Friday Feb 13, 2026

Friday Feb 13, 2026

Wednesday, 23 October 2024 00:00 - - {{hitsCtrl.values.hits}}

The deadline to file personal income tax returns for the Year of Assessment 2023/24 is 30 November 2024 and is fast approaching and many individuals are in a panic trying to figure out their tax status and tax compliance obligations. This article intends to address in an FAQ format some common but important questions individuals have with respect to their tax obligations.

The deadline to file personal income tax returns for the Year of Assessment 2023/24 is 30 November 2024 and is fast approaching and many individuals are in a panic trying to figure out their tax status and tax compliance obligations. This article intends to address in an FAQ format some common but important questions individuals have with respect to their tax obligations.

At the outset it must be noted that the tax payment deadlines on a self-assessment basis have already lapsed for the Year of Assessment 2023/24. However, it is a commonly known fact that people work best after the deadline has passed and when they are in a panic!

It is also pertinent to note that as per Section 113 (1B) of the Inland Revenue Act No. 24 of 2017 and amendments thereto (IRA), it is mandatory for individuals to file their returns online through the e-services portal of the Inland Revenue Department (IRD) website, effective Year of Assessment 2023/24. In other words, manual filing of income tax returns is no longer accepted. The Commissioner General of Inland Revenue (CGIR) has the power to permit the filing of a manual income tax return under “just and equitable” circumstances. However, this power is discretionary. Hence there is no guarantee that you will be given permission to file a manual return in the coming return filing cycle.

FAQ on Personal Income Tax

1.Should I obtain a Taxpayer Identification Number (TIN)?

TIN is a unique number issued to taxpayers by the Sri Lanka tax authority, i.e., the Sri Lanka Inland Revenue Department (IRD), and with effect from 1 January 2024 all individuals over the age of 18 are required to obtain a TIN.

2. What if I don’t obtain a TIN when I am supposed to?

The IRD has the power to register you ex-parte and allocate a TIN.

3. How do I obtain a TIN?

You can either make the request manually or online through RAMIS, the electronic tax services portal of IRD which you can access through the IRD website (www.ird.gov.lk), by completing the form specified and attaching the supporting documents such as a copy of your NIC and utility bill/rent agreement to verify residential address if it is different to that given in the NIC.

4. Once a TIN has been allocated to me, am I liable to furnish a “Return of Income”?

Not necessarily. Obtaining a TIN is separate to the obligation to file a return.

5. How do I know if I should furnish a Return of Income?

You should furnish a return of income only if you have “taxable income”. As a general rule, this means that you have to file a Return, if your income (excluding capital gains) is more than LKR 1.2Mn for that particular “year of assessment”. However, there are exceptions to this rule.

6. What is a “Year of Assessment”?

A year of assessment runs from 1 April of the current year to 31 March of the subsequent year. For example, Y/A 2023/24 covers the period from 1 April 2023 to 31 March 2024.

7.My routine income for the year did not exceed Rd. 1.2 million, but I also made a capital gain from selling a property. Do I still have to file a Return?

Yes. If you had a Capital Gain Tax (CGT) liability during the year and even though such tax has already been paid and a separate CGT return was filed, you still need to declare the capital gain and file a return of Income, even if your other income did not exceed Rd. 1.2 million for that year of assessment.

8. Does that mean that if my income is less than Rs. 1.2 million per Y/A, and I have no capital gains during the period, I am not required to file a Return of Income?

Correct. You are not required to file a return.

9. If my income is derived solely from employment that is subject to tax at source under the APIT scheme, should I file a return of income?

No, you do not have to file a return of income, even if such income exceeds Rs. 1.2 million.

10. What if my salary is deposited into a savings account and I earn a nominal interest on that savings account?

If the salary plus interest for the year exceeds Rs. 1.2 million you are required to file a Return.

11. Am I required to file a return of income if my only source of income is from employment which is less than Rs. 1.2 million for that year of assessment but I have a capital gain?

Yes, in this instance since there is capital gains to declare, you will have to file a return of income.

12. What if my only source of income is final withholding payments, i.e., dividend income. Should I still file a return of income?

No, you do not have to since income subject to “final withholding tax” is not considered “Taxable Income”.

13. Can I file a Return of Income once I obtain a TIN?

No. You have to perform an additional step called activating “Tax type”, in this case, “individual income tax” to be able to file a return at the year end. In other words, if your income (excluding capital gains) is less than Rs. 1.2 million, there is no requirement to activate the tax type, you only need to obtain a TIN.

14. The IRD issued me a PIN along with the TIN certificate. What do I do with this?

The PIN is your password to access the e services portal of IRD. Applying for a TIN does not require a PIN. However, you need to log in with your PIN to activate tax type and to file returns electronically.

15. Will there be penalty if I don’t obtain a TIN?

Yes, tax authorities can impose a penalty not exceeding Rs. 50,000 if you are required by law to obtain a TIN and you don’t.

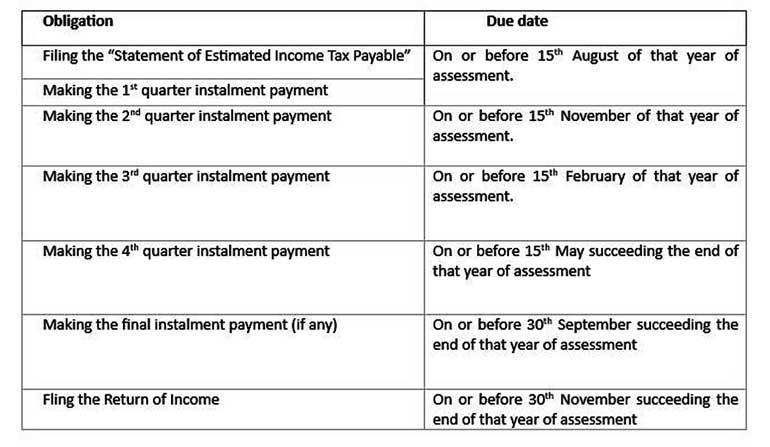

16. What are my compliance obligations during a year of assessment, as an individual registered for Individual Income Tax?

17. What is the purpose of the Statement of Estimated Income Tax Payable (“SET”)?

It is an estimate of the income tax payable by you for the entire year of assessment. This needs to be filed at the time of first quarter payment. If necessary, you can revise the estimate each quarter.

A Tax Credit Schedule (“TCS”) also needs to be filed together with the SET. It should indicate the WHT/ AIT credits claimed up to that quarter. Even if the estimate does not change, an amended TCS should be filed each quarter if there are incremental WHT/AIT credits.

The SET and TCS can be filed online through RAMIS. (Till August 2024 physical filing was also allowed.)

18. How will income be taxed?

Income will be taxed based on your residency status. If you are residing in Sri Lanka or have been in Sri Lanka for more than 183 days in any 12-month period that commences or ends within that year of assessment, then you will be considered a “resident” for tax purposes. In such case you will be liable to tax in Sri Lanka on your global income, i.e., income earned in or outside Sri Lanka. If you are a “non-resident” of Sri Lanka for tax purposes, you will be liable to tax in Sri Lanka only on the income earned or derived from Sri Lanka.

19. How do I compute my income tax liability*?

First, you have to take into account all your sources of income (i.e., employment, business, investment and other income) subject to residency rules referred to above and remove any “exempt income” and income categorised as “final withholding payments” (e.g.: dividends where AIT has been deducted) together with any permitted deductions (allowed for business and investment income) to arrive at your “Assessable Income”. Thereafter, you are allowed to deduct a “personal relief” (only applicable for residents and non-residents who are citizens of Sri Lanka) of Rs. 1.2 million and any other “qualifying payments and reliefs” that may be available to you to arrive at your “Taxable Income” on which the tax rates will be applied.

*Tax on capital gains will be computed in a different manner.

20. Which income is exempt**?

**Not an exhaustive list.

21. What are final withholding payments?

Payments that are not subject to further tax. For example, dividend income.

22. What “qualifying payments” and “reliefs” am I entitled to?

Relief

Qualifying payments***

*** Not an exhaustive list

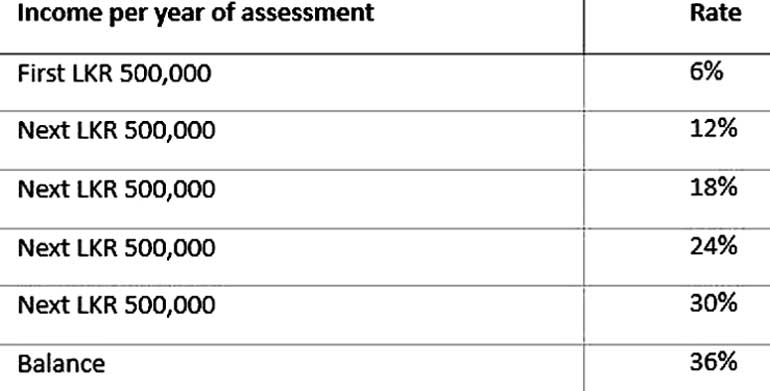

23. How do I calculate my tax payable?

Following tax rates are to be used on the “Taxable Income” calculated as above.

24. What tax credits am I entitled to deduct from my tax payable?

25. Can I set off prior year tax refunds in computing quarterly instalment payments?

Effective 1 April 2023, you are entitled to set-off 60% of the refundable amount against the subsequent income tax payable, prior to a tax audit on the refund claim.

26. How do I compute quarterly instalment income tax payment?

Simply use the formula below.

Quarterly Instalment Payment =A - C

B

A - Estimated tax payable

B - Number of instalments remaining including the current instalment

C - Tax payments made prior to this instalment (i.e. previous quarterly instalment tax payments and any WHT/AIT Credits)

27. Since the tax year ends before the 4th quarter payment and as individuals pay tax on cash basis, can the 4th quarter liability be still based on an estimate, or should it be the actual amount due?

As per the law, balance tax payments can be made by 30 September. However, as individuals pay tax on cash basis and details of all income received would be available by the 4th quarter, your estimate would essentially be the same as the actual liability by 15 May.

28. How do I make a tax payment?

Via online/digital banking from facilitating banks (need the DIN issued by the IRD) or by Pay Order addressed to the Commissioner General of Inland Revenue (need the paying in slip issued by the IRD).

29. Can I request an extension for payment of tax?

No, you cannot request for an extension for self-assessment instalment payments.

30. What if I don’t make tax payments?

If instalment payment is made after the due date (late payment) but within 14 days, penalty will not be applicable, but interest of 1.5% per month is payable from the due date. If the payment is made after 14 days of the due date, penalty of 10% would accrue with the interest of 1.5%.

31. Is there any repercussion for me if my employer or bank does not deduct WHT accurately?

Both you and the withholding agent are equally responsible for tax payments. Hence, if the withholding agent has not deducted the respective AIT, you are responsible to make the AIT payment on or before 15th of the following month for which you will be given the credit.

32. How do I file my Return of Income?

With effect from Year of Assessment 2023/24, the Return of Income has to be filed electronically via RAMIS unless special permission is granted by the CGIR for physical filing.

33. What are the supporting documents that I need to file/upload with my Return of Income?

34. What is a Simplified Return of Income?

This is a return template that was introduced, for the first time this year, to simplify the return for those who have only employment and interest income. Before filing the Return on RAMIS, you will be directed to select applicable sources of income. Depending on the selection, you will be directed to the appropriate Return format. (For example, if you select the boxes which indicate that you have only employment and interest income you will be directed to the Simplified Return format.)

35. If I am eligible to file a simplified return of income, do I still have to file an “Asset and liability declaration” along with the Simplified Return of Income?

Yes.

36. What if I have a capital gain during this year in addition to employment and interest income? Which return should I file?

You will have to file the standard return.

37. What if I need to claim expenditure deduction on installing a solar system?

Expenditure deduction is given in the form of a qualifying payment relief. If this has to be claimed, you will have to file the standard return.

38. What if I am required to file a return but I did not file a Return by the due date?

You will be liable to a penalty computed as the greater of;

a) 5% of the tax payable and 1% of the tax for each month or part month till filing return, and

b) Rs. 50,000 and Rs. 10,000 for each month or part month till filing return.

However, the maximum penalty will be limited to Rs. 400,000.

However, if non-filing is deemed a “wilful default”, it will be a criminal offence and a fine not exceeding Rs. 1 million or imprisonment not exceeding 1 year or both will apply on conviction.

The above penalty provisions are applicable to non-filing of the Statement of Estimated Income Tax Payable as well.

39. Can we request for an extension for filing of Return?

Yes, however the request has to be before the due date for filing of the Return.

40. What is Capital Gains Tax (CGT)?

A type of income tax on gains from “realisation” of “investment assets”.

Investment assets are capital assets maintained as investments. “Capital asset” means each of the following assets:-

i. land or buildings;

ii. a membership interest in a company, partnership or trust;

iii. a security or other financial asset;

iv. an option, right or other interest in an asset referred to in (i), (ii) & (iii) above;

v. but excludes trading stock or a depreciable asset.

41. What is the rate of CGT for individuals?

10%

42. How do I compute the capital gain?

In general, it is by using the formula, “Consideration minus Cost”. However, “Consideration” cannot be less than market value and if the person parting with the asset held it as at 30 September 2017, the market value as at that date will be deemed to be the “cost” of the asset.

43. Does the tax law provide any exemptions for Capital Gains Tax?

Following gains are exempt from CGT:

44. What are the compliance requirements for CGT?

Payment and return are due within 30 days after the end of the relevant calendar month in which the realisation occurred.

45. Should the disposal be declared in the annual Return of Income?

Yes. CGT return is only a “notification”. Hence, disposal details should be declared in the Return of Income.

46. Is gifting a land to my child liable to CGT?

No, the law excludes gifting of land to “associates” of an individual, i.e., the individual’s child by marriage or adoption, spouse, parent, grandparent, grandchild, sibling, aunt, uncle, nephew, niece or first cousin.

47. Is a sale of a land that was received as a gift from my parent liable to CGT?

Yes, at the point of selling the land, the gain made is liable to CGT.

(The writers are Managers at Deloitte

Sri Lanka.)