Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 26 March 2018 00:00 - - {{hitsCtrl.values.hits}}

Long before Vasco da Gama, Magellan, Capt. Cook discovered the Far East on sea routes, the ancient Silk Route existed 2,000 years before them. At that time all roads led to China and today all roads will lead to Beijing. The historical implications centuries ago and the current geopolitical implications today is the consequence of One Belt One Road (OBOR). In ancient times China manufactured products the world wanted; silk, porcelain, jade, glass, spices, gold, silver and luxury goods.

The items from China had to be of high value because the distance was long and hazardous. While the west was still into primitive farming, China had established industries with hundreds of workers manufacturing steel armour, weapons, silk, porcelain, etc. China had comparable large populations then, than its western counterparts and had advanced steel industry 1,000 years before the west. History indicates China was the World Trade Centre, the centre of technology and knowledge. The Silk Route developed many nations economically and culturally. (Silk Road to Bamiyan – Sun Lai Yung)

Asia was the centre of civilisation where great inventions were made. Great ideas from Lao Tze, Buddha, Confucius, Jesus and Prophet Mohamed changed people’s thinking and lifestyles with noble doctrines that were eventually promulgated to laws. The decline of the Silk Route came when the 6,500 km route from Rome via Damascus, Bamiyan to China became dangerous due to bandits, taxes were collected from all points of entry, the use of horse and camel caravans became expensive and worst of all China had internal strife. (Who started the drug trade – Sun Lai Yung.) By the 15th century when new sea routes and better ships were available the Silk Route was abandoned.

Let’s look at China today. It is the second largest economy and in the next 10-20 years expects to be the largest economy. China wants to be a global player. When one looks at her population, economy, military, infrastructure, education and technology, it is the world’s largest trading nation and the largest trading partner to many nations. Now, one would understand why China wants to be the super power it aspires to be.

The Silk Road brought great wealth to China. With OBOR, China wants to recreate its glory. China understands that no nation has the determination, financial might, space technology, mass skilled workers and the technology to develop infrastructure. The Chinese understand construction, they built the Great Wall. China realises the international geopolitical system and strategic economic engagement well to build the modern Silk Road through land and sea. The Chinese have invested strategically in South Asia, Africa, Central America, South America, the Middle East, Australia and Europe.

Why did China establish the Asian Infrastructure Investment Bank?

On 16 January 2016 China officially opened the Asian Infrastructure Investment Bank (AIIB) for business. President Xi Jin Ping had announced to establish such a bank in 2013. Why establish another bank for development lending when there were great established institutions such as the World Bank, (WB) International Monetary Fund (IMF) and Asian Development Bank (ADB)? China established the AIIB due to, what it perceived to be poor treatment by the United States; while the United States and its allies dominate the World Bank and IMF (The World Bank is a group of Institutions).

The United States is the largest contributor to the World Bank and the IMF with 17.48% and 16.21% respectively, while China holds 4.61% in the World Bank and 6.09% at the IMF. It must be remembered that the United States has the only Veto power on decisions at the World Bank. China has minor, insignificant roles in both institutions, even though China has the world’s second largest economy. China also felt left out when the US Congress deliberately blocked efforts to give China a greater voice in the IMF.

To make things worse the United States concluded the negotiation of the Trans-Pacific Partnership, a vast free trade agreement, with most of the nations of East Asia but deliberately excluded China from the negotiations. China realised this as an unfriendly act. China understood that there was no realistic possibility of an expanded role in the World Bank and the IMF, it was confident enough to go its own way by establishing a rival bank. China with its economic power and great relationships with many nations felt insulted when poorly treated by the United States.

The other institution was the Asian Development Bank dominated by Japan and headed by a Japanese President at the helm. Japan holds 12.8% and the USA holds 12.75% a combined 25.5% compared to China’s 5.48%. China realises that the world lending system is predominantly controlled by America, some EU nations and Japan.

What does this mean to China with an ambition to engage the global economic community especially the developing nations in Africa and South Asia? Can China execute its One Belt One Road initiative depending on these three financial institutions?

Problems faced by the AIIB

The United States opposed the AIIB and considered AIIB an unwanted intrusion in the multilateral financial system. The United States has been the underwriter of the world’s financial system for over half a century and its position could be displaced by the Chinese with their AIIB. As per America’s perspective why rival two established financial institutions that have been the foundation of international lending since the Bretton Wood conference after the Second World War.

America perceived that the AIIB will loan to nations that were not stable, protectionist, corrupt, not giving worker rights, political rights and reform, environmental protection and human rights violations as per the “Washington Consensus” where the above conditions to be reformed prior to granting of loans. China understand American history because, it’s not fair to talk of Human Rights when women Suffrage proponent Susan Anthony who managed to vote in 1872, was arrested and found guilty. In America women were allowed to vote in 1920 after the 19th amendment to the US Constitution.

In the 1960s a black person was not allowed to attend school, church, dine at a restaurant where the white patronised. This is what happened to Cassius Clay (Mohamed Ali) when he was refused entry at an all-white restaurant after winning the Olympic Gold medal; Cassius Clay threw his Olympic Gold medal to the Ohio River in disgust. Similarly a black man and white woman were not allowed to legally marry until the 1970s. These young couples were prosecuted and hounded out of the State they lived in.

Today in America it is a criminal offence if you are homeless and feeding the poor is also punishable by law in 31 cities. (However Sri Lanka a poor nation collectively feeds the poor and hungry all the time with multi religious values). It must be remembered the International Workers Day started in Chicago in 1886 May 1st. Here strikers were shot dead and the labour leaders called anarchist were hung six months later and some were forced to commit suicide. All these workers demanded was an eight hour working day. Thanks to their sacrifice we enjoy the current working eight hour shift. How standards have changed? It must be remembered during the Great Depression, read John Steinbeck’s novel “Grapes of Wrath” where Americans helped each other with genuine noble qualities displayed during times of hardship and suffering.

Besides the Human Rights issues, the United States felt that the AIIB bank will finance construction projects that were unnecessary and China will further its global ambitions through the AIIB. The United States spoke out against the establishment of the AIIB and attempted to dissuade its closest allies from joining the AIIB.

Unlike America’s Washington Consensus, China follows a doctrine of Non Interference with internal affairs of other countries. (Beijing Consensus)

There were 21 founding members for the AIIB and Sri Lanka was one of them. The United States was sceptical of AIIB intentions. Jin Liqun the President of AIIB went to Washington to persuade the US to join the bank. He met the National Security Council (NSC) Evan S. Medeiros a Senior Advisor. Jin assured the NSC that the AIIB will not be detrimental to the interest of the World Bank, where Medeiros sceptically stated that, “I am not going to buy the cake you have cooked.” Here Jin replied, “You are always welcome to the kitchen to help with the baking.”

This was the state of affairs for AIIB when the US rallied its allies not to join the bank. To America’s surprise her strongest ally Great Britain joined ignoring all pleas. Subsequently many EU nations and S. Korea too joined. Japan was the exception who did not join and stayed true to the US pleas.

Many don’t understand the Terms and Polices of the World Bank. It is called the Washington Consensus and Doctrine of Conditionality. Here it states loans are granted subject to the following terms been met or willing to reform within a time frame:

1.Fiscal discipline (limits on government spending);

2.Redirection of public expenditures towards education, health, and infrastructure;

3.Tax reform (broadening the tax base and reduction in overall taxes);

4.Market-determined interest rates (no government set interest rates on borrowed money);

5.Competitive exchange rates (no exchange rates pegged to a hard currency such as the US dollar);

6.Trade liberalisation (reduction or elimination of tariffs and quotas on imports);

7.Openness to foreign direct investment;

8.Privatisation of state-owned enterprises;

9.Deregulation;

10.Legal security for property rights, including intellectual property rights; and

11.Reduced roles for the state.

12.Worker Rights – covering labour standards, child and slave labour and elimination of discrimination on employment such as gender, race, religion and age.

13.Corruption in Government

14.Environmental protection

For the Chinese the Washington Consensus was forcing African and Asian countries to Western values, for the Chinese these designed rules were not practical to individual nations that had different characteristics. China felt that it was not necessary to meddle in a nation when it comes to privatisation of SOE, transparency and non corruption in government. China too had its experience in battling SOE and corruption and realises that there were no overnight solutions as dictated by the WB or IMF. China felt that the WB policies were a dent to cost of doing business. China felt powerful nations with money were able to bully poor nations.

China’s Doctrine of Non Interference was at odds with the Washington Consensus. China did not want to interfere with a borrower nation’s internal issues. China felt that poor nations had the right to protect its industries and had the right to close free trade on some industries. Similarly internal political protests, civil wars were of concern but not a subject to deny providing an AIIB loan as long as the project was viable and repayment guaranteed within its economic ability.

As for Environmental pollution China felt that the nation itself will deal with the issues on their best interests. For China Environmental protection is a priority. She does not want a nation bound by term to a loan but preferred a nation joining multilateral environmental treaties as such Paris Accord, Copenhagen Climate Accord and Kyoto Protocol on Climate and Global warming. China also knows that the USA and European countries have been polluters for centuries since the Industrial revolution using coal.

China felt that it was not necessary to impose conditions to conduct trade or borrow from the AIIB on infrastructure projects. What differed drastically with the Washington Consensus was that China’s basic view on Human Rights is the principal that sovereign nations has the right to use force including deadly force against its own citizens if the nation is under threat. For China it’s of National Security Interest.

How One Belt One Road (OBOR) is becoming relevant and the role of AIIB

The One Belt One Road is much more relevant with current geopolitical trends. Global economic architecture is the United States of America and China. These two nations will set the frame work of future global trade. China has been very strategic in its relationship and investments linking countries across nations on strategic infrastructure. China is prepared to take financial and political risks in these strategic investments. The US and Europe are currently unable to make the long term commitment.

These democratically elected nations are very fragile with no strong leaders for the long run. Many Asian and African leaders have started to “Look East Policy” and China has proven that it has risen from poverty to a wealthy nation in 30 years. Western nations rose with colonisation and with favourable trade terms to the colonisers. Today USA is on the new policy of “America First” this policy espoused by President Trump has reversed many American foreign and trade policies. America First policy has repealed many trade agreements and even NATO funding. This is providing China with a global footprint at the expense of America. This will have seismic shifts in global geopolitics.

The rise of China is inevitable. America must accept that China will be a big global player. America must also accept that nations are moving away from US influence. China and the US must find a working model where both will cooperate and grow, than distance themselves. It is expected that China and America will see the same picture but interpret it differently; they need to work on the areas that are disagreeable to each other’s interest.

It is the world’s interest and China’s interest to rise to global power status peacefully. China’s One Belt One Road policy is not without problems. China is pragmatic to realise that all the nations involved in the OBOR has different interests. China knows infrastructure facilitate trade, but trade does not necessarily facilitate infrastructure. China needs to manage nations along the OBOR path. Governments change and policies in these nations change along with elections.

In 2015 with the change of government in Sri Lanka a large infrastructure project called Colombo Port City was stopped for over a year. The project resumed after re negotiating the terms. Building infrastructure is easy, managing governments and the politics will be a headache.

With the establishment of the AIIB, China has paved the way for the funding of One Belt One Road Policy. Today there are 70 nations who have joined the OBOR initiative. China wants free trade and free movements of goods across borders with lesser tariff. China feels that America is getting protectionist; calling America “back to the Cold War mentality”.

Implementing One Belt One Road

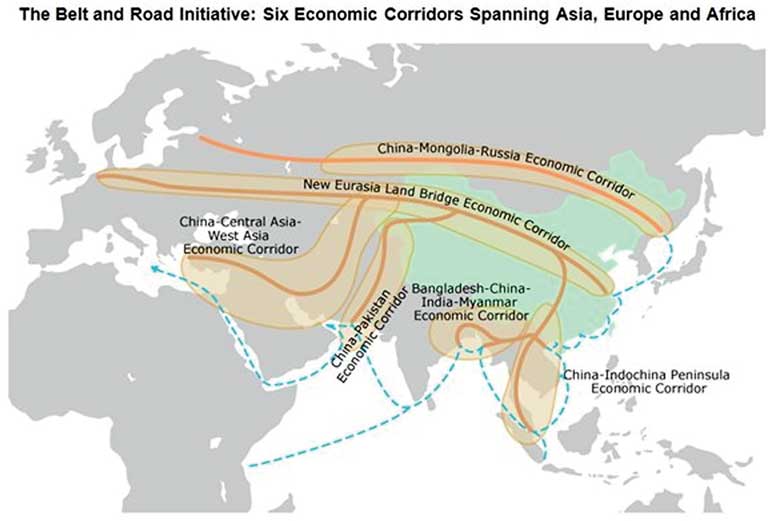

OBOR initiative comprises of six economic corridors spanning from Asia, Europe and Africa. It covers rail and sea transportation. This is the modern Maritime Silk Road with rail freight ensuring great convenience of “one declaration, one inspection, one cargo release” for cargo transported on the OBOR route.

1.The New Eurasia Land Bridge Economic Corridor

2.The China-Mongolia-Russia Economic Corridor

3.China-Central Asia-West Asia Economic Corridor

4.China-Indochina Peninsula Economic Corridor

5.China-Pakistan Economic Corridor

6.Bangladesh-China-India-Myanmar Economic Corridor

As of 2017 there are 70 members that have signed up with AIIB. (10 other nations are awaiting membership for 2018) These nations are able to promote economic cooperation for the OBOR initiative by building the required infrastructure such as railways, ports, land bridges, highways, communication systems, oil and gas pipelines, industrial manufacturing zones and airports. The whole idea is to facilitate and promote cross national transportation and foster trade among nations with priority by removing barriers.

It is anticipated that between 2020 and 2050 about $ 4 trillion will be spent on the OBOR related projects. This project will cover 65% of the world’s population, 37% of Global trade and 30% of Global GDP. It is anticipated that nations involved on the OBOR will increase their annual GDP growth by 1%-2% depending on their economies.

Renmenbi (RMB) as a global currency

As a super power nation one must have a currency that fits its image. Today 90% of the trade is done in US Dollars and only 2% trade conducted using Renmenbi (RMB). AIIB’s initial capital of $ 100 billion by China was in US Dollars. Its current obligation to make loans is in US Dollars. Why can’t China continue using the US Dollar? First China wants a world that uses the RMB, this is national pride. Beyond national pride; is the practical implication when one can controls its financial, trade and political destiny using its own currency.

If the US impose sanctions on a nation by prohibiting transfer of US Dollars through US banks, will be a threat to AIIB’s future operation by using the US Dollar as a platform. China is able to circumvent this problem by using the RMB and trade with nations on RMB. This will give China equal powers to control international financial transactions through its Chinese banks. Most Chinese banks are state owned. China will be able to deal directly with countries subject to US sanctions.

China could use the AIIB to promote the RMB as an international currency. On 30 November 2015, the IMF declared the RMB as one of its official currencies. For China this means there is legitimacy to the RMB and prestige and to make the RMB an “International Currency” where China’s role in the global economy is on par with the USA.

Nations such as USA, Japan and India have boycotted the OBOR; however India is a founding member of the AIIB. It is very unlikely that USA will join AIIB because such a move requires Congress approval. In time to come the AIIB will be a rival to the WB, IMF and ADB. Sometimes these three venerable institutions could be forced to be more accommodating in their policies to lend due to the AIIB. This has to be seen as to who runs America. China with the AIIB and OBOR initiative could further its own ambition. All powerful nations have done it. China has to follow global best practices and gain the respect of the world by lending to the right project that will benefit the borrowing nation and not impose its will.

(Sun Lai Yung has worked in USA, Singapore, Afghanistan, Kuwait and Bahrain. He is currently employed as a consultant and is the Head of China Investment Desk at KPMG. He has a Master’s degree in Economics from Northeastern University Boston. He can be contacted at [email protected]).