Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 8 February 2018 00:00 - - {{hitsCtrl.values.hits}}

Whilst the Share of Voice (SOV) is currently focused on the local elections, the fact of the matter is that Sri Lanka is at a crossroads to pay almost a $ 10 billion debt in the next three years. With our income sources not very competitive, with export revenue at $ 11.4 billion, FDI’s at $ 1.6 billion and remittances at around $ 6.5 billion, the task of debt payment becomes a tough task. In this backdrop, the FTA with Singapore is a move in the positive direction.

FTA with Singapore

The Sri Lankan FTA with Singapore comes in the backdrop of a $ 2.7 billion trade between the two countries. Sri Lanka’s current export mix includes textiles, precious stones, refined petroleum, fisheries, and trade in services to be specific.

Though the two-billion-dollar number looks small for a nation which has five million people and a GDP growing at 2.6%, the fact is that Singapore, positioned as the ‘Financial Hub’ for the region and being a possible gateway to ASEAN, can be a very attractive proposition for Sri Lanka. On a separate note, the fact that Singapore has recognised Sri Lanka as a window to South Asia means that there is potential for the trade to grow significantly between the two countries. Sri Lanka can be the bridge to Singapore with the current FTAs which we have with India and Pakistan.

A point to note is that the FTA with Singapore had taken 18 negotiations, which explains the detail that it must have gone into in the midst of Sri Lanka losing the key architect of the FTA, my good friend Dr. Saman Kelegama. The fact that the Singaporean Prime Minister singled out the contribution made by Dr. Kelegama on the day the FTA was signed in Sri Lanka, in the presence of the President of Sri Lanka, intimates the spirit of the policymakers which is a big win for the future of the FTA.

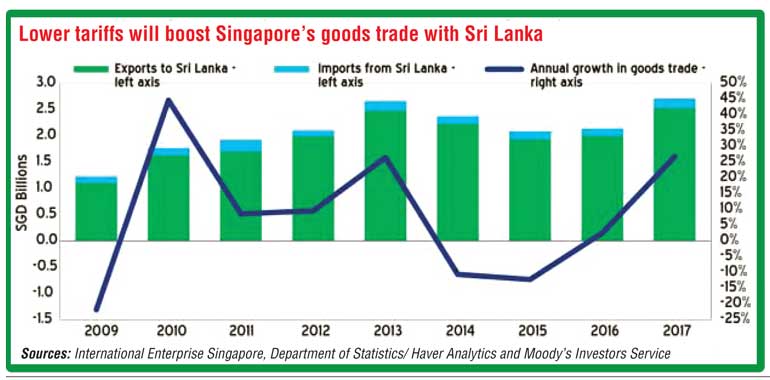

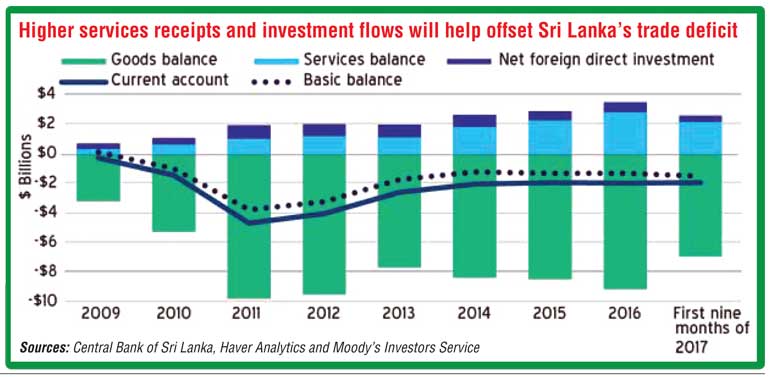

However, one must note the voice of the private sector on the FTA post signing. The logic being that business is done by the private sector and not the public sector. Given that 99% of the goods imported into Singapore is duty free and Sri Lanka in turn will open its doors to 80% of the items within one year duration, the FTA has the teeth to kick in strong economic growth. If we do a deep dive into the reality, both economies are struggling. Sri Lanka registered a 3.3% GDP growth in the last quarter whilst Singapore is also struggling at a 2.7% GDP growth. Based on the Moody analytics, the higher receipts and investments from Singapore can offset the trade deficit whilst the low tariffs have the potential to boost Singapore goods with Sri Lanka as per appendix 1.

Whilst the targeted areas for economic integration from the FTA are financial services, telecommunications and e-commerce, the current best case for a success story is Prima. Sri Lanka now must build on this and improve on the current FDI pattern of just being 5.3% of the total in the period 2014-2017.

ASEAN – $ 2.4 trillion market

The ASEAN market is worth $ 2.4 trillion with an access to around 630 million people with the last quarter growth at 5.2%, which is the fastest growth seen on a quarterly basis since 2013. The US invested almost $ 274 billion in the ASEAN which explains the attractiveness of the geography for top investors.

The key market in ASEAN is Indonesia, growing at 5.3%, Malaysia at 5.2%, Philippines upbeat at 6.6%, whilst the best performing is Cambodia at 7.4%. Thailand is growing at a modest 3.7% while Singapore and Burma are at just 2.5% but showing potential for the future.

Reaching

Indonesia – $ 1 trillion

In my view, the Singaporean FTA will be key for Sri Lanka to reach the $ 1 trillion economy of Indonesia. The country is poised to be the no. 4 economy globally by 2050 and top economy for East Asia. The attractive domestic market can be ideal for the key industries in the fast moving consumer goods sector of Sri Lanka, provided we sharpen ourselves with innovation and supply chain consistency.

Thai and Malaysian markets

The two key markets in East Asia driven on an industrialisation platform are Thailand and Malaysia. Both markets are focused on a strong market-driven tourism industry focused on the Asian region where there is potential for collaboration with Sri Lanka. This can include best practice sharing exercises on marketing and new product development.

There is a planned wage increase in Thailand for 2018, which will increase the household consumption that have positive impacts on Sri Lankan export consumption whilst the Malaysian economy growing at 5.2% can have many options of sharing technology and IT with the Sri Lankan economy via the Singaporean FTA. I guess when the markets open up in the next 12 months, once the FTA is on track, we can see the reality emerging.

Key issue

Whilst the FTA with Singapore can be attractive, the challenge for Sri Lanka will be the growing tussle between China and India.

China’s investment in Hambantota irked India, given that the location is just 10-12 nautical miles to the main sea lanes that drive trade between East-West. This also happens to be the same channel where crude oil moves from India to China. The $ 1.4 billion investment by China in the Colombo Port further challenged the geographical superpower position but Sri Lanka had no option, given the debt challenge.

From an Indian perspective, the media has unearthed that there are discussions on Mattala Airport to be given on lease to India. Given that all Indian airlines can operate out of Mattala, this can lead to a new set of economic activity taking form. It is also an interesting proposition given that India commands almost 19% visitors of the two million people that visit Sri Lanka.

But a point to note is that even after a decade since the FTA with India was signed, the exports out of Sri Lanka remain at below a billion dollars which is dogged by non-tariff barriers that are been challenged by both parties. On the exports of services, India commands a language synergy with Sri Lanka which China cannot enjoy, but in the sectors like construction this has not become a limiting factor.

Conclusion

Whilst there are many ways of developing a country, the FTA approach is one of the preferred options that countries like Bangladesh and Vietnam has followed. Incidentally, Sri Lanka, Bangladesh, and Vietnam, way back in 1990, had an export revenue of $ 2 billion and today, Bangladesh is touching $ 32 billion and Vietnam crossing the $ 214 billion mark. Sri Lanka is lagging behind at $ 12 billion which explains the robustness required by us. The FTA with Singapore is a move in the right direction but let us first see how 10 February turns out for the country.

The author was the Executive Director of the key policymaking body National Council For Economic Development (NCED) in the Presidential Secretariat whilst also being the Chairman of the Sri Lanka Export Development Board( EDB) and Sri Lanka Tourism. The thoughts are strictly his personal views.