Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 25 October 2024 00:05 - - {{hitsCtrl.values.hits}}

Countries like ours should be exempted from requiring to maintain a strict floating rate of exchange

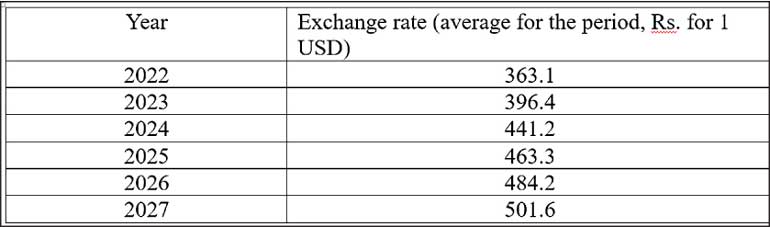

(Source: IMF Country Report No. 23/116, March 2023, Calculated by the author of this essay)

By Hema Senanayake

The IMF promotes a floating exchange rate mechanism. CBSL Governor Dr. Nandalal agrees with it, I think. Some economists too insist that CBSL cannot regulate the exchange rate, hence should allow the rupee to float. SJB has a different idea. They say that they allow first floating the currency to permit market forces to reveal the equilibrium rate, and then stabilising that rate through CBSL intervention. I am not sure about the ideological stance of President Anura Dissanayake as the Minister of Finance.

The IMF never assumed that Sri Lanka should have a stable rate of exchange when they entered into an agreement to approve Extended Fund Facility (EFF) in March 2023. In this agreement the forecasted or estimated exchange rates were as given in the table.

We should be alarmed by these forecasts. Even though Sri Lanka could have some advantages by having a weaker currency, the IMF and Sri Lankan monetary authorities are not interested in ensuring a stable unit of measure of value. Even though the rupee is appreciated, still monetary authorities are not interested in ensuring to have a stable unit of measure of value for the entrepreneurs. They can’t do their business without having a stable unit of measure of value.

Market exchange of goods and services is not possible without a common measure of value. This should be an extremely flexible unit of measure of value that freely penetrates into each and every productive resource so as to have a value for the output. Any unit of the measure of value that has no value in its own form, and which can be produced without any significant effort electronically or in any other form, will lose its character as a unit of measure of value if the production of such unit is not restricted or regulated. This regulation is the job of CBSL. In fact, if CBSL cannot regulate the exchange value of rupee then it cannot ensure the rupee as a stable unit of measure of value domestically.

Real value of domestic currency is determined by global reserve currencies

However, the real value of the domestic currency is determined by the global reserve currencies, mainly by the United States dollar. This means if we buy or sell something in rupee terms, what we actually do is buying or selling it at a relative price determined by US dollar. In fact, there is no value for the rupee on its own. Therefore, the regulation of exchange value of the rupee is important to have a stable unit of measure of value.

It is true, sometimes, the United States does not like extreme regulating of other countries’ currencies. They define it as currency manipulation to get an undue advantage over international trade by creating a global disequilibrium. Recently the US officially condemned China for this behaviour.

“China has a long history of facilitating an undervalued currency through protracted, large-scale intervention in the foreign exchange market. In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past. The context of these actions and the implausibility of China’s market stability rationale confirm that the purpose of China’s currency devaluation is to gain an unfair competitive advantage in international trade.” (U.S. Department of the Treasury, Press Release, August 5, 2019)

I submit the above quote to prove that a country can manipulate or regulate its domestic currency. We agree this process can be used to have an undue advantage in international trade. On the contrary, our case is different. The same can be innocently used to build up reserves to pay foreign debt and to help to rebound an economy which has been declared bankrupt. If we do that the US will not condemn us, because our intention is not to get an undue advantage in international trade but to come out of the bankruptcy and frweeing trade in near future.

The world had its global fixed exchange rate mechanism under the Bretton Woods agreement in 1945. Under the Bretton Woods system, the US dollar was originally convertible to gold at a rate of $ 35 per ounce. This means that the US would return one ounce of gold if any European or other central bank submit $ 35. By the 1960s some US economists insisted that fixed exchange rate mechanism was bad because that system does not allow a natural adjustment to take place in the economy creating an international disequilibrium.

Flexibility in manoeuvring the exchange rate

The said natural adjustment process is that there will be an appreciation of currency when there is surplus in external balance, and a depreciation can take place when the external balance is in deficit. But this natural adjustment does not take place. Because some countries may use currency manipulation or other means to maintain competitive export advantages, creating a gap in international trade that drives debt in deficit countries like the US and savings glut in surplus countries. The solution is to ensure that the IMF must take care of the natural adjustment process of currency appreciation and depreciation. But ours is not a savings glut country. We should have flexibility in manoeuvring the exchange rate. One professor in economics opined that if CBSL had stabilised the rupee at 310 per USD, CBSL could have increased its reserve level by another USD one billion or so while avoiding effective month on month inflation.

It is true that global disequilibrium takes place when the natural adjustment process of exchange rate does not happen, but major savings glut countries should be responsible for it. Countries like ours should be exempted from requiring to maintain a strict floating rate of exchange. Once the CBSL and monetary authorities of the NPP government understand that Sri Lanka would have a stable, exporter friendly exchange rate mechanism. Some of the perceived benefits of this mechanism are: boosting exports, trade surpluses due to weaker currency, attracting foreign direct investments, ease the burden of external debt repayment, stimulating economic growth. Let us think out of the box.

(The writer can be reached at [email protected].)