Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 8 July 2022 03:00 - - {{hitsCtrl.values.hits}}

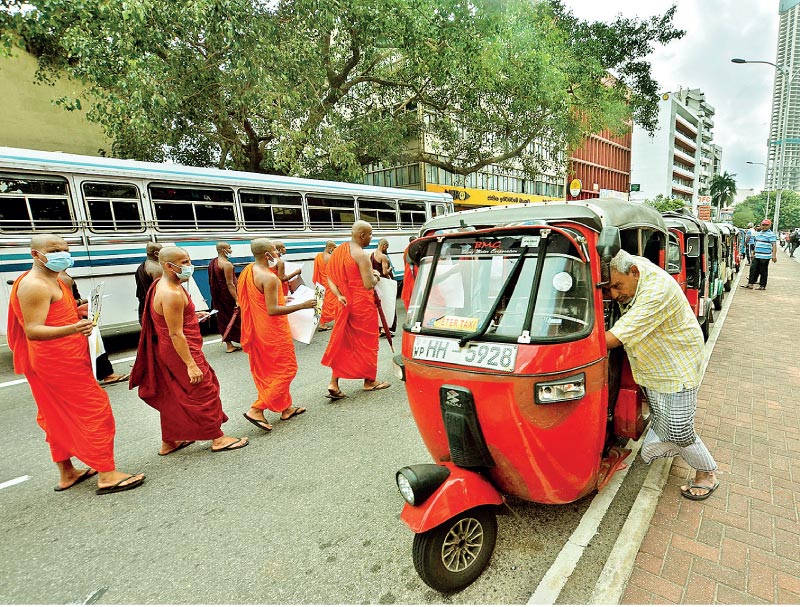

No end to the ongoing crisis yet – Pic by Shehan Gunasekara

Given that fuel supplies will run out, the Government has closed schools, extended power cuts, and restricted fuel issues. Through this the Government is desperately trying to stretch out the remaining fuel supplies for a few more days until the supplies come next week and thereby ensure the country will not shut down totally and industries operate.

Given that fuel supplies will run out, the Government has closed schools, extended power cuts, and restricted fuel issues. Through this the Government is desperately trying to stretch out the remaining fuel supplies for a few more days until the supplies come next week and thereby ensure the country will not shut down totally and industries operate.

The export industries have devised a scheme to keep their diesel supply going by paying in USD. Ironically people have to stay in queues for more than 48 hours to get fuel. This has affected the transportation of goods and essentials, people are finding it near impossible to go to work. According to sources, shipment of diesel and petroleum is due on 13 and 14 July, as the Government admitted Sri Lanka is running short of USD to pay for the shipments. The usable reserves are estimated to have grown to around $ 200-300 million. The Government needs around $ 400 million to import oil and gas for a month. The Government, according to the Prime Minister, is already about $ 750 million in debt to several fuel suppliers. So what can the Government do in the short term to improve the forex liquidity?

Solutions

The country, according to the Prime Minister, is fully focused on obtaining assistance from the IMF, WB, ADB and friendly foreign governments and restructuring the debt. The Central Bank is also meanwhile looking to make the exporters bring back all the earnings to the country as well as imposing a proper system of checks to ensure this is done. Analysts say around 20% of the foreign exchange does not return to the country for surrender. There is no real data to back this argument until the Central Bank and Treasury up their game. Until this is resolved there will never be a solution to the forex crisis in the near term. This has nothing to do with the Havala system or Undial that moves millions of $ around monthly.

The Government according to experts has several options in the short to medium term to manage the forex liquidity:

A. Goods exports

1) Make mandatory export bills on DA/DP terms and retain the open account ban on exports.

2) Exporters be allowed to both surrender the export proceeds in part or in full and retain USD for imports of export inputs only, including emoluments of expatriate staff.

3) Aviation fuel and other goods supplied for payment in USD should be subjected to full surrender into LKR

4) Disallow banks and financial institutions from lending LKR to exporters, even on the collateral of their holdings of USD balances – both resident and non-resident.

5) Disallow exporters from purchasing USD for LKR from banks to pay for USD imports, charges and other USD outflows, when it is below their USD holdings anywhere in the banking system

B. Services exports

1) Allow open account exports for services only or import bills

2) Services exporters be allowed to both surrender the exports proceeds in part or in full and retain USD for imports of export inputs only, including emoluments of expatriate staff,

3)Give a Foreign Exchange Earnings Certificate (FEEC) in LKR up to (say) 25% of the surrendered USD and valid for 12 months, which can be used for specific LKR payments via the banking system – machinery Capex, IT software/hardware, settlement of LKR debts from the banking system, etc.

4) Export of services for payment in USD should be subjected to full surrender into LKR, subject to retention for specific import content like expat USD emoluments, import of input goods

5) Disallow banks and financial institutions from lending LKR to service exporters, even on the collateral of their holdings of USD balances – both resident and non-resident.

6) Disallow service exporters from purchasing USD for LKR from Banks to pay for USD imports, charges and other USD outflows, when it is below their USD holdings anywhere in the banking system

C. Worker remittances

1) Give a Foreign Exchange Earnings Certificate in LKR up to (say) 35% of the surrendered USD and valid for 12 months, which can be used for specific LKR payments via the banking system – motor vehicle purchases, IT software/hardware, settlement of LKR debts from the banking system, etc.

D. Prioritise imports with limited forex

1) Food imports where local substitutes are unavailable

2) Fuel imports transportation/aviation and power generation – aviation fuel should be sold in USD and the proceeds subject to full surrender into LKR

3) Medicines and hospital supplies

4) Energy imports like LP gas and Coal

E. Multilateral, bilateral and commercial/bond market borrowings

1) Interest payments, preferably restructured debt or otherwise

2) Capital repayments, preferably restructured debt or otherwise

F. Import control measures

1) Increase duty and tariff charges on non-essential items to discourage imports. This will also help increase government revenue.

2) Obtain data of goods imported from Jan. to May 2022 against Jan. to May 2021 to identify access quantities of commodities imported and being held as excess stocks. (This data can be obtained from Sri Lanka Customs). Impose higher duty/tariff charges for these items to restrict imports

3) Reporting of unpaid import bills on DA terms is sent by banks to the Imports Controller when bills are outstanding for more than six months. Majority of these payments could still go through Undiyal (Hawala) and six months may be too late to take action. Reduce the same to two months, so that the import controller can act on unpaid bills without delay.

4) Prevent smuggling of goods into the country (hand carrying of items, etc. for commercial purposes) with tighter Customs controls.

Expatriates

5) Lift the restrictions made on outward remittances pertaining to PFCAs held by residents, to encourage more inflows without the fear of funds getting blocked.

6) Permit Dual Citizenship holders and PR Holders to obtain LKR facilities from LCBs for any purpose and with mandatory repayment of these loans through inward remittances.

G. Find innovative ways to bring the USD in the grey market into the banking system.

H. Negotiate a trade finance arrangement with a multilateral partner for opening of and confirming LCs.

Conclusion

Prime Minister Wickremesinghe has warned citizens that “the next couple of months will be the most difficult ones of our lives”. This situation could lead to a major drop in business revenue and loss of hundreds and thousands of jobs. Therefore a PPP crisis management team needs to be established soon to lead the recovery for the next six months with clear goals. The policy of printing money to pay salaries and pensions to public servants and meet the other expenses needs to be gradually reduced, because this will result in hyperinflation followed by a massive increase in the price of goods. However tough, the interest rates need to move down to support business recovery. Therefore unless Sri Lanka sorts out its financial metrics soon and minimises the political drama, the public will have a steep price to pay in the next 12 months for the years of mismanagement of our leaders.

(With contributions from D. Soosaipillai and M. Cooray.)