Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 28 February 2024 00:30 - - {{hitsCtrl.values.hits}}

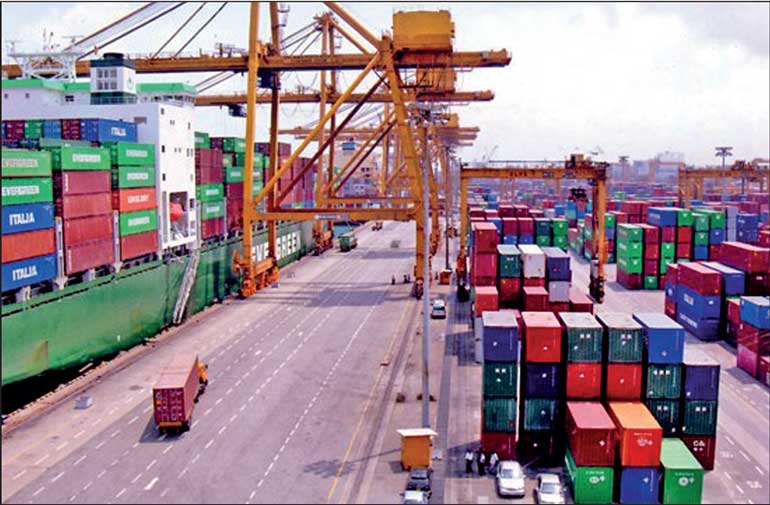

The idea in a Balance of Payments crisis, is to enhance exports to earn more foreign exchange, but the solutions put forward do not direct the economy in such a direction

Though it is now almost two years since the economic crisis blew over, Sri Lanka has not yet addressed the real cause of the crisis and is seeking solutions for the symptoms, while the cause lies elsewhere.

Though it is now almost two years since the economic crisis blew over, Sri Lanka has not yet addressed the real cause of the crisis and is seeking solutions for the symptoms, while the cause lies elsewhere.

What is most frightening is that the solutions that are being acted on would cause greater damage to the economy to a point where it would totally be out of control, with no way out, even if we wanted to get back to a development path.

The past two years was valuable time that Sri Lanka had, to devise a way forward, which was lost in seeking solutions that were not related to the crisis. All the effort of the Government is to be able to go back to borrowing again and fall into a bigger mess.

The idea in a Balance of Payments crisis, is to enhance exports to earn more foreign exchange, but the solutions put forward do not direct the economy in such a direction.

What the so called solutions have done is the opposite, driving the Small and Medium sectors out of business and contemplating selling off public assets to foreign companies.

It would have made some sense if the IMF’s Extended Fund Facility (EFF) was used to enhance the existing exporters capacity, but that is not on the cards. In fact, a World Bank report has identified the present exporters as having the potential to enhance export earnings substantially. However, their request for a bit of help has not been responded to, as sorting out the cause of the crisis was never part of the deal.

The idea of entering into Free Trade Agreements (FTA) is to be able to export products to those countries as well as import from those countries without barriers. However, when there are hardly any additional products for export, it becomes an expensive one-way street, as what we have experienced in Sri Lanka.

The most important aspect overall, is the fact that it has now been well understood by those in business that one need not engage in production and manufacture to make money, when it could be easily made via the financial sector and engaging in ‘Commission-omics’. Therefore, the economy and those in business need a radical re-orientation, which is virtually impossible in the neo-liberal mode.

The real cause of the crisis

The real cause of the economic situation the country is in at present is the lack of investment over the years, in manufacture/production oriented sectors, such as industrial production. Instead it moved to a trading economy, based on imports. The over dependence on the market, when it was not performing and repeatedly doing the same thing over and over and expecting a different result, is the height of stupidity. When orthodox economics was not able to provide the methods needed to move the economy forward and thinking that savings or loans were the only source of funds for development, without exploring the Monetary Financing method, was a mistake.

Though some degree of investment was made in industry in the early 1960s, it was not taken beyond and developed to reach regional and global markets.

When the ‘open economy’ was re-introduced in 1977 with a flood of imports, whatever gains that had been made in the local industrial sector was destroyed and the economy became an import based economy ever since, as the expected FDI did not flood in and the local private sector was in a rather lacklustre mode with regard to industrial development. Sectors in which tremendous progress had been made, such as the Heavy Construction Sector was destroyed with the flood of foreign companies engaging in projects at inflated prices, the result of this is the fact that almost 90% of the present foreign debt was due to inflated project loans. Heavy construction is the very first industry that is developed in a developing country, in order to keep its cost of development low. Sri Lanka did the opposite.

When the ‘open economy’ was re-introduced in 1977 with a flood of imports, whatever gains that had been made in the local industrial sector was destroyed and the economy became an import based economy ever since, as the expected FDI did not flood in and the local private sector was in a rather lacklustre mode with regard to industrial development. Sectors in which tremendous progress had been made, such as the Heavy Construction Sector was destroyed with the flood of foreign companies engaging in projects at inflated prices, the result of this is the fact that almost 90% of the present foreign debt was due to inflated project loans. Heavy construction is the very first industry that is developed in a developing country, in order to keep its cost of development low. Sri Lanka did the opposite.

The creation and direction of money

Directly related to the cause of the issue in question is the important fact that over the past four decades, with the de-regulation of the financial sector, the creation of most of the money in the economy, has moved from the Central Bank to the private banking system. With this important public privilege, now exercised by the banks, so is the direction of money as they see fit.

As the direction of money is left to the market, what does one do when the market does not direct money to the required sectors? Over the past four decades we have been just living in hope, except for a short while, when the Government decided to intervene to set up the Garment Industry, which too should have been taken beyond to the manufacture of textiles, which was once a functioning industry, before the re-introduction of the open economy, which destroyed the textile industry along with most others and we clothed ourselves with imported material.

It is the lack of common sense and the acceptance of erroneous economic theory coupled with a political ideology that is determined to turn the clock back to an era that supports individual well-being of a few, over the collective, with a small Government, which is the underlying cause of the confusion and economic lag.

With the enormous public privilege of money creation now exercised by the banks, should it not be incumbent upon them to make certain that this enormous power is used for the public good? Should the banks be allowed to enhance their profits by using this public privilege at unbearable cost to the public?

While finance should have been able to serve industry, it has been made the master of not only industry but all other sectors and is extracting the maximum for its own benefit while all other sectors suffer.

The present Government has brought the new Central Bank Act, which closes the door for any future government to use Monetary Financing for development. Therefore, if and when a government that can identify economic mistakes comes to power, it would certainly have to repeal and develop a new CB Act.

The role of the Central Bank itself would have to be re-evaluated, as it has failed in its duty to the country. Its mandate should be widened and made to encourage development and create institutions that would enhance development, as observed from the actions of the Central Bank of Canada from the 1940s-70s, the CB of South Korea from the 1960-80s and now China.

Central Bank Independence, may work in developed economies, but for developing countries it has to work within a joint effort with the government to achieve the development objectives as demonstrated by the High Performing Asian Economies (HPAEs) during their development phase.

What held investment back

The Sri Lanka economy was based on orthodox economics even before independence and just carried through over the years, without exploring alternative methods to reach its objectives.

This raises another issue, did Sri Lanka ever have any objectives? The only two development plans, the 10-year plan, was never implemented and the five-year plan was derailed due to the oil shock.

The guiding principal of orthodox economics was a crude economic theory known as the Quantity Theory of Money (QTM). What it says is that when the Money supply (Money Stock) is increased the prices would proportionately increase. In other words, it says that inflation would follow. Sri Lanka was caught in this theoretical trap and held hostage to it.

Though this has been disproved, most economists trained in orthodox or classical economics still follow this, which has become a barrier for innovative thinking. It was precisely because of this reason that, when in the early 1960s President Park of South Korea was offered western trained economists as advisors, he politely refused and opted for Japanese economists, as they had proved they were capable of ‘out of the box’ thinking.

Having been guided for 76 years by the QTM, it is only now we are even talking about it. It reminds me of a book by Robert McNamara, titled ‘In Retrospect’ where he admits how wrong the US was with regard to Vietnam. Well, after all the damage.

When the world entered the Global Financial Crisis in 2007/8, orthodox economics had no solution and governments around the world had to create money via Central Banks to save the economies from collapse. Therefore, one should understand that Common Sense is more important than flawed economic theory or political ideology that is not progressive.

The countries that developed from least developed or developing status, used their common sense over economic theory, particularly over the QTM to get where they wanted, which was expressed in a plan. Sri Lanka to many, does not really seem to know where it wants to go, as ad-hoc decisions, flip flops and the unprecedented corruption makes progress impossible.

The system in operation over a four- decade long period in Sri Lanka was ‘Commission-omics’ (a term coined by me) crafted by those in power for rent seeking with the help of their business buddies, which soon became the invisible hand that guided the economy. Though it was only the Health Ministry scandal that found its way to court, it exists in every sector. One could imagine the extraction that takes place in the economy.

Therefore, the investment in the economy depended on how much commissions could be made by those in authority and would answer why common sense actions were not carried out but only the very expensive ones, that brought the biggest commissions.

The way forward

If Sri Lanka is to move forward it needs to express its plan to the people and the rest of the world. This is possible through a Development Plan. The sectors targeted for development should be clear to all.

It should identify areas for Foreign Direct Investment (FDI) as well as areas for local private sector investment, together with the SMI sector. Where there is a gap, the State has no choice but to step in. There is potential for at least another $ 20 billion of exports, without much capital expenditure required.

The State would have to take back control of the creation of money and direct it through Development Banks for each identified sector, for GDP related activity. The banks could still engage in their credit creation, but the Government need not borrow from them.

As long as the supply side of the economy is not on the short side, demand would not cause a reason for price increases. This requires extremely good management of the macro-economy, which is a major problem with economists trained in the orthodox or classical mode. However, there are many economists who think ‘out of the box’ in Sri Lanka, who could be called upon, if the authorities understand that the present system is not working and a workable system for development is urgently needed.