Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 28 April 2022 00:10 - - {{hitsCtrl.values.hits}}

In Cherry Blossom lined Washington DC in the glare of global media last week, Sri Lanka became the poster child of the International Monetary Fund’s (IMF) Spring Meetings. The strategic Indian Ocean island’s pathetic plight featured on major media and television channels that craft the global narrative, with images of people in queues amid food, fuel, and medicine shortages due to its crashing currency, soaring cost of living and ‘Arab Spring’ style protests.

poster child of the International Monetary Fund’s (IMF) Spring Meetings. The strategic Indian Ocean island’s pathetic plight featured on major media and television channels that craft the global narrative, with images of people in queues amid food, fuel, and medicine shortages due to its crashing currency, soaring cost of living and ‘Arab Spring’ style protests.

One of the wealthier nations in the South Asia region and listed by the World Bank in 2019 as an Upper Middle Income County (MIC), Sri Lanka with a population of 22 billion people had just defaulted on her debt payments—for the first time in the country’s history. Global media imaging of the scenic island nation’s financial crisis served to affirm the relevance of the Washington Consensus and the Fund albeit as the “lender of last resort”.

The timing of the Sri Lanka rupee’s crash against the “exorbitantly privileged” US dollar was as miraculous as the Easter Sunday hybrid war attacks in the tourism-dependent island that targeted Chinese-owned Shangri-La and other luxury hotels, which were mysteriously claimed by Islamic State (ISIS) in 2019.

Meanwhile, Oxfam released the “Inequality Kills” report and called on the IMF to “abandon demands for austerity as a cost-of-living crisis drives up hunger and poverty worldwide”. Its spokesperson noted that “87% of the International Monetary Fund’s (IMF) COVID-19 loans require developing countries facing some of the world’s worst humanitarian crises to adopt tough, new austerity measures that will further exacerbate poverty and inequality.

The organisation noted that “the wealth of the world’s 10 richest men doubled since the pandemic began while the incomes of 99% of humanity are worse off because of COVID-19”. 263 million people could be pushed into extreme poverty in 2022, due to the combined impact of COVID-19, inequality and food and energy price inflation – accelerated by the war in Ukraine.”

Sri Lanka’s total debt is $ 51 billion and the country must pay $ 7 billion this year to International Sovereign Bond (ISB) traders based in New York as noted by Senior Economist and Head of the Institute for Policy Studies (IPS), Dr. Dushni Weerakoon.

For a comparative perspective, Elon Musk offered to buy Twitter for $ 43 billion, in the same week! The greatest transfer of wealth in human history transpired over the past two years while much of the world was in COVID-19 lockdowns and global trade disrupted, also resulting in speculation in commodities

|

| Finance Minister Ali Sabry |

|

| Central Bank Governor Dr. Nandalal Weerasinghe |

futures, which were partly responsible for the spike in global food and fuel prices as noted by Economist Jayati Ghosh. Is the exorbitant privilege Greenback weaponised against sanctions hit Russia being used on other strategic ‘emerging economies’ as a hybrid Cold War envelops the world? Should the US dollar and its supporting financial architecture be dumped?

Staged dollar shortage, down-grades and Arab Spring protests

Back on Colombo’s Galle Face seafront, Arab Spring Playbook-style protests by youth enjoying their freedom after two years of COVID lockdowns unfolded as part of the push to propel the Colombo regime’s pivot to Washington DC.

Usually anti-government protests happen at the iconic Independence Square, but the current protests were staged close to South Asia’s busiest sea port – the Colombo Harbour and notably near the Chinese-built Colombo Port City.

While the protestors, anonymously organised via social media, called on the Sri Lankan President Gotabaya Rajapaksa to go home, they did not say, “Gota Go Home to AMERICA”. The President after all was a US citizen until 2019. Nor was debt cancellation or a debt jubilee on the agenda of the protestors, some of whom held posters calling on the Government to go to the IMF in the hope of better financial management. The IMF had been painted as a saviour by various economists and local think tanks as the drum beat to default intensified!

But the protestors had other creative solutions to the island’s crisis of corruption and economic mismanagement: “A Buy Local Products Campaign’ to encourage citizens to support local manufacture and industry and stop consuming expensive imported luxury goods, for instance.

Some suggested a permanent halt of the practice of providing duty-free car permits to politicians, doctors, university lecturers and the privileged ‘professional’ class, as well as abolishing various special health insurance schemes.

Other protestors wanted to reverse the privatisation of the national healthcare and education system and the sale of Yugadhanavi power plant to a dubious American company called New Fortress. The latter had compromised Sri Lanka’s energy security.

Several protestors suggested marching to the US embassy and calling on the US Government to return all the assets of the dual US citizen and Minister for Economic Disaster, Basil Rajapaksa in Los Angeles to pay down the National Debt. Others called for accountability for those responsible for the Central Bank Bond Scams. Long-term suggestions to grow the economy and develop the country were setting up research and development working groups on energy security, ocean and mineral resources.

Some academics supporting the protests suggested debt cancellation and cited the Debt Jubilee project that had earlier called on the IMF and World Bank to offer an immediate cancellation of all principal, interest and charges due to the deadly economic toll of the World Health Organization’s (WHO) COVID-19 lockdowns in poor countries.

The Jubilee project had also recommended that the G20 support moves by any country to stop making payments on debt to private external lenders and that new IMF and World Bank finance should be in the form of grants not loans, and require other lenders to re-profile the debt where sustainability is uncertain, or restructure their debt where it is unsustainable, i to help ensure money is used to support public policy priorities in response to the COVID-19 crisis, rather than to repay other lenders.

Sovereign bond debt trap

Like Lebanon, once known as the Paris of the Middle East, Sri Lanka is a relatively wealthy country in South Asia and listed as a lower Middle Income Country (MIC). The strategic island is ahead of India, Pakistan, Bangladesh, Nepal and Afghanistan on the SAARC regional poverty count.

The country has always paid down its debt and had no previous history of default. Likewise, its debt to GDP ratio, another metric to determine the solvency of a county, at 110% was not off the map although this is cited as one of the reasons for rating agency downgrades, leading to difficulty borrowing to sustain debt servicing and default. But this too may be kept in perspective. The top 10 countries with the highest debt to GDP ratio according to the World population review are: ii

Venezuela — 350%

Japan — 266%

Sudan — 259%

Greece — 206%

Lebanon — 172%

Cabo Verde — 157%

Italy — 156%

Libya — 155%

Portugal — 134%

Singapore — 131%

Bahrain — 128%

United States — 128

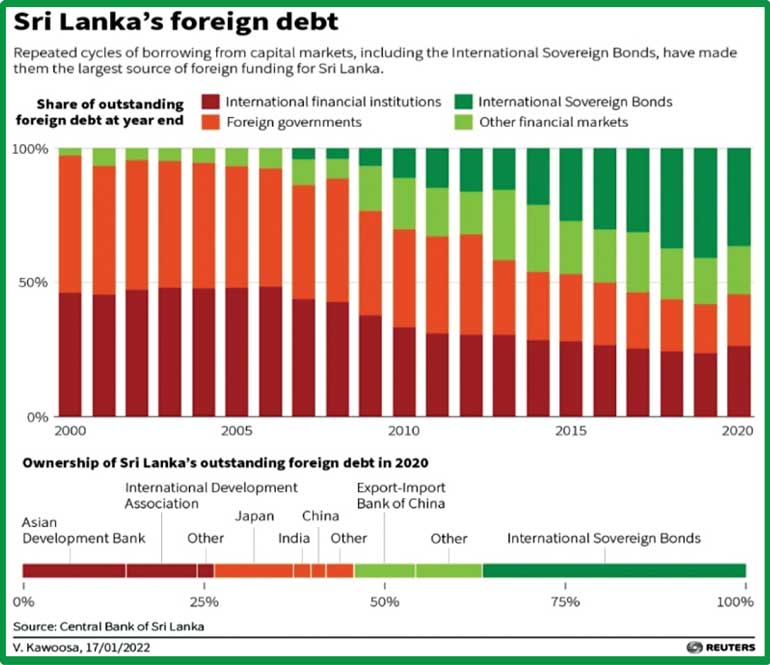

While China has often been identified as the source of Sri Lanka’s Debt trap it is Euro-American based International Sovereign Bond (ISB) traders, whose names are kept secret that are mainly responsible for the default at this time.

The given graph’s colour coding may be miss-leading since it is the green coded International Sovereign Bonds (ISB)s and Other Financial Markets that are the cause of Sri Lanka’s debt default at this time and NOT the bi-lateral lenders (although coded in red in the graph. In fact, Sri Lanka’s bi-lateral and multilateral donors which include the ADB, Japan, China and India have all indicated a desire to help and willingness to delay debt payment. They have also donated food, fuel and medicine to the cash strapped island.

While the names and proportions of the national debt owned by various bi-lateral donors and multilateral agencies, such as the ADB, World Bank, Japan, China, each with around 10% and India around 4%, were known, the names of the US and EU based ISBs that own over 55% of the island’s debt and which are part of the shadowy international financial system where black money is parked in offshore accounts, which are primarily responsible for the ‘debt trap’ and downgrades, are not disclosed.

ISBs are the root cause of Sri Lanka’s default at this time, but this is a well-kept secret, hidden by the “Chinese debt trap” propaganda and narrative, and by local economists and think tanks funded by USAID and EU grants and projects. The latter promotes the narrative that the IMF is the ‘solution’ despite the fact that the IMF has never pretended that it cares about poor people or inequality, or even protestors but rather works for the global 1%. In fact, the IMF is fundamentally part of the problem.

In the final analysis downgrades by rating agencies are based on various and Subjective considerations of “confidence” in the ability of the county to sustain debt as stated by Dr. Nishan De Mel of Verite Research. “When the IMF determines that a country’s debt is not sustainable, the country needs to take steps to restore debt sustainability prior to IMF lending” the Fund’s country director Masahiro Nozaki said recently in a statement regarding Sri Lanka. The IMF does not differentiate between illiquidity and insolvency!

Pumped and dumped into the Middle Income Country (MIC) debt trap

From a longer and wider perspective, the question arises: was Sri Lanka “pumped and dumped” by the Washington Consensus, when the World Bank upgraded it to a lower Middle Income Country (MIC) in 1997, and then an Upper MIC in 2019 thus making it ineligible for low interest development aid which compelled borrowing on Capital markets—like other countries that are placed in the ‘Middle Income Country Trap’?

Rating agencies and sovereign bond traders work in concert with the Washington Consensus and the OECD Paris Club of Western aid donors, and do not recognise the difference between illiquidity and insolvency. It is increasingly evident that the island’s debt crisis has many external dimensions and is not entirely internally driven.

Arguably, under most metrics Sri Lanka should not have been down-graded to the point of default by Rating Agencies like Moody’s and Fitch at this time. The downgrades were principally due to the $ 7 billion payments due to US-based Bond traders like Goldman Sachs, Black Rock and Vanguard.

Asset managers BlackRock Inc. and Ashmore Group Plc. were among the creditors organising in a group ahead of the IMF talks, and had hired law firm White & Case for advice. Ayres Investment Management LLP, DecisionBoundaries LLC and Perella Weinberg LP are among firms seeking to provide financial advice to Sri Lanka’s creditors, sources said, as the country heads towards a revamp of its $ 12 billion of external debt. Recent filings show major asset managers such as Fidelity, T Rowe Price and TIAA also hold some of the country’s outstanding dollar bonds.

Disregarding the difference between illiquidity and insolvency, the drum beat and narrative of and for Sri Lanka’s default was in the air for some time – at least since the rejections of the Millennium Challenge Corporation (MCC) compact: As Professor Howard Nicholas, of the Institute of Social Studies (ISS), Netherlands, recently suggested in a lecture organised by the Economic Students Association of the University of Colombo, alluding to geopolitics and the recent visit by US Secretary for South and Southeast Asia, Victoria Nuland to Colombo, the island’s Default seemed to followed a systematic, deliberate and planned route to deliver Sri Lanka into IMF’s and Washington’s clutches.

Default would effectively enable the IMF’s and foreign ‘legal advisors’ to effectively takeover this strategic island nation’s economic policy process, and Sri Lanka would lose Economic and Social Policy Autonomy and Sovereignty. Simultaneously, the IMF’s aid conditionalities would enable Washington to stave off a perceived China Threat and likely make it impossible for Sri Lanka to source its oil, gas and other Energy requirements which are at the root of the current crisis at discount rates from sanctions-hit Russia. Has Sri Lanka become, like Ukraine, a theatre of US proxy war this time in the Indian Ocean Region as the New Cold War escalates?

However, from a different perspective, this island at the centre of Indian Ocean Sea Lanes of Communication (SLOC), seems to suffer from a ‘Paradox of Plenty’ or perhaps a geostrategic ‘Resource Curse’.

An unsinkable aircraft carrier? Asset stripping a strategic island

Former US Under Secretary for South and Central Asia, Alice G. Well, a few years ago called Sri Lanka a “valuable piece of real estate’ in the Indian Ocean, and the country not long ago turned down a Millennium Challenge Corporation (MCC) Compact and a Status of Forces Agreement (SOFA).

Others have termed Sri Lanka “an unsinkable aircraft carrier” in the Indian Ocean – more strategic than the Chagos Islands whose citizens were forcibly evicted by US marines in the early sixties in order to set up the Diego Garcia military base and CIA Black site, which was recently Green washed by the occupying British Government as a Marine Protected Areas (MPA). In February 2019 the International Court of Justice in The Hague had ruled that the British and hence US occupation of Chagos Islands is illegal under international law as the Island belongs to the government and people of Mauritius.

In the context, it is noteworthy that the Sri Lanka Business Times of 17 April 2022 announced that the Government heading into IMF negotiations is hoping to raise $ 8 billion from the lease or sale of valuable public assets to bolster its rapidly dwindling foreign reserves, based on a report of a newly-appointed economic advisory committee.

Among the main items for sale or long lease were the Katunayake International Airport for $ 2 billion, Mattala Airport for $ 300 million and Ratmalana Airport for $ 400 million. The Colombo North Port Development Project was to be handed over for an investment of $ 600 million while Colombo Port City lands would be leased out at a total of $ 4 billion.

Shares of Sri Lanka Telecom will be sold at a price of $ 500 million and Sri Lanka Insurance Corporation shares for $ 300 million. The strategic island’s telecom frequencies, important for cyber-security, 5G technology and surveillance and security of Under Sea Data Cable Routes (UDC) and Indian Ocean SLOC in Sri Lanka’s marine Exclusive Economic Zone, had been previously targeted by the MCC that also targeted the island’s land, transport and energy sectors, by the MCC.

Divestment of non-strategic State-owned assets, such as lands owned by Sri Lanka Railways and SriLankan Airlines has been suggested as a part of the Government’s multi-pronged plan in the short-term to improve their operational and financial efficiency while increasing the country’s reserves position.

Divesting strategic assets because of cultivated corruption in the targeted public institutions is tantamount to throwing the baby out with the bathwater! Moreover, there is a difference between illiquidity and insolvency that has been ignored in the rush to monetise strategic transport, energy, land and cyber security assets in this island at the centre of the Indian Ocean SLOC.

Questions arise as to who made the above valuations of Sri Lanka’s strategic assets? When and on what basis? In the context of the island being deemed ‘valuable real estate in the Indian Ocean SLOC with extensive ocean and mineral resources, including highest grade Graphite and Rare Earth Elements the island may actually suffer from a geostrategic resource curse, that made it a donor darling in the past and the subject of various colonisation projects in the name of ‘Development Aid’.

However, sale of strategic land and transport assets of the island that had been previously ear-marked by MCC seems to be a pre-condition for the IMF – ‘lender of last resorts’ to bailout Lanka. It is increasingly evident that the island’s debt crisis has many external dimensions and is not entirely internally driven. The strategic island has long been in the cross-hairs of big power rivalry.

Geopolitics of Sri Lanka’s permanent crisis: A staged default and the dollar weaponised

The IMF was gracious in Washington and commended Sri Lanka’s brand new Finance Minister, Ali Sabry, who was previously Minister for Justice and Lawfare, for his dash to Washington for a “bailout” and for the steps it has taken to stabilise the economy. Sri Lanka was urged to apply for Rapid Financing Instrument (RFI) having delayed debt restructuring for two years.

Meanwhile, Indian Finance Minister Nirmala Sitharaman who was also in DC for the Spring Meetings, made representations on behalf of her dear debt-trapped southern neighbour. India is a US Quadrilateral Group (QUAD), partner in America’s confrontation with China in the “Free and Open Indo Pacific”.

Sri Lanka was advised to find financial and legal advisers in 15 to 20 days to chart the restructuring and payments of debts: Asset managers BlackRock Inc. and Ashmore Group Plc. were among the creditors organising in a group ahead of the IMF talks, and had hired law firm White & Case for advice.

Notably absent at the IMF meetings was the President’s brother, dual US citizen and ex-Minister of Economic Disaster who had staged and led Sri Lanka’s Default into Washington’s arms.

Back in 2020 during COVID-19 lockdowns the law of the land was changed to enable Basil Rajapaksa, a high-school dropout, known as Mr. 10% for seeking commissions and corrupt deals with cases stacked against him to enter parliament and later head the COVID-19 Task Force. He directed two years of militarised COVID lockdowns and excessive purchases of injections, including Pfizer “boosters” with a health sector that had been largely bought by big pharmaceutical companies. Basil Rajapaksa was supposed to lead the GoSL delegation to the IMF’s Spring Meeting, but had become a liability as questions were asked about the external factors behind Sri Lanka’s staged default.

Questions had been raised about foreign interests and hands behind Sri Lanka’s crisis following Pakistan Prime Minister Imran Khan’s allegation of regime change operations in his country: Was the long-planned and anticipated plunge of the Sri Lankan rupee against the ‘exorbitantly privileged’ US dollar that came to pass just in time for the IMF’s Spring meetings partly to pre-empt a rescue from

China which has invested heavily in Sri Lanka?

In the final analysis, questions arise if Sri Lanka, ruled by a hybrid Rajapaksa family composed of dual American citizens, is being targeted for hybrid economic warfare? With the USD increasingly weaponised also against sanctions-hit Russia and other emerging economies? This is not just a theoretical question. Is the debt crisis staged by local and global networks of financial corruption at play in this strategic island in order to deliver Sri Lanka on a platter to Washington and its Consensus? After all, we live in a post-COVID 19 world where conspiracy theories increasingly seem to come true.

Finally, debt cancellation, ‘not’ IMF bail-ins and asset stripping are the need of the hour in Sri Lanka and other parts of the Global South that were subject to COVID 19 bio-warfare, including global media narratives promoting fear and economically debilitating lockdowns in the past two years.

Footnotes:

ihttps://jubileedebt.org.uk/a-debt-jubilee-to-tackle-the-covid-19-health-and-economic-crisis-2#_edn1

iihttps://worldpopulationreview.com/country-rankings/debt-to-gdp-ratio-by-country

(The writer is a social and medical anthropologist with expertise in international development and political economic analysis. She was a member of the International Steering Group of the North-South Institute project: ‘Southern Perspectives on Reform of the International Aid Architecture