Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 3 June 2022 00:14 - - {{hitsCtrl.values.hits}}

Picture Credit IPS

Sri Lanka has never been as unstable as we see today, not even during the almost 30+ year civil war which could now be considered normal in comparison to the mess we are in currently. In Sri Lanka, unfortunately both economic and social stability ironically rests on responsible and credible political leadership and their decisions. Bad political decisions in the last few years have had perverse repercussions in wrecking the country’s future. The worst among all in our very long history – Sri Lanka has now joined the list of hapless nations that have defaulted on sovereign debt.

Sri Lanka has never been as unstable as we see today, not even during the almost 30+ year civil war which could now be considered normal in comparison to the mess we are in currently. In Sri Lanka, unfortunately both economic and social stability ironically rests on responsible and credible political leadership and their decisions. Bad political decisions in the last few years have had perverse repercussions in wrecking the country’s future. The worst among all in our very long history – Sri Lanka has now joined the list of hapless nations that have defaulted on sovereign debt.

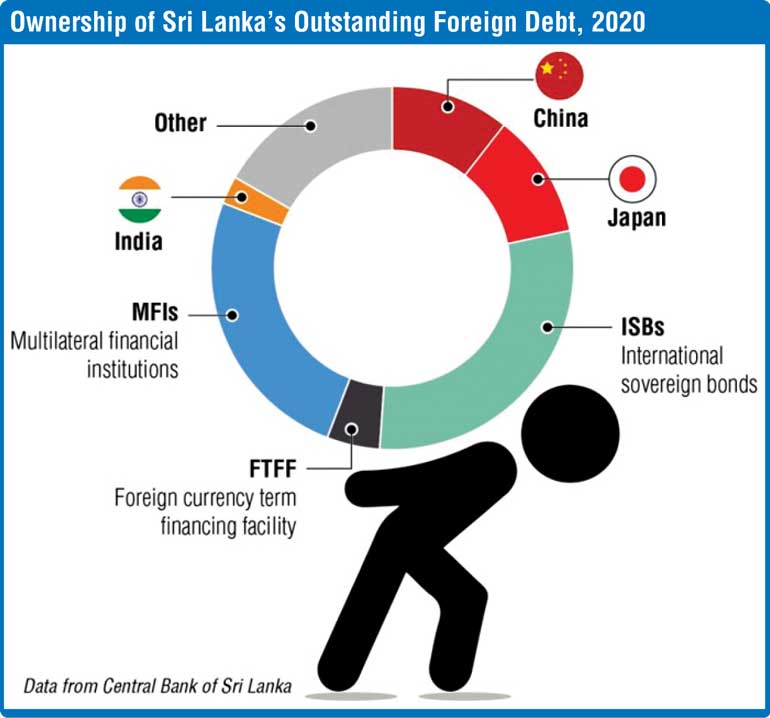

Sri Lanka has now suspended debt payments on its foreign debt worth $ 51 billion. When a country fails to pay back its local and foreign creditors the principal amount as well as the interest amount of the loan/bond it is known as sovereign debt default. According to newspapers Sri Lanka has hired Lazard and Clifford Chance as financial and legal advisers to represent the Government in talks with international creditors. Whilst a creditor group of the largest holders of Sri Lanka’s sovereign dollar bonds hired Rothschild & Co as financial adviser and White & Case as legal adviser.

Hard default

Sovereign debt restructuring can be pre-emptive or hard-default. A hard default will be very costly as it can result in a continuing loss of access to international capital markets for both the government and the private sector for a very long time. Whilst pre-emptive restructuring is when a country deems itself unable to service outstanding debt, works proactively with their creditors. Both finally have the same results, with one less dramatic. Sri Lanka has also now missed a payment to multilateral institutions, blocking fresh funds and the country could now be potentially locked out of multilateral funding, which is very unfortunate.

Sri Lanka is not alone. Several emerging markets have either recently restructured their sovereign debt like Ecuador and Argentina or remain in default like, Surinam, Lebanon and Venezuela. Countries like Chad, Ethiopia and Somalia are in debt distress. Research indicates that Spain in 1557, became the first country to default on its loans. Venezuela defaulted on its loans worth $ 60+ billion. Greece defaulted on its debt twice over in 2015 worth $ 1.7 billion and 456 million euros. Therefore analysts say Sri Lanka’s wait and see attitude and not doing anything to help ourselves by looking for home grown solutions was a very costly mistake. Even at this late stage a proactive debt restructure engaging the best in class may reduce the total magnitude of upfront losses to all the stakeholders and get the country’s debt to a sustainable level at the lowest financial and social cost to both the country and its local and international creditors and help to kick start the IMF program that is two years behind.

Sovereign borrowing

According to analysts and information available on/in the public domain, sovereign borrowing has grown from a small group made up of multilateral organisations, a few high power MNC commercial banks, Funds, and the ‘Paris Club’ of rich countries to something much more complex and demanding and ruthless. Many developing economies have in the last decade borrowed ridiculously more from international bond markets and tapped new non-Paris Club lenders like China and Russia to fund government programs, some of no value to the taxpayers, simply because it was easy to get and often the life span of fund manages are two years.

Debt restructuring

Sri Lanka according to sources, is looking to restructure over $ 12.55 billion on overseas debt. Local banks have invested close to $ 4 billion. This is one of the largest components of the ISBs and SLDBs. The banks have a huge forex liquidity issue because of the Government’s inability to service the debt. Many of the large and seemingly stable Lankan banks are unfortunately losing their credibility internationally. Lee Buchheit who crafted the restructuring deal that cut Greek debt by 100 billion euros says, “Sri Lanka’s creditors —be they bilateral or commercial, will be interested in one critical question – who are we going to share the pain with? Every sovereign bond restructuring boils down to one decision — How much of the country’s pain should be borne by its citizens, and how much should be borne by the creditors.”

Conclusions

Today there is no point in lamenting about the past, we need to move forward. Therefore we need to get the best talent both locally and internationally to cut a good deal for Sri Lanka, given the diversity of the creditors. Over dependence on economists will not help the cause and will only make it worse. This is now also a banking crisis. We must engage an international bank with a large, active and credible trading platform interacting with the world of investment funds, to talk to creditors in addition to the advisory role of Lazard to speedily, smoothly and efficiently accomplish the debt restructuring. We need several parallel tracks running (foreign and local creditors), including a political track to deal with the bilateral and multilateral debt and that requires a soft approach.

The laissez-faire actors of the past must be dropped. Incompetent high commissioners must not be engaged in this project, unless fully trained. As taxpayers we want the Government to ensure the pain (haircuts – LKR and Fx) is managed and ensure that we have the skill and experience in battling litigious hedge funds. This is no longer a project for our politicians and bureaucrats to only manage. Because the public will have to bear part of the pain. In the final analysis, the leadership of the past and present government must surely take the blame for allowing the debt crisis to fester for years, especially in the last two years.