Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 31 January 2022 00:15 - - {{hitsCtrl.values.hits}}

A recovered and vibrant tourism sector can be a key player in extricating Sri Lanka out of this forex crisis – Pic by Shehan Gunasekara

The tourism sector which was the second/third largest foreign income generator for Sri Lanka until 2018, has been severely affected, firstly, by the senseless Easter Sunday attacks in 2019 and then by the global pandemic. Sri Lanka tourism has been hugely affected due to the many travel bans introduced since mid-2020.

The tourism sector which was the second/third largest foreign income generator for Sri Lanka until 2018, has been severely affected, firstly, by the senseless Easter Sunday attacks in 2019 and then by the global pandemic. Sri Lanka tourism has been hugely affected due to the many travel bans introduced since mid-2020.

China, which contributed the second largest number of tourists till December 2019, is still on heavy health guidelines, therefore will most likely not be part of the top 3 countries with India and the United Kingdom. The rest of our tourists have come from Russia, Germany, France, Australia, United States, Ukraine, Canada and Poland. These countries are struggling with Delta infections and now with Omicron.

Therefore, even if the Government hopes to attract one to two million tourists in 2022, it is very unlikely for several reasons. Making it imperative that the industry needs to be supported beyond extended moratoriums and concessionary working capital loans. The sector is severely affected by limited fiscal space. New initiatives to reignite the sector will only help the Lankan economy to recover much faster.

Critical issues

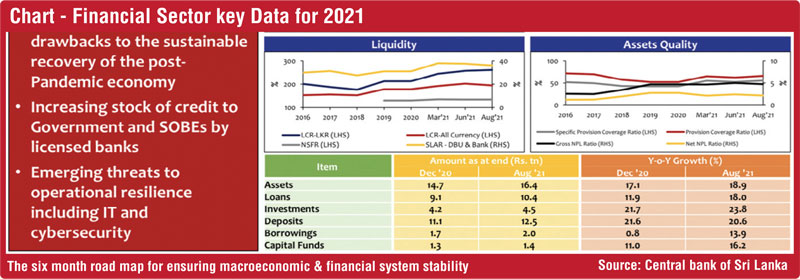

According to a PWC report stating the obvious – “High loan defaults by hoteliers as anticipated could lead to a massive erosion in the regulatory core capital of banks”. This situation gives rise to four main issues according to the PWC report that would require urgent attention by the Government, CBSL as the regulator of the financial sector and hotel owners both big and SMEs. The four key issues according to the PWC report (edited) are:

Interest waiver

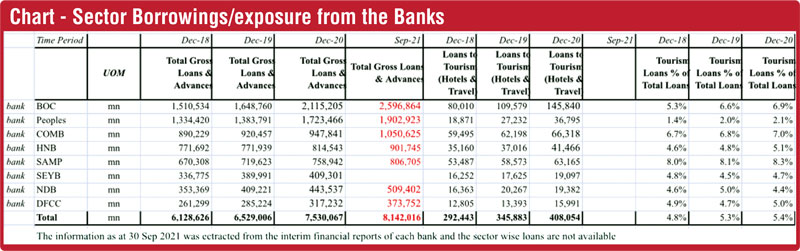

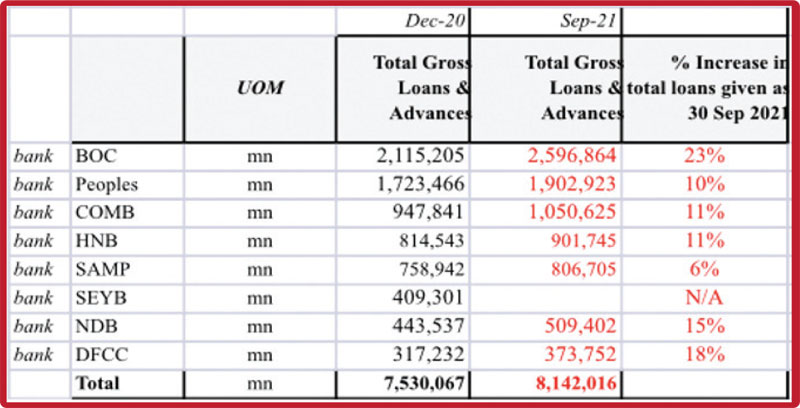

The hotel owners and others in its recommendations have proposed an interest waiver and debt restructuring program. The associations and experts have suggested waiving the accrued interest on loans during the current moratorium (see chart for total exposure). This will significantly impact the financial sector and the country’s long-term economic recovery from the pandemic. The interest income accounts for 75% of financial sector revenue, so the sector must remain liquid to provide the financial assistance that borrowers require during the next 24 months for the economy to recover.

Also, the financial sector credit ratings may be downgraded further reflecting weaker earning capacities and notional income and that will make it more expensive for banks to raise capital in international capital markets. The resulting higher cost of borrowings will be passed on to borrowers, this could trigger liquidity stress, and depositors may have concerns about the safety of their fixed deposits, and this action will also jeopardise depositors’ interest when the earnings of banks and NBFIs are adversely affected.

Banks would also be compelled to restrict dividend payouts to shareholders, bonuses to employees and possibly forced to rollover interest payments to depositors, also offer deposit rates which are well below the current inflation, impacting deposit holders and private sector retirees living off fixed income.

Capital restructuring

In addition to the hotel owners appealing for all tourism-related loan interest from April 2019 be waived off by banks and all the remaining debt is rescheduled at a concessionary interest. Also, the new loans granted for working capital and other purposes to be recovered over a longer tenure. Some have suggested a percentage haircut on the capital outstanding. They see several big business houses and shareholders of banks settling for lower payouts for stressed loans using their influence. Moreover, they argue the financial sector (Banking 8%-10% contribution to the GDP) needs viable businesses to lend to make money, and are not in the recovery business.

Solutions

A recovered and vibrant tourism sector can be a key player in extricating Sri Lanka out of this forex crisis. However, any losses arising to the banks from any interest waivers or haircuts will need to be covered through Government-supported programs; several options have been suggested by many experts and studies/reports. This could involve:

1. Asset securitisation as a means of tourism finance to support recovery and refurbishment,

2. Allowing banks to set off the value of interest/capital written off against corporate taxes payable by the financial institution over five years

3. Issuance of a 10-year government treasury bond to the equivalent value of the haircut,

4. Engage a multilateral institution to set up a bailout fund by taking stakes of some of the distressed tourism companies for a specified period

5. A development bank to support efforts to facilitate sustainable investment and financing, post recovery.

There are several examples in Ireland like the National Asset Management Agency (NAMA). This institution according to public records was established in 2009 as one of a number of initiatives taken by the Government to address the serious crisis in the Irish banking sector. The National Asset Management Agency (NAMA), a majority privately owned asset management company was established to remove non-performing assets from the banks’ books.

Therefore, given that the outlook for the tourism sector remains highly uncertain in 2022 at best, and that the tourism sector once fully recovered post 2023 can once again generate the much-needed foreign exchange – $ 5 billion+ and more, create the jobs and new businesses for Sri Lanka, the tourism sector certainly needs serious handholding in 2022- 2023 in the best interest of the country.

In the final analysis, the longer the pandemic continues, the greater the implications for the tourism sector and the tougher it will be to rebuild the tourism economy. Therefore, intelligent solutions are needed from the Government, of a long-term aspect of support. CBSL certainly has the bandwidth to facilitate this recovery.