Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 3 August 2023 00:52 - - {{hitsCtrl.values.hits}}

Low imported input content in agricultural exports insulates the sector from global supply chain disruptions

Introduction

Introduction

Despite sitting on the periphery of the global supply chain nexus, Sri Lanka was not spared by the disruptions caused by COVID-19 restrictions and the Russian war in Ukraine. Ongoing rivalry between the US and China are going to change the phase of globalisation with the formation of new alignments. Despite being an advocate of fair practices in production and trading, industrial policies of the US are changing in favour of domestic producers and domestic production. Resilience instead of efficiency has come to prominence. Within this context Sri Lanka has to consider ways of developing resilient exports. We carried out a study to assess the import content of various export categories of Sri Lanka and open room for policy discussions on developing the export sector that can withstand severe disruptions to the global supply chain.

Methodology

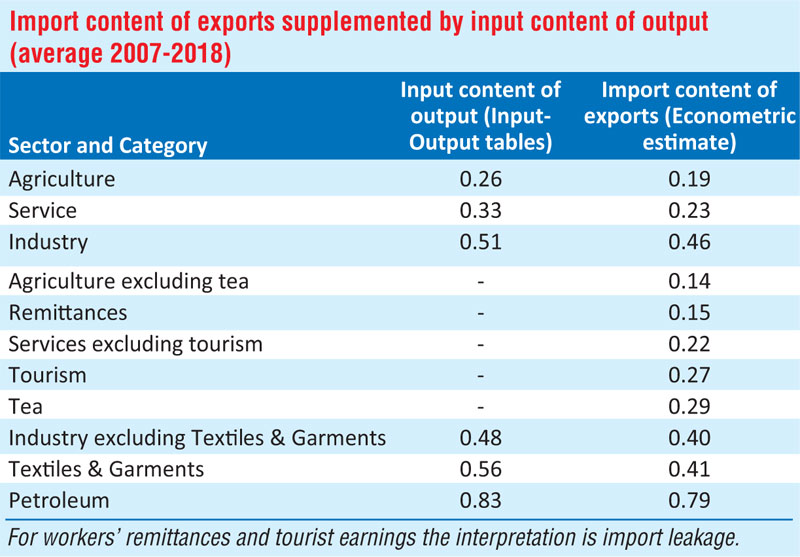

We estimated the imported input content of exports (commonly known as backward linkages) by formulating export supply functions under the assumption that Sri Lanka is a price taker in the world market. Import leakage from tourist earnings and workers’ remittances is estimated through import demand equations. The years 2019-21 were not used in the estimation because of the sharp breaks in the data series due to the Easter bombing in 2019 and subsequent COVID-19 restrictions. As a cross check we also estimated the input content of output from input-output (IO) data over the period 2007-2018. Although the data and methodologies are very different, the basic patterns that emerged on input content of output (from IO tables) and import content of exports (from econometric estimates) are unexpectedly very similar.

Results

The given table provides the average estimates (average over 2007-2018) of input content of output from IO tables and import content of exports from econometric estimates. Note that one minus the input content is the value-added content of output. The import content can be interpreted as cents per dollar of export earnings or simply expressed as percentages. The most salient observations from the exercise and some policy implications are presented in the table in itemised form.

1. Although the industrial sector has been the main export earner for the country, after netting out the import content the service sector has come to prominence after 2014. However, the service sector showed the least resilience. Devastating effects of Easter bombing and COVID-19 have fallen disproportionately on the service sector (both tourist and non-tourist services).

(a) Despite the rapid expansion of the service exports after 2009, there has been no proportionate increase in the import content. This is obviously a healthy development.

(b)A comparison with Thailand, a very popular tourist destination, indicates that Sri Lanka enjoys a natural advantage in tourism and this needs to be enhanced further by creating an atmosphere where tourists are tempted to spend more. Despite the lack of resilience, tourism can be used to create a buffer of foreign exchange earnings during good times.

(c)Workers’ remittances show some resilience though there has been a slowing down (in USD terms) as a result of falling numbers of migrants after 2014. Instead of supplying poor mothers as housemaids to the world that entails substantial (less assessed) social costs, policies are needed to lure back skilled Sri Lankan emigrants with their savings for a steady supply of talent and foreign exchange.

2. The industrial sector shows the highest imported input content, about 46 cents per dollar worth of exports; this drops to about 40 cents after excluding petroleum exports. The industrial sector has shown higher resilience than the service sector during the troubled times. Global value chain dependence of the industrial sector is unavoidable. Studies show that the vulnerability of the industrial sector is higher when the suppliers are highly concentrated in a few geographical locations. The recommendation in these studies is to diversify the supply sources. The practicality of this recommendation for small firms needs to be assessed. The better alternative is the diversification of the industrial sector that may automatically reduce the supplier concentration.

3. The agricultural sector shows the highest value added content and the lowest imported input content though specific crops are more import dependent. The sector has shown the highest resilience to the shocks.

(a) Tea exports show a higher and increasing dependence on imported inputs, on average every dollar worth of tea exports contains about 29 cents of imports. These inputs include fertiliser and agrochemicals. (Rice production also depends heavily on these inputs but we did not assess rice because it is not an export crop.)

(b) The share of tea in agricultural exports has diminished over the years because of the pickup of other agricultural exports which are very low in imported inputs (0.14 cents per dollar worth of other agricultural exports).

(c) As a source of foreign exchange, the agricultural sector is yet to realise its potential. Low imported input content in agricultural exports insulates the sector from global supply chain disruptions. Developing the agriculture sector for both food security and exports is a challenge that Sri Lanka has to handle head on.

(d) Even Singapore is moving in the direction of high-tech farming to ensure some domestic supply of food products. However, these methods are highly energy intensive and having to rely on imported fossil fuel takes us back to square one. Resilience also requires harnessing other energy sources such as solar power.

(The writer is a Senior Research Advisor of the Gamani Corea Foundation and Marga Institute. He was a professor of Economics (currently visiting) at the National University of Singapore. Full study is available at https://gamanicoreafoundation.lk/publications/. The study was carried out with Nethmini Gunarathna.)