Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 10 December 2018 02:00 - - {{hitsCtrl.values.hits}}

Professor H A de S Gunasekara 2018 Oration – Part 1

This is an edited and abridged version of the Professor H. A. de S. Gunasekara 2018 Oration delivered at the University of Peradeniya on 4 December 2018

The economist who produced ‘From Dependent Currency to Central Banking’

Professor H A de S Gunasekara, popularly known as HAdeS, was a legend in economics in Sri Lanka. The doctoral thesis ‘From Dependent Currency to Central Banking in Ceylon’, which he submitted to the University of London, was a seminal contribution to the setting of the monetary and financial system in an economy that was transformed from feudalism to semi-capitalism.

I emphasise the word ‘semi-capitalism’ here because what had been in operation in colonial Ceylon was not a pure capitalist system of the Adam Smith type, but a system carefully managed and guided by the colonial rulers. There are a plenty of examples in his Dependent Currency to prove this point.

Intervention in the economy by colonial administration

The private sector-based issue of money that was prevalent in Ceylon from the early 19th century was continued to be regulated and controlled by the colonial administration. For instance, Natukottai Chettiars, who imported specie or coins from India, and facilitated import and export trade in the colony, were subject to strict control by the colonial Government. Whereas banks from the UK were free from regulation, banks to be established in Ceylon were subject to a set of unusual restrictions. They could accept deposits only up to three times the capital employed – known as the leverage ratio – and, if they became bankrupt, shareholders had to bring money from their homes to pay double the value of their shareholdings to meet the debt of the bank.

This was completely contrary to the principles of joint stock companies, where shareholders were required to pay only the unsubscribed part, if any, of their shareholdings, if a company became insolvent. In 1884, the currency issue was fully nationalised by the colonial administration, by setting up a Currency Board. In the UK, Sterling Pounds were still issued by the Bank of England, which was a private company until it was nationalised in 1947. Land grants were given to British planters by the Government. At first, they were free grants, but later, land was sold to them at an ‘upset’ price of 5 shillings per acre. Commerce and industry had been stringently regulated by the colonial administration to ascertain its own business interests.

Transformation from academic to national planner

I have chosen, on the request of the H A de S Gunasekara Oration Trust, ‘Sri Lanka’s Economy at a Crossroads: The Way to Rescue the Ailing Economy’ as the title of this oration. We are now in 2018 and about to enter the third decade of the third millennium.

Perhaps an appropriate starting point for the discussion would be whether Sri Lanka had a similar problem when HAdeS joined the bureaucracy, leaving his academic job temporarily in 1970, and accepted the top position of the Secretary to the Ministry of Planning and Employment in the newly elected United Front Government under Premier Sirimavo Bandaranaike. He had, according to reports, accepted this position on the personal request of the Prime Minister, and would have thought that it was a good opportunity for him to put his economic wisdom into practice.

This Ministry had the mandate of taking suitable policies to transform Ceylon to a socialist economy, in collaboration with other Government agencies.

The Five Year Plan of 1972-76

A noteworthy work completed during his tenure as Secretary was the release of The Five Year Plan 1972-76, prepared under his direction by a team of economists attached to the Ministry. The Plan was not implemented fully to realise its socio-economic goals, due to lack of resources. But, there is an amazing similarity of the diagnosis of the economic issues, strategies to be followed, and the goals of society in early 1970s and in early 2000s.

Sri Lanka’s economy had always been at a crossroads

The Plan starts with a statement that it is presented ‘at a time of social and economic crisis unparalleled in the history of modern Ceylon’. The severe foreign exchange crisis and the problem of unemployment, especially among the youth, have been the most pressing economic issues of Ceylon at that time. This is exactly the situation which Sri Lanka is faced today.

The Plan had not emphasised on the need for having a high economic growth because, as it declared, the growth in Gross National Product (GNP) was to hide many qualitative issues facing a nation. It noted, apparently with satisfaction, that per capita real income had grown on an average of 2.1% annually during 1959 to 1970. Yet, the fundamental problems of the economy, namely, unemployment, income disparities, and foreign exchange crisis, have remained unresolved. GNP per capita has also not indicated the ‘virtual stagnation of certain sectors in the economy’ and the ‘maturing crisis within society’.

The Plan aimed at using physical and human resources to create an economy benefitting ‘the nation as a whole’, a goal known as inclusive growth today, and eliminating income disparities which have been the bane of society. Thus, the objective of the Plan, as explicitly laid down in it, had been to meet the ‘socialist aspirations of the masses’ which had elected the Government into power in the General Elections held in May 1970.

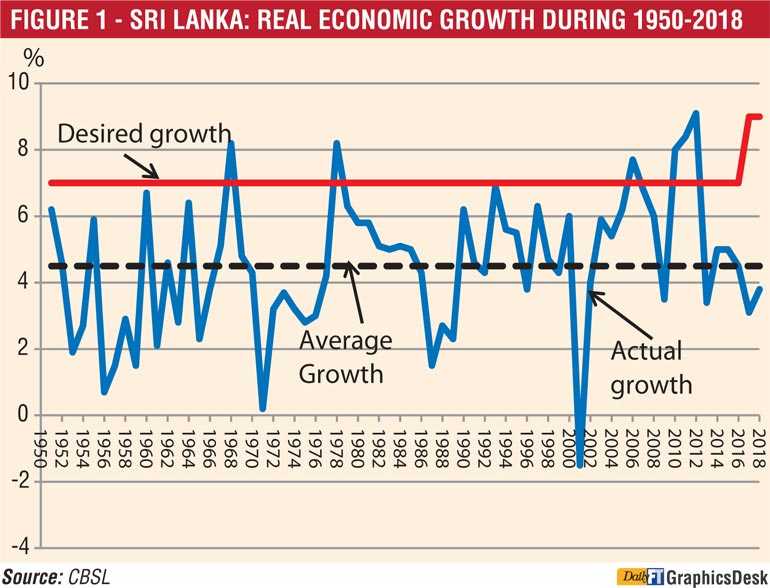

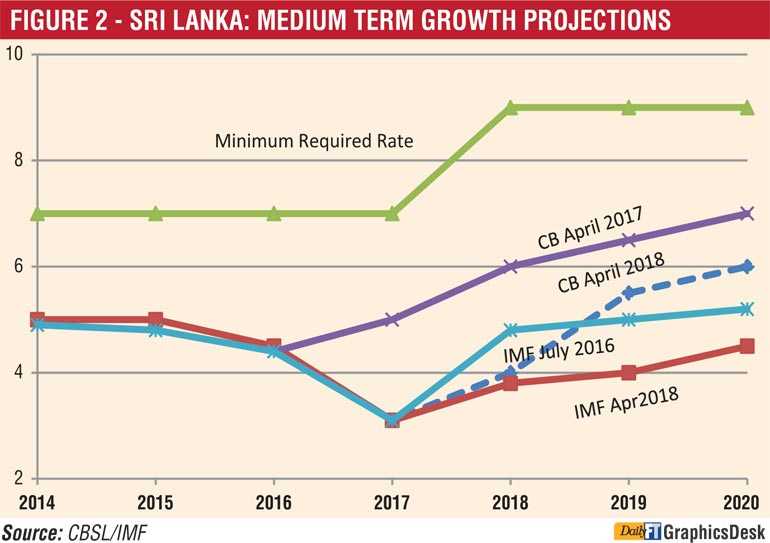

Sri Lanka needed a desired growth of 7% continuously to become a rich country within a generation, but in the whole of the post-independence history, that rate has been exceeded only on five occasions. In the next three year period, the best projections made about Sri Lanka’s economy as at November, 2018, has been a growth rate of around 4-5%. Sri Lanka’s slow economic growth has snared it in what is now known as the ‘middle income trap’: a term coined by a group of economists attached to the World Bank to theorise the failure of some developing countries to move from an upper middle income country to a rich country.

Animosity against unfair income distribution

Societies throughout history have been intolerant of capitalist classes enjoying a disproportionately high share of the national wealth, though it was these capitalist classes which have been responsible for organising economic enterprises to create such wealth. In recent times, this was presented cogently by Thomas Piketty who argued in his bestselling book ‘Capital in the Twenty First Century’ that in 20 countries made up of USA and European nations, the rich have used capital inheritances to appropriate for themselves a larger portion of national income.

Similar sentiments have been expressed in The Plan drawing on the data on disparate income distribution revealed in the Central Bank’s Socio-Economic Survey of 1969-70. This has, according to the Plan, resulted not only in an unfair distribution of income, but also in a false social value system. These false values had led people, especially the youth, to imitate the wasteful consumption pattern of the rich, which was unaffordable by the prevailing economic conditions of the country.

However, income distribution in Sri Lanka has remained the same throughout its post-independence history. In 1953, the lowest 20% of the population had earned an income share of 5%, while the highest 20% had earned 57%. In 2016, the first category had earned a share of 4.8%, while the latter category had earned a share of 50%. Thus, the poorest have become poorer, with the richest being reduced to a lower share. It is the middle class which has been fattened at the expense of both the poor and the rich, a development known as Director’s Law, named after the American economist Aaron Director.

Diagnosis of Sri Lanka’s economic ailments

The diagnosis of the economic issues faced by Ceylon in the early 1970s has been the same as today. There was a paucity of savings, exacerbated by dissavings of the Government, to meet the required investments. The Government savings had been low because of the high current expenditure, relative to the revenue. Hence, to generate savings for investment, the Plan had recommended that the budget should run a ‘substantial surplus’ in its current account, and to generate the same, the past policies have to be ‘drastically revised’. Today, such a strategy is known as ‘fiscal consolidation’.

The Plan had noted that, without this strategy, the Government had to borrow to finance its investment expenditure. Though it was a mere book entry from the private sector to the Government, the Plan had concluded that it would put more money in the hands of the people, creating a demand greater than the supply of goods and services. The rationale here is the generally known Keynesian multiplier effect. It would lead to two outcomes, according to the Plan.

First, the increased demand would create shortages unless they were met out of imports. But imports were constrained by lack of foreign exchange. Second, import and exchange controls had to be introduced to overcome the problem, but it would lead to increases in prices, emergence of black-marketeers, racketeers, and profiteers.

This is the critical issue faced by any open economy. That is, the aggregate demand boosted by increased Government expenditure programs financed out of borrowing or printing money will leak out of the economy, by way of increased imports, causing long term balance of payments problems. Hence, the solution to the problem of lack of foreign exchange would have been not resorting to import and exchange controls, but curtailing Government expenditure, on one side, and increasing exports, on the other. Yet, the strategy suggested in the Plan had been to curtail imports through domestic production and setup industries that would use less imported raw materials.

The designers of the Plan cannot be faulted for this, because that was the strategy adopted by many countries which Ceylon used as examples for stimulating growth. It was indeed a system of curtailing domestic demand to suit the available foreign exchange resources. However, there was still a gap which was financed out of external borrowings.

The Plan had recognised that it would lead to accumulation of external debt, the servicing of which would create further problems for the economy in the years to come. Thus, the problems faced by Sri Lanka’s economy had been the same as today, and one could appropriately label it as an economy in the crossroads, the title of today’s oration.

I will now revert to the topic this afternoon.

Sri Lanka’s economy in a series of crossroads

The experience that we go through today is not the first time Sri Lanka’s economy has been at a crossroads. As mentioned above, it had previously been at a crossroads, as per the designers of the Five Year Plan 1972-76. When the new open market economy policy was introduced in 1977, the Central Bank stated that the economy was experiencing a ‘watershed’, a change from one inferior system to a better system.

It then appears that the Sri Lankan economy has been moving from one crossroads to another frequently. Despite the fact that the avowed goal of the country has been to deliver prosperity and richness to its people, the whole of the post-independence period has been marked by low growth that fluctuated continuously from high to low.

Figure 1 shows Sri Lanka’s economic growth during 1950-2018. Sri Lanka needed a desired growth of 7% continuously to become a rich country within a generation, but in the whole of the post-independence history, that rate has been exceeded only on five occasions, and that again, well apart from each other. In the next three year period, the best projections made about Sri Lanka’s economy as at November, 2018, has been a growth rate of around 4-5%. This is presented in Figure 2.

Getting caught in the middle income trap

Sri Lanka’s slow economic growth has snared it in what is now known as the ‘middle income trap’: a term coined by a group of economists attached to the World Bank to theorise the failure of some developing countries to move from an upper middle income country to a rich country.

From low income to lower middle income

According to the proponents of the middle income trap hypothesis, a poor country can easily move from a low income country to a lower middle income country. That is because, being a low income country, it could make use of the abundantly available cheap labour for the production of mass consumption goods, and supply the same to rich Western nations at a competitive price. Sri Lanka did so by using its labour resources to produce apparels, with a significant competitive edge from around 1980.

However, once a country becomes a lower middle income country, it will experience an increase in labour costs, making it difficult for it to compete in the cheap labour market with newly entering poor countries, which have a relatively lower wage level compared to countries which have now attained the lower middle income status. As per statistics compiled by the International Labour Organisation (ILO), in 2014, Sri Lanka had the lowest monthly wages for garment workers out of 25 major garment exporters in the world. However, actual costs to employers are about two and a half times higher than the minimum wages set for the industry, making Sri Lankan garment exports less competitive in the global markets.

As a result, Sri Lanka’s garment exports, which are less than 2% of the global trade in garments, have saturated in the last few years, making it difficult for the country to rely on this source of income anymore. Accordingly, though garment exports have increased in absolute terms over the years, they have slightly fallen as a share of total exports. In 2009, its share in total exports amounted to 46%. In 2017, it has fallen to 44%.

Strategy to beat the middle income trap

Sri Lanka is at a crossroads today because it cannot beat the middle income trap with the available economic resources and the production system it follows. The way to beat is to transform the export sector into a modern sector, and align its economy with the rest of the world, a policy involving the integration of the country’s economy with the global economy. It is challenging and difficult, but not impossible if appropriate policies are adopted to modernise the export sector of the country.

The next part will discuss the present state of the export sector in Sri Lanka.

(W A Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])