Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 18 July 2023 00:08 - - {{hitsCtrl.values.hits}}

The expected deceleration in the contraction of Sri Lanka’s economic output in the coming months is only the start to claw back lost output

Debt restructuring is fundamentally about allocating the associated economic costs to someone. The onus is typically on the debtor country to secure participation from its creditors, applying comparable treatment to all. As with all negotiations, the level and modalities of relief will always be subject to some degree of controversy. Sri Lanka’s recently gazetted domestic debt restructuring (DDR) exercise too has drawn expressions of both support and criticism. Overall though, negotiations have to be framed within certain desired outcomes to minimise costs to the economy. To this end, Sri Lanka’s negotiating stance dovetails neatly with crucial research evidence.

Debt restructuring is fundamentally about allocating the associated economic costs to someone. The onus is typically on the debtor country to secure participation from its creditors, applying comparable treatment to all. As with all negotiations, the level and modalities of relief will always be subject to some degree of controversy. Sri Lanka’s recently gazetted domestic debt restructuring (DDR) exercise too has drawn expressions of both support and criticism. Overall though, negotiations have to be framed within certain desired outcomes to minimise costs to the economy. To this end, Sri Lanka’s negotiating stance dovetails neatly with crucial research evidence.

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimise these, some notable findings are:1

No real appetite to include a DDR

To begin with, there was no real appetite to include a DDR in Sri Lanka’s case, especially in view of the substantial real erosion in value to debt holders as inflation spiralled. But, as opening gambits commenced with external creditors, the bondholder group’s request that ‘domestic debt is reorganised in a manner that both ensures debt sustainability and safeguards financial stability’ could not be ignored if only to avoid an impasse. Sri Lanka has limited room to circumvent a DDR altogether. As a middle-income country, the inclusion of domestic debt optimisation is implicitly encouraged in the IMF’s debt sustainability framework (DSF) for market-access countries. It focuses on the total stock of public debt but is avoided by low-income countries where the applicable DSF focuses only on external public debt.

Having opened the door to a DDR, there would have been very real concerns that the combination of skyrocketing inflation and financial fragility would test the banking sector’s resilience to deal with a DDR. Figures on capital adequacy and asset quality (with the non-performing loan ratio on stage 3 loans rising from 5.2% in 2020 to 11.3% in 2022) and exposure to restructuring the country’s international sovereign bonds (ISBs) meant the stakes were high. When times are uncertain, a herd mentality will rule, and this is to be avoided at all costs.

Another element in a DDR is that there are negative externalities that need to be internalised – i.e. there may be direct costs to a country’s financial sector from a DDR, such as recapitalisation and these have to be taken on board. This is particularly so where there is a strong link between the sovereign and its financial system. In setting aside resources to ensure financial system stability, the anticipated fiscal benefits of a DDR can potentially reduce. Thus, on both counts, ringfencing the banking sector to avert a far more damaging economic crisis and deeper output losses has been the first step in Sri Lanka’s approach.

Having left out the banking sector, the economic cost appears to have been disproportionately directed at the savings of workers contributing to pension funds. Private bondholders have been exempted denying ‘comparable treatment’ while the captive nature of the Employers Provident Fund (EPF), managed by the Central Bank of Sri Lanka (CBSL), means there has been no attempt to ‘secure participation’.

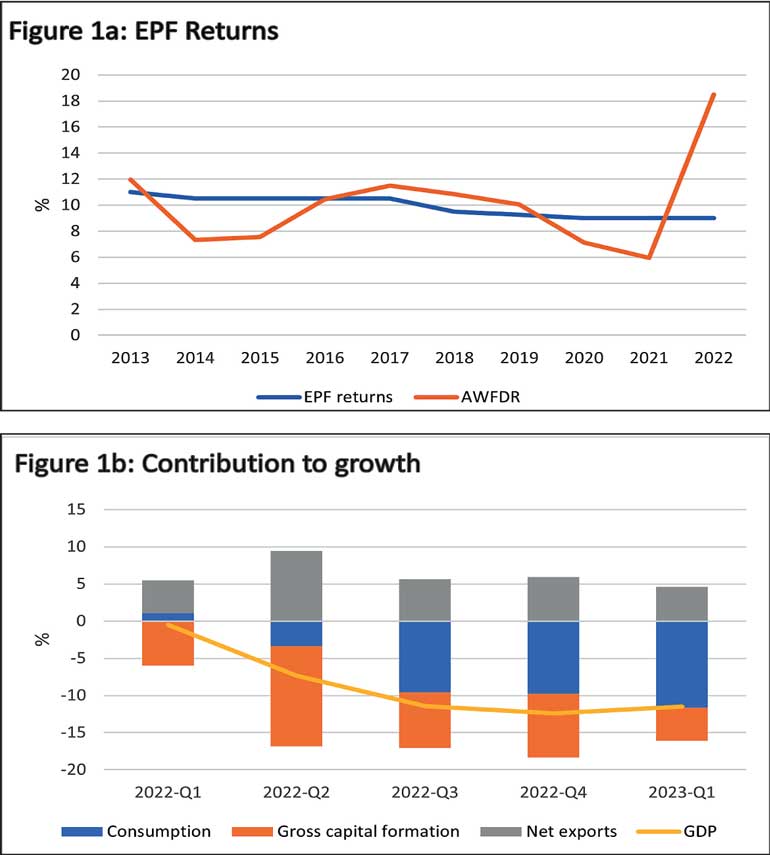

Sri Lanka’s DDR treatment in effect is an example of the considerable degree of influence that a sovereign can exert over domestic legal and regulatory frameworks, unlike that of an external debt restructuring (EDR). Under the terms, pension funds are required to opt for a 30% haircut or be liable for higher taxation at 30% instead of the prevailing 14%. For EPF savers, there is the only assurance of receiving a 9% return in the long-term for a fund that has often performed below par even against the simplest alternative instrument that an average saver may look at, such as one-year fixed deposits (Figure 1a). Where there has been a substantial erosion of real savings from a crisis-induced economic environment, this is scant consolation for workers. The premise of a return to single-digit inflation merely means that price increases have slowed from the previous exorbitant high levels, but the erosion of the value of savings remains very real.

Bring as many of Sri Lanka’s external creditors on board as quickly as possible

The second step of the negotiating process is to bring as many of Sri Lanka’s external creditors on board as quickly as possible. Having complied with the bondholder group’s request on including a DDR, comparable treatment is being offered by way of a 30% haircut on EDR too. As a bilateral creditor, China’s preference globally is for deferral rather than reduction. But merely pushing repayments down the line with maturity extensions (and some coupon adjustments) still leaves Sri Lanka at the risk of being permanently illiquid and, therefore, vulnerable to repeat short-term crises. Clearly, the deeper the haircut, the more sustainable the debt becomes, but negotiations will likely drag on. A complex creditor group and geo-political wrangling add to these risks. Ecuador, a middle-income country, came to an agreement with its bondholders to a haircut of 9% on $ 17.4 billion in 2020, with a high 98% of bondholders agreeing to the deal. China persisted with maturity extensions and coupon adjustments.

Corralling in the bilateral creditors will require more diplomatic persuasion than economic analysis. China’s recently concluded deal with Zambia to restructure $ 4.2 billion of loans under an initiative driven by the G20 Framework for low-income countries pushed back repayments and accommodated interest rate cuts. This follows on from its deal with Ecuador a year earlier that included maturity extensions and interest rate adjustments on debts worth $ 4.4 billion. There are two key arguments put forward by China for not taking losses in debt restructurings: first, that its loans are development-oriented, tied to projects that generate revenues for the recipients, and second, that multilateral banks should also participate, instead of the current preferred status of having their loans repaid in full. In many ways, Sri Lanka will be a test case on these issues.

The expected deceleration in the contraction of Sri Lanka’s economic output in the coming months is only the start to claw back lost output. This too is under threat. As domestic consumption faltered, net exports were the only positive driver of growth in recent quarters, but there are concerning signs of a slowdown (Figure 1b). In the event, it is even more probable that the allocation of costs associated with debt negotiations will be weighed and measured against the need to get an overall deal done as quickly as possible to support Sri Lanka’s slow-burn economic recovery.

Footnote:

1Asonuma, T. and C. Trebesch, Christoph (2016). Sovereign Debt Restructurings: Preemptive or Post-Default, Journal of the European Economic Association, 14(1): 175-214; Asonuma, T. et al. (2019). Costs of Sovereign Defaults: Restructuring Strategies, Bank Distress and the Capital Inflow-credit Channel. IMF Working Paper. Washington, D.C: International Monetary Fund; Fang, C, J. Schumacher and C. Trebesch (2020). Restructuring sovereign bonds: holdouts, haircuts and the effectiveness of CACs. Working Paper Series No. 2366, European Central Bank; Grigorian, D.A. (2023). Restructuring Domestic Sovereign Debt: An Analytical Illustration. IMF Working Papers Issue 024. Washington, D.C.: International Monetary Fund.

(The writer is IPS’ Executive Director and Head of its Macroeconomic Policy research. She has nearly three decades of experience at IPS and functioned as its Deputy Director from 2005 to 2017. Since joining IPS in 1994, her research and publications have covered areas related to regional trade integration, macroeconomic policy and international economics. She has extensive experience working in policy development committees and official delegations of the Government of Sri Lanka. She holds a PhD in Economics from the University of Manchester.)