2023. Importantly, persistent imbalances in the fiscal sector were largely adjusted through fiscal consolidation measures and improved fiscal discipline. Buffers of foreign reserves to withstand external shocks were improved, supported by continuous forex purchases by the Central Bank.

Meanwhile, reflecting the external current account surplus supported by increased net inflows of forex and positive market sentiments, exchange rate appreciation continued in 2024 as well. These improvements on the external front alongside the need to increase fiscal revenue prompted the Government to consider the relaxation of remaining import restrictions by the end of the year.

In addition to the improvements on the macroeconomic front, the financial sector resilience also improved, and any financial sector catastrophe was avoided decisively. Key financial soundness indicators, including capital adequacy, credit quality, liquidity, and profitability, have shown improvement in the year. Completion of the restructuring of foreign currency debt held by the banks reduced the uncertainties and risks to the banks. Prominently, the legal framework governing the banking system was further strengthened to enhance the soundness of the banking sector, including the areas of governance, related party transactions, large exposure, and ownership. Money market and financial market performances were enhanced, and the stock market reached new heights.

Nevertheless, the scarring effect of the prolonged economic hardships on the people and businesses remains. Targeted policy measures to support the most vulnerable segment of the population and businesses would offer temporary relief for survival. Nevertheless, improving inclusive economic growth prospects would be a lasting solution to this problem.

Global economic performance in 2024

Global economic prospects revived, even amidst tighter disinflationary policies of central banks and continued stiff financial conditions. However, global growth over the medium term is projected to hover below the averages recorded before the pandemic. Inflation in many countries returned closer to the targeted levels, after spikes observed during 2022-2023. This disinflation record without leading to global recession is commendable, thanks to the synchronised monetary policy measures and eased global supply. Subsequently, consistent reduction in inflation and anchored inflation expectations facilitated transition towards broad-based monetary policy easing. In 2024, major advanced countries, including the USA, UK, and European Union, began to reduce policy interest rates, after maintaining tighter monetary stance in 2022 and 2023.

Meanwhile, prices of key commodities, such as crude oil, LP gas, coal, and agricultural products, exhibited less volatility and stabilised at a lower level, due to an improvement in demand-supply mismatches. The US dollar strengthened against its major rivals, as measured by the US dollar index. Several political developments unfolded this year with many countries electing new political administrations. Shifting major policy priorities in global superpowers, particularly the USA, could shape the global geoeconomic and social dynamics in the period ahead.

In general, fiscal performance worsened globally in 2024 and fiscal sustainability concerns have resurfaced. Global public debt widened in 2024 and is set to increase further in the coming years. Even though it is mainly driven by the USA and China, increasing public debt is becoming a widespread issue. Moreover, fiscal vulnerabilities are emerging further, prompting warnings from multilateral agencies on the high likelihood of sovereign distress in many countries. From a medium-term perspective, pursuing fiscal adjustment through fiscal consolidation, building fiscal buffers along with enhancing fiscal governance would help mitigate the lingering effects of debt unsustainability and the need for painful one-time fiscal adjustments. The time is conducive now, as easing global monetary conditions creates space for countries to absorb the impact of fiscal tightening.

On the financial front, the near-term risks to global financial stability remain muted, supported by stable macroeconomic conditions and easing monetary conditions. However, the possible spillovers of growing economic and geopolitical uncertainties on economic sectors and financial system cannot be ruled out. Meanwhile, social indicators, including poverty reduction, gender equality, and female labour force participation, did not show any significant progress during the year, and thus requiring continuous global attention.

Key takeaways

Sri Lanka has once again demonstrated its resilience by emerging from the deepest economic crisis in record time. This was possible through decisive policy measures involving multiple stakeholders and international partners. However, it is essential not to become complacent and to continue prioritising structural reforms. Sri Lankans have now fully understood the cost and implications of persistent economic imbalances and macroeconomic instability. Any step forward should be taken cautiously to circumvent backtracking from the strong reform agenda.

Having macroeconomic and financial system stability being restored, the focus should shift towards enhancing growth prospects that are both inclusive and sustainable. Reforms aimed at addressing remaining structural economic issues and vulnerabilities should continue in the same spirit. Since the global environment is becoming ever more unpredictable, Sri Lanka should build buffers in its external, fiscal, financial, and monetary sectors to withstand externally driven shocks with minimal adjustment cost. Additionally, Sri Lanka needs to adapt to global megatrends, such as climate change, geoeconomic fragmentation, the adoption of artificial intelligence, and the aging population. Such preparation will empower Sri Lanka to navigate the evolving global landscape effectively in the years to come.

(The writer is Director of Economic Research, Central Bank of Sri Lanka.)