Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 9 June 2022 00:23 - - {{hitsCtrl.values.hits}}

Empty hotels

Tourists protest

Sri Lanka tourism is yet again going through a severe crisis. But this time the crisis is multi-faceted and of unprecedented proportions. Many service providers are barely managing to survive with several expected to ‘go under’ in the next few months.

Sri Lanka tourism is yet again going through a severe crisis. But this time the crisis is multi-faceted and of unprecedented proportions. Many service providers are barely managing to survive with several expected to ‘go under’ in the next few months.

However tourism is one of the main sources of the much needed direct foreign exchange earning industries in the country. Hence it stands to reason that reviving the industry should be one of the Government’s primary strategies by providing some relief to the providers.

At the same time there is a crying need to reach out and provide support to many needy poor families with some form of subsidy and help.

With desperately limited resources which should the Government choose?

The current situation

The unprecedented and severe crisis that Sri Lanka is currently going through, said to be the worst we have faced since independence, is having a drastic impact on all industries. Foremost among them is the tourism industry.

Sri Lanka tourism, reeling after the Easter attacks and two years of the COVID pandemic, is almost at death’s door now. Travel advisories from several countries, inability to service customers in a proper manner due to shortages of gas and food, long periods of interruption of electricity, transport restrictions for site seeing by tourists, etc. are all contributory factors. Recently one of the world’s largest tour operators TUI suspended operations to Sri Lanka.

Hotels are struggling to maintain minimal operations. Costs are going up weekly, and food costs are skyrocketing. Menus have been pruned down due to unavailability of food items. Even with the exchange rate appreciation bringing in some enhancement of the equivalent rupee yields from the USD room revenue, the increase in costs outweigh this. Therefore there may have to be a room rate increase to make operations viable. In the post-COVID environment, when all destinations are trying to entice tourists back, such a rate increase may jeopardise our competitiveness in the world market.

The moratoriums on loan repayments granted for tourism will end soon, and providers will have to start paying the outstanding loans. The medium and small sector who have taken out loans would suffer much more than the formal larger sector in tourism. Several of the micro sector (home-stays and small guest houses) who have such borrowings, may soon go bankrupt.

Tourists’ perception of Sri Lanka

Tourists’ perception of Sri Lanka

In spite of the ‘doom and gloom’ the silver lining is that this time there is no real security threat. The few tourists who have been here are unanimous that they did not have any safety issues at all. They have been only inconvenienced and could not enjoy their holiday. They are of one voice in being sorry for the people of Sri Lanka and the suffering the people are undergoing. There is no anger. In fact some tourists have been seen joining some of the protests, carrying placards.

So I think there is light at the end of the tunnel. If and when the country returns to some sense of normalcy, tourists will return. Tourism is a ‘front end’ industry. It takes the first hit during a crisis, but it is also the first to recover.

If we constantly keep communicating with foreign operators about the ground situation honestly and effectively, and when the shortages of essential goods eases, tourism should be able to bounce back strongly.

Revenue from tourism

Sri Lanka has an annual shortage of inflows of $ 6 billion to accommodate basic needs such as fuel, gas, medicine, fertiliser, and food.

Sri Lanka has three primary sources of dollar income – exports, tourism, and worker remittances. From June 2021 until April this year, Sri Lanka’s monthly export earnings (mainly apparels) managed to surpass $ 1 billion. However, export earnings for the month of April dipped below $ 1 billion, breaking a 10-month streak of $ 1 billion per month earnings. This figure is expected to dip further in the coming months with some of Sri Lanka’s buyers moving towards Bangladesh and India for their orders.

During the good years, Sri Lanka tourism brought in some $ 4 billion+ direct foreign exchange (FX) to the country. Tourism has been the third largest FX exchanging industry in Sri Lanka, preceded by worker remittances and the apparel industry.

The apparel industry, which is also facing problems currently with buyers shifting to other sources elsewhere, has a relatively small value added component of only about 35%, due to the higher imported inputs such as the fabric, accessories, etc.

Tourism on the other hand has a high value added component of around 80%, with only a few food items and other items being imported. The third FX generator, worker remittances is showing a drastic drop (over 50% drop YoY for April 2022) due to the lack of confidence in the current political climate in the country.

Hence tourism is the only reliable avenue through which some of the much needed FX for the country can be generated in the short term.

The plight of the industry

With substantially reduced income streams the tourist industry is now in a tail spin, running out of cash to sustain their operations. The cost of operations is skyrocketing daily. Unlike other industries the tourism sector is not one which can be shut off and restarted ‘willy-nilly’. It is a 24x 365 day ‘show business ‘operation which needs constant maintenance, innovation and nurturing.

Occupancy

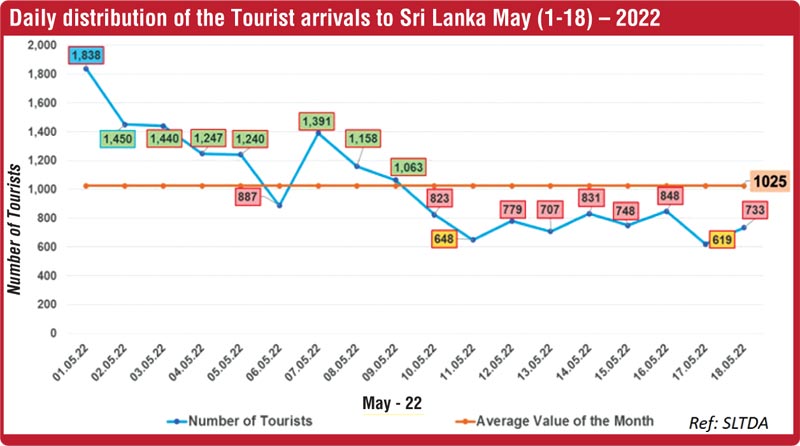

The very bad publicity in the international media about the acute shortage of food, fuel, gas and other essential items, and negative travel advisories several countries, is causing serious doubts in potential travellers’ minds about holidaying in Sri Lanka. Arrivals are slowing trickling down, we are seeing a gradual slowing down of forward bookings and large number of cancellations also.

Food costs

Sri Lanka’s food inflation is said to be around 45% and there is an embargo of a wide range of imported food items which are used in hotels (especially city hotels).

In hotel operations, food cost (normally measured as a percentage of food cost to food revenue) is one of the most important indices that is tracked on a daily basis in operations.

Discussions with a few leading chefs in hotels and operations mangers indicate that food cost of Sri Lankan hotels, currently around 35%, may rise to around 50% or more at current rates.

Fuel and gas

With power cuts now a way of life, most of the larger hotels are compelled to operate their generators for extended periods of time on a daily basis. Firstly, just procuring the required diesel for the generators is full of challenges. Every day, hotel staff have to stay in long queues to get diesel pumped into barrels. Often they are refused, and sent from pillar to post to get authorisation letters from various Government officials. So every day there is more than three-quarters of a day lost in a totally frustrating and unproductive activity.

Purchases

Most hotels contract with specific suppliers for supply of food and other items required for operations. However because of the volatility of the economic situation of the country, suppliers are now refusing to forward contract and are willing to supply on a daily spot market price only. This causes great difficulty in forward planning of hotel operations, menu planning and cost management. Eventually there will be shortcomings in the product quality to the guests.

“We are on top of a volcano,” a senior State official makes request, “Whether we like it not, the reality is by next month we will definitely break apart. We don’t have any assurance of our agricultural production in the Yala.

Hence it is clear that hotels in particular, and the travel industry in general, need to be supported to ensure that they survive this crisis.

All the industry needs is help to keep its head above the water now. This private sector-led industry has proved time and again of how resilient it is, and given the necessary support; it will be able to not only weather the storm, but at the same time help the country in some way out of this economic quagmire, by generating vital foreign exchange earnings.

The crying need – managing the cash flow

The industry is struggling to make both ends meet. It has to sustain some form of operations, maintain the equipment and infrastructure. This is affecting the entire cross section of the industry both large and small. No one is sparred – big or small.

Entities who have taken out loans are in greater peril. The Government has granted a moratorium on all loan repayments but very soon that will end. If they are called upon to start making these payments it will further aggravate the cash flow and many establishments may then have to file for bankruptcy.

This may lead to wide spread redundancies in an industry which employs about 500,000-600,000 workers, directly and indirectly. (Already the Sri Lanka United National Businesses Alliance has warned that nearly 4.5 million workers belong to 4,500 small and medium enterprises will not be able to be paid their wages)

So to help the industry tide over the current situation and survive, the ‘wish list’ to ensure for cost saving measures would include:

(This does not include any marketing initiatives to stimulate short-term tourism demand which can be covered as much as possible through social media channels at minimal cost)

There will no doubt that there will a big ‘hue and cry’ if any government were to try and implement such proposals. Other industries will protest, as well as perhaps the public also. Quite rightly the government’s priority should be to provide a ‘safety net’ for the lower income earning segment of the population.

So in spite of all these valid arguments should the tourism industry be singled out for preferential treatment?

A good economist can estimate what the above support initiatives will cost the government. Even if tourism can be brought to 50% of the 2018 levels, then one could expect about Rs. 2 B inflow of FX. It then would be easy to work out a cost benefit analysis and see whether this is a viable proposition.

The fact is that by helping the industry to stay afloat and bounce back at the earliest opportunity, the Government will be helping the economy earn much-needed FX, which will then indirectly help the public at large.

So it is indeed a ‘Catch 22’ situation where the Government will have to choose between the conflicting priorities.