Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 28 June 2023 00:35 - - {{hitsCtrl.values.hits}}

By Murtaza Jafferjee

By Murtaza Jafferjee

Government will most likely announce a Domestic Debt Restructuring on Wednesday. Declaring a bank holiday on Friday is the right thing to do because it gives time for market players to digest the ramifications.

It is likely it will be in the form of a swap of existing bonds for longer dated bonds (maturity extension) and a bond with a coupon computed based on med inflation rate + real rate + term spread.

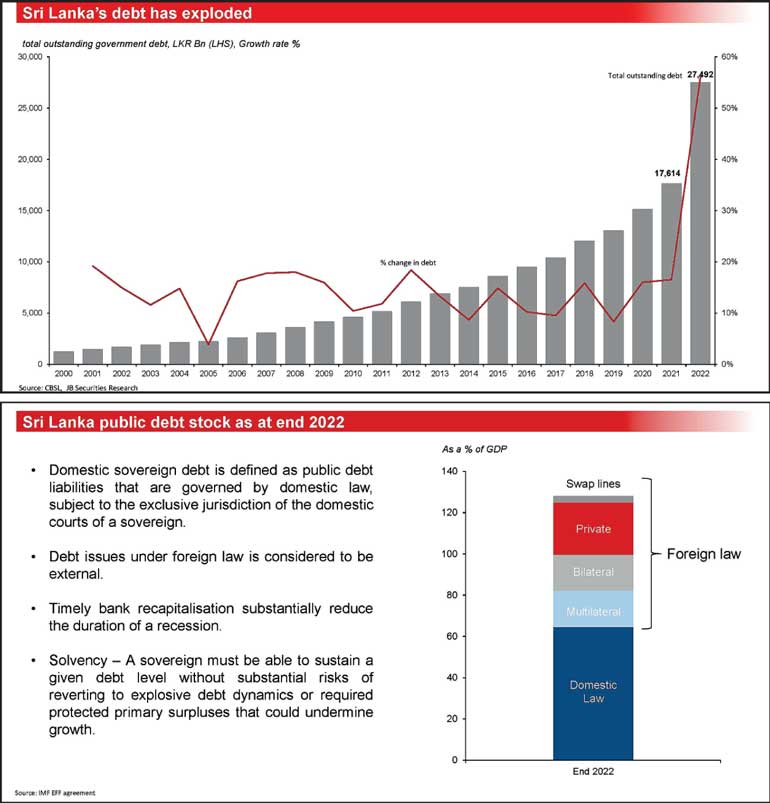

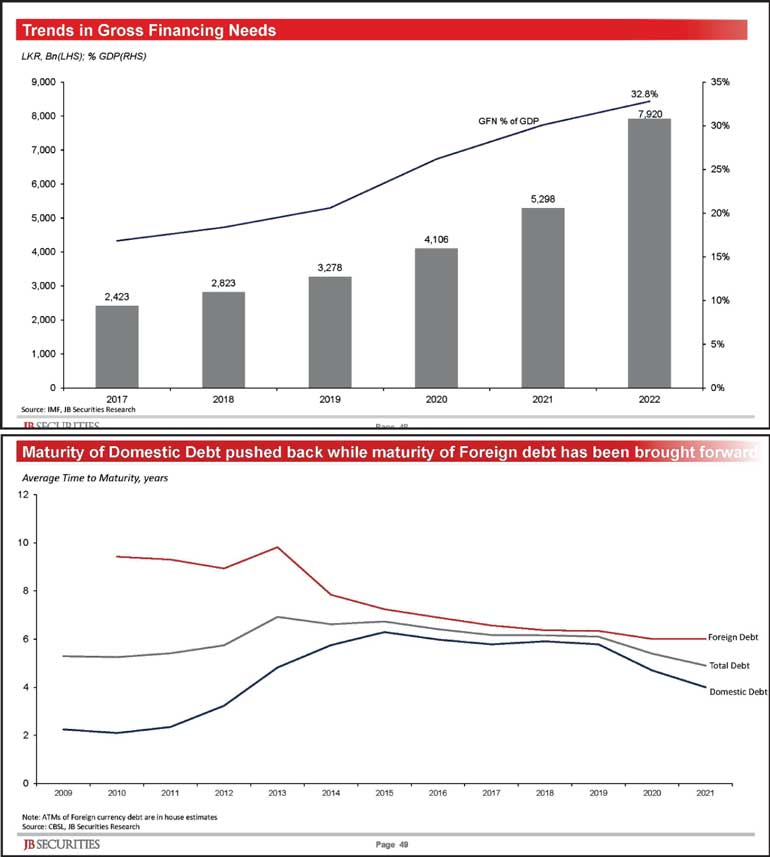

Let’s take a moment to reflect as to why a domestic debt restructuring is needed. We have three problems – stock (high debt to GDP), flow (high Gross Finance Needs (GFN)) and affordability (into GDP).

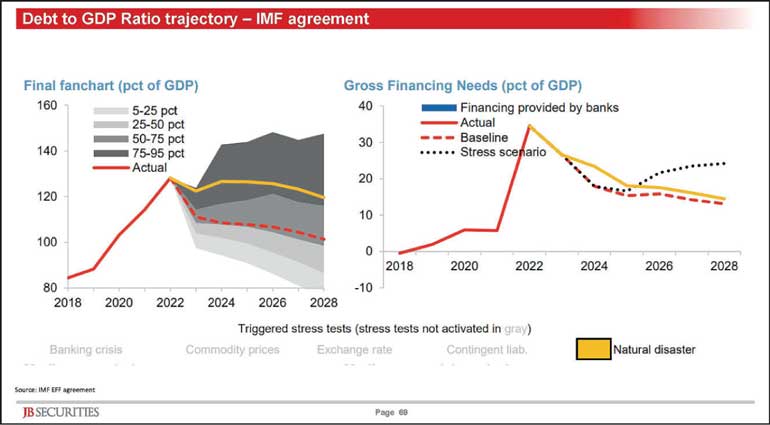

At the end of 2022 the IMF has calculated our public debt (central government + guaranteed SOE debt + CBSL liabilities) to be 128% of GDP. There is no magic red line but for a middle-income market access country like ours we should target below 60%.

GFN is high in 2022. There was a large primary deficit to fund and the average term to maturity (ATM) of the local debt has come down due to issuances of shorter dated securities.

GFN is high in 2022. There was a large primary deficit to fund and the average term to maturity (ATM) of the local debt has come down due to issuances of shorter dated securities.

ATM for bonds is 4.5 years, total DD is around 3 years due to T-bills.

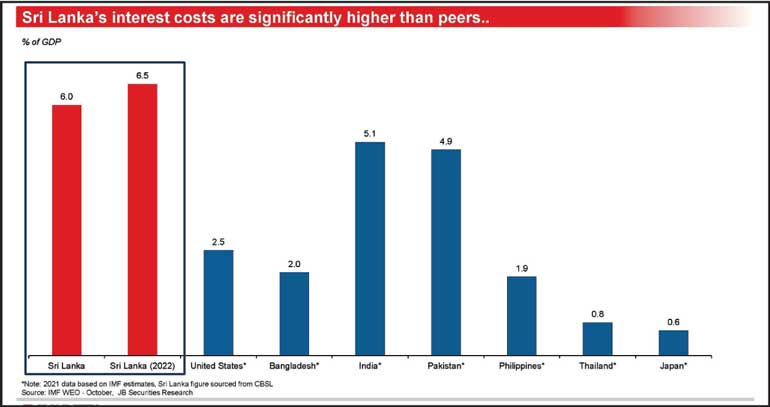

Interest to GDP is around 6.5% of GDP, one of the highest in the world. At the end of this year the LKR Domestic Debt will end up at around Rs. 15 trillion. At 10% interest this works out to Rs. 1.5 trillion. Foreign interest must be added.

If you injure your back you should not carry a load on it, you need to rest it to heal and you should not exert it. Similarly, a country needs to reduce its debt load, needs time for its economy to recover and needs relief.

When our rating was downgraded to CCC we lost market access, so we were unable to rollover our maturing debt by raising new debt. We ran out of usable forex reserves to service our foreign debt (< $ 50 m) hence we have no option but to announce a standstill.

In April 2022 Sri Lanka announced a standstill in servicing its debt to private and bilateral creditors. We continued to service our multilateral creditors (WB, IMF, ADB, etc.). Interest arrears are accumulating.

The external debt to be restructured is 68% of FX debt. This is around 32% of the total debt. As per our IMF agreement we have agreed to the following targets to make our debt more sustainable. We have got off lightly for even after 10 years as per the program we will be carrying a debt to GDP of 95%. We can lower it further by accelerating growth because the assumptions are very conservative. But this will require faster reform and luck.

Restructuring FX debt ONLY is not enough – the bulk of the flow and affordability problem is with DD. Further, the fiscal targets set are extremely ambitious and debt sustainability is a headwind for growth thus a DDR is needed.

Restructuring FX debt ONLY is not enough – the bulk of the flow and affordability problem is with DD. Further, the fiscal targets set are extremely ambitious and debt sustainability is a headwind for growth thus a DDR is needed.

A successful negotiation with external creditors will require a demonstration of greater burden sharing and sustainability. Delays cost us in arrears piling up at the issued rate of interest + a possible penalty.

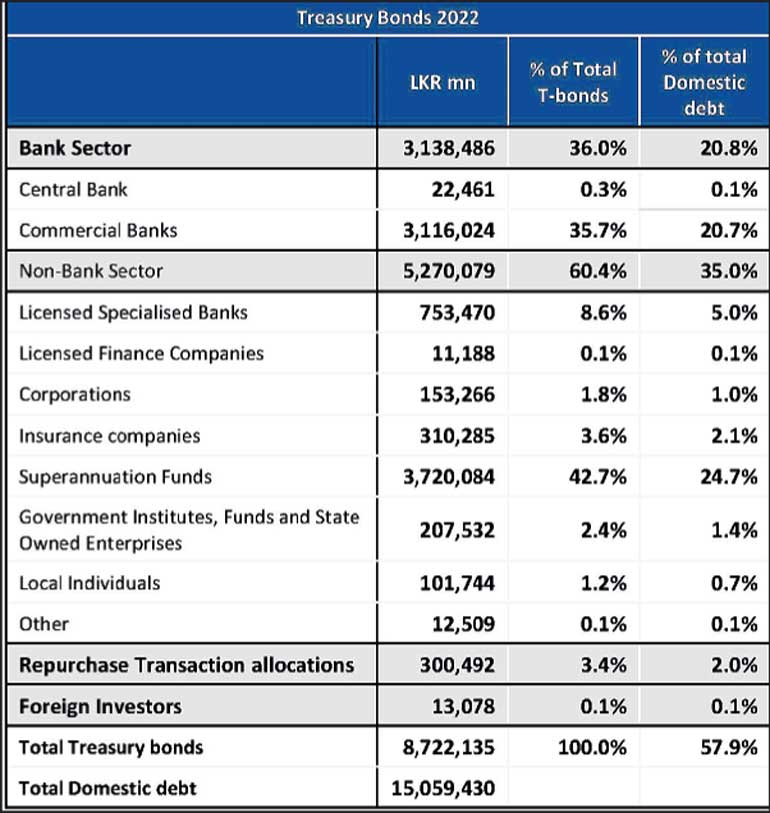

As of the end of last week the total GSEC securities outstanding was Rs. 9 trillion in bonds and Rs. 5.3 trillion in T-bills. CBSL owns Rs. 2.45 trillion of T-bills.

GOSL owns CBSL. Interest earned on T-bills and provisional advances minus expenses are paid to the government as profit transfers. Swapping bills for longer bonds with lower interest has no real impact, only accounting implications.

The remaining T-bills are in the public hands. Governor and ST have stated that they will NOT be restructured. Most of them are short term thus they will get reissued at lower interest rates during this year. Who holds them – end 2022.

The remaining T-bills are in the public hands. Governor and ST have stated that they will NOT be restructured. Most of them are short term thus they will get reissued at lower interest rates during this year. Who holds them – end 2022.

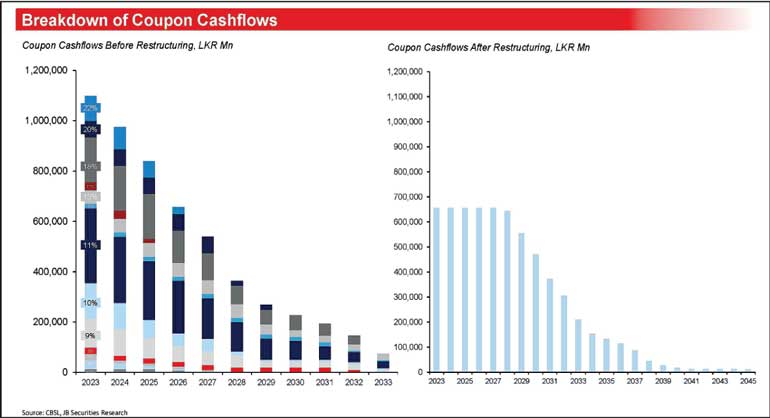

There are bonds of varying maturities and coupons. The interest expense from them originates from different coupons. See below.

The bonds will need to be re-profiled (maturity extension) + coupon adjustment. Haircut of principal owed is ‘not’ warranted due to inflation above 50% driving down its value. Who holds them – end 2022.

The key principle of any kind of debt restructuring is to broaden it. One hopes that the announcement does not leave out any owner group(s). There cannot be some who unjustly enrich themselves.

CBSL will be able to reduce policy rates with the expected fall in inflation to single digit or even negative. Post DDR the default premium on risk free rates will also fall. Thus, market interest rates will come down in line with the macro fundamentals.

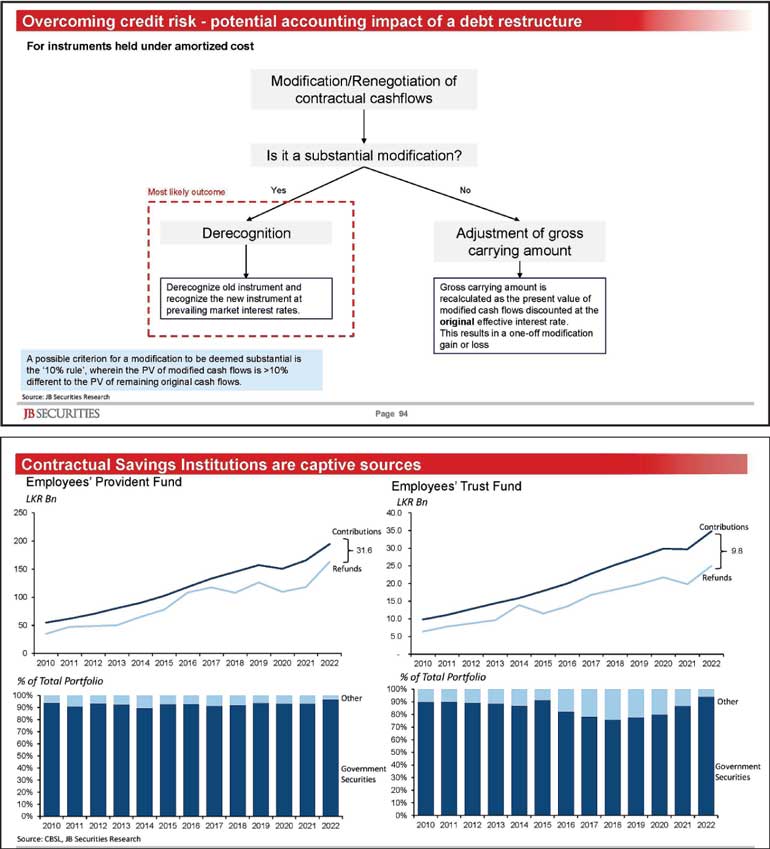

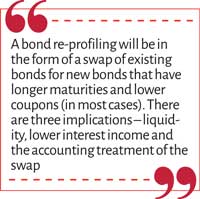

A bond re-profiling will be in the form of a swap of existing bonds for new bonds that have longer maturities and lower coupons (in most cases). There are three implications – liquidity, lower interest income and the accounting treatment of the swap.

Longer maturities are less liquid than shorter maturities for there are few buyers in our financial system for them. Lower interest income can be managed if interest expenses are also lower.

A swap involving bonds held under amortised cost will require a de-recognition (if NPV hit is more than 10%) and re-measurement. If a high discount rate is used a Day One Loss will

result in arriving at a fair value.

SLFRS 9 permits the use of a “regulated interest rate” if a well-functioning market does not exist. Longer dated bonds warrant this treatment, hence a regulated rate can reduce the hit from a re-measurement.

SLFRS 9 permits the use of a “regulated interest rate” if a well-functioning market does not exist. Longer dated bonds warrant this treatment, hence a regulated rate can reduce the hit from a re-measurement.

The banks are the largest holders of bonds. Majority of them are accounted for under amortised cost (not subject to mark to market accounting).

Banks are in the business of maturity transformation – longer term assets funded through short term liabilities – deposits and borrowings. Unencumbered capital is also part of the funding pool.

Their main source of income is net interest income (NII) (80%) + fee income (20%). The NII is generated from a spread between their interest-earning assets and interest-bearing liabilities. Lower interest earning assets can be matched with lower interest cost.

GSECs held by banks are zero risk weighted (RW). A bond swap is categorised as a selective default – BASEL III guidelines require GSECs to be RW at 150% requiring more capital. Regulatory relaxation will permit 0 weighting.

Fear of a banking crisis from the DDR is unfounded. On the contrary, by including banks in a DDR it will prevent them from making extraordinary profits from high coupon bonds that can be funded with lower deposit rates.

The Sri Lanka Banks Association has come out and stated that around 18% of their lending books have had some degree of restructuring, moratorium, relief, etc. This is a real problem. Faster growth and insolvency framework needed.

The Sri Lanka Banks Association has come out and stated that around 18% of their lending books have had some degree of restructuring, moratorium, relief, etc. This is a real problem. Faster growth and insolvency framework needed.

The superannuation funds hold 43% of the bonds at the end of 2022. They are a pay as you go system – inflows fund outflows which yet remain positive. They will not face a liquidity issue from longer maturity bonds for the retirement age is being extended so flows can be managed.

They use amortised costs to account for their bonds. Re-profiling will result in lower interest income but what matters is real interest which will be aided by lower inflation. All retirees are impacted by inflation which has reduced their real balances.

Life insurance companies are in the business of underwriting morbidity (illness) and mortality (death) risk. Pure insurance is coupled with riders (investment products). Most investment products are participatory depended on investment returns.

Insurance companies must manage the liquidity and interest rate risk (duration) between their assets and liabilities. Regulatory relaxation can help them account for a swap without recognising a large day one loss.

Insurance companies must manage the liquidity and interest rate risk (duration) between their assets and liabilities. Regulatory relaxation can help them account for a swap without recognising a large day one loss.

The bond swap can be either mandated through a change in the law or through a carrot and/or stick approach. Potential tools are special taxes on old bonds, 100% risk weightings if held by banks, cannot be used as collateral when accessing the SLFR, etc.

(The writer is the Chair of Advocata Institute and a qualified investment professional with over 25 years of industry experience.)