Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 11 November 2022 00:35 - - {{hitsCtrl.values.hits}}

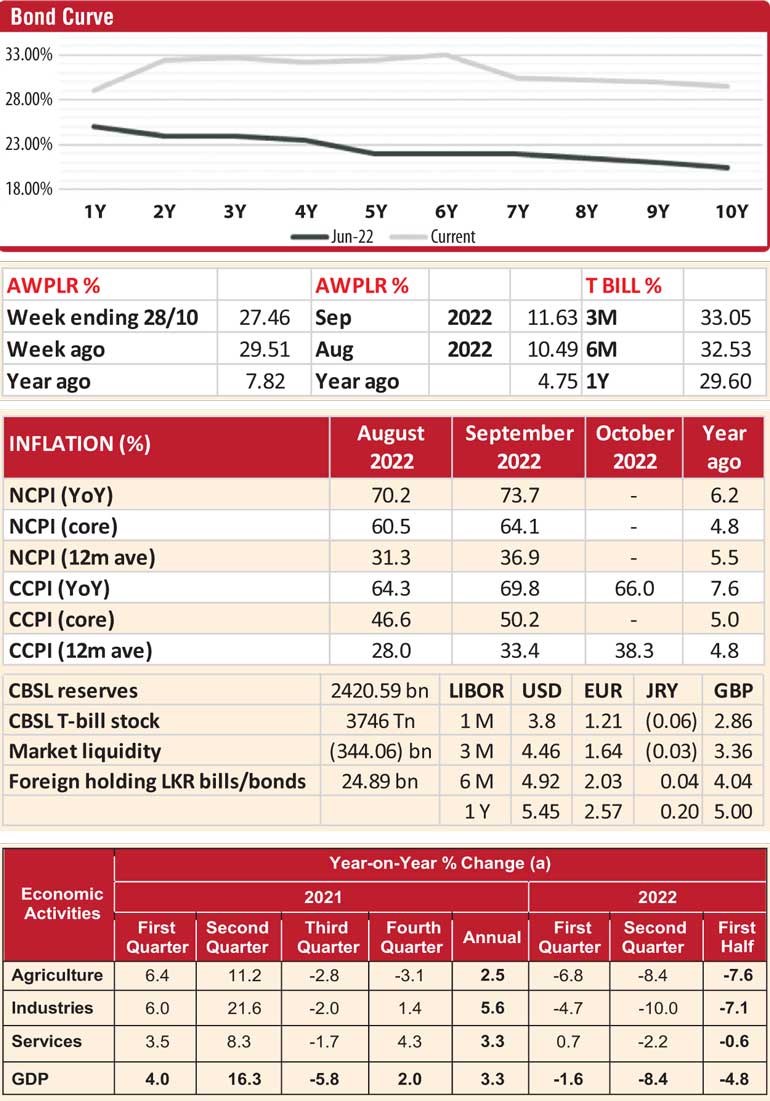

The Central Bank has kept raising interest rates to check inflation by suppressing consumption demand, though its final impact on the CCPI is not as pronounced as expected since the larger driver of inflation was supply side factors and currency depreciation. The unintended consequence of high bank lending rates is the suppression of cost factor demand which has retarded growth in the economy already in a technical recession.

The Central Bank has kept raising interest rates to check inflation by suppressing consumption demand, though its final impact on the CCPI is not as pronounced as expected since the larger driver of inflation was supply side factors and currency depreciation. The unintended consequence of high bank lending rates is the suppression of cost factor demand which has retarded growth in the economy already in a technical recession.

Like most of its global peers, CBSL has followed a standard template followed by other global central banks in advanced economies and raised the policy rate several times, but it failed to tame inflation effectively and has largely depressed credit demand due to high lending rates. The interest rate targeting policy needs to be used with other tools at the disposal of CBSL. Unfortunately our financial sector is not so advanced and as a result we don’t have a mature bond market to manage the liquidity challenges. At present, the call money rate is reasonably stable. CBSL is fully focused on managing the monetary ceiling.

The policy rate is a monetary tool, which is used to check credit demand. Despite the policy rates being below 20%, Treasury Bills are above 30% and fixed deposits are being created at almost 30% by banks. Due to the high rates on Government Securities, most FDs have on average moved up to around 28%. Also issuing bonds with tenures over five years at nearly 30% is not helping to set a clear direction to the market. To a layman this is saying interest rates will remain high over the next 5-7 years. Excluding the massive capital gains to be made on the way down for the traders. Most banks as a result are quoting lending rates as high as 30% for prime customers even for one-month loans.

CBSL needs to get the GSec rates gradually down to bring government debt servicing costs down and to reduce the operating costs for businesses. However, market liquidity has been negative for some time. The rates could jump up further if government expenditure is not cut intelligently.

Policy options

Monetary Policy Review: No. 07 – October 2022 highlighted the negative 8.4% second quarter growth in the industrial sector. Sri Lanka needs to start focusing on growth in its industrial sector. More of this negative growth would mean more businesses will get closed down and loss of productive jobs.

The agricultural sector negative is largely driven by fertiliser, pesticides and other input factors and have been addressed as of now though cartels controlling distribution and wholesale markets would need to be administratively neutered as a matter of urgency.

Lending caps

Targeted lending rate caps on lending to the industrial base would bring immediate relief in driving industrial growth towards a positive by 1Q23. Industrial growth will additionally address business working capital tightness and enable higher utilisation of existing capital investment and labour inputs in the industrial sector. This can be supported by ceiling rate caps on FDs by Banks and NBFIs at the 2 to 3 year current bank FD rates. Both lending and FD caps can be short-term measures.

“Ceilings on lending rates remain a widely-used instrument in many emerging markets as well as developed economies. The economic and political rationale for putting ceilings on lending rates is to protect consumers from usury and to make credit cheaper and more accessible.” (Aurora Ferrari & Oliver Masetti 2018). Net positive savings has eluded savers in Sri Lanka for many years, though savings itself has been growing at a steady rate Y-o-Y. A few more quarters may not be a significant deterrent to savers, given the measure taken to address inflation that is expected to achieve its objectives of a CCPI rate of under 20% by 4Q23.

October 2022 CCPI Y-o-Y headline inflation is 66% – a decline from the previous month of 69.8% and October 2022 CCPI Y-o-Y Core inflation is 49.7% – a decline from the previous month of 50.2%. Since May 2022 Policy Rates with the CBSL Standing Deposit Facility for Banks for the Overnight window have been at 14.5% for deposits and the Standard Lending Facility at 15.5% for borrowings.

Way forward

Banks are paying savers (FDs) around 25% while the CBSL Ceiling Rate for NBFI FDs is around 30%. Negative savings rate is the result. However, an objective analysis should extract the energy inflation (fuel, electricity and gas) from the CCPI as energy demand and its weightage in the basket has effectively reduced since the exchange rate depreciation in April 2022. The Statutory Reserve Ratio for banks is 4% and 18.5% is the CBSL rate at which the Central Bank grants advances to commercial banks for their temporary liquidity purposes, stipulated under section 87 of the Monetary Law Act.

There are reported recent instances of such advances being extended at 30% for 1 month tenure to some banks for their temporary liquidity purposes. Recent 3 yr. to 5 yr. TBonds have been issued at WAYs of 32% – a steep rise since May 2022. A respite in this upward trajectory is not evident and is setting up a high debt service cost which will absorb most of the tax revenues (currently 103%) in the fiscal reforms proposed. Budget 2023 therefore needs to drive serious reforms on the public expenditure side and the way the economy is managed and also led by key public institutions.