Monday Feb 16, 2026

Monday Feb 16, 2026

Saturday, 2 October 2021 00:05 - - {{hitsCtrl.values.hits}}

In all 16 stabilisation programmes supported by the IMF during 1965-2020, the decision to go to the IMF has been dictated by the country’s own failure to keep the macroeconomic house in order. There is no evidence to suggest that the IMF insisted on implementing a stereotyped policy package in all ‘crisis’ cases. Moreover, governments in both ideological camps have gone to the IMF in times of need

IMF programmes and economic performance

IMF programmes and economic performance

There are two ways to evaluate the impact of IMF stabilisation programmes: (a) counterfactual evaluation: comparing outcome with what would have happened without the programmes; and (b) comparing results to objectives: evaluate performance against the benchmarks imposed by the policy-makers.

It is not possible to apply the first approach to assess the impact of IMF programmes using data for a single country simply because there is no suitable counterfactual (situation in the absence of the programme) for assessing how the country would have fared without the programmes. This approach can be applied with ‘proxy’ counterfactuals only in multi-country comparative analyses (Goldstein and Montiel 1986, Barro and Lee 2005, Easterly 2005, Vreeland 2003). We apply here the second methodology, using economic growth (measured by annual growth rate of real GDP) as the key performance criterion.

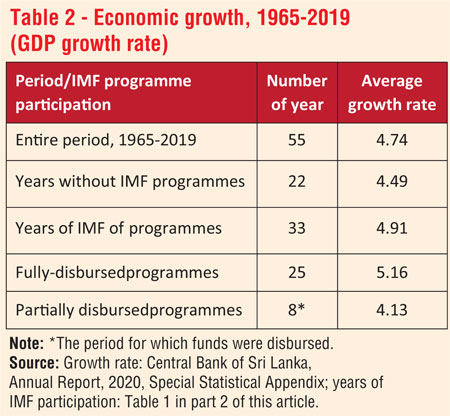

In Table 2, the average growth rate of the Sri Lankan economy during the years under IMF programmes (‘programme years’) is compared with that of the entire period (1965-2019) and years without IMF programs (excluding the ‘pandemic’ year of 2020). The growth rate in all programme years (4.91) is 0.42 higher compared to that of the non-programme years (4.49). When the programmes years are separated into years under fully-implemented programmes (proposes under with the entire committed fund was disbursed by the IMF) and partially implemented programmes, the growth impact of the fully implemented programmes is found to notably higher, as one would expect (5.16%).

Note that doing the period under study (1965-2009), all non-programme years are preceded by programme years: the period stars with the first IMF programme in1965. Therefore, lower growth rates in the non-programme years reported in Table 2 shows that, on average, the positive growth impact of the programs has not percolated beyond the programme years. The average growth rate during the non-programme years is 4.49 compared to 5.16 during the average growth rate during the fully-implemented programmes.

This simple comparison of growth rates ignores the possibility that the growth impact of reforms could have shaped by exogenous shocks such as the two JVP uprisings (in 1971 and during 1988-89), escalation of the separatist war, and changes in the terms of trade. Also, the economy has the natural tendency to grow over time at a certain rate regardless of reforms. Moreover, the degree of openness of the economy to foreign trade could impact on the nature of the adjustment process in the economy (Arpac and Bird 2009). The real issue is whether the IMF programmes have produced better growth performance after allowing for these other factors.

We undertook an econometric analysis to delineate the impact of IMF programmes after controlling for these influences. The results indicate that average growth rate is 1.26 percentage points higher using the 33 years under all programmes compared to the non-programme years. This estimated growth impact is however statistically significant only at 20% (that is, there is a 20% probability that this estimate is likely due to chance). By contrast, for the 25 years of completely fully-disbursed programmes, the growth rate is 1.45 percentage points higher compared to the non-programme years and incomplete programme years are taken together. This estimate is statistically significant at the one-percent level (that is, there is only one percent probability that this growth impact is likely due to chance).

In sum, the results of the econometric analysis is consistent with what we observed in the simple data tabulation (Table 2). This estimated growth impact is all the more impressive when we take into account what the econometricians call the possible ‘negative selection bias’. A country normally approaches the IMF at a time of macroeconomic distress. It would not, therefore, be surprising if we had found no statistically significant association or even a negative association between programme participation and economic growth (Easterly 2005).

It is clear from this evidence that the growth outcome during the IMF programme years has been respectable. But, have the programmes been successful in rectifying macroeconomic imbalances of the economy to set the stage for sustainable growth? This is an important issue because the very purpose of IMF stabilisation programmes is to achieve ‘adjustment with growth’.

Addressing this issue requires an in-depth analysis of individual programmes, paying attention to the programme objectives, problems cropped up in the implementation process, and the impact of the programmes on the overall incentive structure of the economy. However some tentative inferences can be made by comparing the relevant macroeconomic variable across years of the fully-disbursed programmes and non-programme years. The relevant data are summarised in Table 3.

The data clearly indicate the catalytic effect of the programmes on net capital inflows to the country. During the programme years, net capital inflows relative to GDP was 1.4 percentage points higher compared to the non-programme years (or the level of net capital inflows was about 32% higher than during the non-program years). Increase in capital flows seems to have helped maintaining imports and government expenditure at relatively higher levels. However, there is no evidence of net capital inflows augmenting domestic investment: investment as a percentage of GDP is strikingly similar between programme years and non-programme years.

There is some evidence of improvement in the country’s international competitiveness (measured by the real exchange rate change), but this has not persisted beyond the programme years.

Government revenue was notably higher during the programme years, with an increase in tax revenue making a significant contribution to the increase. However, this was overwhelmed by the Government’s failure to contain Government expenditure. The difference of the magnitudes of excess domestic demand (which is equal to the sign reversed value of net capital inflows), current account deficit and the budget deficit during programme years and non-programme years are striking similar.

This pattern suggests that domestic excess demand, which is driven by the failure to contain the budget deficit, is the prime driver of the failure of the reform programmes to contain the external imbalance (widening current account deficit). The current account deficit during the programme years is 50% larger compared to that in the non-programme years (4.8% compared to 3.2% of GDP).

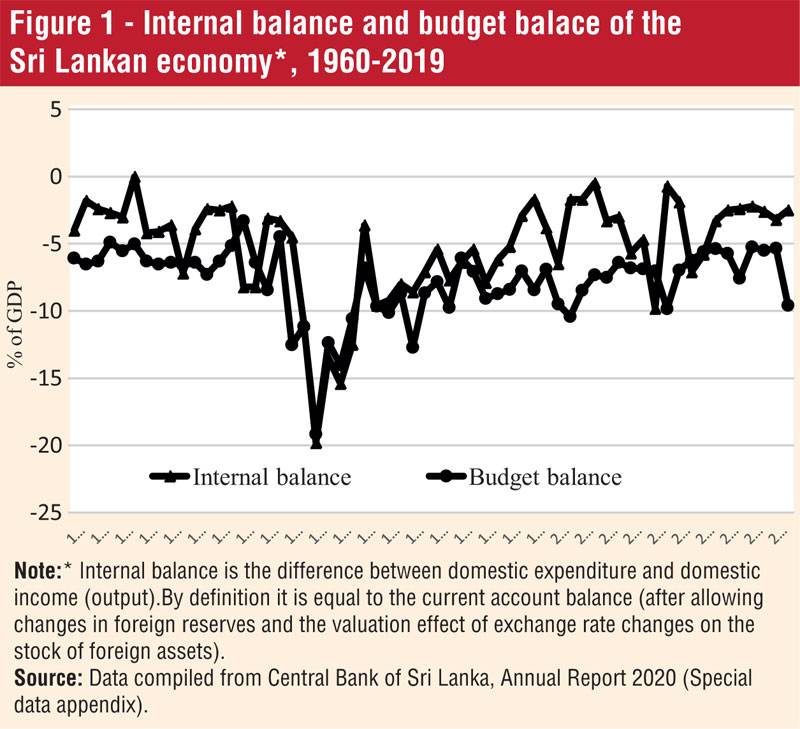

The date relating to the domestic imbalance (domestic expenditure over income) of the economy and the overall Government budget balance are depicted in Figure 1. Note that the domestic imbalance is by definition equal to the current account balance (the external imbalance), after allowing for changes in foreign reserves and valuation effect on foreign assets resulting from exchange rate changes. The figure therefore vividly demonstrates that the explanation of the persistent external imbalance of the economy is deeply rooted in the failure of fiscal management. The widening budget deficit that propels domestic excess demand has been an endemic structural feature of the economy, notwithstanding repetitive recourse to IMF adjustment programmes during the period under study.

Concluding remarks: Seeking or rejecting IMF support

Concluding remarks: Seeking or rejecting IMF support

There is no evidence to suggest that the IMF has been a determining hand in shaping economic stabilisation reforms in Sri Lanka. In all 16 stabilisation programmes supported by the IMF during 1965-2020, the decision to go to the IMF has been dictated by the country’s own failure to keep the macroeconomic house in order. There is no evidence to suggest that the IMF insisted on implementing a stereotyped policy package in all ‘crisis’ cases. Moreover, governments in both ideological camps have gone to the IMF in times of need.

The Sri Lanka-IMF relationship during the UF movement during 1970-77 indicates that there is room to enter into an IMF programme even for a national government with an incompatible ideological position provided it agrees with the IMF on the importance of achieving macroeconomic stabilisation. During the right-of-the centre UNP regimes of 1977-’94, the IMF supported trade liberalisation, but subject to its standard conditionality relating to macroeconomic stability. In hindsight, one could surmise that the outcome of the liberalisation reforms would have been much more impressive had the Government followed IMF-World Bank advice (and Shenoy’s advocacy) for combining trade and investment liberalisation with macroeconomic stabilisation.

There is convincing evidence that the growth rate of the economy was significantly higher during the years of fully-implemented IMF stabilisation programmes. However, the long-standing fundamental macroeconomic disequilibria of the country has persisted despite the repetitive reliance on IMF programmes. This simply reflect policy failures of the country to use the breathing space provided by the programmes to undertake the required structural adjustment reforms: the ‘repetitive client status’ of the country does not, therefore, make a case for rejecting IMF support.

Borrowing from the IMF is much cheaper than raising funds through sovereign bond issues and borrowing from other commercial sources. Unlike other donors, the IMF always lend funds to the Central Bank of the country strictly for meeting external payments. Therefore, IMF programmes do not have a direct impact on the domestic money supply and hence domestic inflation. More importantly, entering into an IMF programme acts as a catalyst to generate additional financial assistance.

Other international financial institutions such as the World Bank and the Asian Development Bank, and individual donor nations find comfort to lend to Sri Lanka as the lending risks are reduced given the financial discipline that an IMF programme instils. Financial credibility achieved by entering into an IMF programme also helps raising funds at competitive interest rates from private capital markets.

Other international financial institutions such as the World Bank and the Asian Development Bank, and individual donor nations find comfort to lend to Sri Lanka as the lending risks are reduced given the financial discipline that an IMF programme instils. Financial credibility achieved by entering into an IMF programme also helps raising funds at competitive interest rates from private capital markets.

Delaying the inevitability of approaching the IMF can be costly in the form of more stringent conditionality. The IMF team visited Sri Lanka in February 2020 to meet with the new administration and discuss its policy agenda has pre-warned about Sri Lanka’s formidable macroeconomic adjustment challenges: ‘Ambitious structural and institutional reforms are needed to anchor policy priorities, buttress competition and foster inclusive growth. Fiscal prudence remain critical to support macro-economic stability and market confidence, amid high level of debt refinancing needed. Given risks to debt sustainability over the medium term, renewed effort to advance fiscal consolidation is essential for macroeconomic stability.’ [https://www.imf.org/en/News/Articles/2020/02/07/pr2042-sri-lanka-imf-staff-concludes-visit-to-sri-lanka]

(The writer is a Fellow of the Academy of the Social Sciences of Australia, and Emeritus Professor of Economics at the Arndt-Corden Department of Economics, Crawford School of Public Policy, Australian National University and can be reached via [email protected])

[In writing the analytical native of Sri Lanka-IMF relations during 1960-1985, the author has drawn heavily on the PhD thesis of J.B.A.D Jayalath, ‘The Political Economy of Adjustment and Stabilization: Sri Lanka’s Relations with the International Monetary Fund and the World Bank, 1960-1985’ (The University of New England, Australia, 1990). He has also benefited from discussions with Sisira Jayasuriya. The full paper will be available soon at https://acde.crawford.anu.edu.au/acde-research/working-papers-trade-and-development.]