Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 20 April 2022 00:00 - - {{hitsCtrl.values.hits}}

The brief of economic history

Sri Lanka had a very strong economic background in Asia compared to peer economies and the world. The economy was mainly focussed on manufacturing and agriculture in the 1950s-1980s and had a very strong position in the world. After opening up the economy in the 1980s as open economic policies, the successful management of fiscal and monetary policies towards betterment of the people is in doubt. Because the open economic policies created more domestic issues which mainly led to the 30 years’ civil war and three years’ insurgency in 1987-1990 with loss of 20,000 lives to the country.

The economy was mainly focussed on manufacturing and agriculture in the 1950s-1980s and had a very strong position in the world. After opening up the economy in the 1980s as open economic policies, the successful management of fiscal and monetary policies towards betterment of the people is in doubt. Because the open economic policies created more domestic issues which mainly led to the 30 years’ civil war and three years’ insurgency in 1987-1990 with loss of 20,000 lives to the country.

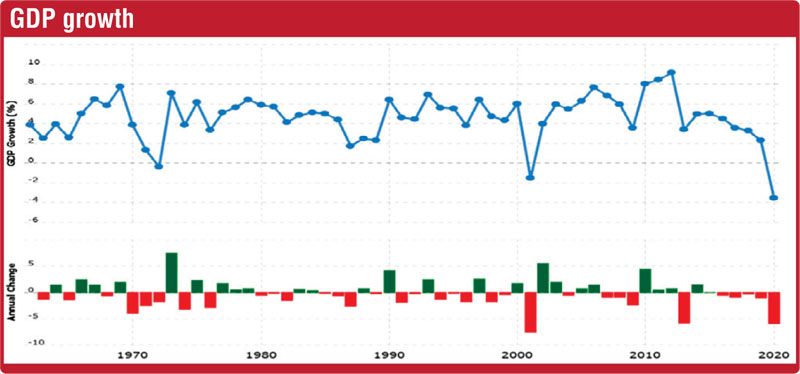

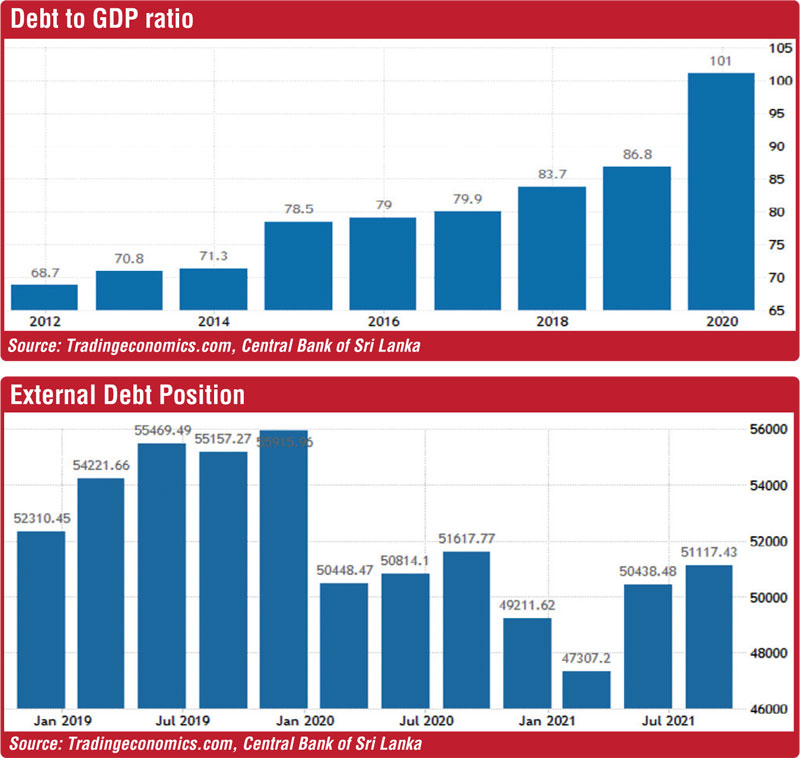

After defeating the LTTE terrorist organisation in 2009, the country was enjoying economic prosperity with an average of 7% GDP growth and close to 71% debt to GDP ratio in 2014. This economic development brought Sri Lanka from low income country status to lower middle income country status. But the steady growth phase of the economy has declined during the period of 2015-2019 after the government change. The GDP growth has declined an average of 3.2% in 2019 and debt to GDP ratio went up to 86%-90%.

After the government change in 2020, the economy was reviewed with positive sentiments. Unfortunately, the COVID-19 pandemic has made a disaster to Sri Lanka and to the world from 2020-2021 till the completion of vaccinating 80% of the population in Sri Lanka and the world.

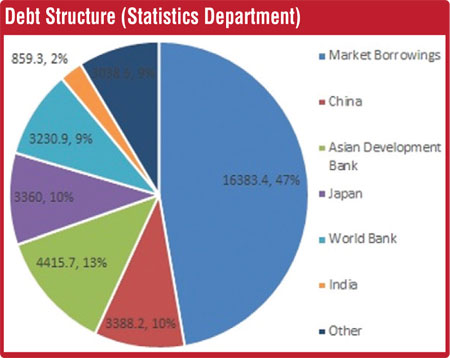

After analysing the debt profile of Sri Lanka, it is evident that China is not the largest lender to Sri Lanka. The country has borrowed a significant amount from market sources. China and Japan are the largest funding nations to Sri Lanka apart from the Asian Development Bank and the World Bank.

The total outstanding external debt of the Government was $ 35.1 billion from approximately $ 81.5 billion of total debt in 2021.

The problem of Sri Lanka

The problem of Sri Lanka

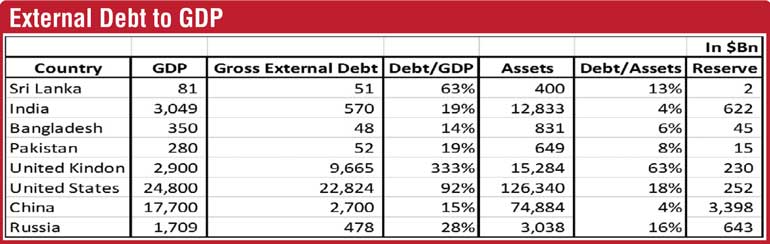

Sri Lanka had $ 81.0 billion of GDP in 2021 and $ 51.0 billion of external debt in the same year. The external debt is 62%. The balance is the domestic debt which can be managed internally without a cash outflow from the country.

The issue is coming with the external debt portfolio due to the foreign currency payments. That means, after payment is done, every transaction is affecting the Reserve position in the country.

Sri Lanka has managed the country cash flow is with exports, tourism proceeds and worker remittances during the last decade. But the COVID-19 impact and the Easter Sunday attack in 2019 has badly affected to the cashflow position of the country. Tourism is the worst affected revenue source seconded to the worker remittances.

The total export revenue was $ 12.5 billion and imports expenditure was $ 20.6 billion. The trade deficit was $ 8.1 billion in 2021. The deficit has to be financed by worker remittances and Government borrowings. The total worker remittances were $ 5.5 billion in 2021 compared to $ 7.1 billion in 2020. The net deficit is $ 2.6 billion and Government has to finance the deficit with internal or external sources of borrowings.

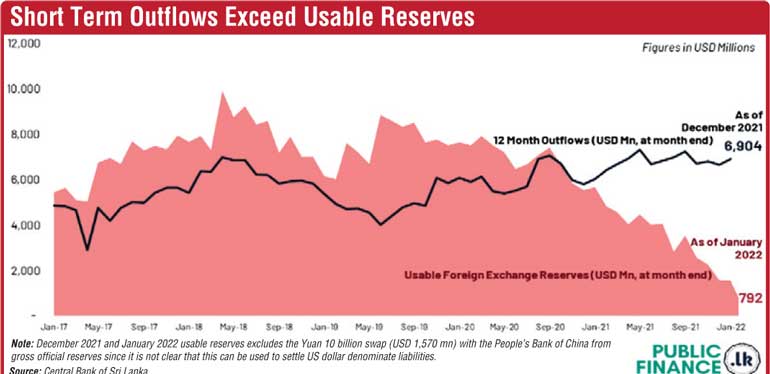

Also, the Government having the commitments for Loan Capital and Interest Settlement during the period. The average of $ 6.5 billion loan commitment with the Government in 2022 and $ 500.0 million was already settled.

The approximate total commitment in 2022 will be $ 6.5 billion but Government can manage International Sovereign Bond of $ 1.0 billion with a replacement of the maturity date. The real effect is approximately $ 3.0 billion due to the decline of tourism average revenue of $ 5.0 billion. But if the country is able to restore the tourism revenue, the real effect to the cash flow will be moderate because of majority of the settlements for internal debt obligations.

The argument for the default is that Sri Lanka is having the international reserve position of $ 3.0 billion only for settling the obligation with high oil price of $ 120.0 per barrel. The total obligation of oil bill can be forecasted as $ 3.5 b-4.0 b during 2022. The major impact is coming with debt payment, budget deficit which is widened with huge oil bill and negative impact of tourism revenue. If the tourism income will be restored after April 2022, we can see a rainbow in the economy with higher FDI flow to the country.

The external debt and the asset base of Sri Lanka

Some of the economists are arguing that Sri Lanka is going to be bankrupt due to the default in 2022. But the problem with them was, they have not really analysed the total potential of Sri Lanka and the country asset base. Also, most of them have learned only Western education theories and international reports but not own concept and analysis. The main reason is that some of them are funded by NGOs and INGs for an agenda. The out of box practical economists are very limited in this juncture. We should understand that the situation is manageable with many options but need to have financial discipline with policy framework with Government commitment for restricting of the debt portfolio. The Government should have an honest commitment and responsibility to prevent the disaster.

One way of assessing whether Sri Lanka is bankrupt is to see whether the country can pay its debt obligations. As we are aware, the country has trouble repaying its USD and other foreign-denominated debt in the maturity date. This test of paying debt “as it arises” is an important due diligence test for insolvency and potential bankruptcy. But if the country is having a vast majority of resources with potential large projects with FDI attraction will neutralise the risk of bankruptcy.

If Sri Lanka pays its LKR debt as it arises the bankruptcy risk will not arise. Because none of the countries can ever actually be bankrupt in its own currency as governments have the sovereign right to print as much money as they wish and also have the sovereign right to tax its population to settle the debt obligations. Therefore, it is impossible for Sri Lanka, or for that matter any other sovereign country, to be bankrupt in its own currency. So now, Sri Lanka is close to insolvency in forex terms, but certainly not when it comes to LKR terms.

Also, there is another important method to explain the ability of a country to repay its debt obligation. That is the “balance sheet” of Sri Lanka. The acceptable method of a banks and financial institutions to look at the balance sheet of a company as well as its profit and loss statement when doing a due diligence of a company. But the global economists never discuss and apply that method and no economist discusses about the balance sheet approach of a country. Economists are only concerned with GDP and all the measurements are in proportion to GDP. That would be like judging a company by its revenue alone ignoring the balance sheet and ignoring market value of that company.

Therefore, the measurement of Sri Lanka’s economy with asset base is indicating a promising picture of the economy. Credit Suisse and McKinsey Global Institute publish a global wealth report for countries each year. As per the Credit Suisse, Sri Lanka’s net wealth as a country is $ 351 billion ranking as 58 in the world countries in wealth.

Further, the net wealth is calculated after deduction of $ 51.0 billion external debt. Therefore, the total net wealth of the country is $ 402.0 billion. The issue is that the country with $ 402.0 billion of assets are going to be bankrupt just because of $ 51.0 billion total external debt position with various maturity profiles. The total debt liability is $ 6.5 billion in 2022 is argument and the largest payment of the debt in the history. There are no economists talking about the real fact. Sri Lanka is in fact quite a wealthy country with $ 402.0 billion and is #58 in the world league of countries by wealth.

The debt to assets ratio is 13% in Sri Lanka compared with the UK at 63%. Therefore, we can say that UK is riskier than Sri Lanka. But the real fact is the UK is having long trust with investors with fairly acceptable legal system which is acceptable to the world. Also, they are having very strong currency in the world. If a lender is having a default issue with the borrower, they can size the asset and recover within a short period. If the Government is facing a default issue, they can print and settle debt due to the acceptability of the currency in international trade.

When we analyse the situation in Sri Lanka, the lenders have to wait a long time, may be 10-15 years to recover the asset. The trust of the system is lower compared to UK and our currency is not a strong currency in the world which is exchangeable and acceptable for international trading. And we do not have a property right for foreigners due to our Sri Lankan mentality.

Therefore, lending for UK borrowers by external parties is a secured debt compare to Sri Lanka. The issue is this. So, the internal agencies like IMF, IFC, and World Bank are able to influence with various tools to control the policy decisions quoting the risk of lending to Sri Lanka. Especially with low credit rating.

Back then to the issue of Sri Lanka is with debts which is 106% from the GDP. As foreign lenders are not sure that we will not default on our debt. Therefore, the opinion of all those people’s suggestion to the government to default are making matters worse.

So, the country is unable to secure the borrowing against our assets in the way that a country like the UK and US is doing will be an issue. The issue is our own mistake because every decision is having a political motivation, insecurity, ad-hock policy decisions and changing government policies and budget decisions are the main issues pertaining to Sri Lanka. Also, significant weight is going with the credibility of ministers and officers handling the finance in the country.

The Government of Sri Lanka is responsible for its own mess and the top to the bottom of the hierarchy has to make a decision collectively to correct the situation. We are able to change the situation overnight by constant policy decisions with 5-10 years with honest commitment by government and opposition parties. Also, our laws to guarantee foreigners’ ownership of Sri Lankan assets and by guaranteeing that foreign debt will always be serviced and repaid by law.

And also, the Government should have appointed experience, efficient, qualified and credible people to government positions. The suitable people should be recruited to Government institutions with experience in international finance, economics and geo-politics to face the challenges.

Other main aspect is to show the ability to pay debt from the revenue sources. One of the major issues with the Sri Lankan Government is the revenue base with taxation. Sri Lanka is one of the lowest paying tax countries in the world with less than 10% of the population. As per the Auditor General Department, the revenue per day of the Government is Rs. 6.0 billion with less tax base currently. The annual revenue is closer to Rs. 2.2 trillion to 2.5 trillion as per the data. If we secured the current revenue with a proper tax system also it will boost the country situation within a short period.

The minimisation and eradication of corruption in the country is one of the best practices of the Government to getting the trust and confidence of the people and the international investors. Government can introduce the ESG System (Environment, Social & Governance) as policy decision and can introduce the GRID System (Quality Infrastructure for a Green, Inclusive and Resilient Recovery) for infrastructure development introduced by the World Bank.

With all these policy changes, the Government immediately should market the country with best practices and policies to the international investors and governments. All the ambassadors have to be aligned with the new change and all the ambassadors should assign with an annual performance measurement system as marketing managers of Sri Lanka. If they fail to achieve, immediately recall them without any political interference. The changing of government ministerial portfolios may be a key trump card to the Government to achieve the trust and confidence of the people of the country, investor community and international community.

Management of exchange rate

The management of foreign exchange rate is a key factor in the country today. The exchange rate fluctuation is 30%-40% during the month of March 2022. This much of exchange rate impact has been seen first time in the history of Sri Lanka today. The Government is responsible for the whole scenario and if we planned like the vaccination process and the COVID-19 pandemic, we would have managed 50% of the effect to the economy. Also, we would have not done currency fluctuation in this juncture knowing the effect. Now the damage has done to the economy and the people with 54% of inflation, upward trend of interest rate to 12%-20%, Rs. 300-325 exchange rate to the USD.

Therefore, currency board proposal for Sri Lanka is a more viable model for the economy which is having Foreign Exchange problems now. The currency board may be a better solution to overcome the situation and should be coming back into fashion. The experience of the currency board is going back to 1800-1950s in the country with effective management.

To overcome the situation, currency board arrangements, under which domestic currency can be issued only to the extent that it is fully covered by the central bank’s holdings of foreign exchange, were long generally dismissed as throwbacks to the colonial era.

It was argued that such a rigid, rule-based arrangement was not well-suited to diversified economies in many of which the authorities had developed sophisticated skills in monetary management. Instead, currency boards were seen as desirable and, indeed, workable only in very special circumstances, such as the small, open economies of city-states and small islands.

The renewed interest in currency boards has come in several waves, raising the number of countries. Following the successful use of a currency board to stabilise the economy in the aftermath of Argentina’s hyperinflation in 1991, additional attributes of currency boards became evident as a result of the successful efforts made by two transition economies Estonia and Lithuania to achieve credibility quickly for their newly established currencies.

In 1997, a currency board was introduced to end the economic chaos in Bulgaria. In view of the favourable outcome, and given that to-date no currency board has had to be abandoned as a result of a crisis, the discussion about potential candidates has recently been broadened further. In early 1998, there was serious discussion of whether a currency board would be an appropriate anchor to use in efforts to halt the Indonesian currency crisis. Most recently, there have been calls to study the possibility of stabilising the Russian ruble under a currency board.

Conclusion

Finally, we can conclude that the responsibility of the fiscal and monetary policy management is with the Government. Therefore, the Government has to take the responsibility of the economic issues people are experiencing now. The following policy decisions should be considered to minimise the economic impact. Those are:

Sources:

CBSL Report 2021, Department of Government Statistics, Getting out of a debt hole: Aravinda Korala

Credit Suisse Wealth Report, GDP Growth - World Bank Data, Are Currency Boards a Cure for All Monetary Problems? Charles Enoch and Anne-Marie Gulde, www: Statistica.com, Wikipedia

(The writer is CEO/Co-Founder of Sioera Capital Partners Ltd., Council Member of Gampaha Wickramarachchi University of Indigenous Medicine, and Financial Advisor and Investment Banker.)