Thursday Feb 12, 2026

Thursday Feb 12, 2026

Monday, 17 September 2018 00:00 - - {{hitsCtrl.values.hits}}

Prime Minister Ranil Wickremesinghe, speaking recently at the World Economic Forum in Vietnam, denied that Sri Lanka was in danger of spiralling into a debt trap from excessive Chinese borrowings. However, during the past Presidential and General elections he and his team portrayed a picture contrary to that, although it is true that subsequently debt on  Hambantota port was swapped with equity.

Hambantota port was swapped with equity.

Writing an article to Daily FT titled “Sri Lanka’s Rupee and Debt Burden now at Critical Stage” a former Governor of the Central Bank of Sri Lanka Ajith Nivad Cabraal stated as follows:

“It is now clearly evident there has been a serious deterioration of the Debt Dynamics of Sri Lanka over the past 3½ years. It is also clear that such outcome is primarily due to the present Government’s unsound economic management, reckless borrowing, imposition of unbearable taxes and severe discouragement of investors. Consequently, the Sri Lankan Government’s debt situation has now reached a precarious and dangerous level.”

There are several opinions expressed by many that Sri Lanka is moving towards a debt trap. All these opinions were derived from the last Presidential and General election platforms. If one wants to find out the reality, one only has to go through the statistics provided by the Central Bank. It is nothing but simple arithmetic.

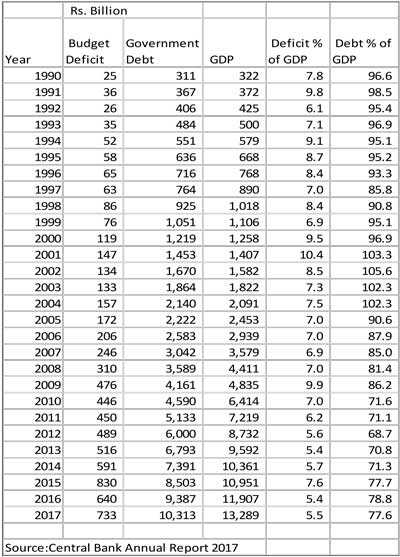

In the Table, I have reproduced data given in the Annual Report 2017 of Central Bank of Sri Lanka. From the year 1990, year by year the manner in which the Government debt has been increased can be viewed by going through the Table. In addition, the root cause of the problem was also given: The deficit budgeting of the successive Governments. When a Government spends more than what it earns, the difference will be borrowed. This can be either foreign or domestic borrowings. During the period 1991 to 2005, proceeds from the privatisation of the Government institutions were also used to bridge the gap.

The best way of easing the problem is to reduce the deficit. Another way of easing the problem is to have a high growth rate of the economy, so that the economy has the capacity to pay. In Table, Gross Domestic Production (GDP) of the country, budget deficit and the debt as a percentage of GDP is given. It is interesting to note that in the year 2002 debt was 105.6% of the GDP. To the credit of Cabraal and the team, it is evident from the Table that during their period the debt to GDP percentage has gone down due to the increase of GDP. This is commendable. It should also be noted that the interest payments we make on debts is around 5% of GDP. From the Table it is evident that his statement that the situation has now reached a precarious and dangerous level is not true. It is just a political statement.

There is a difference between the budget deficit which is financed by debt and the increase of the debt each year. The major factor contributing to this difference is the depreciation of the rupee. When the rupee depreciates, as Cabraal points out, the Government will have to pay more rupees to settle the foreign currency borrowings. That is why he requests not to increase foreign borrowings. But why does Cabraal and the others who are concerned about high debt, not tell the successive Governments to reduce the budget deficit? To my knowledge only the International Monetary Fund (IMF) has said so.

To reduce the budget deficit, either the expenditure should be reduced, or revenue should be increased. The Government has taken an initiative to increase the revenue by introducing the new Inland Revenue Act amid severe criticism from the Private Sector. Out of the tax revenue In Sri Lanka 20% comes from the direct taxes and 80% comes from the indirect taxes. In India the relevant percentages are 56% and 44%. In Singapore the figures are 64% and 36%. The rich in this country, who are in the Private Sector, and the professionals are reluctant to pay taxes.

As a result, the Government is funded by the paupers who pay VAT on the products they consume. I do not think that the budget deficit will be reduced in the budget of this year since next year would be an election year. General Public will be bribed at their own expense.

During the period of the previous regime, the rupee was kept stable. One advantage of this was that the country was able to control the imported inflation. However, by adopting an artificial methodology to keep the exchange rate stable there was a severe impact of the exports of the country. Exports of a country cannot be solely managed by the exchange rate since it is only one factor promoting the exports. Exporters of this country cannot simply increase their prices, because their prices are dependent on the prices quoted by the competitors.

In the point of view of the exporters, if the domestic prices including the interest rates increase, one way to mitigate that is the depreciation of the rupee. If the domestic currencies of the countries of the competitors depreciate at a rate more than the Sri Lankan rupee, our exporters would be in a disadvantageous position. During the previous regime, the 2006-2014 depreciation of the rupee was very low. In two instances they could not manage it and the rupee depreciated very rapidly, which was not good for the economy.

In the first instance Rupee depreciated by 5% within three months from September 2006 to December 2006. The second instance was in 2012, from January to March, where the rupee was depreciated by 12%. This policy contributed to the decline of exports during the previous regime. Export of Goods and Services as a percentage of GDP was decreased from 30.13% in 2004 to 21.09% in 2014.

A country cannot have a policy on depreciation of the rupee just to keep the value of the foreign debt intact. If it does, it is a policy of an accountant to manage the Balance Sheet rather than a policy of an economist to manage the economy.

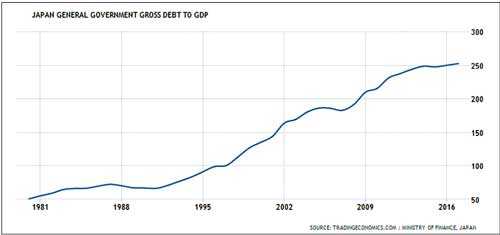

Japan is the third largest economy of the world behind USA and China. However, Japan has the highest debt as a percentage of GDP, 253%. Second in rank is Greece, which has a debt of 178%. Rank of Sri Lanka is 31. Greece had a GDP per capita of $ 17,890 in 2016. Relevant figures in Japan was $ 38,972, and in Sri Lanka it was $ 3,835. Greece is a developed country which was not able to pay its debts. To overcome this situation, the IMF and the European Union helped Greece.

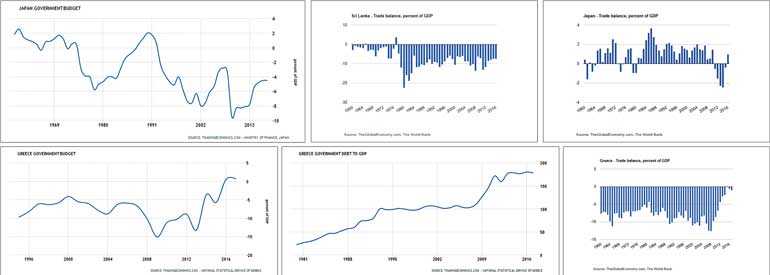

The public debt and budget deficit of Greece is given Charts 1 and 2. At one point budget deficit of Greece reached the point of 15%. In recent times, under pressure from different parties, Greece managed to reduce the budget deficit. Greece also shows a trade deficit, the difference between imports and exports in the National Accounts. The trade deficit of Greece is given in Chart 3. Greece is a county where Government spends more than its income and imports more than its exports. As a result, it tends to borrow more and more. Recently it has come to a relatively stable stage.

The public debt, budget deficit and trade deficit of Japan is given in charts 4, 5 and 6 respectively. The difference between Greece and Japan is that Japan has shown a long-term trade surplus. In addition, Japan shows a surplus in Balance of Payments, which includes trade surplus and other remittances of interest and investment income. Interest rates in Japan are very low, leading to Japanese entrepreneurs investing in government bonds using the income received from foreign countries. As a result, the majority of Japan’s debt is domestic debt rather than foreign debt. Therefore, the situation of Japan is not critical as the situation of Greece.

The trade deficit of Sri Lanka is given in Chart 7. It shows that Sri Lanka is going through the path taken by Greece and not Japan. Sri Lanka should increase its exports at this juncture. Exports was prominently focused in the time of N.M. Perera, the only Finance Minister who had a doctorate in economics. At the time of introduction of the free economy in 1977, the country could not have any control over the process. Hence there was a tendency of the Private Sector to concentrate on trade rather than on manufacturing and export. This tendency came to the zenith during the last regime.

Exports cannot be promoted by just conducting seminars. The Private Sector, the Public Sector and the Politicians should up their sleeves and get on to the job. We have an opportunistic Private Sector, lethargic Public Sector, a cunning set of politicians and idiotic General Public. Corruption is present in all the sectors. Fortunately, we have great exceptions in all four sectors mentioned.

Debt, whether by the Government or otherwise, is a not a bad thing provided that the borrower has the capacity to pay the capital in instalments and pay the interest regularly. Debt trap is what happened to Greece and what happened to Sri Lanka as far as the presently unproductive Hambantota port is concerned. Sri Lanka, as a country, can be moved away from a debt trap provided we take corrective measures as discussed.