Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 20 February 2023 00:57 - - {{hitsCtrl.values.hits}}

How far exactly are we away from being burden-free?

The Paris Club, an informal group of Western creditor nations including Japan and the US, issued a press release last week supporting Sri Lanka to obtain green light from IMF for a $ 2.9 billion bailout, following letters by Indian Finance Ministry and the Exim Bank of China offering support to ease Sri Lanka’s debt burden.

The Paris Club, an informal group of Western creditor nations including Japan and the US, issued a press release last week supporting Sri Lanka to obtain green light from IMF for a $ 2.9 billion bailout, following letters by Indian Finance Ministry and the Exim Bank of China offering support to ease Sri Lanka’s debt burden.

Ranil Wickremesinghe’s Government has officially welcomed the latest developments. In his Parliament address last week, Ranil Wickremesinghe assured the country that negotiations with the International Monetary Fund (IMF) are in the final stages and again announced this Wednesday that he was hopeful to get the IMF approval in March. The Sri Lankan business community was also encouraged and the Ceylon Chamber of Commerce issued a statement asking other creditors for support while urging IMF to speed up approval process with the assurances given thus far.

This is indeed one step closer to the much-awaited financing, which could help the country head back on track. Although the 16 IMF bailouts since 1950s (including the most recent one in 2016) didn’t keep Sri Lanka from crisis like the one we are in, and controversies often arise when it comes to conditionality of IMF lending and the painful implementation of IMF prescription, let’s not undermine the progress made in the past few weeks. But how far exactly are we away from being burden-free? When can the Sri Lankan people feel the benefits of the IMF bailout rather than the pains of its obligations? One might need to look beyond the mainstream rhetoric.

Who holds Sri Lanka’s debt?

It is common knowledge that China, India and Japan are the largest bilateral creditors to Sri Lanka. This is true. However, public debt of a sovereign country is not only consisted of bilateral debt. Debts or loans are of different nature, differentiated by the borrowing body, lending body, currency, governing law, etc. In Sri Lanka’s case, the public debt portfolio is somewhat complicated.

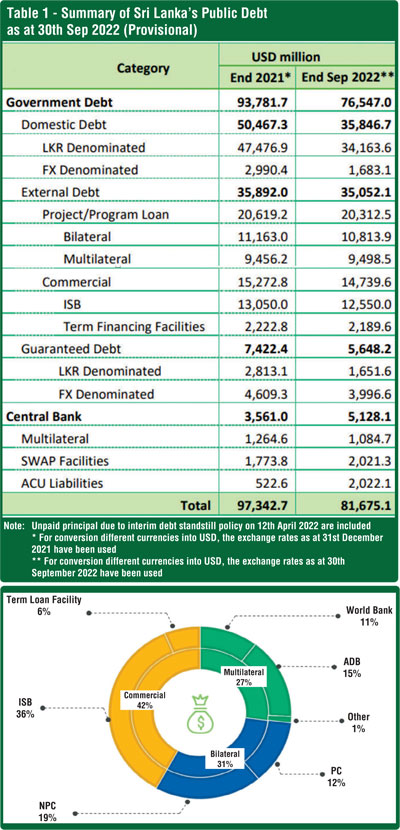

According to the recently published quarterly debt bulletin by the Ministry of Finance1, domestic debt ($ 35.8 billion) accounts for almost half of SL’s total public debt ($ 81.7 billion) by September 2022, although Sri Lankan Rupee depreciation contributes to its shrink in percentage (see given table). The remaining is divided by Central Government (GoSL) and Central Bank debt, and each part has its own sub-compositions.

Let’s take foreign debt or external debt owed by the GoSL alone as an example (since it is the most highlighted by IMF’s debt restructuring requirement). Commercial debt, multilateral or multilateral development bank (MDB) claims and bilateral debt are all playing major roles, where bilateral debt ($ 10.8 billion) accounts for 31%, MDBs 27% and commercial (majority ISBs) 42% (see given chart). There is another way to look at it, that the bilateral debt ($ 10.8 billion) which is 13% out of SL total public debt ($ 81.7 billion), is under the IMF spotlight, as financing assurances from the bilateral official creditors including Paris Club, India and China are explicitly requested by the IMF.

Let’s also be mindful that the GoSL is not the only public borrowing body in SL. Adding the Central Bank debt to the table, it is not wise to ignore $ 1.1 billion additional MDB borrowing and $ 2 billion Asian Clearing Union (ACU) borrowing (most likely from India), and $ 2 billion SWAPs.

Looking at the numbers, it is obvious that the burden of SL debt is much heavier than the media portrait, where the main focus seems to be placed only on major bilateral creditors, while 87% the public debt (domestic, commercial MDBs and Central Bank debt) slips under the radar of the public scrutiny.

What is actually offered by Sri Lanka’s creditors?

What is actually offered by Sri Lanka’s creditors?

The Indian letter of support on 16 January and Paris Club announcement on 7 February both specified the strong support for SL to get the IMF bailout and committed to continuing negotiations with GoSL for medium-to-long term debt treatment consistent with the IMF program targets.

China’s support letter on 19 January is somehow different. In the letter from China Exim bank, what was offered to SL is a two-year moratorium without preconditions as well as the commitment to negotiate medium-to-long term debt treatment during the window period and support for SL to get approval for IMF bailout.

Other than the bilateral official creditors, the international bondholders (actually hold more debt than all bilateral creditors combined) recently voiced their readiness to engage in debt restructuring with SL towards restoring debt sustainability consistent with the IMF program requirement. However, it is worth noting that the bondholder group reserves the right to follow its own analysis on how to achieve the IMF program targets.2

Is one assurance more effective than another? Well, it’s up to the receiving end, i.e. GoSL and IMF to decide. One might argue that the focus should be respecting the IMF program requirements, another may consider only one creditor offers substantial debt treatment, while a third party might deem all of the supports are empty promises as no concrete solution was provided in the long run.

In addition, there will always be messages not in the same tune. Bangladesh, who’s Foreign Minister Dr. A.K. Abdul Momen visited SL for the country’s 75th Independence Day celebrations, told reporters that it is expected for SL to repay their loan by September this year.3

What happens now?

For now, those developments are the support GoSL gathered so far to persuade the IMF to approve the bailout package. It’s up to the IMF and its key shareholders to decide whether SL is worth the $ 2.9 billion support and whether to grant the approval before it’s too late.

At the same time, many are eying the first sovereign debt roundtable meeting this Friday. It is reported that bilateral creditors including G7 countries, India, China and Saudi Arabia will be attending alongside MDBs like the IMF, the World Bank, commercial creditors and debtor countries that are in trouble including Sri Lanka, to discuss a systemic solution to deal with the roaring debt distress. It is also mentioned that a Chinese proposal for the MDBs to participate in debt reductions would also be on the agenda.

For countries like Sri Lanka with a complicated debt portfolio, it makes sense to engage all creditors, no matter whether it’s bilateral, commercial and multilateral. Together a comprehensive solution might be more helpful to truly ease the debt burden of SL without putting too much weight on one sub-group of creditors.

However, the reality is that, the IMF is serving the role of both player and the judge. Just like the World Bank, ADB, IMF is a multilateral lender itself. Even though no reduction in MDB claims is requested by now, it is worth exploring at least that the principle of comparable treatment among creditors to be applied on the MDBs, including by calculating their contributions with new financing for instance.

Old habits die hard. The usual practice might not be the best solution for every country. Sometimes to face the unpleasant truth and get the guts up to seek changes is the very first step of a successful reform. President Ranil Wickremesinghe seems to be courageous regarding the domestic economic reform. But whether to take the same approach with the debt crisis, it is a question to be answered only by the authority and its creditors. The Sri Lankan people will also need to think clearly to tell what is best for the country and not be carried away in the meaningless debate of who said it better.

Footnotes:

1https://www.treasury.gov.lk/api/file/d857ad94-e632-4fc6-a221-cab9965d7085

2https://english.newsfirst.lk/2023/02/03/bondholders-group-prepared-to-engage-with-sri-lanka-on-debt-restructuring

3https://www.themorning.lk/articles/lAn4W6Qxbl8ol7kWRZUV

(The writer currently serves as a Director of BRISL, an independent and pioneering Sri Lankan-led organisation, with strong expertise in BRI advice and support. He can be contacted at: [email protected].)