Tuesday Apr 29, 2025

Tuesday Apr 29, 2025

Monday, 24 January 2022 00:10 - - {{hitsCtrl.values.hits}}

Finance Minister Basil Rajapaksa

Treasury Secretary S.R. Attygalle

Central Bank Governor Nivard Cabraal

Background

Background

The new bill titled ‘Special Goods and Services Tax’ was published by gazette dated 7 January 2022.1 The Special Goods and Services Tax (SGST) was originally proposed in Budget speech 2021 but was not implemented. It has once again been presented in Budget 2022.

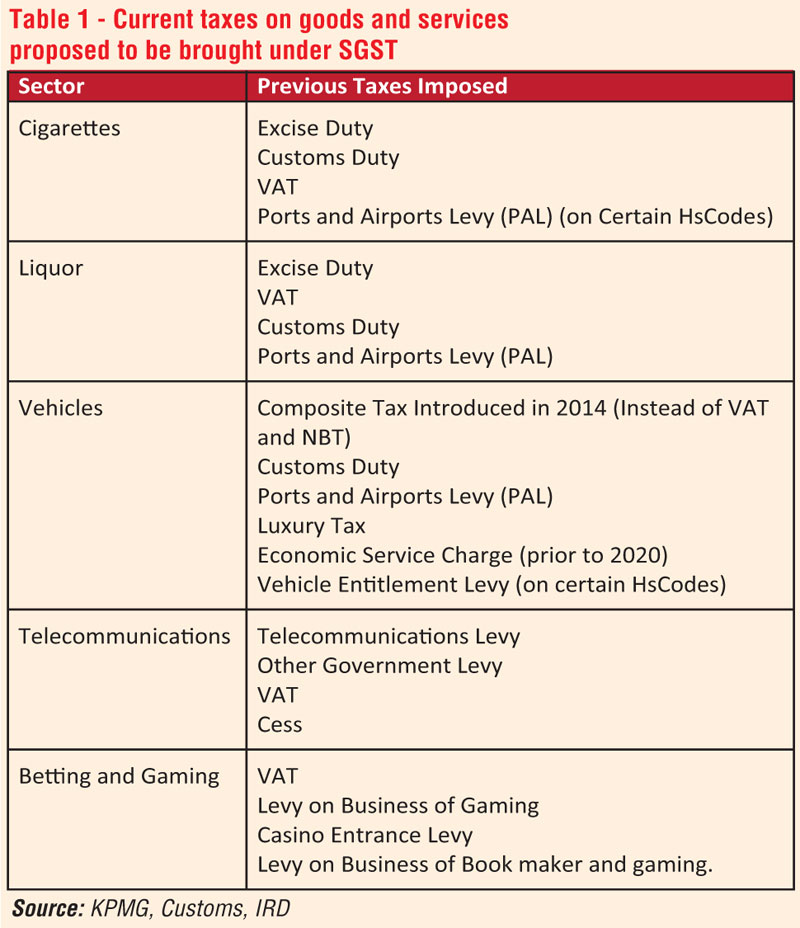

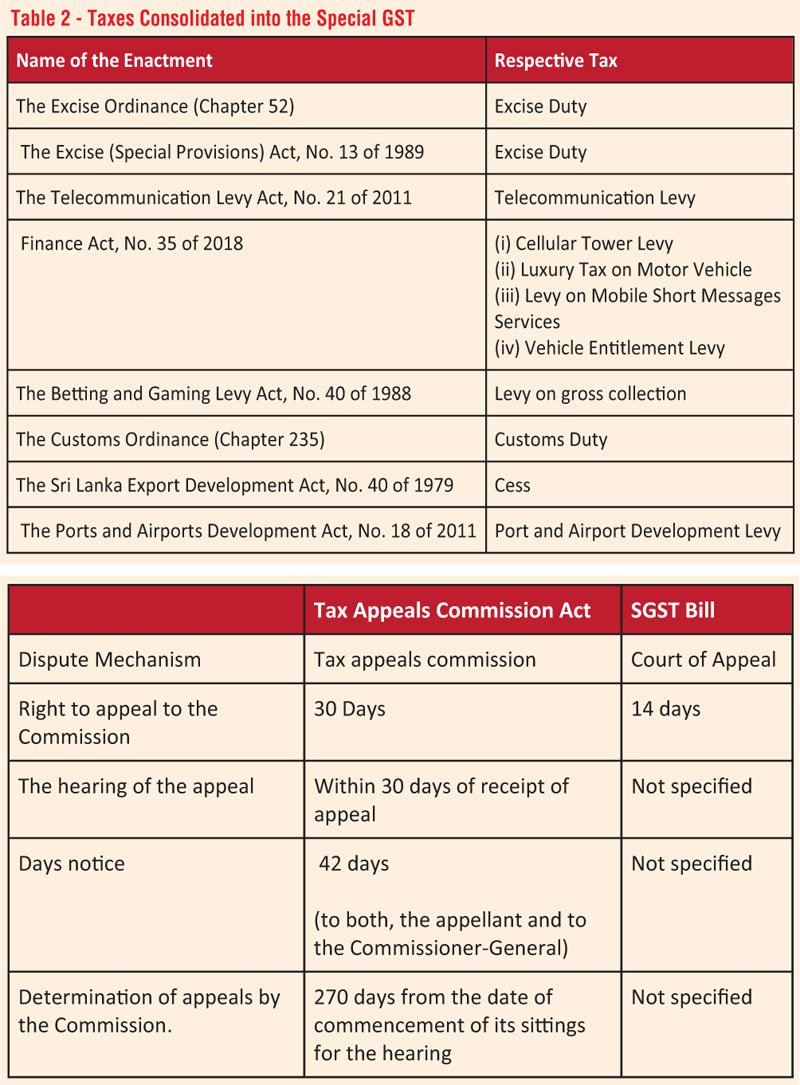

The SGST aims to consolidate taxes on manufacturing and importing cigarettes, liquor, vehicles and assembly parts, while also consolidating taxes on telecommunication and betting and gaming (see table 1 for existing taxes on these products and table 2 for taxes consolidated into the SGST as per the schedule in the gazette). The rationale for this new tax as per the bill is “...to promote self-compliance in the payment of taxes in order to ensure greater efficiency in relation to the collection and administration on such taxes by avoiding the complexities associated with the application and administration of a multiple tax regime on specified goods and services.”

Given the multiplicity of taxes and the complexity of the current tax system as a whole, rationalising taxes is necessary to improve collection. However, whether the proposed SGST simplifies the tax system, while ensuring revenue neutrality or even improving revenue collection, needs to be carefully examined.

The SGST Bill is silent on the treatment of the existing VAT on these goods and services. However, according to the Value Added Tax (Amendment) Bill also gazetted on 7 January 2022,2 liquor, cigarettes and motor vehicles will be exempted from VAT while telecommunications and betting and gaming services will still be subject to VAT.

While the gazetted Bill sets out some of the features of the proposed SGST there are many important areas not covered in the Bill. These are expected to be gazetted as and when required by the Minister in charge.

Issues and concerns

The motivation behind SGST is the simplification of the tax system. Although the objective of introducing the SGST is to improve efficiency by reducing the complexity of the tax system there are many issues and concerns with this proposed tax.

Revenue

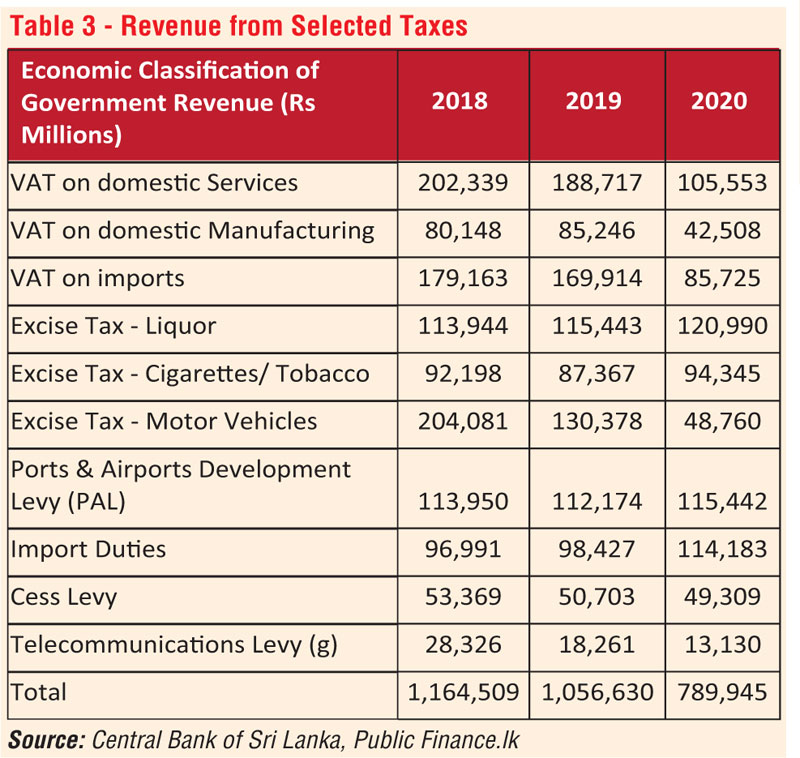

Tax revenue which was 13% of GDP in 2010, declined to 8% in 2020. Ad hoc policy changes and weak administration contributed to the decline in tax revenue collection. This continuous decline in tax revenue has led to widening fiscal deficits and increasing debt. One of the main reasons for the current macroeconomic crisis is low tax revenue collection. Hence, any change to the existing tax system should be with the primary objective of raising more revenue.

According to the budget speech the SGST is estimated to bring in an additional Rs. 50 billion in revenue in 2022.3 Revenue from taxes proposed to be consolidated under the SGST has significantly declined over the past three years. Given the already difficult macroeconomic environment, along with ad hoc tax policy changes raising the additional revenue estimated at Rs. 50 billion seems a difficult task.

Tax base and rate

For the SGST to raise taxes in excess of what is already being collected through the existing taxes, the rate and the base for the SGST needs to be carefully and methodically calculated. Further, the existing taxes have different bases of taxation. For instance, the basis of taxation of motor vehicles is both on an ad valorem4 basis and a quantity basis while the basis of taxation of cigarettes and liquor is quantity.5 In light of this, the basis of taxation on which SGST is applied becomes an issue. Having different bases and different rates for various goods and services would complicate the implementation of the tax. These issues need to be carefully considered to ensure the new tax is revenue neutral or be able to enhance revenue collection.

Efficiency

One possible revenue benefit of this proposal is the inability to claim input tax credits on the sectors exempted from VAT. However, the issue is the cascading effect that would result where there would be a tax on tax with the end consumer paying taxes on already paid taxes. If the idea was to raise additional revenue by limiting tax credits, it would have been simpler to raise the tax rates on the existing taxes rather than introduce a new tax.

Administration

According to the bill, SGST will now be collected through a new unit set up under the General Treasury where a Designated Officer (DO) will be in charge of the administration, collection and accountability of the tax. The existing revenue collection agencies, such as the Inland Revenue Department (IRD) or the Excise Department will not be primarily responsible for the collection of this tax. By removing the IRD and Excise Department, a parallel bureaucracy will be created, at a time when public spending needs to be carefully managed. The General Treasury also has no previous experience and expertise in direct revenue collection. Weak administration is one of the key reasons for the low tax collection and success of this tax would depend on the strength of its administration.

In addition to the abovementioned concerns, as per the Bill the minister in charge of the SGST has been vested with the power to set the rates, the base and grant exemptions. Accordingly, Parliamentary oversight over fiscal matters is weakened under this proposed Bill.

It could also lead to a time lag between the gazetting and implementing of changes to the SGST (such as the rate, base, etc.) and obtaining Parliamentary approval for those changes.

Dispute resolution

The SGST Bill also focuses on the dispute resolution mechanism. Under the present tax system, with the enactment of the Tax Appeals Commission Act, No. 23 in 2011 the Tax Appeals Commission has the “responsibility of hearing all appeals in respect of matters relating to imposition of any tax, levy or duty”.6 The most recent amendment to the Tax Appeal Commissions act (2013)7 seeks to address the large number (495) of cases pending before the Tax Appeals Commision8 by increasing the number of panels to hear the appeals.

Under the proposed SGST disputes will be handled through the court of appeal. However, the time period by which specific actions need to be taken is not provided in the bill. In addition, disputes have to be taken to the court of appeal. Hence, the entire process will be more time consuming. This could result in revenue lags and difficulties in revenue estimation until disputes are resolved.

Additionally, in the case that no valid appeal has been lodged within 14 days, any remaining payments would be considered to be in default. Thereafter, the responsibility is shifted to the Commissioner General of the IRD to recover the dues. Given the IRD is completely removed from the normal collection process, the rationale for bringing defaults under the IRD is not clear.

Policy recommendations

As discussed, the SGST Bill has several limitations and much of this is due to the ambiguities in the Bill.

Given the critical state of revenue collection in the country the question to ask is whether this is the best time to introduce a new tax. Focus should be on fixing issues in the existing tax system to ensure revenue is maximised. The VAT is the least distortionary tax and it is the easiest to administer. Given these features it can be a very efficient revenue generator for a country. Therefore, instead of introducing a new tax, capitalising on systems that are already in place and amending the VAT rate, threshold and exemptions may be a more practical solution to the revenue problem that the country is currently facing.

Footnotes:

1http://documents.gov.lk/files/bill/2022/1/162-2022_E.pdf

2http://documents.gov.lk/files/bill/2022/1/163-2022_E.pdf

3https://www.treasury.gov.lk/api/file/0c3639d9-cb0a-4f9d-b4f9-5571c2d16a8b

4A value based tax base of ad-valorem refers to a rate of tax, where revenue will increase if the value of tax base increases.

5A quantity based tax base is a tax imposed on a per unit quantity of the product.

6https://www.treasury.gov.lk/api/file/304e2f2f-f215-40ad-b613-4d7cc3427178

7https://www.treasury.gov.lk/api/file/4028b5a0-f166-4f1d-a076-299e32200212

8http://www.cabinetoffice.gov.lk/cab/index.php?option=com_content&view=article&id=16&Itemid=49&lang=en&dID=10210

(Dr. Roshan Perera is a Senior Research Fellow at the Advocata Institute and the former Director of the Central Bank of Sri Lanka. Naqiya Shiraz is a Research Analyst at the Advocata Institute. The opinions expressed are the authors’ own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.)

(Learn more about Advocata’s work at www.advocata.org.)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.