Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 15 August 2018 00:10 - - {{hitsCtrl.values.hits}}

Globally we see that when an economy gets challenged at the corporate end, it has a ripple effect on the consumer, leading to protests, strikes and agitation. The latter is often termed by politicians as having linkage to the opposition, but the fact of the matter is that it purely based on declining purchasing power that leads to such behaviour. Let me do a deep dive on Sri Lanka.

Sri Lanka corporate performance is reporting a challenging time in Q1 2018. The diversified top conglomerate which operates in a cross section of businesses, John Keells Holdings PLC (JKH), has reported a dip in profit, reflecting challenging economic conditions to several of its core sectors, though few others remained resilient to improve their bottom line.

JKH’s Group Profit Before Tax (PBT) at Rs. 2.91 billion in the first quarter of the financial year 2018/19 was down 29% from a year earlier. The profit attributable to equity holders declined by 23% to Rs. 2.19 billion. The last time JKH suffered a dip in 1Q was in 2013/14 FY, which indicates the deteriorating economic performance in Sri Lanka.

Another diversified entity, Aitken Spence Group, reported operating profits of Rs. 720.4 million for the April-June period on revenues of Rs. 10.6 billion compared to Rs. 911 million profit and Rs. 11.6 billion revenues for the same period last year. This means a drop of 9% on top line and a 21% decline in the bottom line which once again reads the declining performance due to the challenging environment that it operates in.

Consumer sinking?

Consumer sinking?

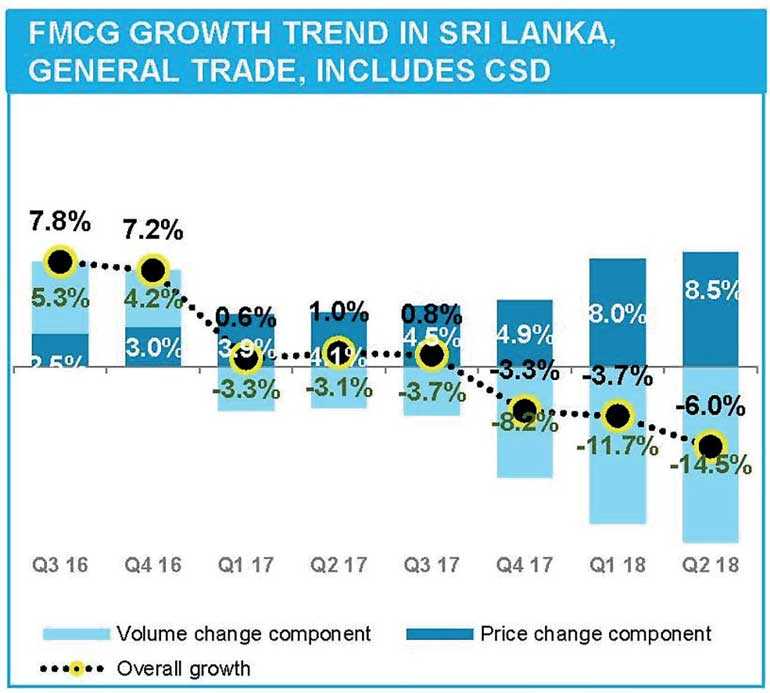

In this backdrop we see how in Sri Lanka the consumer is sinking due to escalating prices. As the Q2 2018 Nielsen research report released last week revealed the overall consumption at the consumer end has contracted by a crazy 14.5% which means it is the sixth quarter in succession that the attack of the consumer has happened.

Way back in 2017 we saw the contraction of 3.3% in Q1, 3.1% in Q2, 3.7% in Q3, and in the final quarter by 8.2% in 2017 which gives us the trajectory that consumer behaviour was happening. Many thought that the policymakers having got a jolt at the 10 February MC elections would get more focused to implementing strategy but one has only got more deeper into the mire with -11.7% in Q1 2018 and now it has hit all-time low of 14.5% which is how serious the situation is.

Consumer – Red card out?

Nielsen further extracted the consumer household dynamics where job prospects being Excellent/Good dropped from 34% to 8% in the last two years and state of personal finances being Good/Excellent dropped from 22% to 5% which means that things are seriously rough.

In fact, 52% of households say that they do not have any spare cash which can be mirrored to the private sector performance. On the attribute time to purchase in the next 12 months it is at an all-time low of 1% from the 19% recorded in 2016 which gives a view of the consumer sentiment.

Macro performance – 3.2%

As per the data shared by the Department of Census and Statistics, Sri Lanka’s economy grew at 3.2% during the first quarter of this year, with the total economic output of Sri Lanka as measured by Gross Domestic Product (GDP) for the first three months of 2018 reaching up to Rs. 2.224 trillion compared to the Rs. 2.155 recorded for Q1 2017. The global view of such a performance is that anything below a 6% growth in small economies like Sri Lanka which is $ 80 billion odd, means a typical consumer will not feel a lifestyle change.

What is worrying is that Industrial activities have expanded marginally, recording 1.0% of growth rate during this period, which means the macro and micro data are in sync.

Rupee challenged

The rupee has been depreciating sharply against the US dollar since the beginning of this year. The weakening of the currency reflects the continuing pressure by the external sector characterised by the wide trade gap and heavy external debt commitments which strictly from an economic sense is not healthy.

The rupee is falling by 3.3% against the dollar as at today in 2018. In April alone the rupee has fallen by 1.1%, reflecting a sharper depreciation which to my mind is one of the causes for the 7.8% price-led consumption growth as per the Nielsen report for Q1 of 2018, the logic being that the basic essentials for a Sri Lankan home like rice, sugar, dhal and sprats are all import-dependent.

A point to note is that when a currency depreciates, it also has an impact on the foreign debt burden. As per the release by Central Bank, depreciation does not cause any rise in the foreign debt stock in US Dollar terms but we must note that it will have a direct impact on the servicing costs on the debt stock and disposable income at the consumer end as explained before.

If we analyse the currency depreciation as at end April, it will also result in the foreign debt stock increasing by almost Rs. 14 billion. For the record let me stack the debt servicing that Sri Lanka has to meet between 2018 and 2022. To be specific in value it is around $ 17.8 billion with the 2018 at $2.8 billion, in 2019 it is a staggering $ 4.2 billion, 2020 will be $ 3.3 billion and 2022 is $ 3.7 billion which is said to be the reason why some say that the opposition does not want to come into power until 2020.

Budget implementation crash?

Given the above arguments, we will see that a Sri Lankan consumer will not only be challenged in 2018 but it will in fact increase in 2019 and then it will slowly ease out provided that the country can spruce up the economy.

Sadly, we cannot have the confidence from the current administrators of the country that the economy can be spruced up to a level that we can protect the consumer from external shocks, the logic being that research done by the Pathfinder Institute which has revealed that in 2017 only 54% of the Budget proposals have been actioned for implementation with 8% fulfilled, 22% substantial fulfilment and 24% partial fulfilment. This poor performance is the reason why Sri Lanka GDP has grown by 3-4% GDP whilst South Asian countries are recording 6-7% GDP. In my view, even if Sri Lanka implements the 1960 Economic Development Plans, we can go on to achieve a 6% plus GDP growth.

The Pathfinder Institute report went on to state that 11% of the Budget proposals of 2017 were not disclosed on the progress achieved, which is unfortunate given that it accounted for Rs. 21.6 billion in value. This adds to the lethargy of driving the economy and it will not be good news for the Sri Lankan consumer.

Tourism not kicking in?

Once again going back to empirical research, it states that in a typical island nation the contribution from the tourism sector can be as high as 25% of the GDP. Sri Lanka is at around 5-7% which tells us the opportunity Sri Lanka has to develop this sector and thereby contribute to the economy. If Sri Lanka is looking at a quick win for the economy, my pick is to aggressively drive the tourism industry given that every time when we bring down a quality tourist it will create four new job opportunities locally.

But the development of an economy cannot be done only by the policymaking body which is State-driven, but it must be pushed by the private sector so that the industry can be consumer-led. Sadly, if I track back to the period 2008-2018, my humble observation is that the aggressiveness of the private sector tourism sector development is not on par with the other sectors in Sri Lanka like apparel, tea, cinnamon, IT/BPO sectors just to name a few.

The key initiative required on the development of the tourism industry is to increase the awareness level of Sri Lanka as a tourist destination in the development key markets and thereby make Sri Lanka a top-of-the-mind destination among the potential visitors.

Successive governments have tried to address this issue but failed. If I track back in 2010 when the famous global marketing campaign ‘Miracle of Asia’ was totally developed, on the day of the launch it was cancelled.

Then in 2015, when the current Government came to power, once again the initiative of the global marketing campaign was planned out but just five days before the top seven global advertising agencies were to present the campaign it was cancelled and the Board of Directors was dissolved and Chairman removed. We are now in 2018 and are yet to see the light of day on this activity whilst our competitor destinations like Maldives, Seychelles, Thailand or Malaysia have launched more than 10-12 marketing campaigns in the last 10 years.

Conclusion

Whilst the country is grappling with strikes and industrial action, the focus now will be on the upcoming Provincial Council elections which are to be staged in January 2019. But the challenge is how a household will survive given the contraction trend seen in the market.

(The thoughts are strictly the views of the writer and do not reflect the organisations he serves in Sri Lanka and globally. Writing is a hobby he pursues.)