Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 18 March 2024 00:24 - - {{hitsCtrl.values.hits}}

2024 would be a telling year in not only further understanding tourism’s role within the economy, but also its role in forecasting for the future

How close is the reported tourism earnings estimate to reality?

How close is the reported tourism earnings estimate to reality?

In understanding the macroeconomy, carefully hashing out details within the Balance of Payments (BOP) current account is an important initial step. Official tourism earnings contribute significantly to Sri Lanka’s balance of payments (BOP) figures. This makes accurately tracking the foreign exchange earnings from the tourism industry crucial for understanding external sector performance and as macro advisors this tie in closely into our work of formulating potential scenarios for macro variable forecasting.

Despite its significance, the current method of calculating tourism earnings employed by the Sri Lanka Tourism Development Authority (SLTDA) due to the difficulty of adopting the recommended tourism satellite accounts, does have loopholes which might result in overestimating earnings values.

This overestimation stems from the statistical approach currently used, which uses a sampling approach to collect survey data at the airport which is then extrapolated to arrive at an overall number. We explored alternative methods to triangulate the estimated earnings arrived at through the SLTDA survey and identify if it provides a realistic view.

Our alternative approaches showed that there is an overestimation of the reported earnings, posing potential challenges in accurately measuring external sector performance. Our findings concluded that the reported number should be at least discounted by 20% in order to match a more realistic earnings number (Please feel free to reach us at [email protected] if you want more information on the above said workings and estimates).

Furthermore, Sri Lanka’s future tourism earnings capacity could also be hindered by regional peers who have been displaying greater potential in increasing their dominance within global tourism. In addition, the profile of tourists visiting the country currently seem to be in the low-end backpacker range. While they might spend longer in the country, their contribution to the economy in the form of earnings is likely to be sometimes even below that of domestic tourists.

2023 was great! But were we competitive against our regional peers?

2020-2022 pandemic forced hibernation created a period of pent-up demand for tourism across the world which created the background for an immediate boom in the tourism industry in 2023. While Sri Lanka also benefited from this, a key problem the country needs to address is whether the country is a key player in the region in terms of the profile of tourists it attracts and the earnings they generate.

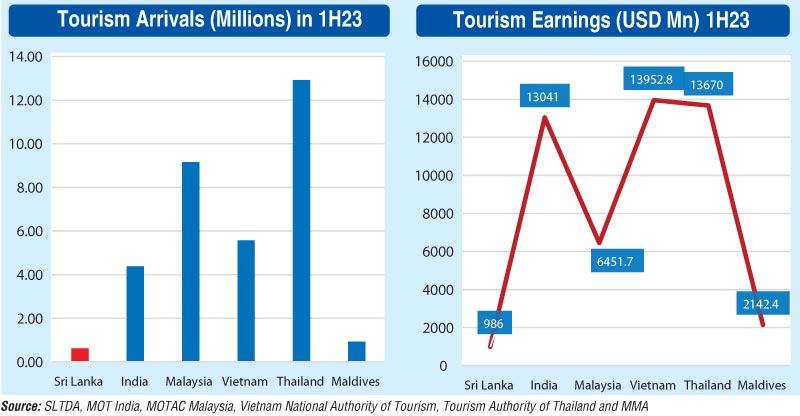

While Sri Lanka and Maldives have been unable to attract more than 1 million tourists in the first six months of 2023, peer countries have been able to attract more than 4 million tourists. The earnings number also indicates that Sri Lanka generated the lowest revenue compared to its peers. While Sri Lanka has hardly managed to generate even $ 1 billion in earnings, Vietnam and Thailand have been able to generate more than $ 13 billion. This points to the possibility that Sri Lanka is not sufficiently competitive in the south Asian region and might have resulted in lacklustre performance in contrast to its peers. Although Sri Lanka has been able to attract more tourists compared to the pandemic period, it is yet to match the standards of peer countries in the region.

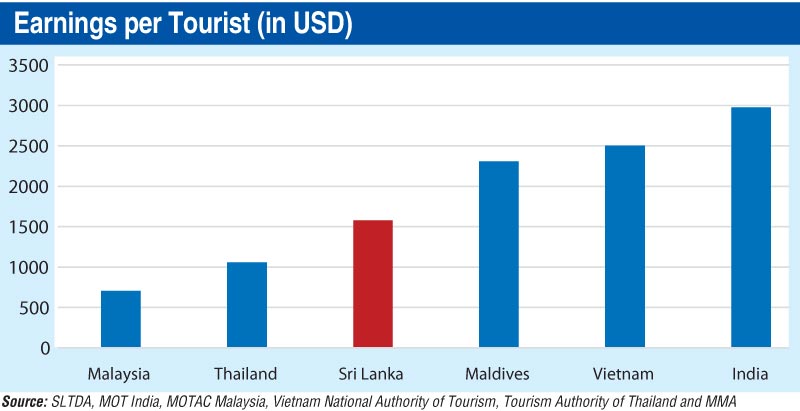

Looking at numbers from regional peers India, Vietnam and Maldives are earning an increased level of earnings from a tourist. While Malaysia and Thailand have been able to attract a higher number of tourists than Sri Lanka the earnings these tourists generate to the country has been roughly around $ 600-1000.

In contrast, Sri Lanka has recorded a higher earnings number compared to Malaysia, and Thailand, but is still distant from the earnings generated by India, Vietnam and Maldives. To put this into perspective, our closest competitor in terms of the unique value proposition is the Maldives, given the significant variation in geography and culture in other peer nations. Therefore, Sri Lanka still lags behind in its unique value proposition and ability to attract high end travelers.

Is Sri Lanka attracting a different tourist persona now?

While we explore Sri Lanka’s need to step up the game, one problem we are faced with is the lack of spending by the tourists. This would result in lesser and lesser earnings. Compared to 2018, the current Sri Lankan economy has undergone several changes with the impact of high inflation which persisted throughout 2022.

Essentially, despite the rise in prices since 2018, the expenditure of tourists visiting the country hasn’t surpassed previous periods when the cost of goods was comparatively lower. This suggests that Sri Lanka may be predominantly appealing to the budget traveller. However, quantifying this shift is challenging based on available data. Nonetheless, the numbers indicate that the country faces hurdles in revitalising its tourism sector, as current visitors tend to spend less than in the past.

Despite the grey clouds, a silver lining remains. Recognition on the international stage as an ideal travel location, or specific cities being recognised as must visit places, could create more traction. However, sustaining earnings would require a positive case scenario related to the election year up ahead, which signals stability and security for international travelers to step into the island. Therefore, 2024 would be a telling year in not only further understanding tourism’s role within the economy, but also its role in forecasting for the future.

(Navinda Meepe is a research analyst at Frontier Research working within sector and thematic research teams.)

(Niroshi Perera is the Head of Macro-economic Intelligence at Frontier responsible for the macro-economic intelligence products, and also team mentoring and development.)

(Yusuf Ali-Barrie is a short-term research intern predominantly working within the special projects and thematic report research teams.)