Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 3 December 2024 00:03 - - {{hitsCtrl.values.hits}}

This is the first time in the history of our legislature since the days of the first State Council of 1931 that a VOA will be proposed on the basis of a law passed by the Parliament. The recently enacted Public Financial Management Act No. 44 effective on 8 August 2024 has built in provisions for the submission of a VOA to the Parliament. Hence the examination of the background and procedure with respect to VOA is important and timely. A major legal deficiency that had been in existence for decades with respect to submission of VOA was circumvented by a law passed by the Parliament in 2024

Introduction

President and Finance Minister Anura Kumara Dissanayake has informed publicly that a Vote on Account (VOA) for the first few months in to 2025 will be submitted to the Parliament for approval prior to the annual Budget being presented for the year 2025. This is the first time in the history of our legislature since the days of the first State Council of 1931 that a VOA will be proposed on the basis of a law passed by the Parliament. The recently enacted Public Financial Management Act No. 44 effective on 8 August 2024 has built in provisions for the submission of a VOA to the Parliament. Hence the examination of the background and procedure with respect to VOA is important and timely.

President and Finance Minister Anura Kumara Dissanayake has informed publicly that a Vote on Account (VOA) for the first few months in to 2025 will be submitted to the Parliament for approval prior to the annual Budget being presented for the year 2025. This is the first time in the history of our legislature since the days of the first State Council of 1931 that a VOA will be proposed on the basis of a law passed by the Parliament. The recently enacted Public Financial Management Act No. 44 effective on 8 August 2024 has built in provisions for the submission of a VOA to the Parliament. Hence the examination of the background and procedure with respect to VOA is important and timely.

Government’s revenue collection, expenditure and borrowings being carried out by various officials of the executive are based on the approval of the legislature. The executive (Government) cannot spend as it wishes without the approval of the legislature, the Parliament of Sri Lanka. In any representative democracy, the legislature is entrusted with controlling public finance and accordingly drawing money from the Consolidated Fund (CF) is strictly subjected to the approval of the legislature.

In this regard, there are two key principles that ensure the accountability at the core of the democratic system: (a) raising revenue and spending requires prior approval (b) overseeing of public spending. The Executive cannot raise or spend a cent of public money without the prior approval of the legislature. Thus, both the policies associated with the expenditure of public funds, and the plans and laws for imposing the taxes through which those monies are raised, must first be approved by the Parliament. So are the borrowings to bridge the revenue-expenditure deficit which also require prior approval of the Parliament. For raising revenue through taxes, fees, levies, charges, etc., the executive seeks prior approval from the Parliament whenever it feels required or the circumstances warranted. On the contrary, there is a principal method by which the approval of the legislature is obtained for expenditure: Annual Appropriation Bill.

Hence the rule is that the Government cannot spend as it desires. Even though the Government collects money from the public by means of various taxes, fees, levies, charges etc., for the expenditure of the same, it needs approval from the appropriate authority (i.e. the legislature). Simply the executive (Government) needs the approval of the legislature (Parliament) for spending. Further the supervision including scrutiny of the public spending is also entrusted with the legislature being part of the responsibilities associated with controlling public finance.

Besides the annual Appropriation Bill, there is yet another method being used by the executive to obtain approval for expenditure and to raise borrowing applicable for a short period in a fiscal year in Sri Lanka, which is known as the Vote on Account. It should also be noted that there are other forms of Budgets such as interim Budget, supplementary Budget being used in some countries, depending on the requirements, circumstances, laws and conventions as appropriate. Occasionally, Sri Lanka too used to present supplementary estimates of expenditure, not a Budget, to the Parliament for approval to meet the unexpected rise in expenditure during the fiscal year itself, which is the calendar year in Sri Lanka.

What is a Vote on Account?

Vote on Account (VOA) is a practice found largely within the countries in the British Commonwealth being a short-term arrangement in absence of an annual Budget enabling the Government to incur expenditure for a short period for the maintenance of Government services. VOA is the special provision given to the Government to obtain the approval of the Parliament to withdraw money when the annual Budget (Appropriation Bill) for the new fiscal year has not been passed. The annual Budget is, in general, a statement of the financial position of the Government for a definite period of time (i.e. a year) based on estimates of expenditures during the period and proposals for financing them.

An annual Budget thus spells out both the way in which the money is to be spent and how it is to be raised. Simply, the approval given by the Parliament to withdraw a certain sum of money from the Consolidated Fund of Sri Lanka for a specific period could be called VOA. Since the Parliament is not able to approve the entire Budget for the year before the beginning of the new fiscal year, the necessity arises to keep enough finance at the disposal of the Government. A special practice is, therefore, made for “Vote on Account” by which the Government obtains the approval of the Parliament for a sum sufficient to incur expenditure on various items for a part of the year. This enables the Government to fund its expenses for a short period of time or until an annual Budget (full Budget) is passed.

By convention, a VOA is treated as a formal matter and passed by Parliament without a lengthy discussion. Though VOA is a temporary measure, it does need the approval of the Parliament. Ministries and departments can utilise the funds available for non-plan expenditure which includes payments of salaries to Government employees, loan interest payments, subsidies, pension payments, based on the VOA.

Nature and circumstances of VOA

VOA represents the expenditure side of the Government’s Budget, i.e. the Government gives the estimate of the funds required during the period stipulated in a VOA. It is generally for 3-4 month in practice, and the Government expects, however, an annual Budget (full Budget) to be presented for approval of the Parliament after the specific circumstances (say elections) are over. The expenditure proposed to be incurred under VOA will, however, be absorbed into the annual Budget being presented subsequently for the relevant fiscal year. Sri Lanka’s VOA, besides having the details of expenditure, seeks approval for raising borrowing as well, as the country has historically been running deficits in its fiscal accounts. Besides, the approval for a VOA takes the forms of a resolution not as a bill to be enacted by the Parliament.

Constitutional and legal provisions

In its Articles from 148 through 152 of Chapter XVII of the Constitution of the Democratic Socialist Republic of Sri Lanka of 1978, provides the constitutional basis for managing country’s public finance: revenue, Consolidated Fund (CF), withdrawal of funds from the Consolidated Fund, Contingencies Fund, and procedure for presenting to the Parliament of revenue related bills or motions. Besides, Articles 153 and 154 in the same Chapter deals with the auditing arrangements. Article 148 of the Constitution being the overarching and principal provision says that “Parliament shall have full control over public finance.” Sub Articles (1), (2), (3) and (4) of Article 150 deals with procedures to be adhered to in withdrawing from the Consolidated Fund. These fiscal related constitutional provisions are very much in common in many representative democracies.

Although Sub Article (3) of Article 150 has references only to an annual Appropriation Bill, there is no mention about a VOA or any other form of expenditure or Budgeting arrangement. But in some countries like India which follows the British Commonwealth practices, has built provisions for VOA into the Constitution itself. Parliamentary approval is usually meant by the annual Appropriation Act, although other relevant legislation and procedures also provide legal foundations for Government expenditure. The meaning of the parliamentary full control over the public finance also refers to the fact that the legislature must have the power to oversee public spending, and to permit that the executive adheres to the taxation and expenditure plans that the legislature has approved.

However, during an election year, the ruling Government generally opts for a VOA instead of an annual Budget based on an Appropriate Bill. While technically in those circumstances, it is not mandatory for the Government to present a VOA, but it would be inappropriate to impose policies that may or may not be acceptable to the incoming Government taking over in the same year or immediately following the election. VOA also is also a mechanism which prevents the situation where the newly formed Government after the elections, is burdened by the previous Government’s Budgetary allocations. Is it mandatory for the Government to present VOA instead of an annual Budget in an election year? It is not mandatory for the Government to present a VOA in an election year.

Though the convention is to go through an interim arrangement and ensure the funds required for spending via the VOA route, the Government (if it wishes so) can even go for an annual Budget and get the appropriation bills passed to warrant the finances. However, during an election year, the ruling Government generally opts for an alternative short-term arrangement like VOA instead of an annual Budget, as it would be inappropriate to impose policies that may or may not be acceptable to the incoming Government taking over in the same year.

Although specific provisions have not been made in the Sri Lanka’s Constitution for the presentation of a VOA, the legislation titled Public Financial Management Act No. 44 passed in August 2024 has integrated provisions for allowing the presentation of a VOA. Section 23 of the said Act says that:

“23. (1) In the event the Appropriation Bill for the succeeding year is not approved by Parliament by thirty first day of December of the current year, the Minister of Finance shall submit a vote on account to Parliament, under which the Parliament shall allocate funds for ongoing projects and continuously provide specified public services which need to be maintained.

(2) The period for which expenditure is allocated under the vote on account shall not exceed four months and shall be followed by the adoption of the Appropriation Act integrating the expenditure of the vote on account.”

As per the said provisions, VOA based expenditure cannot be incurred beyond 4 months. This expenditure should be made for the continuation of the ongoing projects and for the maintenance of specified public services. Further, the provision specifies that the VOA should be submitted to the Parliament by the Minister of Finance.

Difference between Annual Budget and VOA

Annual Budget (full Budget) deals with both expenditure and revenue sides but VOA deals only with the expenditure side of the Government’s annual Budget.

VOA is normally valid for a few months, but an annual Budget is valid for 12 months (a fiscal year).

By convention, a VOA is treated as a formal matter and passed by the Parliament without a lengthy discussion. Even if there are discussions, it is confined to a day or two. But approval for an annual Budget (Appropriation Bill) happens only after lengthy discussions and voting on demand.

VOA cannot alter taxes or revenue measures since they need to be passed through a revenue bill as appropriate. Under the regular annual Budget, fresh taxes or revenue measures may be imposed, and old ones may be discontinued.

Past practices

Provisions with respect to VOA have not been built into any of the constitutions in operation since 1931 till today: the Donoughmore Constitution 1931-47, Soulbury Constitution 1948-71; first Republican Constitution 1972-1977; and the second Republican Constitution of 1978. Although there are no specific provisions in the constitutions of Sri Lanka on VOA, Sri Lanka from the days of State Council beginning in 1931 has had many VOAs passed by the legislature. VOA is a list of expenditures prepared by the General Treasury for a specific period, approved by the Cabinet of Ministers before being submitted to the Parliament. It is submitted, as a resolution through the usual process by the Minister in charge of the subject of Finance for the approval of the Parliament.

It was not debated as in the case of an annual Budget (Appropriation Bill) and if there was no consensus it was put to vote. This process must be completed before incurring expenditure by the executive branch of the Government. The practice was such that VOA did not have a specific period, but it was for a part of the fiscal year. When the annual Budget was presented for the relevant fiscal year, those expenditure related VOA was absorbed into the annual Budget.

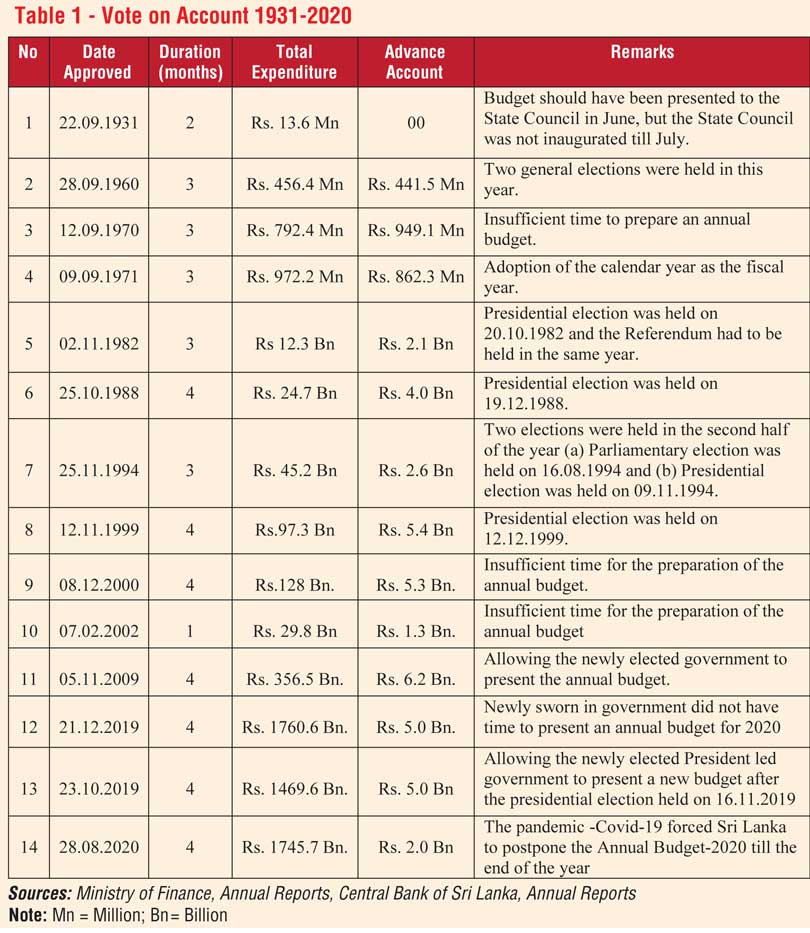

Table 1 illustrates how Sri Lanka has been following the VOA route under specific circumstances to obtain legislative approval for expenditure over the last nine decades.

Since 1931, there have been 14 VOAs approved by the legislature during the last nine decades until 2020. VOAs have been more frequent in the recent decades particularly since the 1970s. Due to deficit financing arrangements, a borrowing limit was also made a part of the VOA-based expenditure. In general, VOA has been approved for up to 4 months. Besides, the expenditure associated with the advance account is also part of the VOA process.

Conclusion

Vote on Account is a short-term fiscal arrangement, until an annual Budget is approved by the Parliament. This affords the legal basis for the executive to incur expenditure for a short period in fiscal year for the maintenance of the Government services in absence of an annual Budget. By convention, it had been submitted to the legislature as a resolution. VOA based expenditure, a kind of an advance, is absorbed into the annual Appropriation Bill, when it is presented for the approval of the Parliament. Though there are no constitutional provisions, VOA by convention has been presented as a resolution to be passed by the Parliament until 2020 going by the British Commonwealth practices.

VOA has been frequently used since the 1970s in Sri Lanka. In practice mostly due to elections, making it inappropriate to present an annual Budget, VOA route is used to obtain necessary legal backing to incur public spending. A major legal deficiency that had been in existence for decades with respect to submission of VOA was circumvented by a law passed by the Parliament in 2024.

(The author, a retired public servant can be reached at [email protected].)