Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 13 September 2024 00:22 - - {{hitsCtrl.values.hits}}

Irrespective of who becomes President, implementation of any of these manifestos, as usual, would be impossible – Pic by Shehan Gunasekara

Shallow election manifestos

Shallow election manifestos

Election manifestos of all main contenders are out, and by and large it has followed the precedence over the last so many decades. Increase salaries for the public sector, lower PAYE tax, and long lists of prosperity. There is little indication as to how all these would be achieved, how much funds would be allocated to accomplish each task and how these funds would be obtained, etc.

There is a more recent tendency to show lengthy 200, 300 page manifestos to give the impression of a detailed study. On the contrary, although the problems are complex, a truly detailed analysis should result in a short, concise and simple action plan which is implementable. Complex, lengthy solutions are unlikely to be implemented and what could be achieved in a period of five years is limited (remember the infamous lengthy Budget speech of 2015?).

The narrative of welfare, for a population with a majority struck by poverty, may make sense from the point of attracting votes. Nevertheless, whatever welfare donated needs to be earned, or put another way, someone needs to pay for that. In short, a welfare state which is poor to start with, is a recipe to remain poor. The solution lies in investment and incentives to sectors that could make the economy stronger, so that sustainable welfare could be afforded eventually.

12-point economic challenge

Irrespective of who becomes President, implementation of any of these manifestos, as usual, would be impossible. The course of the President, also as usual, would be one that is not in the manifestos. In that light, the purpose of this article is to provide 12 challenges for an economic turnaround. If the next President manages to achieve these over the next five years, it could result in a sustainable turnaround of the country, possibly for the first time since independence.

1. Invest in foreign currency earning segments

Invest a total of Rs. 50 b annually in technology, tourism (special emphasis on medical tourism), small-scale agricultural exports and export-based small industries.

The objective is to boost the annual earnings of each sector from $ 1b, $ 3 b, $ 1.5 b and $ 4 b respectively to $ 3 b, $ 8 b, $ 2.5 b and $ 6 b respectively over the next 5-7 years. The relevant industries need to be consulted as to how best the investments should be made.

2. Concessionary tax rates for foreign currency earning segments

50% lower concessionary corporate tax rates (including WHT on dividends) and PAYE rates for employees of the above four sectors. It could be gradually implemented over the next five years. The objective is to promote investments (both foreign and domestic) into these sectors and to retain and attract the workforce.

The annual loss of tax income from this measure could reach Rs. 50 b by 2029.

3. Selective, temporary import restrictions or restrictive taxes

Import restriction on vehicles should be lifted immediately. Yet, selective restrictions or restrictive import taxes should be implemented on non-essential or luxury goods. These restrictions could be gradually lifted in the long run, once foreign reserves grow sufficiently.

4. Ensure new foreign borrowings are solely to repay existing foreign borrowings

The combined objective of the above three measures is to ensure foreign currency earnings to exceed the import bill. As a result, the need for foreign borrowings on an annual basis would be solely to repay the existing foreign borrowings. Therefore, the foreign debt burden should not be increased further and should remain around $ 55 b until 2029. Foreign reserves should be increased from $ 6 b to $ 21 b.

Reducing the gap between foreign borrowings and the foreign reserves would be the single biggest factor to improve the confidence of foreign lenders.

5. Foreign policy to singularly focus on foreign currency earnings

In the modern competitive global economy, making inroads in the global market is an uphill task. Hence having sponsors in the form of supportive nations is paramount to make material progress.

Historically, the foreign policy has been rigid and traditional with no strategic plan to boost foreign currency earnings. Instead, the policy should be shifted to be more open and align with the interests of nations who are willing to support Sri Lanka’s quest to develop foreign currency earnings. Foreign policy should be directed decisively to promote the above four foreign currency earning sectors.

6. Protection for the most vulnerable groups

Welfare programs should be strengthened to support the livelihood of the bottom 30% (below the poverty line) of the population. The subsidies for small scale farmers (e.g. – subsidising fertiliser, etc.) should be implemented. The higher interest rates for senior citizens should continue. Some relief should be offered to the middle class through adjustments to PAYE rates and slabs.

Rs. 25 b could be allocated (as expenditure and tax income foregone) annually for this purpose.

7. Gradually reduce annual expenditure on public administration and defence

The staggering annual expenditure of over Rs. 1,000 b on Public Administration and Defence sectors is not sustainable and drains the tax revenue. Drastic measures should be implemented gradually which could include:

Annual savings from these measures could gradually reach Rs. 100 b by 2029.

8. Restructure education and healthcare sectors for long-term sustainability

The free service could continue for the bottom 30% of the population. A nominal fee should be gradually charged from others.

Utilising the world class resource pool in the Healthcare sector, Medical Tourism should be promoted with vigour in order to earn foreign currency income. The regional countries such as Nepal, Bangladesh, South India and Maldives could be targeted. Further capacity expansion of the Healthcare sector could be driven by the private sector. Healthcare industry experts should be consulted in the first year to establish the overall roadmap.

Further capacity expansion of primary and secondary Education sector should be driven by the private sector. Tertiary education and vocational training should be developed as PPP (Public Private Partnerships) with focus on above four high growth foreign currency earning sectors. The Government investment in this is covered in challenge 1 above.

Annual income of Rs. 10 b could be expected by 2029 by charging nominal fees.

9. Eradicate salary anomalies in the Government sector

Eradicate salary anomalies in the Government sector and gradually ensure market-based salaries to attract and retain high quality staff. Additional annual expenditure of Rs 10B could be allocated for this task.

10. Measures to shrink the black economy

Move towards exclusive electronic fund transfers and discourage cash transactions to erode the black economy and prevent tax evasion. As the country moves towards a cashless society by 2029, reduce the online transaction fees (including credit/debit card payments) to near zero, charge a Government levy for cash transactions over Rs. 1,000 (excluding the senior citizens) and abolish the Rs. 5,000 note.

As a result, annual tax collection could improve to Rs. 50 b by 2029.

11.Improve efficiency of key SOEs to improve financial viability

Providing reliable and affordable power and fuel to industries and households, particularly during periods of excessively high global prices, is the primary function of CEB and CPC, while financial viability needs to be ensured at other times. Sustainability of CEB would also depend on utilising low-cost power generation technologies. Sri Lanka which is at a weak economic state is not in a position yet to completely shift to higher cost clean energy sources. The shift should be gradually done in the long run.

Driving the Tourism sector and connecting Sri Lanka with the rest of the world at times of both global and local turmoil are the primary functions of Sri Lankan Airlines, while financial viability is of secondary importance.

Privatisation of majority ownership of CEB, CPC and SriLankan Airlines which are of strategic national importance could be unwise. Nevertheless, management of these SOEs should be assigned to competent private parties to improve efficiency and financial viability.

12. Short-term Rupee funding should be provided by Central Bank

Best efforts should be made to keep fiscal deficit intact in the short term, until a sustainable level is reached in the long run. Nevertheless, the short to medium term priority should be given to bridge the gap between foreign borrowings and foreign reserves. Rupee based fiscal deficit could be temporarily supported by the Central Bank in the short term, until commercial lenders gain confidence in the program and contribute significantly in the medium term.

The plan and implementation should inculcate confidence on foreign lenders

It is not by an accident that IMF is not even mentioned in the above challenges. IMF per se is only providing Sri Lanka with a measly sum (of around $ 2 b), while the greater purpose of adherence to their program is to give confidence to the greater foreign lending community. Alternatively, the above plan should give confidence to both foreign lenders as well as IMF as a more practical, sustainable and home-grown approach (of course it would require strong negotiating skills to convince the IMF).

On the other hand, efforts need not be wasted to negotiate with the existing foreign lenders to agree to a greater haircut. The lower the haircut the more confident the lenders would be. Bargaining to not pay what is rightfully theirs would not give Sri Lanka a head start.

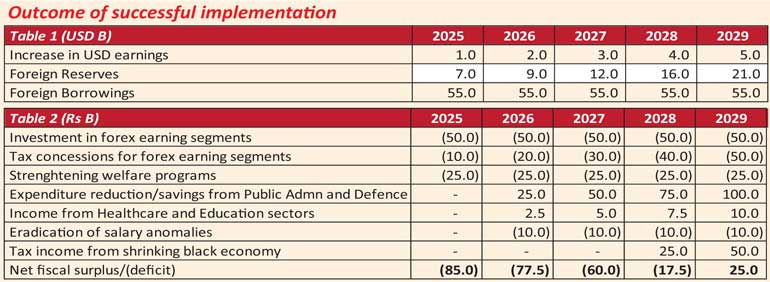

Outcome of successful implementation

Table 1 and 2 summarises the outcome of this approach by 2029. The foreign reserves could increase to $ 21 b while maintaining the foreign debt stock at $ 55 b. Net fiscal position from these measures would be neutral or slightly favourable (surplus) by 2029. Economy would be driven by export-oriented industries, which could see economic growth reaching 6-7% by 2029. These are realistic and doable objectives.

Unfortunately, these kinds of objectives are not seen in any of the manifestos of Presidential candidates. Nevertheless, one would hope that whoever is elected would take a pragmatic, export-led growth-oriented approach as above, understanding that the capacity for welfare spending is limited until the economy is stronger.

(The writer could be contacted on [email protected].)