Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 10 February 2023 01:21 - - {{hitsCtrl.values.hits}}

|

It was good news for Sri Lanka when Paris Club members at their meeting on January 25, 2023, in the presence of representatives from Hungary, Saudi Arabia, the Kuwait Fund for Arab Economic Development and India, as well as from the International Monetary Fund and the World Bank, agreed to provide financing assurances to support the approval by the IMF Executive Board of the envisaged IMF program for Sri Lanka, which would allow to restore the country’s macroeconomic stability. The Paris Club, formed in 1956, is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by borrower countries. Paris Club members are Japan, France, Korea, Germany, the United States of America, Spain, the Netherlands, Russia, Sweden, Austria, Canada, the United Kingdom, Den-mark, Belgium, and Australia. Non-Paris Club members include China, India, Saudi Arabia, Kuwait, Hungary, Iran, Pakistan, and Bangladesh.

It was good news for Sri Lanka when Paris Club members at their meeting on January 25, 2023, in the presence of representatives from Hungary, Saudi Arabia, the Kuwait Fund for Arab Economic Development and India, as well as from the International Monetary Fund and the World Bank, agreed to provide financing assurances to support the approval by the IMF Executive Board of the envisaged IMF program for Sri Lanka, which would allow to restore the country’s macroeconomic stability. The Paris Club, formed in 1956, is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by borrower countries. Paris Club members are Japan, France, Korea, Germany, the United States of America, Spain, the Netherlands, Russia, Sweden, Austria, Canada, the United Kingdom, Den-mark, Belgium, and Australia. Non-Paris Club members include China, India, Saudi Arabia, Kuwait, Hungary, Iran, Pakistan, and Bangladesh.

The members, according to the media, examined the macroeconomic and financial situation of Sri Lanka, including its long-term debt sustainability, and the need for a debt treatment by all bilateral creditors to both fill the financing gap and to ensure Sri Lanka’s debt sustainability is in line with the proposed Extended Fund Facility.

They noted “We acknowledge that the Sri Lankan authorities had the opportunity to present Sri Lanka’s economic and financial situation to their creditors, which underscored the need for debt treatment from all creditors. They also presented their reform program that will be supported by an IMF arrangement requiring a debt treatment to restore debt sustainability, as well as the prior actions already implemented. Paris Club members as well as Hungary, Saudi Arabia and India continue to look forward to working together along with all bilateral creditors and to engage with other key stakeholders in order to proceed with a comparable debt restructuring as soon as possible.”

Further the members noted “To support the implementation of the envisaged IMF supported program and the Sri Lankan authorities’ efforts with other official bilateral creditors, Paris Club members, jointly with Hungary, expressed their full commitment to negotiate with Sri Lanka, in accordance with the comparability of treatment principle among all bilateral creditors, and with the goal of restoring debt sustainability with due regard to targets and overall macroeconomic goals under the Extended Fund Facility.

According to reports Saudi Arabia expressed its support for the process and acknowledged the importance of offering financing assurances in the near future. Members further expressed appreciation for the specific and credible financing assurances issued by India on January 16, 2023 and its coordination with the Paris Club. The Paris Club members as well as Hungary and Saudi Arabia urged other official bilateral creditors, including China, to do the same in line with IMF program parameters as soon as possible.

|

Next steps

Next steps

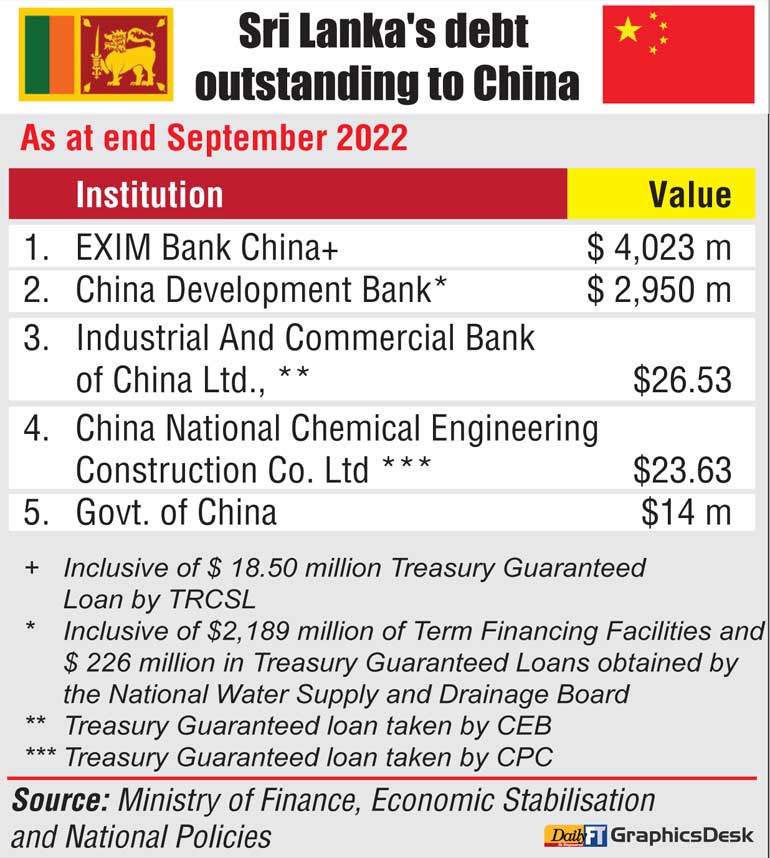

Given that a staff-level agreement has been signed between Sri Lankan authorities and the International Monetary Fund staff for a 48-month arrangement under the Extended Fund Facility (EFF) over 4 months ago, the next steps for Sri Lanka would be to get China also to agree to similar terms . Sri Lanka will also need to get commitments from its commercial creditors and other official bilateral creditors to a debt restructuring structure on some favourable terms and to hold all creditors together until an equitable debt treatment is agreed by a majority. The private creditors are a more challenging subset to deal with.

This is why many top experts are challenging the former government’s arbitrary decision to default without consultation with the lenders. Some termed it a soft default. Anyone doing a business would know the consequences of defaulting to a financial institution – soft or hard. This is why borrowers approach the financial institution way before the deadline to restructure their loans and agree on a new payment plan. As a result of the default Sri Lanka now cannot borrow and secure any borrowing against our assets in the way we were doing pre default. So this is a mess of our own making. Unfortunately as a result the private sector is saddled with crazy interest rates and high taxes.

Way forward

Overall Sri Lanka is far from bankrupt. It is estimated that SL has over $450 billion of assets and $50b of debt. So it is not bankrupt as people claim. Sri Lanka can pay its debt on the due dates had we proactively worked out a repayment plan way before we defaulted . With exports doing over a $ 1 billion a month, FDI climbing and Remittances improving to $350-$400 a month and tourist arrivals increasing, Sri Lanka only needs a good Team to hammer out a debt restructuring plan with the private creditors based on our forex flows despite our pathetic ratings . In its absence what we need the IMF to do for us is to help us negotiate with our lenders and restructure our debt. Meanwhile we have to fix the trade deficit and the negative current account balance. Otherwise we will have a persistent forex problem. Also it is very important to continuously explain to the people that we will have to make the hard decisions to get out of this mess and we have to pay our way to come out of the crisis. Importantly our tax net from 500,000 files needs to expand. No creditor is going to help us until we help ourselves. President is on the right track, but needs to sell the story more effectively.

|

Sources

https://www.ft.lk/top-story/Chinese-credit-conundrum-for-Sri-Lanka/26-745032

https://www.ft.lk/front-page/Paris-Club-Creditors-provide-financing-assurances-to-support-IMF-bailout-of-SL/44-745042

https://youtu.be/jrN6HRiT0UY