Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 18 April 2019 00:00 - - {{hitsCtrl.values.hits}}

Let us see the background of the unholy trinity or impossible trinity or trilemma. Every country is challenged with international monetary policy which will in return decide the fate of the economic growth. Three strategies available are;

This concept/theory says that no country can achieve all there elements in its favour at the same time period. At any given time two policies can be made use of for country benefit. Let’s dig deep into the cause and effect of these three policies (not in any order of importance).

A fixed exchange rate

Ever since the Nixon shock in the 1970s, almost all countries’ exchange rates were free floated due to the extensive global trade and the USD becoming the reserve currency of that time. Hence for a country to hold an exchange rate fixed is a challenge based on the level of foreign reserves one may hold. Hence to hold an exchange rate stable a country’s central bank will have to infuse or buy back the currency in question based on the demand and supply for the currency in question.

Still the world is dependent or benchmarking exchange rates in relation to the USD. Therefore no country has unlimited USD reserves to infuse since economies are more dependent on imports. However, the China story is different since they are the manufacturer to the world and exports supersede imports, resulting in trade surpluses with many countries. Therefore, China is capable of holding the exchange rate fixed if they desire.

Due to arbitrage gains in forex trading, eventually the exchange rates will find an equilibrium away from the fixed exchange rate. The importance of a stable exchange rate is to maintain a stable or predictable inflation situation in a country.

Free flow of capital movement

All countries try to attract FDIs and investments for development. Free flow of capital means that there are no restrictions on international investments, capital can move in and out of a country without any restrictions. Hence, based on capital movement a country reserve situation may vary sporadically and further will have a direct correlation (+ or -) to the exchange rate.

An independent monetary policy within the country

This is where a country will try to stimulate the economy by lowering the interest rates in the country. It will make credit cheaper, prompting more consumption and investment within the country. But a lower interest rate will have a negative correlation to attracting foreign investments to the bond markets and put more pressure on reserves due to excessive demand and imports. If the rate is made too high, still the country will experience a higher inflation in return will impact the exchange rate. Investments will look at the “real interest rate” in its decision to move capital for investments. Interest rate is determined by a country in relation to inflation status and comparison to the reserve currency to attract investments whilst maintaining the exchange rate stable.

Most of the countries have their country strategy to compete in the world market by mixing the right proportion of the above three strategies. It is similar to tuning a sounds equaliser to the liking of the listener. If we dissect that, the listener is the nation, equaliser is the strategies spoken above, tuning is done by the authorities/regulator of a country.

Let’s look at this from Sri Lankan economy point of view.

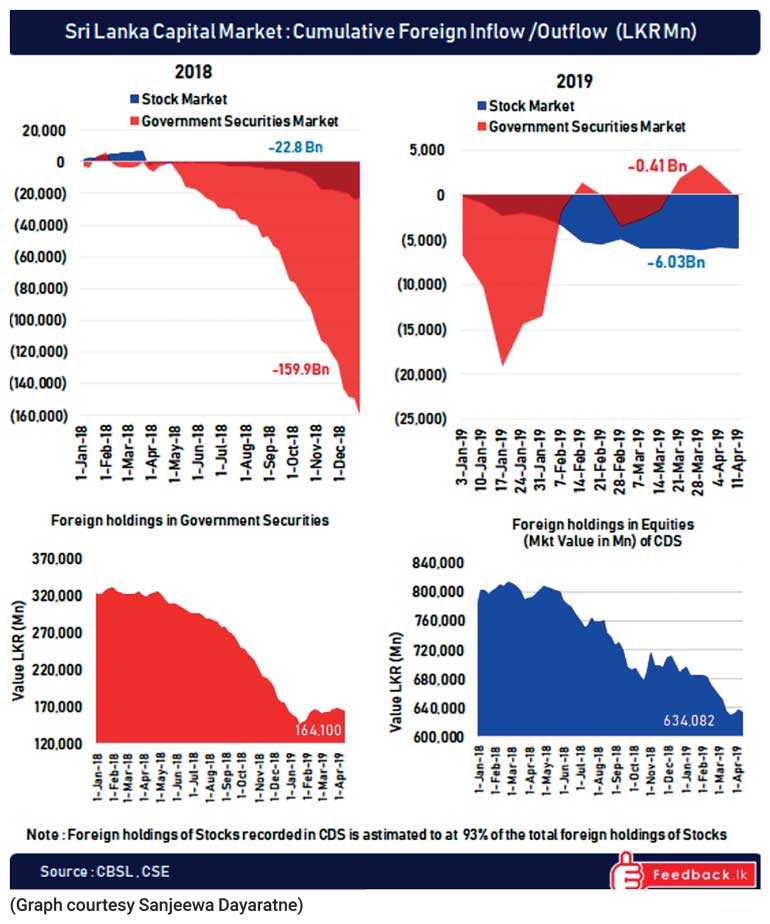

We have seen two unusual spurts in exchange rate depreciation once in the year 2012 (after many years of trying to peg the currency to show economic growth) with the budget proposal to devalue the currency by 3% overnight resulting in 12% depreciation in that year, thereafter the year 2018 52-day saga, bad communication of the debt repayment and forex traders making a quick buck out of the situation resulting over 19% depreciation (153.5 in Jan 2018 to 183 in Dec 2018, source https://www.bloomberg.com/quote/USDLKR:CUR). These are all manmade issues which were never in the interest of the country but of petty party politics. Sri Lanka lacks real FDI; instead what the country attracted was hot money to bond and equity markets. As per the graphs, the country vulnerability in terms of investments by foreigners in Sri Lanka is quite visible. So-called FDIs to Hambantota Port or roads and railroads of that nature from China came with conditions that the contractor must be a Chinese entity, consultants are from China, even those who worked on sites were Chinese. What does it mean? The loan given or the capital inflow goes back to China. How will the reserves improve with FDIs of this nature? We need real FDIs for increasing manufacturing capabilities and to reap benefits at the trade account level.

Here comes the funniest part of Sri Lanka; all parties are requesting lower interest rates. But the inherent issues of Sri Lanka interest rate determinants has not been addressed.

Lending Rate = Cost of funds + Operation Costs + TAXES + B&D Provisions + Inflation + Risk Margin + Profit Margin (etc.)

Direct benefits to the economy through reduced interest rates will be immediate as follows (subject to country reserve situation):

As shown above, Sri Lanka has failed to capitalise on the right blend strategies of “unholy trinity” or in whichever combination and failed to tune the equaliser with the right policies. It is Sri Lanka which has failed, not that the world is treating us bad.

In conclusion, my humble request to all politicians, authorities, regulators, professional bodies and chambers of commerce is to come together as one body/nation to draw up a strategy for Sri Lanka to compete in the world market. No matter what party is in power, the National Strategy must continue.

My message to the reader is, do not tolerate petty party politics at the expense of national interest, we have bigger issues in hand. The good news is that all issues can be managed with right strategies embraced and commitment to implement.

[The writer can be contacted through email [email protected]. He is the Principal Consultant of JKSE Consultants Ltd., a boutique consultancy firm to scale up or sustain or revive ailing businesses. He holds MSc in IT and Strategic Innovation from Kingston University UK, Fellow member of CIMA, UK and the Bankers Institute Sri Lanka. Obtained his MBA from University of Colombo (special marketing). Holds Certificate in Capital Markets (FA-SEC), GSLID and Chartered Global Management Accountant.]