Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 27 December 2017 00:00 - - {{hitsCtrl.values.hits}}

By Sanjana Fernando

The airline business is highly susceptible to turbulent oil prices, which management has little or no control over. Under the previous management, the fuel prices were at record high levels but under this management the fuel prices were at their lowest levels. The last two years offered the best opportunity for the airline to show a paper profit and reinstate the popular misconception that the economy automatically prospers under a UNP government. Unfortunately, this handpicked controversial UNP Management Team and the board seems to have had no clue as to how to achieve it.

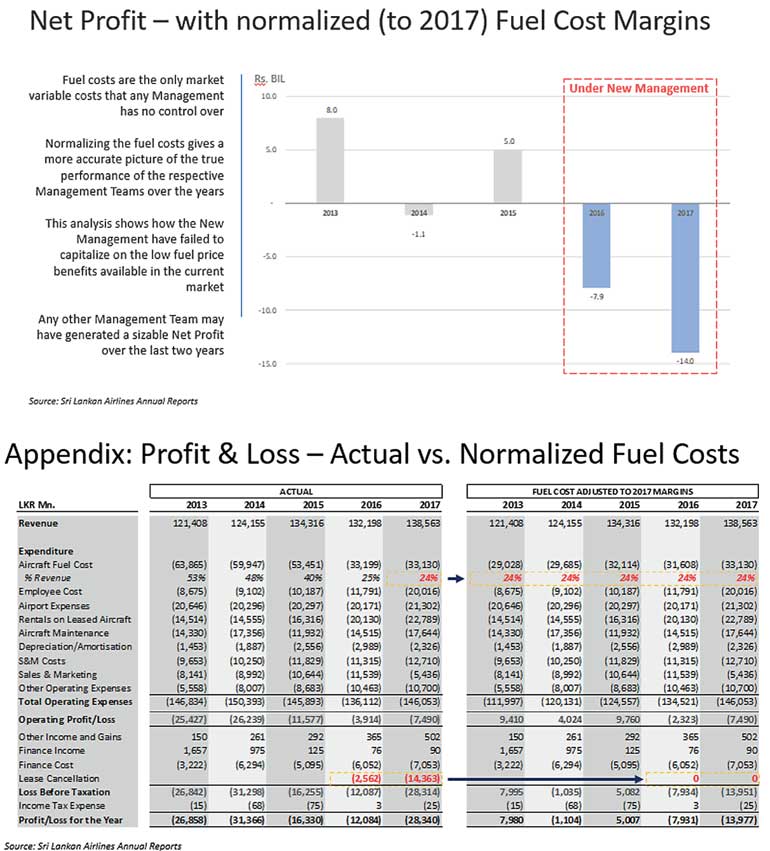

The true efficiency of the Management teams over the years can be easily measured by looking at the discipline of the operating cost margins, but excluding the non-management related fuel costs. So for the last 5 years are as follows:

New management:

Previous management:

It can be seen that under the new management, led by a Pilot CEO, the operating efficiency has dropped by around 10% (that’s around Rs. 13 billion [$ 85 million] per year of wastage due to poor management).

In 2017, the fuel costs were only around 25% of revenue, almost half of that under the previous management. In fact, hypothetically, if the previous management had the benefit of the same low fuel cost margins, they would have surely succeeded in showing a net profit as shown below (even after debt servicing):

New management:

Previous management:

While this simple analysis did not adjust for the benefit of fuel surcharges by the previous management or the revenue impact due to airport closure by the current management, it still gives a good indicative picture of the catastrophic and embarrassing failure of the current management; a missed opportunity indeed.

In the backdrop, the Shylocks of the IMF are blackmailing the Chairman of the UNP to strangle the flag carrier out of credit and out of oxygen, in return for additional government funding (shark loans). The threats by President Sirisena to sack the UNP management team and the board a few month back were outmaneuvered by the PM, who appointed two committees, one with mostly corrupt Cabinet Ministers (Ministerial Committee) and the other with State Employees loyal to the PM (Official Committee). At the unofficial request of Charitha Ratwatte, the CEO, his brother in question was also later added into the Official Committee. These great minds later decided to appoint a UK aviation consultant with archaic views at a cost of over a million dollars, only to receive a preliminary report last week with basic and obvious recommendations.

Just like in the Bond Scandal, the only way to find a genuine solution to a problem of such national interest is for the President to immediately appoint a Special Committee led by the likes of Prof. Lalith Samarakoon under the National Economic Council. The NEC should also be tasked with putting together a new management team and appointing a fresh bunch of board members.

After global deregulation, it has been almost impossible for flag carriers around the world to make a profit. If they do, it has been razor thin margins. It is even more difficult for SriLankan Airlines with only 25 leased planes.

To be successful in the aviation business, any new management has to look pass the traditional business models and look at P&L optimisation strategies using financial engineering, digital technology and big data. That is the future of aviation.

(The writer is a former investment banker from London, with airline sector experience.)

Read the response to this article by SirLankan Airlines Management: Management of SriLankan Airlines responds to “Lost Two Years” opinion article

Click to read Sanjana Fernando's response: SriLankan Airlines’ Six Million Dollar Man