Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 9 December 2022 00:00 - - {{hitsCtrl.values.hits}}

|

Corruption in Sri Lanka is considered a national malady, which has been the root cause for high inequality and disparity in income, increased poverty and low growth rate. Though successive governments have pledged to eradicate this menace, it has been an impossible task to arrest malady due to the prevalence of the corruption culture backed by powerful politicians, bureaucrats and business tycoons.

Could you just imagine that the two former Presidents, Mahinda Rajapaksa and Maithripala Sirisena had deployed a personal staff of 2,578 and 1,300 respectively at a staggering cost of Rs. 630 million and 850 million during their tenure? This does not include the cost of the police and service personnel released to the Presidential Secretariat. Even the White House or for that matter Buckingham Palace would not have employed a huge contingent. Surely, somebody would have had siphoned and pocketed out massive amounts very systematically.

Pathetically, Sri Lanka is ranked today in the 102 position among 180 countries in the corruption index. The Commission of Allegations and Bribery and Corruption (CIABOC) became a toothless tiger and its mismanagement, lethargic and inefficient approach compounded the situation. Lack of good governance and absence of whistleblowing (WB) protection had negative impacts on citizens’ willingness to stand up against corruption.

Hopefully, the proposed anti-corruption bill (ACB) approved by the Cabinet of Ministers last week in line with the United Nations Convention could be the final nail in the coffin to drive this menace from the Sri Lankan soil. The legislative provision contained in the ACB for the protection of whistleblowers to respond to corrupt dealings without retaliation is one of the significant features. The birth of this bill which marks the International Day on 8 December 2022 with the theme being “Your right, your role; say no to bribery and corruption” is a powerful message the Government intends sending across the board.

To achieve this mission, a plethora of new policies, systems, measures and institutions are expected to be in place, replacing the present Commission namely CIABOC, which was found to be a highly ineffective, lethargic and inefficient institution which in its totality failed to live up to the expectations of the people at large.

Rationale for WB

Experience has demonstrated that especially employees in any organisations are well-aware of the degree and scale of corruption of the organisation in which they are employed but they are compelled not to divulge those illegal and unethical activities due to the fear of reprisals. There has been a long-felt need to provide adequate protection to whistleblowers so that they would inspire to blow the whistle at the first opportunity enabling the Government, its agencies to swiftly galvanise into action.

It is also widely believed that corruption, bribery, fraud or any other criminal activity especially occurs in the absence of transparency and accountability in the procedures within organisations both in the public and private sectors. Therefore, it is a matter for solace to bring in potential policy framework for whistleblower legislation even at this belated stage.

What is WB?

A whistleblower is a person who raises a concern about a wrongdoing occurring in an organisation or body of people. The exposed misconduct may be classified in many ways; for example, a violation of a law, rule, regulation and or a threat to public interest such as fraud, corruption, health and safety violations within the organisation or externally to regulators, law enforcement authorities or to media.

Corporate WB

In this age of globalisation where economic motives precede over all virtues and traditions; protection of large public interest from huge corporate scandals has become a matter of great importance. Corporate whistleblowing is considered as one of the best tools to ensure good corporate governance but the same is still in its infancy in Sri Lanka. In the case of corporate companies coming under the purview of the Security and Exchange Commission (SEC) and Colombo Exchange Commission (CEC), my inquiries reveal that there has not been a single company that has installed whistleblowing mechanism in the respective corporate entities.

Corporate governance

It must be stated here that the success of the corporate governance in any organisation mainly hinges on the effective implementation of five essential mechanisms such as independence of the board, role of the (internal and statutory) audit committees, whistleblowing mechanism, shareholder activisms and fast-track redressal forums. The corporate entities in the SEC should ensure that the above five mechanisms are in place, if they honestly believe in corporate governance. The mere installation of the WB procedure itself would not suffice to expect a sound corporate governance from the corporate sector as envisaged in the anti-corruption bill. Whistleblowing plays a crucial role in implementing corporate governance practices.

Ambiguities and inconsistencies of the bill

The proposed anti-corruption bill (ACB) appears to have several ambiguities, loopholes and inconsistencies from the eyes of the whistleblowers and these questionable provisions need to be straightened out in order to avoid any misinterpretations, when the enactment becomes a law. Hence, this article would be incomplete, if such loopholes and inconsistencies are not pinpointed at this juncture for the greater benefit of all the stakeholders.

Section 73 (1) – Protection of informers, whistleblowers, witnesses

It is commendable that Chapter V 9 section 73 (1) of the bill exclusively deals with the protection of the informers, whistleblowers and witnesses wherein it specifically says the names and the identity of the whistleblowers shall not be revealed and disclosed in any proceedings before any court, tribunal or other authority. To the extent of the protection of the confidentiality, this provision itself is not a mean achievement but it needs further elaboration. This provision appears to include the protection of informers and their identity prior to the happening of an unethical transaction and not after the offence has been committed. This ambiguity needs to be further clarified that the confidentiality of all the persons need to be safeguarded even after the investigations and trials have completed and convicts punished by the courts. Otherwise what will happen is that the informers would invariably become victims at the hands of the convicts and other interested parties.

Section 74 – Offences committed to be spelt out

The whistleblower discloses a complaint to the Commission and other authorities in the firm belief that he has reasonable grounds to disclose any wrongdoing and such misdeeds warrant an investigation and these whistleblowers shall incur no civil or criminal liability nor to adverse conditions of employment, reprisal. Coercion, threat, intimidation, retaliation or harassment as a result of such disclosure. Another distinctive feature in the Bill is that it has provisions under section 74 to deal with persons who make false or malicious allegations.

However, the bill is silent when a person contravenes subsection (4) shall be guilty of an offence and on conviction to a fine and imprisonment. The person who contravenes should realise the gravity of the offence committed and the due punishment before a complaint is made so that he would refrain from submitting frivolous/malicious allegations that cannot be substantiated to the authorities.

Section 76 (2) – Protection of witnesses and persons assisting the Commission

Another notable provision is that the Commission has inalienable responsibility for providing the personal protection to the whistleblowers and witnesses who assist the Commission in terms of section 76 through the Police or any public authority depending on the circumstances of the case. However, this sole intention of giving personal protection to whistleblowers and witnesses has been diluted by adding a clause under section 76 (2) “as far as reasonably possible”. It must be point blackly mentioned here that any directives issued by the Commission on the protection of the whistleblowers and witnesses must be mandatory and no escape route should be inserted such as “as far as reasonably possible”. Such a provision would render the whistleblowers and witnesses frustrated and the committed sprit with which they assist the Commission would be nullified with the inclusion of above clause.

Constitution and the integrity of the members of the Commission

In terms of section 4 of the Bill, the Commission shall consist of three members (1) A judge of the Court of Appeal or a judge of the High Court (b) An officer of the Attorney General’s Department not below the rank of deputy Solicitor General and a person qualified in the field of accounting, auditing, management or public administration.

It is hoped that the members to the Commission shall be appointed by the President on the recommendations of the Constitutional Council. A question can be raised regarding the suitability of an officer of the Attorney General’s Department on the ground of the independence of the Commission, which could cause conflicts of interest as the Attorney General is the chief legal advisor of the government.

Utmost care must be taken not to appoint retired government servants, as they could be henchman or chuckgolayas of the government in power. In the true sense of the word, members must be competent, efficient and honest of moral integrity and above suspicion like the proverbial Caesar’s wife.

It was toe-curling and disgusting to see that the Chairman of the Police Commission, a retired Inspector General chatting and mingling with the infamous Mr. 10% who ruined the Sri Lankan economy when he arrived to the country last week through the VIP lounge. Could such political sycophants with low mental status be the members of the Commission? Essentially, the constitutional Council has a herculean task not to appoint such square pegs in round holes to the Commission. Some of the members who served in the Commission stooped to such a low level enjoying all the perks and they were considered to be dregs selling their souls to their political masters, ignoring the onerous tasks they were expected to perform.

Section 93 – Acceptance of gratification

The above section – which empowers for a public officer to solicit or accept any gratifications which he is authorised by any written law or the term of his employment is in direct conflict with the sole of the objectives of the anti-corruption bill. This is an area where strict prohibition is needed and no public officers should be allowed to accept gratifications. This provision undoubtedly opens an escaping route for wealthy people to get away with ill-gotten moneys. Hence such exemptions and loopholes provide unfettered rights and opportunities to the influential people who are on the frontline of corrupt activities. Even if there is a written law allowing the acceptance of such gratification, the scale of corruption the country is wrapped with should not be allowed to continue unhindered.

Institution of whistleblowing mechanisms

Another major drawback in the anti-corruption bill is it has not spelt out the institution of whistleblowing mechanism in all public and private sector institutions so that employees blow the whistle on unethical transactions to the Chairman of the Audit Committees. Such a provision is a sine quo non in the face of the magnitude of the corrupt deals taking place at the institutional level.

|

Worst corporate accounting scandals and complicity of auditors

It is interesting to emphasise here that most notable accounting scandals running into billions of US dollars have taken place with the tacit complicity with the auditors. Ideally, we ought to have bribery commissioners, auditors, and audit committee chairmen of high moral integrity whose partiality and servility cannot be questioned on any grounds. They should possess an unblemished career track record to prove they cannot be bought over under any circumstances.

Now that the private sector has also been kept inside the operation of the anti-corruption bill, all external auditors have a bounden duty to carry out their fiduciary duties in keeping with the highest norms and accepted accounting standards. It is not a mean task which entails a highest order.

Empirical studies have shown how the external auditors who have earned a name in the industry indulged in questionable and dubious roles in complicity with the CEOs and ruined their professional careers and reputation. Security Exchange Commission (SEC) and Colombo Stock Exchange (CSE) should ensure that their audit committee chairmen play a pivotal role in keeping with the onerous obligations expected of them.

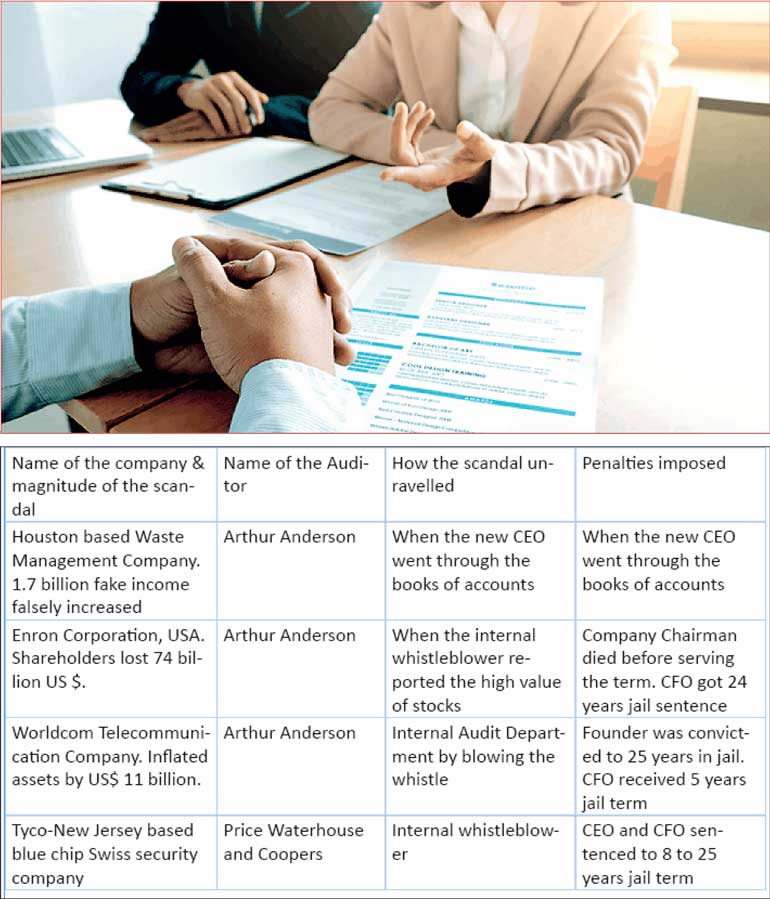

As seen in the given table, in developed countries, whistleblowers’ intervention have brought the desired results in the detection of mega corrupt deals unlike the developing countries like Sri Lanka.

It is in this backdrop; the desperate attempt of Thushan Gunawardana (TG), a former Executive Director of the Consumer Affairs Authority (CAA) to expose a garlic scandal to the tune of Rs. 23 million has to be viewed. The politicians and the bureaucrats harassed this whistleblower to the hilt compelling him to leave the CAA under frustration. Now Mr. TG can take an innocent solace that he would not be faced with similar harassments, once the proposed anti-corruption bill is enacted.

In a way Mr. TG should be happy that he is alive today considering the long battle he singularly fought with the authorities despite the enormous threats he received. In 2004, the killing of a whistleblower Satyendra Dubey, an engineer employed in the National Highways Authority of India led to the initial work on protecting whistleblowers. This engineer was killed after he wrote to the former Prime Minister A.B. Vijayapaee exposing corrupt practices in the construction of highways. The government issued a notification laying down certain guidelines for whistleblowing and protecting whistleblowers.

Revisit to the Fraud Survey 2011/12 by the KPMG Auditors

It would be a worthwhile exercise for the respective authorities to revisit the key findings of the fraud survey carried out by KPMG Auditors and satisfy themselves how far those recommendations have been put into practice during the last 10 years with a view to creating a corrupt-free corporate business environment in Sri Lanka by the public and the private sectors.

The six initiatives suggested were (a) Strengthening employee and 3rd party due diligence, (B) the implementation of a WB mechanism (both Internal & external), (c) the establishment of a framework for monitoring the corporate ethics, (d) Fraud awareness training, (e) Establishment of a dedicated and independent investigation unit lastly the introduction of a process specific fraud controls.

The latest initiative that has come from the civil society is the naming and shaming of the fraudsters, including that of directors, auditors, accountants and errant regulators. We would call upon the SEC and CSE to incorporate such provisions immediately, as the corruption of the private sector’s corrupt activities has risen to unprecedented levels.

CIABOC Vs. New anti-corruption commission

Having experienced the surreptitious manners in which the Commissioners beholden to the politicians released well-known crooks who stashed away millions of wealth, if not billions, a question arises whether a similar fate would befall once the new members are appointed to the proposed anti-corruption commission. A weekend English paper rightly raised this incontrovertible question. Will there be a distinctive turning point in our miserable history of bribery and corruption, once the proposed anti-corruption law comes into force in line with the UN Convention?

(The writer is a Productivity Specialist and Management Consultant. Any views of this article could be sent to this email: [email protected].)