Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 20 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Iresha Jayakody

The COVID-19 pandemic has made an unprecedented threat on both the health status and the smooth functioning of economies in the world, and Sri Lanka is no exception. The global health, economic, and social impacts of the coronavirus (COVID-19) pandemic are growing day by day. The people worldwide are strongly committed to working together and supporting each other in every way possible during this critical period filled with fear and uncertainty. It is a very common phenomenon to blame the Government and financial institutions for not supporting businesses and failure to address cost of living during pandemic times.

It is obvious that Government has a vital part to play in planning and implementing rapid responses to the COVID-19 pandemic. In this effort, Government had to face three extraordinary challenges initially: (1) a public health emergency in identifying and treating infected populations and containing the virus (2) widespread food and livelihood insecurity due to mandated stoppage of economic activity and the resulting disruption of food supplies; and (3) adoption of emergency powers to address the crises and maintain public safety.

The economic consequences of the COVID-19 pandemic call for urgent policy responses to keep the economy afloat and enable people to retain their jobs and incomes. Most of the measures envisaged at present are macroeconomic in nature, focusing largely on the provision of emergency liquidity by central banks. Fiscal and support measures that have been announced at first stage include tax relief, tax deferment, moratoriums, subsidies, the deferment of utility bills and rent payments, mortgage relief, deferment of recovery actions, etc. Government and regulators had taken these measures considering the urgent need to prevent a catastrophic economic collapse that would have dire human, social, and health consequences.

The banking system of the country has to play a crucial role in the mobilisation and better allocation of funds. In light of this, the Central Bank of Sri Lanka has imposed a number of measures to support borrowers with moratoriums and low interest working capital loans. Though the society finds fault on achieving high profits in the banking sector, banks have stepped forward to fulfil its obligations and assist the Government’s ongoing efforts to restart the Sri Lankan economy. Banking sector profitability is also anticipated to remain under pressure given the low interest rate environment; subdued loan growth, foreign currency liquidity, restrictions on non-interest income and the risk of higher NPLs.

Outbreak of the third wave would certainly impact the recovery of the tourism sector and other industries the next one to two years. Loan growth is likely to remain subdued in the near future as market volatility and uncertainty surrounding the impact of the pandemic delay investments by individuals and businesses. In this given scenario, banks and other financial institutions obviously have to carry the burden as a conduit with Government initiatives and support the clients.

Hence it is not fair to put pressure on the banking system and others also should participate in this critical time. Each company and industry faces a unique array of challenges today; no single approach or solution will suit them all. In this article, I would suggest some “dos and don’ts” to help leaders navigate their territory while supporting the impacted public during the pandemic.

Prominence to rejuvenate the economy

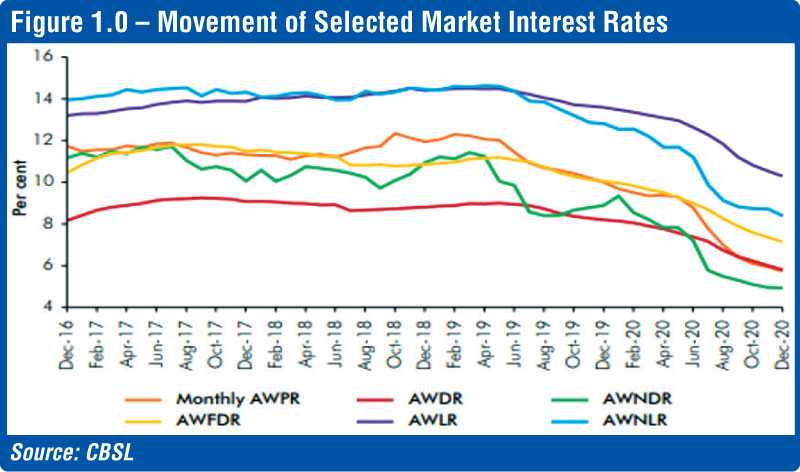

Since early 2020, in spite of extreme difficulties, the Government had given more prominence to rejuvenate the economy, national security and focus on uplifting domestic industries. To provide financial assistance to MSMEs and corporates through the banking channels with a view to kick start economic growth, Average Prime Lending Rate (AWPLR) has been brought down to historically low levels from 10% to 5.65% approx. since January 2020 (reduction was almost 43% since Jan 2020 to date). Figure 1.0 shows the movement of key interest rates during 2020 which is evidence of downward movement in rates.

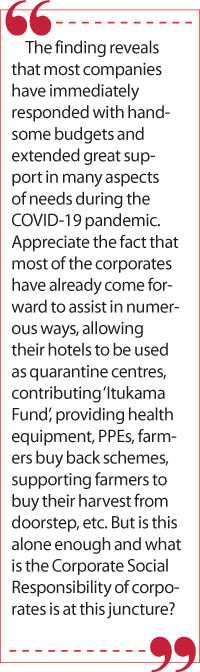

Similarly, the Central Bank of Sri Lanka brought down the statutory reserve requirement (SRR) to the lowest level since 1950 to manage liquidity and to affect the trending of lending interest rates. A lower effective rate of reserve requirement means lower costs for banks, thus encouraging customers to utilise credit facilities for their business activities, in a low interest rate regime. From these moves, Government expected to stimulate economic activities during COVID 19 by pushing companies and entrepreneurs to share the cost benefit with the consumers’ whist expanding their business.

Apart from that, Government also has taken measures to reduce corporate tax from 28% to 24% and reduced VAT. With the intervention of the GOSL, CBSL has taken punitive action to support banking sector and other business. CBSL’s expansionary monetary and fiscal policies introduced at the commencement of 2020 such as the reduction in VAT and income tax in selected sectors including banking, removal of debt repayment levies, WHT and PAYE for lower income brackets, aimed at boosting the sector’s profitability, will not only be offset by the outbreak of COVID-19, but create a much larger negative impact on the banks’ earnings.

Above actions would certainly boost the profitability of corporate clients. For example, hypothetically if we assume one corporate client used funded facilities totalling to Rs. 1 billion from all banks, reduction of interest would have saved financial cost approximately Rs. 500 million (Gross) yearly. Even the inflationary cost is being considered, they could easily save approximately Rs. 250 million. It is accepted fact that corporates also going through challenging time, mainly, demand and supply side, increase cost of goods sold (COGS), cost of good manufactured (COGM), supply chain disruptions, etc.

However, majority of corporates could support this perilous time. It is observed that certain retail giants, key market and financial indicators such as Earning per Share (EPS) Dividend per Share (DPS), Dividend Yield (DY), and Net Asset Value (NAV) have improved significantly. Some have recorded three-fold increases in DPS from 1.5 to 6.5 times, declared profit almost 50% to 60% at the end of financial year 2020/2021. Most of the retail and supermarket chain industry groups have recorded noteworthy performances, Profit after Tax (PAT) over Rs. 1 billion in third quarter in 2020/21 which was an increase of 8%-10% against profitability of the corresponding quarter of the previous financial year (2019/20).

While reviewing the latest published audited financials (CSE) it was noted that most of the retail giants have recorded profitability increase in the range 30%-80%, revenue almost up by 100%. It was recorded that some major companies’ certain sectors have recorded double-digit growth in volumes and first-time achievement of highest revenue from mobile phone segment reaching a billion rupees in sales during the months of November and December. It is noted that the supermarket businesses continued the positive momentum with overall revenue and EBITDA recording growth over the previous year.

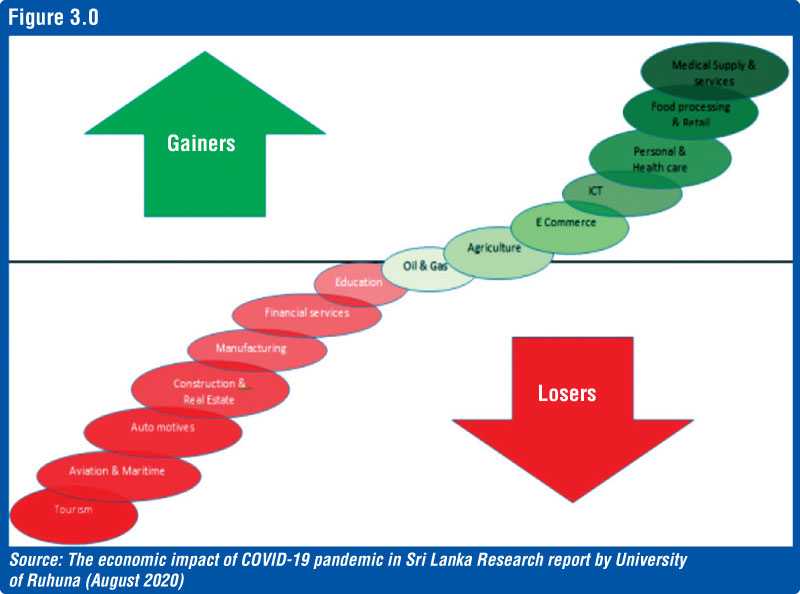

For most of the corporate companies, the pandemic created an opportunity to grow. Mainly growth was also aided by increased penetration of online sales due to the isolation measures which were in place time to time. As per research done by University of Ruhuna (August 2020), on the economic impact of the COVID-19 pandemic in Sri Lanka, it was revealed that different industry sectors would take different time to recover. The recovery depends on many factors, including the regaining of the leading business sectors of the economy, investor confidence, political stability, government policies and the global business environment.

Major impacted industries are tourism, aviation, automotive, education, whereas marginally boosted some sectors such as agriculture, e-commerce, telecommunication, pharmaceuticals, medical service, etc. Food and retail sectors fall into high recovery and gainer list which is based on their research findings.

Identify our responsibilities

Sri Lanka has gone through difficult periods time to time, mainly if we recollect the 1989 ethnic violence, 30 years’ war, Tsunami, Easter attack, now the pandemic issue. As much as the Government, we too should individually and collectively look at the current scenario and identify our responsibilities to make our contribution towards strengthening the general public in this critical time. Even the corporate giants too should accept the fact that this is not normal times to generate super normal profits and make high dividend pay outs.

Despite many measures taken by Government and CBSL to revive the economy, the question arises whether the benefits are being passed among masses, as expected. The finding reveals that most companies have immediately responded with handsome budgets and extended great support in many aspects of needs during the COVID-19 pandemic. Appreciate the fact that most of the corporates have already come forward to assist in numerous ways, allowing their hotels to be used as quarantine centres, contributing ‘Itukama Fund’, providing health equipment, PPEs, farmers buy back schemes, supporting farmers to buy their harvest from doorstep, etc. But is this alone enough and what is the Corporate Social Responsibility of corporates is at this juncture?

Also, it is disappointing to note that retail giants have not given the real benefit or failed to share the financials benefit with their suppliers and consumers. Should we expect ‘Sathosa’ to give relief packs or budget packs for the impacted public? Why cannot corporates take an initiative to carry out joint CSR projects with the Ministry of Trade and Commerce? In this case I would not put the blame on the Private sector; Government officials should also think beyond paradigm and explore new avenues to support the affected community.

Particularly with the reduction of interest rates, corporate taxes, VAT, corporates were able to save billions of rupees which may have partly been used to declare hefty dividends and invested in CAPEX (Capital Expenditure), clean up their balance sheet, etc. Most of our corporates are very generous but need clear leadership and communication to get their support and active participation. All stakeholders should understand the gravity of the situation and moral duty towards the society.

With the import restrictions imposed by the Government necessitating import bill settlements of certain items to be carried out after 180 days, 360 days, certain corporate cash flows have been further improved. Thereby most of the companies used that excess liquidity to settle their other high-cost liabilities and fund-related parties. But unfortunately, most of them have failed to support their debtors and continued with the same payment arrangements. Similarly, creditors are being settled after three to six months.

Corporates should review the pricing mechanism and efforts to be made to reduce consumer products pricing, introduce budget packs, reduce credit period to their suppliers, etc. Even if they get together, it is most probably easy to face the so-called ‘Rice Mafia’ and make this opportunity to support the Government to stabilise rice prices in the market. There are numerous examples globally on how corporates provide support during this pandemic.

Unilever had offered € 500 million (approximately $ 540 million) of cash flow relief worldwide to support livelihoods across its extended value chain through: early payment for its most vulnerable small and medium sized suppliers, to help them with financial liquidity; and extending credit to selected small-scale retail customers whose business relies on Unilever, to help them manage and protect jobs (www.unileverusa.com).

Renewable energy firm Acciona, which manages several hospitals in Spain, Mexico and Canada. Further global mining company Anglo American, support includes providing water tanks to 69 villages and clinical training and PPE equipment to 70 local clinics. It also means providing 6,000 food parcels per month for three months to alleviate economic hardships brought by quarantine. Toyota Group, Japan participates in research activities to support drug development and infection control, transportation support for mildly-infected patients.

Why can’t Sri Lankan companies? As per latest information (Colombo Stock Exchange: CSE) there are about 282 listed companies in Sri Lanka out of which almost 50 companies are well-established and diversified conglomerates in Sri Lanka. If they could set up a separate fund under CSE or any other legal entity, it would accelerate the building of a solid fund to support COVID-19-impacted areas. Government is adopting aid and stimulus packages that will provide a number of benefits to communities and business entities. Debates are also emerging as to how to ensure that the benefits of these plans will be fairly distributed among all those that have suffered from the crisis.

It is accepted beyond any doubt that corporates also do business to enhance shareholder value while supporting the growth in the country. Concern being most of them sticking to the same strategies in maximising their profits, whilst some part of the society is struggling to survive. Nobody expects to continue this forever, at least for the next one-two years.

This was clearly evident from the study carried out by D. Udubampola, which was published in Daily FT on 10 May, where it was mentioned that six out of nine conglomerates selected for study posted growth in their topline leading to a combined turnover of Rs. 861 billion. Underlying reasons for such growth come in the midst of a pandemic. It was revealed that demand for certain products have been increased significantly during the peak of pandemic. Mainly food products, healthcare and pharmaceuticals. The pandemic induced panic buying which resulted in a huge market for retail and consumer giants. Government policy to ban sanitary wear and tile imports also supported local industrialists led by giants Rocell and Lanka Floor tiles. The increase in demand and scarcity of tiles in the market leads to the growth in revenue in large players, but it was visible that the end-consumer had to suffer with increased pricing. Corporates were able to capitalise from market opportunities and nevertheless mostly fail to extend or share the benefit.

Maximum benefit

Maximum benefit

Needless to mention, exporters are also taking maximum advantage from the current situation. It was also observed that Government intervention to curtail rupee depreciation further led to create a ripple effect. In this article I would not touch upon all those scenarios but would like to emphasise that from this move also large clients (exporters) do get the maximum benefit. They are inclined to refrain from converting their foreign currency base and resort to rupee borrowing to finance part of their working capital requirements, and adopt a wait and see approach to take maximum benefit from currency conversions at a later date.

As mentioned by Ronald McKinnon in his book (1979) ‘Money in international Exchange: The convertible Currency System’, what is currently happening is ‘official speculation’. This means CBSL intervenes in the foreign exchange market without eliminating the excess money supply. Keeping rupee interest rates down, the soft-pegged agency incentivised exporters to borrow rupees and loan dollars at high rates. In the absence of money printing, exporter rupee borrowings should have crowded out some other credit, but as opposed when credit is taken from printed excess liquidity, the peg is pressured.

Although Government is trying to push exporters to convert their foreign earning, they approach banks and take rupee loans or SWAP foreign deposits placing their foreign currency deposits. Exporters gain from both ends, rupee borrowing at very low cost and getting high interest for foreign deposits. Exporters’ sides there may be justifications to do so, such as cost escalation import value additions, supply chain disruptions led to increase in raw material prices, etc. Thereby, to minimise the loss arising from same, they are holding on to the foreign currency until favourable for them.

This practice would further create money supply in the market and regulators would not be able to curb pressure on rupee depreciation. Hence, in this current crisis situation, exporters have a moral duty to support the economy without adopting a strategy we called ‘Fish in troubled water.’

Conclusion

The people worldwide live through an unpredictable time with the fast spread of the COVID-19 pandemic creating fear and uncertainties. At this time, the number one priority is always the safety of people’s lives with good health. Private sector is identified as the engine of growth of a country led with the social responsibility towards society in this critical juncture. This implies putting behind exorbitant profit generation at least for a period of two years; instead align with the Government to support economic recovery and give the benefit to consumers.

At this time, corporates should look not only for financial performance but also for society’s benefit and the welfare of their stakeholders, such as partners, families, employees, customers, and communities. Business leaders in Sri Lanka should pledge to contribute their skills, networks and resources to shape the COVID-19 recovery and build back better. Professor Klaus Schwab, Founder and Executive Chairman of the World Economic Forum mentioned, “To achieve a better outcome, the world must act jointly and swiftly to revamp all aspects of our societies and economies.”

While the global impact of the COVID-19 pandemic is evolving every day, it is the best time to come together and unite under one country to face calamity and economic disruption, to save the people and make the earth more beautiful than it ever was.

(The writer is a research assistant, mainly on socio-economic research studies, and an ex-banker.)