Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 29 January 2019 01:21 - - {{hitsCtrl.values.hits}}

Whilst Sri Lanka is grappling with a 2.9% GDP growth in Q3 2018, which happens to be the lowest growth seen in the recent history of Sri Lanka, thankfully the Sri Lanka housewife is raising the head at the household end due to the low inflationary attribute driven by lower fuel prices in last the quarter of 2018 as per the latest Nielsen.

HH consumption picks up

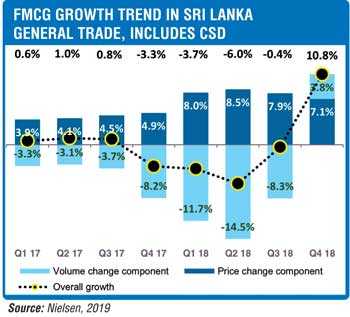

After almost six quarters of negative growth, we see that the general trading conditions have recovered to register +10.8% GDP growth in Q4 2018 to reach Rs. 63 billion which is a relief for policymakers.

However, a point to note is that it is a skewed picture at the household end as it’s the festive period and not the normal life style of a consumer. However, given that the comparison is versus last year there is merit to the argument that household consumption is increasing.

If one does a deep dive, we see that the Q4 2018 data is weighted to a price change growth of 7.1% whilst volume growth is just 3.8%. I guess we will have to breakdown the regional wise growth, so that we can see if the volume growth is fuelled by the Western Province or does it cut across the North Western and Eastern Provinces.

A point to note is that is we take off the carbonated soft drinks from the ‘General Trade’ numbers in appendix 1, we see that Q4 2018 data changes to a volume growth of 8.8% and overall growth to a healthy 12.4% which is interesting. Let’s see if the trend continues in Q1 2019.

Household and personal care

On the area of household and personal care, Q4 2018 numbers are very positive at 9.1% volume growth and 11.6% respectively. The total growth taking into account price changes as per appendix 2 is that the numbers are as high as 13% and 16.9% which is encouraging.

It’s strange that even with such strong numbers the overall business confidence index has nosedived to 50 in December as against the 54 rating in November. This means that the sectors other than FMCG are having a tough trading environment. It will be interesting to see the private sector performance in the December quarter results (Q3 in the financial results).

Consumer vibes negative

A point to note is that the 2.9% GDP growth reported by the Department of Statistics is been challenged by even the Central Bank but what people are forgetting is that Sri Lanka has to service a $ 4.2 billion in 2019 and it will have its own ramification.

The Dashboard report of Nielsen also state that job prospects in the next 12 months looks bleak at just 9% mentioning it will be positive. This is below the 12% reported in the September report. On the other hand ‘Consumers calling time to buy things they need’ has dropped from 20% to 5% which is strange given that the numbers mentioned above are positive in nature. This is further re informed by the overall Business Confidence (BCI) Index declining from 110 to 90 whilst Consumer Confidence Index (CCI) dropping from 54 to 50.

SOEs loss $1 billion

Whilst the overall growth of the economy is at 2.9% the neighbouring countries are registering a growth of 6-7% namely India, Bangladesh and Pakistan means Sri Lanka is losing its competitiveness in the region.

Strangely, the State-Owned Enterprises that were to be revived with good governance by the Yahapalana Government has registered a loss of almost $1 billion and reports in the media state that practicing good governance was a tough task to put into practice. Some say that unless there is a political will across the second and third layers in the political hierarchy it will tough to turnaround SOEs. The deteriorating economy may have had an impact to the numbers is my view.

Exports – number game

Whilst it was nice to see the $17 billion export numbers been flashed in the media the fact of the matter is that if we compare likes the number will be around a 5-7% growth vs. last year is what the economic analyst state. What we must do is to focus more on the quality of the exports and move the complexity of exports from the current 34% to say 50% within the next three years so that we can increase the overall revenue that can be earned.

What next?

Whilst the world is moving forward, aggressively driving Free Trade Agreement agendas, Sri Lanka is at a crossroads on when the local elections should be and who will be the next presidential candidates from the respective parties. Whilst the FTA with Singapore is positive, there has to be significant policy changes to be actioned if we are to make use of the opportunity for the advantage of the country from 1 April. But the reality as at now is that the country is on a wait-and-see mode.

[The author was the first Executive Director of Sri Lanka’s key economic policymaking entity, the National Council For Economic Development (NCED). The thoughts are strictly his personal views.]