Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 7 October 2021 01:47 - - {{hitsCtrl.values.hits}}

Introduction

Introduction

Share repurchases are, in effect, an investment in the company’s own stock. They are a means to distribute cash to shareholders. Any repurchased public shares are subsequently cancelled or held in treasury, so they are no longer held publicly. However, in Sri Lanka, treasury operations on shares repurchased are not allowed, and therefore the shares are treated as cancelled after a buyback and are no longer outstanding.

This article focuses on the reasons for companies to engage in share buybacks, one of the primary reasons being, too much cash on the books and low investment opportunities. It goes on to set out other motives for buybacks such as to improve valuations and send strong signals about managements’ confidence in growth prospects of companies.

The buy-back wave

The ‘buyback wave’ has trended higher in recent times and share repurchases or share buybacks have overtaken aggregate dividends as one of the main forms of corporate payout in the United States. Historically, dividends have been the dominant form of corporate payout. However, there has been a structural change in corporate payout policy, in that share repurchases have seen to fill the gap between excess capital and dividends so that businesses return more to shareholders without locking into a pattern.

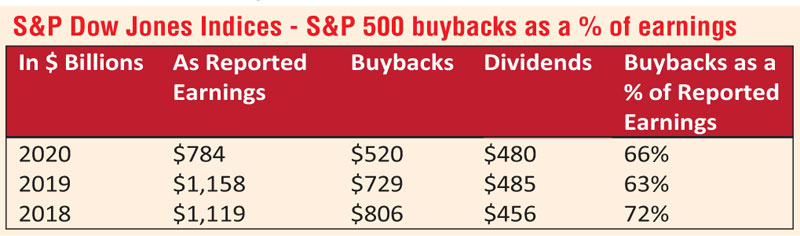

S&P Dow Jones Indices (S&P 500)1 announced in 2020 that buybacks remained top heavy, with the buybacks in 2020 accounting for 66% which was down from 72% in 2018 but still up from the historical pre-COVID-19 average of 44.5%. The IT sector continues to lead and dominate in buybacks. Indian IT companies such as Infosys; Tata Consultancy Services (TCS) conducted its most recent buyback up to INR 160 billion share buyback plan in November 2020; Wipro which bought back shares four times in the past six years and HCL Tech, decided their excess cash was better returned to its shareholders.

Similarly, a company like Reliance Industries also flushed with funds, have investments in IT companies with matured business models and surplus cash in the books, which was the key reason for its buyback of shares. Additionally, major global companies such as Diageo PLC, Unilever PLC and BP PLC have incorporated share repurchases as a part of their distribution strategy.

Why buy-back?

The initial motivations for corporations to turn to share buybacks rather than dividends as a way to return cash to shareholders, were tax advantages and protection or deterrent against the risk of hostile takeovers and unwanted bids prevalent mostly in the US, where share buybacks were used to reduce the number of shares that could be purchased by a potential buyer or by arbitrageurs who would sell to the highest bidder.

The Inland Revenue Act No. 24 of 2017 in Sri Lanka brought all forms of dividend including share repurchases and issuance of bonus shares into the tax net. A share buyback constitutes a dividend distribution by a company, and therefore the tax treatment applicable to dividends will be applicable to a payment derived by a member from a company i.e., 14% tax. Therefore, it would be prudent for companies in Sri Lanka engaging in buybacks to repurchase shares at a higher value than the market share price.

More recently share buy backs have been associated with the reduction of free cash flows to avoid wasteful expenditures by managers on projects with a negative net present value or inadvisable mergers and acquisitions.

A company might also buy back shares because it believes the market has discounted its shares too steeply, signalling undervaluation and may want to invest or to improve its financial ratios. Those companies that bought back stock even during the COVID-19 pandemic, indicated the strength of the company and their confidence in maintaining operating cash flow. Another positive signal is management’s confidence that the company does not need the cash to cover future commitments such as interest payments and capital expenditures.

Where buybacks are financed by cash or equivalents on the balance sheet, rather than by issuing debt, it will appear less risky to investors. Highly leveraged business funds are less likely to repurchase shares at an overvalued price, since they face a higher risk of financial distress.

Buybacks benefit shareholders by increasing the percentage of ownership held by each investor by reducing the number of a company’s outstanding shares, which tends to boost share prices and inflate earnings per share (EPS).

A higher EPS could also help a company beat market expectations for their performance and help drive a higher stock price. As such shareholders who sell their shares in the open market will see a tangible benefit overtime on share price performance, while those who opt out will also benefit as the share buyback profits. For investors planning on building wealth over time, share buybacks could be a better option than dividend payouts, because EPS tends to rise when the floating share count falls.

Therefore, enhanced shareholder value is seen for both selling shareholders and those continuing to stay, where the former obtains cash and the latter witnesses an increase in EPS of a company.

Flexibility of share repurchases compared to dividends

Compared with cash dividends, share repurchases make it more flexible and efficient to payout cash to shareholders by not establishing the expectation that a particular level of cash distribution will be maintained. Investors’ value smooth dependable income and as such the consistent increase of the payout of dividends is considered satisfactory by the market. While, investors will usually have less of an adverse reaction to postponing or even abandoning share repurchase programmes, the reduction of dividends by a company usually leads to a significant negative stock market reaction.

The use of share repurchase policies generates greater flexibility since cash is returned to shareholders at a time when funds are available in excess of financial investment needs. This proves to be particularly valuable to companies facing uncertainties regarding future income levels and unrealistic expectations of future dividends. Overtime some companies have also been able to increase dividends per share following buybacks because there are fewer shares on which the company must pay a dividend.

Additionally, investors decide whether they want to take part in the share repurchase programme or not, which gives them the option to change their shareholding pattern, making this an increasing beneficial and flexible distribution policy for shareholders.

Narrowing the NAV Gap

For a listed investment fund, where the market price per share exceeds the net asset value (NAV) per share, the shares are said to stand at a ‘premium.’ On the other hand, when there is limited investor demand for the shares of the investment trust causing the share price to fall below the NAV per share, the shares are said to stand at a ‘discount.’ By conducting a share buyback, these investment funds currently trading below NAV may be able to cure persistent discounts. These funds are able to acquire its own shares at favourable discounts, thereby sometimes increasing the NAV per share and the equity of shareholders of the fund.

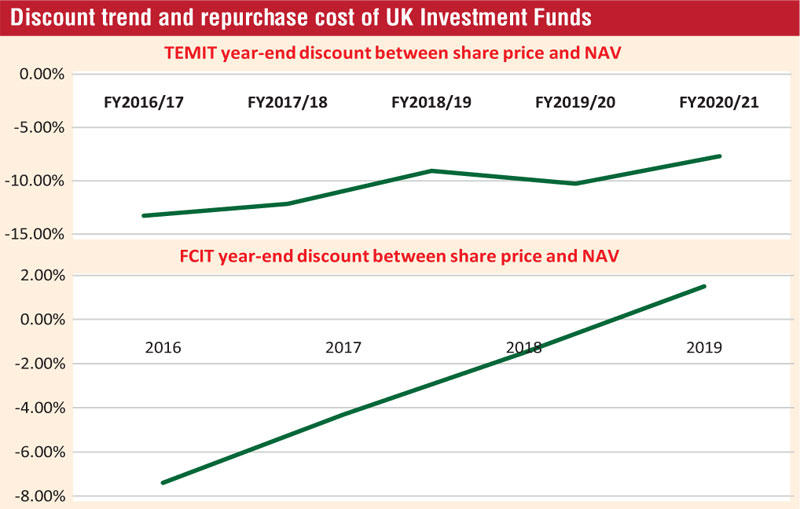

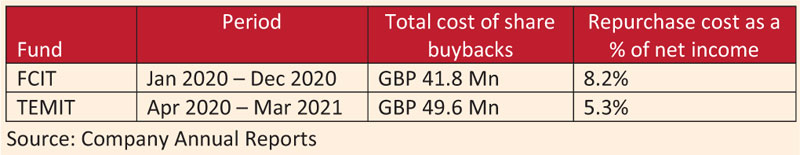

Closed end funds that repurchase shares may experience an expected wealth gain for shareholders that may results from elimination of the discount on the assets associated with the repurchased shares. Share repurchases appear to be used as a tool to keep the share price close to NAV in the UK and examples include F&C Investment Trust PLC (FCIT) and Templeton Emerging Markets Investment Trust PLC (TEMIT), where the past year’s repurchase cost as a percentage of net income was 8.2% and 5.3% respectively.

Share buybacks would prove to be advantageous for companies in Sri Lanka when the shares are trading at a discount or at prices below NAV because even where the NAV per share may not change, the percentage discount is seen to decrease temporarily. After the shares are repurchased, the NAV per share may eventually increase and this is seen to be derived by capturing the discount on the assets associated with the shares repurchased.

Conclusion

Buyback portfolios have tended to have more balanced win ratios or excess returns in developed markets, which could be a good complement to defensive approaches such as dividend and low volatility strategies. However, due to the operating nature of these developed markets, their size, the differences in the rules and regulations that govern such markets and the maturity of the stock exchanges, their findings may not be applicable to the developing markets such Sri Lanka. Share buy-backs have not been used widely in Sri Lanka and could be used as a powerful tool to correct share price anomalies and return excess capital.

One of the most important decisions that corporations have to make is how to distribute generated profit, and it is prudent for such corporations to have payout policies or distribution policies in the form of dividends or share repurchases. Corporations are seen to use share repurchases as a mechanism to sustain the share value in the marketplace and to boost the performance of the depressing exchange trading during periods of instability in the markets.

Investors will also be encouraged by share repurchase policies which conveys a very strong signal of a healthy company as well as relief that these companies do not intend to engage in unwise diversification policies, risky and expensive acquisitions, complicated cross-participations and unsound and ill-managed expansion strategies with their excess cash.

Footnote

1Source: S&P Dow Jones Indices http://www.spdji.com

(The writer is a Barrister-at-law.)