Friday Feb 13, 2026

Friday Feb 13, 2026

Wednesday, 10 October 2018 00:00 - - {{hitsCtrl.values.hits}}

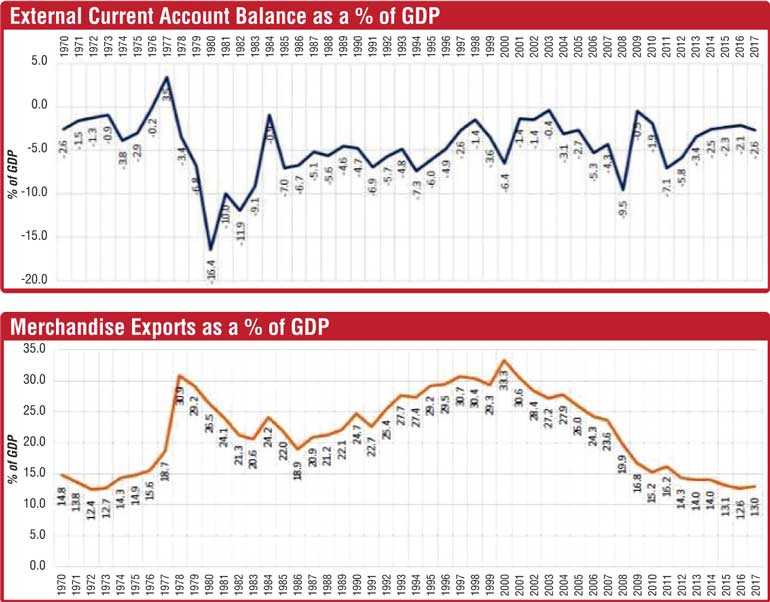

When you look at the graphs, it’s not difficult to understand the long term reason for the pressure on the currency. Seen is the data for merchandise exports and the external current account balance from 1970. Look at the trend.

See how the problem was first addressed in 1977 with dramatic results but was then negatively impacted by the 1983 riots and subsequent issues. See how the problem got aggravated around the year 2001.

By 2004 the then Government was able to reverse the falling trend and just about get the exports up again. But from 2005 it was in a free fall to 2016. With the restoration of GSP plus and a major refocus once again this Government has stopped the decline and finally turned it around by 2017.

Yes, this is only goods trade, and there has been some progress in service exports, IT, etc. But the trend is the same. Export of goods and services put together was around 36% of GDP in 2004 and fell to around 20% by 2015 and now at around 22%. But imports continued to rise plus large USD loans to bridge the other deficit; the budget. Government revenue to GDP fell from 15.5% in 2005 to just 11.5 by 2015, making Sri Lanka one of the worst in the world, and we have turned that around too; to 14% in 2017. And so you see, we have a huge problem.

While it is true the rising US interest rates have been the immediate reason for the current depreciation of the LKR the long term reason is what is in these two graphs plus the deficit in the budget.

We cannot expect the pressure on the currency to ease unless we are able to continue with the change of direction of exports we have finally made and aggressively push for greater reforms on the supply side and on the demand side through FTAs. We must make the incentive structure much more attractive for exporters. Yes, a competitive exchange rate is fundamental but other issues also need to be resolved particularly in doing business. We must understand that for us, with a small domestic economy, but positioned at the most enviable geographic location in the new ‘growth pole’ in the Indian Ocean, trade is our way out. We must engage, we must leverage our advantage.

That is how we prospered as a nation centuries ago. That is why the JRJ Government started on trade and investment reforms along with FTZs and the port, but along the way we didn’t have the determination to go through with what was needed.

Singapore and Dubai succeeded because we failed to grab what was in our reach. We can’t give up, in fact I believe we have a very good opportunity in front of us. That is why our V2025 is to create a knowledge-based, highly-competitive social market economy at the centre of the Indian Ocean.

In order to make it happen we as a nation must have a change of attitude; that trade is good and that plugging in to global and regional production networks is positive. We have to understand that building walls around our island will not help, in fact it will hurt us.

We must make it easier for companies to move partially completed goods in and out freely. That is how we can gain from trade. That is how countries like Vietnam and Thailand, etc. are turning their economies around.

For instance Vietnam has some 17 FTAs and will benefit hugely from the TPP and the RCEP (ASEAN plus 6). Their exports to GDP just crossed 100% with a value of some $ 270 billion.

I hope this current episode with the currency will help us realise that no amount of scaremongering of international conspiracy theories will get us out of this hole. What we need is to trade with the world. That is how we can link the farmer in Matale to a supermarket in France through GSP plus or have Apple build a factory in Horana to produce parts for their next phone to sold in the US.