Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 5 May 2023 00:10 - - {{hitsCtrl.values.hits}}

By Charles A. Goodhart, M. Udara Peiris and Dimitrios P. Tsomocos

By Charles A. Goodhart, M. Udara Peiris and Dimitrios P. Tsomocos

internationalbanker.com: Sri Lanka’s recent sovereign default places the spotlight back on the International Monetary Fund’s (IMF’s) approach, particularly regarding the Extended Fund Facility (EFF), through which, conditional on a program of medium-term macro-fiscal adjustments, it provides loans of a relatively short horizon (generally up to four years) with a few tranche disbursements (usually less than five). However, there is little evidence that this approach works in the long run. On average, there are 2.1 restructuring episodes when a country enters default, with a typical duration of 7 to 10 years until the default is fully resolved.1

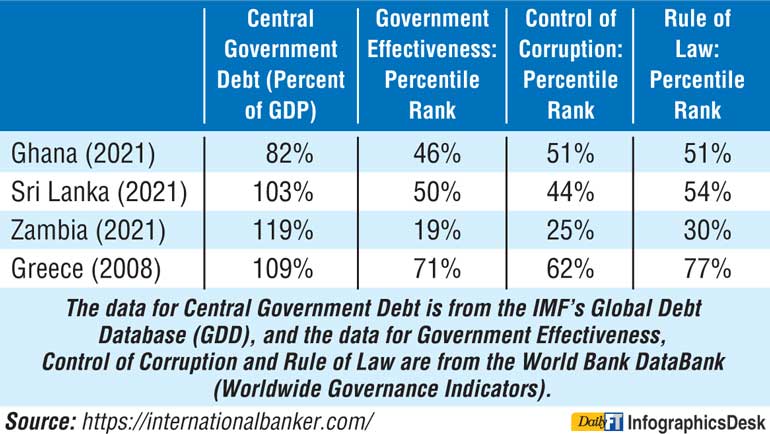

Currently, debt renegotiation occurs in parallel with but separate from the IMF program. This approach is usually rooted in the view that sovereign-default episodes are primarily a balance-of-payments crisis. However, in the case of Sri Lanka and many others, the crisis is a twin-deficits crisis (simultaneously a fiscal and balance-of-payments crisis), albeit one where domestic macroeconomic, fiscal and monetary profligacy precipitated an eventual balance-of-payments crisis. As Nishan de Mel of Verité Research in Sri Lanka has argued for some time, the Sri Lankan crisis is rooted in governance failures. These domestic-policy weaknesses reflect weaknesses in governance, institutional difficulties in implementing evidence-based policy, corruption and the political capture of institutions. To provide context, see table that summarises the stark reality that is faced.

The weaknesses of institutions in Ghana, Sri Lanka and Zambia are significantly greater than that of Greece, which was also severely criticised for its weaknesses at the time. Developing countries’ abilities to cope with rapid and severe fiscal adjustments are limited by the institutions tasked with implementing such policies, the prevalence of corruption and cultures of favouritism between governments and the elites. While governance-related conditionality is now often part of IMF conditionality, it is often not comprehensive, nor are economic targets based on grounded reality.

In contrast to the sudden and severe adjustments usually observed by IMF programs and the calls from some for greater unconditional debt forgiveness, we suggest a third way. We propose that the IMF’s lending program be designed to consider the institutional and economic realities of countries such as Sri Lanka. We propose:

1. A longer horizon (for example, 15 years) over which smaller but more frequent tranche disbursements will coincide with more frequent and shorter-term macroeconomic, fiscal and governance targets being met.

2. Deadlines for material progress on specific governance-related targets should precede deadlines for key economic and fiscal targets.

3. Creditors agree to an initial debt standstill, deferment or reprofiling, which will be supplemented by additional haircuts on the stock of debt when IMF program targets are achieved. In exchange for these haircuts, the remaining maturity of the debt would be reduced.

We are, in effect, advocating for a comprehensive state-contingent program that sequences governance and economic targets in a manner that is feasible for a country to implement. The longer horizon over which economic targets would need to be met means that the sharpness of the necessary fiscal correction is spread out over more years, allowing the economy to adjust and reducing the burden of the adjustments on the most vulnerable.

Although our suggestion increases uncertainty in the short term while such a program is negotiated, it reduces uncertainty in the long term. It strongly incentivises the Government of Sri Lanka (GoSL) to implement reforms and policies that do not fluctuate with the political cycle. Since negotiations with the IMF began in March 2022 and to meet the conditionality of the EFF, Sri Lanka has developed a new central bank act that promotes greater independence. Further targets such as an independent debt-management office, professional management and corporate governance over state-owned enterprises and the freezing of any tax holidays announced since the suspension of debt payments should be implemented as early milestones in the IMF program and certainly before the third tranche. The absence of these, among others, will be a major obstacle to a meaningful fiscal and economic recovery.

Our suggestion attempts to balance the need to implement fiscal adjustments with the realities and difficulties of arriving at a sustainable and responsible path for government debt. The combined approach of the IMF, multilateral, bilateral and private creditors must strive towards measures, targets and policies that consider the country’s inherent vulnerabilities and weaknesses and work towards ameliorating them.

Reference:

1World Bank Blog: “External sovereign debt restructurings: Delay and replay,” Clemens Graf von Luckner, Josefin Meyer, Carmen M. Reinhart and Christoph Trebesch, April 6, 2021.

(Charles Goodhart, CBE, FBA is Emeritus Professor of Banking and Finance with the Financial Markets Group at the LSE, having previously, 1987-2005, been its Deputy Director. Until retirement in 2002, he had been the Norman Sosnow Professor of Banking and Finance at LSE since 1985. Previously, he had worked at the Bank of England for seventeen years as a monetary adviser, becoming a Chief Adviser in 1980. In 1997 he was appointed one of the outside independent members of the Bank of England’s new Monetary Policy Committee until May 2000.

M. Udara Peiris is an Associate Professor of Economics at Oberlin College and a Global Academic Fellow at Verité Research.

Dimitrios P. Tsomocos is a Professor of Financial Economics at Saïd Business School and a Fellow in Management at St Edmund Hall, University of Oxford, and was Economic Advisor to the Greek Prime Minister.)

(Source: https://internationalbanker.com/finance/the-need-for-governance-linked-state-contingent-imf-programmes-a-third-way-for-sri-lanka/)