Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 17 January 2025 00:28 - - {{hitsCtrl.values.hits}}

While these establishments are often well-run and popular with tourists, they’re operating in a legal grey zone that

creates real problems for our economy and communities

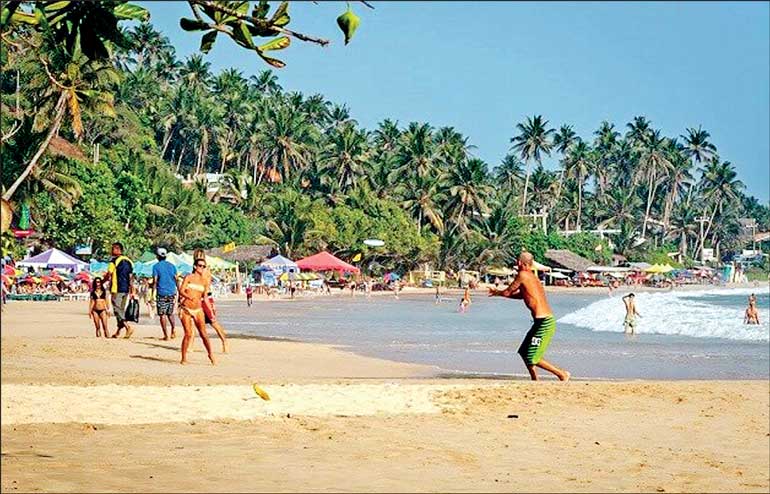

If you’ve spent time in Sri Lanka’s beach towns recently, you’ve probably noticed something interesting: a boom in foreign-run businesses. That trendy café with perfect flat whites, the popular surf school, the Instagram-worthy yoga retreat – many of these spots, while adding character to our tourism landscape, are operating without proper licence or approvals.

If you’ve spent time in Sri Lanka’s beach towns recently, you’ve probably noticed something interesting: a boom in foreign-run businesses. That trendy café with perfect flat whites, the popular surf school, the Instagram-worthy yoga retreat – many of these spots, while adding character to our tourism landscape, are operating without proper licence or approvals.

The grey economy in paradise

From Arugam Bay to Mirissa, unauthorised foreign-operated businesses have become part of the scenery. While these establishments are often well-run and popular with tourists, they’re operating in a legal grey zone that creates real problems for our economy and communities.

According to the Immigration Act No. 20 of 1948, tourists can’t simply arrive and start businesses here. The Exchange Control Act also has strict rules about handling foreign currency. Yet these regulations are routinely sidestepped.

Why this matters

This isn’t just about following rules – the impact is significant and multifaceted:

Understanding the big picture

Here’s the thing: as Sri Lanka’s tourism sector recovers post-COVID, many of these unauthorised businesses are actually filling important market gaps. They’re bringing in tourists, creating buzz, and contributing to local economies – they’re just doing it through the wrong channels. One issue is that our system isn’t designed for small and medium-sized foreign investments.

While we roll out the red carpet for large FDIs, smaller entrepreneurs face a maze of bureaucracy that often feels impossible to navigate. In fact, you could argue that this red tape is a feature and not a bug: it allows corrupt officials from Immigration, Excise, and Inland Revenue to be given bribes in exchange for approvals.

Combined with the lack of enforcement, this makes operating outside the law the easier choice for anyone who wants to set up a business here.

A solution that makes sense: The Local Business Visa

Instead of playing cat and mouse with unauthorised businesses, the solution should be to create a legitimate pathway that works for everyone. Here’s how such a solution could work in the form of a specific visa for SME investments that, for want of a better term, I’m going to call the Local Business Visa.

Restricted to specific sectors/businesses

Minimum investment thresholds

Smart employment rules

Making it simple

The key is bundling all necessary approvals together so that the investor gets the following along with the visa. This also makes it easier for authorities to track and ensure tax and other statutory payments are collected.

Making the switch

Here’s how we can make this transition work:

1. Amnesty period (6 months)

2. After the amnesty

The broader benefits

This isn’t just about regulation – it’s about smart economic growth. Consider this: Colombo proper has a night-time population of only around 750,000 residents. We need more people living, working, and spending money here to build a vibrant economy. While the proposed Local Business Visa would have less of an impact on Colombo, it’s perhaps time to think along similar lines on growing Colombo as a destination for skilled workers who are location agnostic and who would enjoy contributing to the social fabric of the city.

Time for change

The reality is clear: people want to do business in Sri Lanka, and they’re finding ways to do it, whether we have proper systems in place or not. Instead of maintaining this unsustainable situation, let’s build a framework that:

We have a choice: continue watching our tourist towns operate in a regulatory grey zone, or create a system that works for everyone. The Local Business Visa isn’t just good policy – it’s good business sense.

(The writer is an entrepreneur with interests in multiple sectors. He’s a Chevening Fellow and holds an MBA from INSEAD.)