Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 26 April 2022 00:00 - - {{hitsCtrl.values.hits}}

The Chamber of Industry of Sri Lanka (CCI), which is the apex representative body of all who are engaged in the construction sector, predicts that with the present economic crisis and due to several factors causing a debilitating impact, over 100,000 jobs will be lost within the next 3 months, unless immediate remedial action is taken. In the past, the construction industry used to contribute on average 8 -10% to the GDP. However, due to negative impacts in 2019 and 2020, the contribution to GDP was only 7.4% and 6.2% respectively. In addition, this sector has provided employment to 650,000 direct and 325,000 indirect. As such it must be reckoned as an integral growth sector that should be prioritised for economic revival, especially as the country is now in recession.

The main factors affecting can be summarised as below:

(I) Delays in payments for work done

(II) Unprecedented cost escalations

(III) Fluctuation of the exchange rate

(IV) Shortage of construction materials

(V) Difficulties in importing raw materials to manufacture construction materials

(VI) Suspension of capital expenditure works

(VII) Interest rate increases

(VIII) Recovery action by banks

At present the total overdue payments to construction contractors in the roads, buildings, and water supply sectors alone amount to nearly Rs.100 Billion. When other sectors are considered it will be more than this. To alleviate the burden on the industry, the Government is kindly requested to make early arrangements to settle these outstanding payments by the RDA, Education Ministry, UDA, and the NWSDB as a matter of urgency.

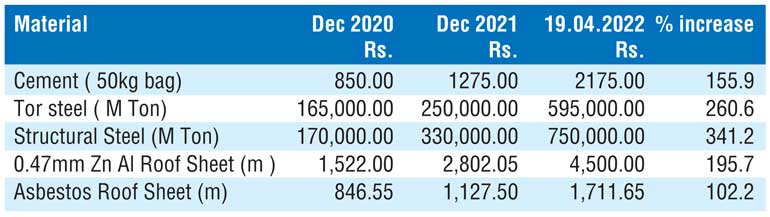

During the last 15 months, there has been an unprecedented increase in the prices of all construction materials. The table below gives the price changes of 5 basic materials.

With the free float of the Rupee, the exchange rate has now increased to Rs.340.00 against 1 US$. In Dec 2020 and Dec 2021 this was Rs.186.40 and Rs.203.00 respectively. Thus, an increase of 82.4%. As nearly 70% of the construction materials in building and other engineering constructions and 60% of road projects are import based, the impact of this will be to increase the construction costs by at least another 60%. In addition, the price of diesel which was Rs.121.00 / It in December 2021 is now Rs. 289.00 / lt, increased by 138.8% during the last 4 months. This increase will further increase the overall construction costs by another 5%.

CCI acknowledged and appreciated the Cabinet Decision for the progressive solution of allowing the price escalation formula of the Construction Industry Development Authority (CIDA) to be applied up to an upper limit of 20% of the contract sum for contracts beyond 3 months that have excluded the price escalation clause. However, CCI regrets to note that certain state organisations are reluctant to offer this relief to its fullest extent to contractors. CCI therefore kindly requested the Ministry of Finance to communicate this Cabinet Decision to all SOE’s via a Public Finance Circular as the industry is in dire need of this relief. Due to the unprecedented cost increases shown above the 20% cap imposed earlier on price fluctuations will not be relevant any longer. Therefore, CCI strongly requests that this ceiling on price escalations should be removed and to allow the actual price escalation based on CIDA formula.

A common complaint is that CIDA price indices do not reflect the actual market price. Even though the CIDA is in the process of revising the price escalation formula and its responsiveness to the present market conditions, this exercise will take several months and once finalised will apply to work done in the future only. As an interim measure, the following reliefs are proposed.

(i) To immediately bridge the gap created by the formula, in not properly allowing for transport costs, to grant a 5% increase of the contract price as compensation for the sharp fuel price hike;

(ii) To provide for the difference of the Dollar fluctuation on the current CIF prices especially for Mechanical, Electrical and Plumbing (MEP) items, and any other items which are not reasonably covered by the CIDA price escalation formula.

In countries where statistics are available, it can be seen that quite often construction companies lead the bankruptcy numbers. This is due to the many variables in construction projects with differing site conditions, the large number of different materials needed, higher exposure to weather, operating on low profit margins (Usually 5%), inability to claim price increases fully, and the nomadic nature of the workforce. As a result, it is very important that timely payments for work done are received. It is seen that most construction companies become bankrupt not due to no – profitability but as a result of cash flow problems. In the present situation with unprecedented increases in material prices, exchange rates, and bank interest rates, the need to reimburse cost increases and timely payments must not be overemphasised. As such CCI wishes to introduce a “ Building and Construction Industry Security of Payment Act” similar to the Act in Singapore. This Act in Singapore has even provided the legal framework for adjudication and to enforce adjudication decisions. This will also address a lacuna prevailing at present in the adjudication process.

The Shortage of construction materials due to the import restrictions and difficulties in opening L/Cs because of the exchange crisis is having a serious impact on the completion of development projects. The importers of materials and also the manufacturers of building materials such as cement or steel etc are faced with the dilemma of correctly assessing the cost when importing raw materials on deferred L/C’s, as at the time of settlement of L/C’s the Rupee cost would have increased more than what was estimated. Very often by the time of settlement of L/C’s, the imported materials and the manufactured items would have been already fully sold due to a starved market and any extra cost due to the exchange rate fluctuation will have to be borne at a loss.

The new Secretary to the Ministry of Finance has indicated that the Government will be compelled to suspend capital works for at least 1 year. Perhaps the Government has no choice considering the huge budget deficit, and with the IMF applying brakes on money printing and the inability to release foreign exchange for construction sector imports; CCI wishes to propose that the foreign funded projects should proceed without any interruption. In fact, it will be prudent to have a mechanism to fast track these projects to improve the foreign exchange inflow from these. On the other hand, locally funded projects without a satisfactory EIRR could be suspended or stopped altogether. However, suspension of locally funded projects which are already commenced will have practical and legal issues. Government Authorities will have to negotiate and mutually agree on these on a reasonable basis.

For locally funded projects which are deemed important to continue the CCI wishes to propose establishing a credit line of about US$ 100 Million to cover the imports. To properly manage the disbursements on this credit line, CCI is willing to assist by setting up a mechanism to monitor the project requirements and make recommendations to the Ministry of Finance. Another suggestion is to allow property development companies to deposit sales proceeds in foreign currency in separate RFC accounts and utilise such funds to import items required for their property development projects. This measure will allow these projects to proceed smoothly.

It is observed that many projects are commenced at the whims and fancies of politicians and senior officials, without any regard to the EIRR. There are many examples of such projects that have led us to the present foreign exchange crisis. As such it is proposed that all future development projects shall commence only on the recommendation of a Technical Evaluation Committee appointed with the mandatory representation of CCI, which is established by an Act of Parliament.

The recently announced highest policy rate increases ever by the Central Bank will drastically increase the interest rates on all facilities such as bonds and guarantees, overdrafts, term loans, and leasing provided to businesses including construction companies. The Central Bank should ensure that banks will not increase rates on already approved facilities but only on new facilities. Also as the policy rate increase could be a short term measure, CCI wishes to propose that the interest rates on long term housing loans should not be increased.

The moratorium allowed by the Government and Central Bank on loans taken by the construction sector due to difficulties arising from a multitude of problems faced by the construction industry consequent to the COVID–19 pandemic and recession, ended on 31 March 2022. Due to large outstanding payments, unparalleled cost increases, import restrictions, and foreign exchange shocks the construction industry is still encountering the same difficulties. As such CCI wishes to request that the moratorium on loans taken by construction companies and property developers should be extended on the same basis up to 31 December 2022.

CCI wishes to inform that unless the Government takes serious note of the situation and takes necessary remedial action immediately, large scale retrenchment in the construction sector is unavoidable as the majority of construction sector employees are recruited on a project basis. If this happens the total job losses in the sector may exceed 100,000.

The writer is the Secretary General/CEO Chamber of Construction Industry.