Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 11 April 2022 01:20 - - {{hitsCtrl.values.hits}}

At last, the Central Bank gets a true Governor

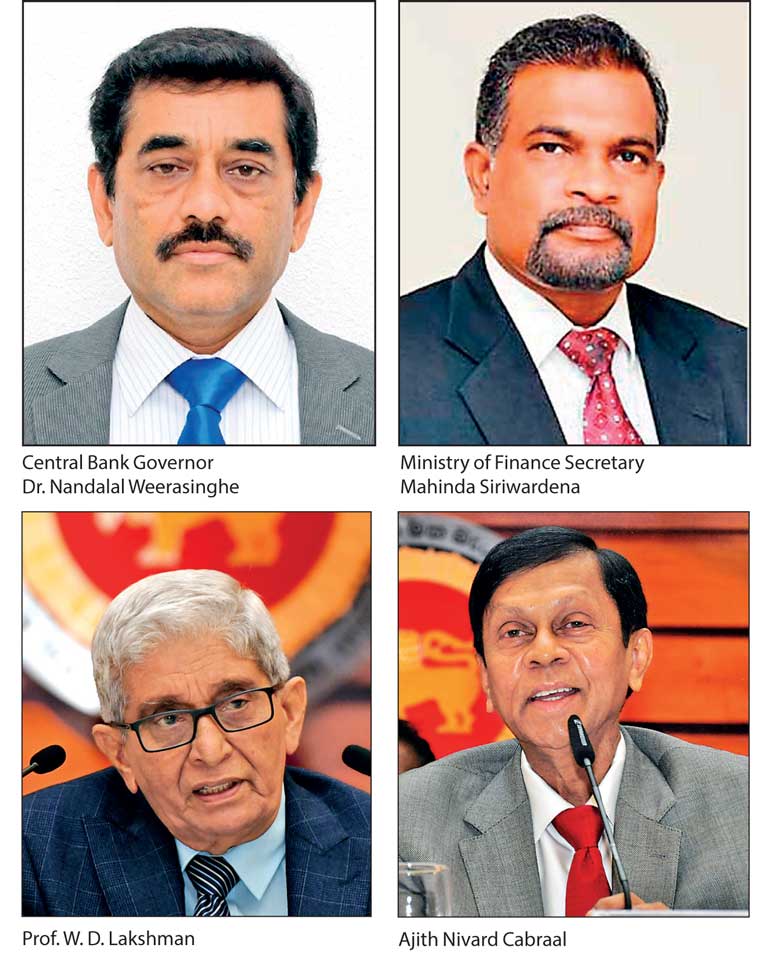

My former colleague Dr. Nandalal Weerasinghe, fondly known as Nandalal, should be commended for coming forward to take the baton of the Central Bank at a time when the country’s social, political, and economic fabric is in utter chaos unprecedented in the whole of Sri Lanka’s post-independence history. Along with him, another former colleague of mine, Mahinda Siriwardena, who is presently a Deputy Governor of the Central Bank assumed duties as the Secretary to Ministry of Finance.

forward to take the baton of the Central Bank at a time when the country’s social, political, and economic fabric is in utter chaos unprecedented in the whole of Sri Lanka’s post-independence history. Along with him, another former colleague of mine, Mahinda Siriwardena, who is presently a Deputy Governor of the Central Bank assumed duties as the Secretary to Ministry of Finance.

Both will serve on the Monetary Board, Nandalal as its Chairman, and Mahinda as the Official Member deciding on the fate of the rupee that we hold. At the first Monetary Board meeting he chaired last Friday, Nandalal has shown that he is serious about his job. The policy interest rates of the Central Bank around which all other interest rates are revolving were increased by a mega 7% to 13.5% and 14.5% to tame the inflation rate rising at 19% officially but close to 70% according to independent economists and crush the black market for US dollars. With this shock treatment, the market will begin to have confidence in the policies of the Central Bank and the results will be shown shortly.

This is a salutary development. But given the seriousness of the problem, Nandalal cannot be expected to do miracles and resolve the issues overnight. He should be given time and the nation should give him support to continue his work without fear or favour.

Monetary Board cannot wash off hands

Ordinary people know only the nation-wide economic catastrophe. But inside the Central Bank, the situation is much worse as the Bank’s Executive Officers’ Association had warned the Monetary Board, the body responsible for orderly monetary management of the country, in their official bulletin recently. It had blamed the Monetary Board for failing to listen to the wise counsel given by its membership in numerous fora and papers submitted to it. What this means is that the professional economists and other technocrats in the Bank had seen the deteriorating situation and alerted the Board in time that it must change its course. Hence, in my view, my former colleagues now holding high positions in the Bank are not responsible for the current malaise. It is the Monetary Boards led by two Governors, W.D. Lakshman and Ajith Nivard Cabraal, which should take the blame.

Alarming situ within Central Bank

What is this alarming situ that is burning within the Bank which is not known to the public and the political leadership of the country? The general public could be excused because they have a low central banking literacy. The political leadership will know of it if and only if it is being apprised. Who should apprise them? The Monetary Board which should be made up of people who should be aware of their role as the defender and protector of the currency issued by the Central Bank on its behalf should apprise them. If the leadership is not willing to listen, as the first Sri Lankan Governor the late N.U. Jayawardena had remarked, it should continue to nag leaders until its wise counsel is driven home. Hence, the Board cannot just wash off its hands that it gave this advice, but the political leadership did not listen.

the first Sri Lankan Governor the late N.U. Jayawardena had remarked, it should continue to nag leaders until its wise counsel is driven home. Hence, the Board cannot just wash off its hands that it gave this advice, but the political leadership did not listen.

The disastrous Lakshman Shock

The Central Bank had a comfortable foreign reserve of $ 7.6 billion in December 2019 when W.D. Lakshman became the Governor of the Bank. In his first address, he thanked, among others, President’s Secretary Dr. P.B. Jayasundera, for appointing him to that post. When he said so, the market immediately knew that his loyalty was to some outside party and not to the Bank or its statute, the Monetary Law Act. Then, under his management, the Monetary Board sold in February 2020, 13 tons out of the 19-ton gold reserves. This was a time when other central banks were buying gold and not selling.

When I pointed this out, the Bank explained that it was done as a part of its ‘portfolio readjustment’, a strategy involving the reduction of low-earning gold and increasing high-earning securities. Unfortunately for the Monetary Board, gold prices began to rise immediately after this disposal, and, hence, the Bank could not replenish its gold reserves. With further sales of gold in December 2021 and January and March 2022, the remaining gold balance is now about half a ton valued at $ 29 million placing Sri Lanka in a critically risky situation.

The result was the sudden fall in the market prices of Sri Lanka’s international sovereign bonds or ISBs pushing up the yield rates and the downgrading of Sri Lanka’s sovereign borrowings by all the three rating agencies. This closed the door for Sri Lanka to tap this market. With no new market borrowings, the country’s foreign reserves began to deplete, and the usable reserve level now stands below $ 200 million.

The worst development was the conversion of Central Bank’s net foreign reserves to a negative position indicating its foreign borrowings are much more than its assets from May 2021. That negative position is increasing month after month. At end 2021, it amounted to $ 1.9 billion. By January 2022, it had jumped to $ 3.2 billion and by end- February to $ 3.6 billion. It is therefore rising like the falling rupee month after month. This is a dangerous red light that cannot be overlooked.

February to $ 3.6 billion. It is therefore rising like the falling rupee month after month. This is a dangerous red light that cannot be overlooked.

Economic crisis has deep roots

The current economic crisis has its roots in the ‘domestic economy-based economic policy’ adopted by Mahinda Rajapaksa administration from around 2005. I highlighted the fallacy of this policy in an article in June 2012 (available at: https://www.colombotelegraph.com/index.php/domesticating-economic-growth-can-the-puny-middle-class-make-it-sustainable/). The Yahapalana Government that came to power in 2015 vowed to change it but did nothing to attain its goal. As a result, exports fell continuously as a ratio of Gross Domestic Product or GDP from 26% in 2005, to 15% in 2010, and 12% in 2019.

Because of the outbreak of the COVID-19 pandemic in early 2020, exports fell but since GDP also fell, the ratio remained at this level in 2020. This was the source of the external sector crisis in Sri Lanka. Since the domestic economy could not provide the needed scales of operation, growth began to fall and by 2019, it had fallen to 2.3% from the high above 9% in 2012. With the pandemic hitting the economy, growth was negative by 3.6% in 2020. It slightly recovered to 3.7% in 2021 indicating a near zero average growth rate during 2020 and 2021.

Government disabling itself by offering unsolicited tax cuts

The crisis aggravated due to several policy errors made by the Gotabaya Rajapaksa administration. First, it offered an unsolicited attractive tax concession to both income and value added tax payers apparently in a bid to stimulate the economy by increasing the aggregate demand from the public’s side and aggregate supply from the side of the businessmen.

When this was announced, I warned President Gotabaya Rajapaksa in December 2019 that it would not work in Sri Lanka because of the structural problems in the economy and it would cause the Government to lose revenue, estimated at that time at Rs. 600 billion, restricting Government’s capacity to run the country (available at: https://www.ft.lk/columns/Tax-cuts-Control-the-damage-before-the-unconventional-stimulus-backfires/4-691207).

This was not heeded to and the outcome was the revenue loss of about Rs. 1,000 billion in both 2020 and 2021 accounting for about 4% of GDP in each year. Unfortunately for the Government, this loss is continuing into its future revenue as well. In the meantime, the Government expenditure ballooned due to the extra expenditure it had to incur due to the unexpected outbreak of the COVID-19 pandemic. Consequently, the budget deficit rose to a historical high level of above 11% making the entire fiscal sector fragile. This alarming situation has been noted by IMF as presented in its staff report on Article IV consultations.

future revenue as well. In the meantime, the Government expenditure ballooned due to the extra expenditure it had to incur due to the unexpected outbreak of the COVID-19 pandemic. Consequently, the budget deficit rose to a historical high level of above 11% making the entire fiscal sector fragile. This alarming situation has been noted by IMF as presented in its staff report on Article IV consultations.

The report says that Sri Lanka should increase income and value added taxes to consolidate the budget and warned against relying on non-quality and unsustainable revenue measures. The point here is that Sri Lanka should go to the tax system that prevailed before 2019 and desist from resorting to taxes like the selective surcharge tax just approved by Parliament. In my view, going against the counsel of IMF will be a crucial issue when Nandalal-Mahinda duo will start negotiations with the Fund for a loan facility.

Insane drive for organic

The second policy error was the attempt at converting Sri Lanka’s agriculture to organic farming overnight, again with the objective of providing a toxin free food to Sri Lankans. To go organic, the importation of chemical fertilisers and pesticides was banned. This was against the wise counsel of the scientific community in Sri Lanka. The result was the drastic drop in food production making farmers poorer. Though the ban was removed in November 2021, the damage has already been done. Fertilisers are coming to Sri Lanka now, but the prices at about Rs. 42,000 in the case of a 50 kg bag of urea are unaffordable.

That is because the importers who import these fertilisers after obtaining six months’ suppliers’ credit as directed by the Central Bank are unsure about the rate at which they should settle their bills. Every day when the official exchange rate falls, the benchmark rate used for pricing the imported products also move up. The private sector cannot be blamed for adopting this pricing policy because there is uncertainty about the movement of the currency. This is a crucial challenge faced by Nandalal today.

Keeping IMF out

The third error was the refusal to go to IMF and the continuation of the artificial exchange rate at Rs. 200 per dollar without foreign exchange reserves to support it. This led to drying up of foreign exchange in the formal financial institutions which in turn led to the development of a lucrative black market for dollars. Under normal circumstances, the premium in the black market is about Rs. 1-2 over the official rate. However, in the present case, the premium increased to Rs. 50-60 showing that black market is more reliable than the official market. The way to eliminate the black market was to allow the rupee to depreciate gradually and seek IMF support as a backing for the flexible exchange rate.

circumstances, the premium in the black market is about Rs. 1-2 over the official rate. However, in the present case, the premium increased to Rs. 50-60 showing that black market is more reliable than the official market. The way to eliminate the black market was to allow the rupee to depreciate gradually and seek IMF support as a backing for the flexible exchange rate.

Neither was done and the result was the fall in the immediately usable foreign reserves drastically to a level of about $ 400 million as at end February 2022. At this level, the Central Bank had to give up its tight grip on the rupee in the first week of March. The rupee fell initially to 230 per dollar and then continued its downward journey without brakes because of the low interest rates introduced by the Bank and the non-availability of back-up support from IMF. This is now Rs. 320 per dollar and it is still falling.

With these deficiencies in policy, the black market further flourished maintaining the same premium over the official exchange rate. The recent mega increase in the interest rates will serve as a disincentive to keep foreign exchange out and bring back to the country. That way, the black market for dollars can be gradually eliminated.

Continuing with expanding the money stock, mother of all economic crises

The fourth error is the fatal error committed by Governor Lakshman first and then continued by Governor Cabraal. That was to allow the money stock to increase unprecedentedly by Rs. 3 trillion or 40% during the 25-month period from December 2019. Because of the drop in revenue, the Government was compelled to borrow from the Central Bank and commercial banks huge amounts. The total such borrowing during the same period amounted to Rs. 4.2 billion, an increase of 173%.

Both Lakshman and Cabraal maintained that money does not affect inflation and hence, the currency depreciation. The folly of their belief is now proven with inflation rising at 19% officially and close to 70% according to independent trackers like Steve Hanke of the Johns Hopkins University. The rupee dollar rate is falling freely without a control. Nandalal, with support from Mahinda, will have to put a stop to this soon.

The ignored advice by Cabraal

When Cabraal became Governor, an economic analysts asked me what advice I may wish to offer him. I said that I have four pieces of advice (available at: https://twitter.com/waw1949/status/1510901533340499973?s=21). First, he should remove Lakshman shock of keeping the rupee-dollar rate at 203 and 100% margin requirement on imports. Second, he should function as the Governor of the nation’s central bank and not that of Gotabaya Rajapaksa. Third, he should immediately advise the Government that it should go back to the tax system that had prevailed prior to 2019. Fourth, he should make an announcement that Sri Lanka would seek IMF assistance to get out of the present balance of payments crisis. Had he listened to this, Cabraal would still have remained the Governor of the Bank.

Nandalal is now up to his job

At the very first press briefing, Nandalal has reversed the trend. He was consistent, frank, and firm. Since the blood of the Central Bank is running through his veins, he knows the value of the independence of the Central Bank. He did not say that he was appointed by the Government. Instead, he said that he has the blessings of the all the political parties implying that he is heading not Gota’s Central Bank but the nation’s Central Bank. Gota may be the authority on the general administration of the country. But with respect to monetary policy and the accomplishment of the mission of the Central Bank, he said firmly that he is the number one in the country.

This is a very rare occasion where a Governor of the Central Bank speaking as the Governor. With that I am sure that he is getting the blessings of all Sri Lankans. With such blessings, a politician will think twice before trying to intervene in the work of the Central Bank. There was a new central banking bill giving additional independence to the Central Bank drafted by a committee headed by Nandalal when he was in the Bank previously.

The previous Yahapalana Government, with the blessings of the late Mangala Samaraweera and the present parliamentarians Eran Wickramaratne and Harsha de Silva, had agreed to enact it in Parliament, and it had even been gazetted as a bill. But for obvious reasons, Gotabaya administration shelved it. Nandalal’s mission of making the Central Bank independent will be complete if he could get the support of all the political parties to enact it. The present crisis is a good opportunity for doing it because countries have gone for such drastic reforms when they had been hit by uncontrollable crises.

Both Nandalal and Mahinda have Herculean tasks ahead. Nandalal should take bold decisions to tame inflation and eliminate the black market. Mahinda should fill the Treasury with funds that do not contribute to inflation and currency depreciation. These are tasks to be accomplished by working together and not fighting with each other. It is a challenge difficult but not impossible. The nation expects them to stand up to this challenge.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)