Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 21 November 2018 00:00 - - {{hitsCtrl.values.hits}}

The rising Non-Performing Advances (NPA/NPAs) is a matter of concern to the entire financial industry. It is a nightmare. The weekend papers have published some articles based on interviews journalists conducted with respective bank CEOs and also based on the third quarter financial results of those banks.

All CEOs have stated their concerns over rising NPAs. However, no one has quoted a strategy to overcome the situation. It may be that they don’t want to disclose their strategies to the public. There can be many reasons for the cause and some of them were highlighted by the writer in his article dated 17 October, published in the Daily FT.

However, apart from them, external factors too can influence the NPAs. Scrutinising further, a correlation was sensed and presumed between the rising value of the dollar and alarming NPAs of the country. Hence, the following study has been carried out in order to establish the connection between the exposed hypotheses.

However, apart from them, external factors too can influence the NPAs. Scrutinising further, a correlation was sensed and presumed between the rising value of the dollar and alarming NPAs of the country. Hence, the following study has been carried out in order to establish the connection between the exposed hypotheses.

Sri Lankan context

Our economy is mainly driven by imports. It is visible every day a vast number of ships are anchored in the harbour bringing everything from needles to heavy machinery to this country. Any negative price variance of the dollar has an enormous impact on the economy. Also, the unfavourable deficit between imports and exports which is better known as the Current Account Deficit (CAD) creates an unrest in the market.

As per statistics published by Central Bank of Sri Lanka (CBSL), Sri Lanka’s imports rose more than 10% to $ 1,754 million Year-on-Year (YoY) as of July end, this year. The major contributors to this upsurge are 28% from the fuel imports and 120% from personal motor vehicle imports.

Sri Lanka has spent $ 276.6 million on fuel in July and for the first seven months, the total bill was $ 2.4 billion. Overall, during the first seven months of this year, Sri Lanka has imported goods worth of $ 13.2 billion, up by 12.4% YoY and exported goods worth of $ 6.8 billion, up by 6.1% YoY, creating a wider current account deficit of $ 6.4 billion. During the same period last year (YoY), the current account deficit was $ 5.3 billion.

Worker remittance to Sri Lanka continued its declining trend as Sri Lanka’s biggest foreign income generator and one of the two current account stabilisers is facing the crucial test of rebalancing socio-economic changes in the Gulf.

The workers’ remittances in August declined by 11% compared to the previous month and by 1% to $ 4.7 billion in the first eight months, YoY. By the end September, workers’ remittances amounted to $ 5.27 billion, down by 1.5% from $ 5.35 billion YoY. Similarly, Tourist arrivals in October managed to grow by a disappointing 0.5% whilst the first 10 months figure was up by 10.6% YoY. To make matters worse, it is reported as of first week of November, the country has seen an outflow of Rs. 16.2 billion in stocks and Rs. 100.8 billion in Government securities.

Under the given circumstances, the value of dollar hiking against the rupee is an inevitable scenario. Oil prices in the world market have risen 22% this year. The US-China trade war creates many uncertainties in the global market. The rate hikes in the US fascinate funds from money markets around the globe. The crashing rupee, rising oil prices, and the festive importer demand could drive the prices of goods further up during the next few months.

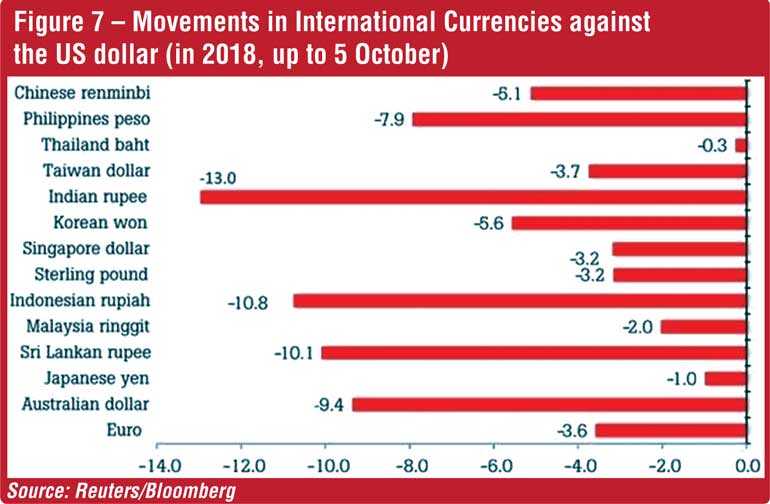

The Sri Lankan Rupee has lost its value by over 10% as of the first week of October this year against the US Dollar. This set up has certainly challenged the Non Performing Advances (NPA/NPAs) situation of the Banking Financial Industry (BFI) and also the Non-Banking Financial Industry (NBFI) as most of the customers, especially in the BFI, are involved or influenced by imports at some point of their supply chain.

It is reported CBSL will only conduct limited interventions to prevent sharp volatility of the Sri Lanka Rupee and will not intervene given the learnings from the past where reserves were unsuccessfully used to defend the currency which then eventually depreciated sharply (during 2011/12 and 2015). Instead, CBSL with the blessing of the Government has started to enforce restrictions on imports and exporter friendly rules to ease the pressure on the currency.

The behaviour of the dollar for the last 12 months has been significant. The range within which it performed during the said period has been from Rs. 153.24 to Rs. 174.77, the lowest being Rs 152.37 at one point during this period.

The prevailing political scenario of the country will have a nasty impact on the economy. It is predicted that the economy will have tougher times ahead. Restrictions on Letters of Credit (LCs) have been implemented. The festival season is around the corner. This will pressurise the economy further as the demand for goods irrespective of their essentiality will rise. However, the question arises at what cost these goods will come to the market and whether they will be sold as expected. If not, a mismatch of the demand and the supply will occur. This will result in a surplus of goods in the market and that will influence the debt servicing capacity of the borrowers which will finally end up with NPA issues.

Further, the Government has allocated little over Rs. 2,057 billion for debt servicing in 2019 which is the highest amount allocated from a budget in the history of Sri Lanka. It is revealed out of this amount, Rs. 1,271 billion should be paid locally next year, while Rs.786 billion, which is equal to $ 4,650 million, should be paid to foreign lenders. Accordingly, the Government expects to borrow Rs.1, 944 billion from local and foreign sources for its debt servicing, including the financing of the budget deficit in 2019.

How the deficit will be reinforced is unclear yet. The budget for 2018/19 has gone missing from the limelight as there are crucial issues than the budget to handle at present. However, as happened before the end users and the retailers will be forced to carry the final burden. This means the impact on NPAs will be further challenged. It has been experienced in the past the lack of consistency in economic policies in the country, especially in the tax policies introduced by the Government has had worse adverse impact on the rupee depreciation. Though the Government has tried to increase revenue through taxation, the budget deficit can be solved through increasing income.

Sri Lanka’s Foreign Exchange Reserves (FER/FERs) were measured at $ 7.1 billion in October 2018. The FER is equalled to 4.1 months of imports in August 2018. The country’s domestic credit reached $ 50.9 billion in September 2018, representing an increase of 11.0% YoY

NPA

It is earlier reported the ratio of Non-Performing Advances, one of the key indicators of the banking industry’s asset quality, rose to 3.6% by the end of August from 3.4% in July. It was at 2.5% at the end of 2017, 2.6% in 2016, 3.6% in 2015, 4.2% in 2014 and 5.6% in 2013. The notable factor is that the NPA ratio has been declining in the last five years. However, it suddenly started to incline and it is reported during the first eight months of this year, the total NPA volumes rose by 58% from Rs. 161 billion to Rs. 255 billion. The report further said, in August alone the non-performing loans grew by 6.7% to Rs. 16 billion compared to the growth of 4.7% or Rs.11 billion in July.

It is also reported out of the new loans, the rescheduled loans showed an accelerated growth since the beginning of 2018 as the banks were fighting to discipline non-performing loan base. These statistics show a clear evidence that businesses and consumers continue to struggle in servicing their loans on time.

Indian context

The Indian Rupee continues to decline, having lost over 13% since January up to the first week of October this year against the US Dollar, and the Current Account Deficit has widened to 2.4% of GDP. India’s CAD is $ 13 billion or 1.9% of the GDP in the 4th quarter of 2017/18.The CAD increased to 1.9% of the GDP in 2017/18 from 0.6% in 2016/17.However, the CAD inclined marginally in the following quarter to $13.7 billion or 2.1% of the GDP.

The Reserve Bank of India (RBI), the Central Bank of India, attributed the widening of the CAD to a higher trade deficit was due to a larger increase in merchandise imports which was around $ 41.6 billion related to exports. India’s trade deficit increased to $ 160 billion in 2017/18 from $ 112.4 billion in 2016/17.India’s FERs were measured at $ 376.2 billion in September 2018. The FER is equalled to 9.0 months of imports in September 2018. The country’s domestic credit reached $ 2,030.0 billion in September 2018, representing an increase of 10.5% YoY.

NPA

The NPAs and restructured advances in the banking system stood at 12.1% of gross advances as at end of March 2018. This is the highest level since 2000. The Reserve Bank of India’s Annual Report for 2017/18 stated same was standing at 9.32% in 2017, 7.48% 2016, 4.27% in 2015, 3.82% in 2014, and 3.23% in 2013. However, to be fair by the Indian economy, it is noted the result of transparent recognition of stressed assets as NPA in the last financial year too have been contributed to this factor.

However, it is evident that the NPA of the BFI of India is higher than the Sri Lankan context and it has been increasing at a rapid speed during the last five years. The gross bad debt ratio of the banking system may touch a two-decade high, with banks under Prompt Corrective Action (PCA) expected to be the worst hit, warned the Financial Stability Report (FSR) released by the RBI in last June. India’s NPAs are growing rapidly and the country is at fifth spot in terms of high NPAs across the world, says a research note. One of the key factors for this situation is their liberalised credit policies during the last four to five years.

While Sri Lanka and India are struggling against the rising dollar prices two of the Southeast Asian countries namely Thailand and Malaysia are managing the situation very positively.

Thailand context

The Thailand Baht has been the best performing Asian currency with a 1.3% gain since mid-August and has held steady throughout the year averaging 0.3% as of the first week of October. It is evident, Thailand has a large current account surplus partly driven by very strong tourism growth.

The Bank of Thailand (BOT), the Central Bank of Thailand very proudly says that they have high trade and current account surpluses, steady GDP growth, low inflation and, more importantly, economic policy certainty. These factors have outperformed the recent global currency market turmoil and safe guarded their local currency, baht.

Thailand is a big exporter of autos and other goods, which contributes to its account surplus. Its status as an economic centre is also unlikely to be challenged by the ongoing US-China trade war. The auto sector of Thailand is geared toward exporting to the region, and not to the US. The country is “potentially standing to gain, from trade and supply-chain diversions” with manufacturers possibly relocating their factories there to avoid tariffs.

Thailand’s economic growth is looking stronger and it is predicted the BOT could soon raise interest rates which would support the currency further. In the latest reports, Money supply in Thailand increased 5.3% YoY in Jun 2018. Thailand’s FERs were measured at $ 196.4 billion in September 2018. The FER is equalled to 9.7 months of imports in September 2018. The country’s domestic credit reached $ 601.0 billion in September 2018, representing an increase of 6.8% YoY

It is also noted that the Thailand’s bank lending rates are low as 6.32%. This strategy has allowed their customers to enjoy high returns. The system is geared to generate low-cost funds by itself.

NPA

Thailand’s NPA ratio stood at 2.94% in Jun 2018, compared with the ratio of 2.93% in the previous quarter. The data reached an all-time high of 47.4% in Jun 1999 and a record low of 2.2% in Dec 2014. The notable factor is that the NPA ratio has been fluctuating around the same centred percentage i.e. 2.5%, for the last four years.

(The BOT provides quarterly Non Performing Loans Ratio. Non-Performing Loans are loans classified as Substandard, Doubtful, Doubtful of Loss, and Loss. Those loans as in Sri Lanka are overdue for more than three months).

Malaysian context

While not as strong as Thailand’s currency, the Malaysian Ringgit has been quite resilient, not sliding as much as the other currencies in turmoil. Malaysia is a large oil exporter. Higher oil prices have helped the country’s current account surplus. Investors who are looking to escape the struggling Indonesian rupiah may want to consider the ringgit because Malaysia can also offer the same exposure to commodities like palm oil.

These two countries (Malaysia and Indonesia) are the world’s two largest palm oil producers and exporters. While the ringgit has not escaped the emerging markets rout fully, Malaysia’s exports were strong in July with 9.4% growth against the YoY figures. Imports growth meanwhile, reduced to 10.3% YoY.

The ringgit has slipped only 2% against the dollar, as of the first week of October. Malaysia expects the (Malaysian ringgit) to reacquire its status as an Asian outperformer once the ongoing uncertainty from the US-China trade war and the US dollar strength lifts.

In the latest reports of Bank Negara Malaysia, the Central Bank of Malaysia says money supply in Malaysia increased by 5.7% YoY in Jun 2018. Malaysia’s FERs were measured at $ 98.2 billion in October 2018. The FER is equalled to 6.1 months of imports in September 2018. The country’s domestic credit reached $ 480.7 billion in September 2018, representing an increase of 8.0% YoY

NPA

Malaysia’s NPA ratio stood at 1.6% in May 2018, compared with the ratio of 1.58% in April. The data reached an all-time high of 9.5% in February 2006 and a record low of 1.5% in January 2018 and again in September 2018 which highly commendable under the current economic conditions.

These two economies have a few things in common, low inflation as well as large current account surpluses and high foreign exchange reserves. Typically, a strong surplus supports a country’s currency because it means the nation is less dependent on foreign currencies.

Conclusion

When summarising the above findings, the following characteristics are visible. The Sri Lankan Rupee has lost its value by over 10% as of the first week of October this year against the US dollar. The NPA of Sri Lankan banking industry stands at 3.4% as of July 2018. The Indian Rupee has lost its value by over 13% during the same period. The NPA of Indian banking industry stands at 12.1% as of July 2018. Both these countries are experiencing a current account deficits.

Correspondingly, the Thailand Baht has held steady throughout the year averaging only 0.3% value depreciation as of the first week of October. The NPA of Thailand stands at 2.94% as of Jun 2018, the Malaysian ringgit has experienced only 2% value depreciation against the dollar during the same period. Malaysia’s NPA ratio stands between 1.6% and 1.5% during May and June 2018. Both these countries are enjoying current account surplus.

Considering the above outcome it is evident that there is a strong correlation exists between the behaviour of the dollar and the NPA of a country (vice versa situations are also possible under different conditions). When the local currency is strong against the dollar, the NPAs are performing well within expected limits. When the local currency is weak against the dollar, the NPAs are behaving miserably. Therefore, one of the main reasons for high NPAs of a country can be identified as the lack of withstanding power of the local currency against the dollar or foreign currency.

Also, the countries with current account deficit like India and Sri Lanka are most vulnerable to an economic downfall during times of global volatility which finally leads in to NPA issues. (There can be other factors which influence rising NPAs such as Government policies and PESTEL factors. Some of them have been discussed in my previous article. The reason for the mismatch of comparison between Thailand and Malaysia under the same scenario is due to these factors.)

Elaborating further on this scenario, it is presumed when the local currency is strong against the dollar or foreign currency, the production process doesn’t get distracted. Government restrictions to discipline the current account deficit such as present 200% cash margin on LCs doesn’t frustrate the costing process of a business. Therefore a sustainable business process could be seen in such countries. The supply chain operates without any interruption. No one in the chain gets panicked or victimised as a result of the forex market conditions. Hence, their loan commitments could be met on time and lenders such as bankers and non-bankers can enjoy an uninterrupted loan re-payments. This will result in well controlled NPAs in such countries.

(The writer, is the founder of Infornets, an organisation formed with the intention of sharing credit related information and financial knowledge to less-informed people, locally and globally. He counts 35 years of experience in the Non-Banking Financial Industry of Sri Lanka. He is a former CEO/General Manager of a Non-Bank Financial Institution. He holds a Master’s Degree in Business Administration from the UK. He is a Member of Institute of Management of Sri Lanka and an Associate Member of Sri Lanka Association of Advancement of Science. He can be reached via www.infornets.com or [email protected].)