Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 17 July 2019 00:00 - - {{hitsCtrl.values.hits}}

Traditionally one of the main indices by which tourism performance is assessed the world over is by analysing the total tourist arrivals into a country. Historically Sri Lanka also has been adopting this method. However Sri Lanka seems to place too much emphasis on arrivals only to determine the ‘health’ of tourism in the country.

In addition, due to certain inherent country specific issues related to gathering this source data and other operational issues, there could be some serious misinterpretation of these arrival numbers. This, in turn, gives rise to wrong strategic decisions being made in relation to tourism development in the country, based on this information.

This is particularly relevant in the current context, where there is some debate going on about the actual extent of rebound of tourism after the 21/4 attacks. This paper is an attempt to analyse and discuss the issues relating to this controversy.

1.0 International visitors and tourists

1.1 Definitions

Although the terms ‘tourist’ and ‘visitor’ (or guests) are used interchangeably in general parlance, from a proper tourism perspective there are differences in the terms.

A visitor is a traveller taking a trip to a main destination outside his/her usual environment, for less than a year, for any purpose (business, leisure or other personal purpose) other than to be employed by a resident entity in the country or place visited. These trips taken by visitors qualify as tourism trips. (UNWTO, 2008)

A visitor (domestic, inbound or outbound) is classified as a tourist (or overnight visitor) if his/her trip includes an overnight stay, or as a same-day visitor or excursions. (UNWTO, 2008a)

Hence if one were to combine both these definitions we could arrive at a clear distinction of a tourist as follows: A tourist is a visitor or traveller who makes a trip outside his home environment to another destination for not more than one-year duration or not less than one day’s duration for the purpose of business, leisure or other personal matter and not for employment in the country that is being visited. Hence on the face of it, the definition is quite clear that even a visitor staying over for one night in the destination is considered a tourist.

1.2 Sri Lanka tourist arrivals

In Sri Lanka the overall arrival statistics are provided by the Emigration Department, derived from the disembarkation card that is filled by arriving passengers at the airport (and other ports of entry) In Sri Lanka the main point of entry is the International Airport in Katunayake accounting for some 98.2% of all arrivals to the country (SLTDA 2017).

In 2018 according to the SLTDA/Emigration statistics of ‘tourists’ (arrivals) was 2,333,796. However, issues prevalent in the data gathering system and also certain practices prevalent in the tourist industry specific to Sri Lanka could complicate and distort the picture of tourist arrivals to the country.

2.0 Factors affecting the correct assessment of arrival numbers

2.1 Transit passengers

The transit passenger is a visitor who stays for a short time in the country while awaiting his onward airline flight connection. Normally such transit times are less than eight hours, but there is a somewhat unusual situation particular to Sri Lanka related to such transit passengers.

Given the good connectivity of Colombo Airport, it is a well-known fact that it is sometimes cheaper and more convenient for South Indian passengers to use Colombo as a gateway to Europe. Very often such connections out of Colombo may be as much 36 hours, but to a South Indian traveller it is still a good deal to ‘transit’ in Colombo, and have a comfortable short break in a good three- to four-star hotel in the Negombo region before the long haul flight to Europe.

This is an important segment of the revenue makeup of the Negombo hotels and is called Connecting Passenger Services (CPS) business. It provides easy revenues streams for hotels with quick turnaround of rooms. Some hotels even boast of ‘repeat frequent transit passengers,’ who insist on transiting in a hotel they have stayed before!

Hence, while the importance of this segment to the hotels in and around the airport region cannot be ignored, such transit passengers do still get counted as ‘tourists’ according to the international definition of a tourist, since they stay for just over 24 hours. However in the correct sense of the word, they are not ‘real tourists’ and do not really contribute to the tourism value chain. There is no mechanism currently in place that can track this.Hence for a country like Sri Lanka, which is a mini hub for transiting passengers, this ‘error’ margin that gets included in the overall tourist arrival data could be significant

2.2 The Sri Lanka diaspora

Sri Lanka has a large contingent of expatriates living overseas who have migrated to various Western countries seeking a better future. They number a total estimate of around three million (https://en.wikipedia.org/wiki/Sri_Lankan_diaspora) and most of them regularly visit the country on holiday.

These visitors, usually identified in tourism as a segment called ‘Visiting Friends and Relatives’ (VFR), travel on foreign passports and are counted as proper tourists. They most often stay with relatives and friends and do not really contribute directly to hotel occupancy levels nor tourism economy. This reasonably large segment has some distinct seasonality patterns in visiting Sri Lanka where certain holiday periods see a larger influx.

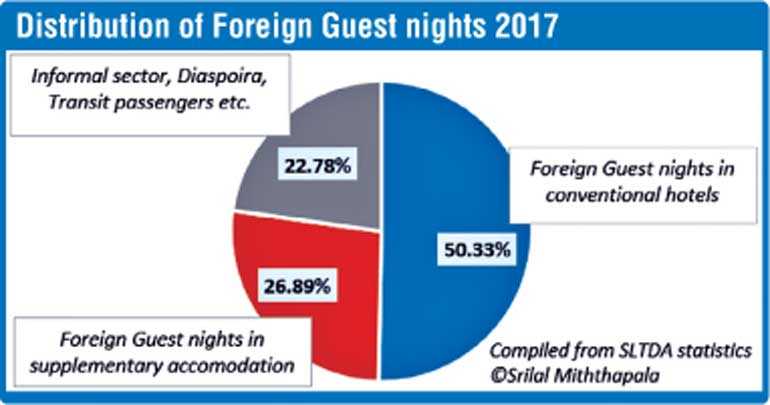

This ‘leakage’ factor is estimated to be about 23-24% according to studies done, and this component includes the diaspora, transit passenger and the unregulated (informal) sector, with only about 77% of all tourists patronising proper hotels and other accommodation establishments approved by the SLTDA (https://www.academia.edu/34154607/Only_50_of_Tourists_to_Sri_Lanka_patronize_star_class_hotels). Hence this fluctuating error margin of Sri Lankan diaspora that is included in the tourism arrivals is also an important factor that has to be understood

3.0 Overemphasis on arrival numbers

While arrival numbers are certainly an important index by which international tourists are tracked, it is always backed up by average tourist spend (which is the overall average spend by each tourist per night, during his or her stay in the country). In mature tourism destinations both these indices are always quoted together, when assessing tourism development.

Unfortunately in Sri Lanka there seems to be more emphasis placed on arrival numbers by the Government and tourism authorities. Almost always our targets set for tourism has the number of arrivals highlighted. This gives an impression that we seems to be more concerned on ‘quantity’ rather than ‘quality’.

There is no assessment of carrying capacities in certain tourism locations and attractions leading to severe crowding and congestion. This phenomena is known as ‘over-tourism’ and is today a hot topic in tourism circles. (https://www.academia.edu/37468352/Over_Tourism-The_new_Buzz_word_in_Tourism)

4.0 Assessment of tourist earnings

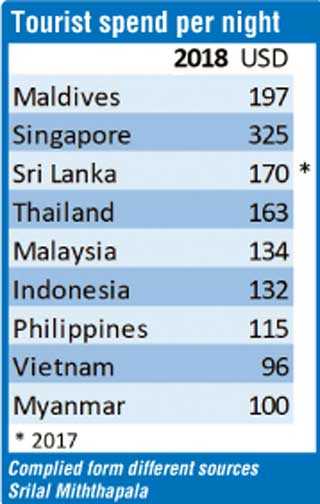

Tourism earning in Sri Lanka is assessed by surveys done on departing tourists at the airport. This is done by the SLTDA on an ongoing basis. According the latest statistics of the SLTDA (only up to 2017 is currently available) the average spend per tourist night is $ 170.

Compared to other more mature tourism destinations in the region, this figure seems to be on the high side. Most hoteliers would lament that hotel rates (pre-Easter 2019) were very much depressed. However, on the other hand there is a general perception that Sri Lanka is fast becoming a slightly expensive destination.

There have been calls for the method of assessment of tourism earnings to be improved and the SLTDA has done some improvements in the face of some criticism from the private sector. (https://www.newsfirst.lk/2017/10/07/sri-lankas-tourism-earnings-data-inaccurate-says-chamber-commerce-report/)

However this debate will rage on until the method of collection of this vital data is improved and shown to be reliable.

5.0 Post-Easter 2019 tourism recovery

5.1 Recovery based on arrivals

In the first full month after the incident there was a drastic drop in arrivals as was expected. May 2019 showed a 71% drop from the same period last year with arrivals plummeting down to just 37,802. June 2019 showed arrivals going up to 63,072 which on a pure month-on-month basis is an ‘increase’ of about 50%. However compared to last June, when arrivals were around 146,800, the drop is 57%. Now, one can argue about interpretation of the statistics ad nauseam. (“There are lies, damned lies, and statistics” – Mark Twain.) It is the proverbial story of the glass of water being half empty, or half full.

As shown earlier, the bottom line is that there are several aspects that affect the composition of the arrival numbers. These ‘errors’ are not constant and can vary depending on seasonality (diaspora visitation) changes in airline flight schedules (transit passengers).

So one cannot dismiss these factors saying they have a common error impact right through the year. However, after all is said and done, there is definitely an increase in overall arrival numbers to Sri Lanka in June, when compared to the disastrous previous month of May.

5.2 Tracking recovery based on new bookings and cancelations

In a post-crisis situation there is another important index that should be tracked to assess the actual level of revival. That is the trend in new bookings coming in and number of cancelations.

5.2.1 Cancellations

Immediately after the attacks there were large volumes of cancellations that came in. Over time, with travel advisories and ground situation returning to normalcy, these cancellations slowed down. So it is important to track the number of new cancellations coming each week, which will give a correct picture of how safe Sri Lanka is as perceived by potential visitors.If these cancellations can be tracked by nationality, it will indicate what nationalities are more, or less, risk averse as well. This in turn will yield valuable insights into the proper design of recovery based PR communication strategies.

5.2.2 New booking trends

The important information that needs to be carefully monitored is the number of new bookings being made. Increase in each week’s bookings will give a basic idea of how well the market is rebounding. If new bookings can be analysed by nationality, as in the case of cancellations, proper and effective recovery PR initiatives can be launched in the relevant countries that are showing a resurgence.

A further valuable trend can be arrived at if these new bookings can be compared to the booking status and trend during previous years for the same period. This will then show accurately how well the recovery is taking place

6.0 Conclusion

Hence it is evident that assessing the extent and proper growth of tourism cannot be derived from one single source of data such as arrivals. It has always to be augmented by other important and relevant information, and it is only by interpreting the combined impacts of such information, that the real growth of tourism can be assessed. This is much more relevant and important in an environment where the destination is recovering from a major disaster. Focusing on one single source of data to assess the extent and speed of tourism recovery, can therefore give wrong signals to all stakeholders, resulting in erroneous strategic decisions being made, which could have serious consequences and even retard the recovery process. And what is this ‘recovery’ we are talking about? Is it a recovery to the same point we were at before 21/4? Is it at current prevalent low (discounted) yields? Or are we aiming to take this ‘opportunity’, and ‘put our house in order’, improve our service and product offerings, and recover to a much higher level that before, rather than simply chasing after numbers?