Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 18 September 2024 02:19 - - {{hitsCtrl.values.hits}}

Voters to elect a new President

Voters to elect a new President

Sri Lankans are to elect a new President on 21 September 2024 to rule the country for the next five years. Whether it is the confirmation of the incumbent interim President Ranil Wickremesinghe in the post or the election of one of the two frontrunners to presidency, it is the economy stupid that the new President should tackle immediately. That is because the economy is not stable as claimed by the incumbent President in his election campaign.

Ranil’s aphorism about Grusha of The Caucasian Chalk Circle crossing a suspension bridge

Ranil Wickremesinghe, when he assumed office in 2022, used an aphorism to describe the challenge he is faced with. Drawing on Bertolt Brecht’s popular stage drama, The Caucasian Chalk Circle, he said that his biggest challenge was like that of Grusha, the palace maid, in the drama. She had to take the rescued baby son of the deposed and then assassinated Governor to safety by crossing a suspension bridge made of coir. She was being pursued by enemy soldiers who wanted to kill him. That was a razor-edged task shifting between life and death, but she walked along the suspension bridge keeping the baby to her bosom with one hand and holding on to the rope that connected the two hillocks with the other hand. The bridge was swinging to and fro, but she finally made it.

Ranil said that he also had to take the ailing economy to safety through this unstable suspension bridge. After two years he said that he did it, but his election campaign now maintains that he had done it only halfway through and he should be elected for a further five years to complete the balance half and then drive the economy to prosperity. According to them, anyone elected to presidency should also do the same.

|

Sri Lanka has not walked through even halfway across the suspension bridge as claimed by the President’s election platform

|

The dire state of the economy

The present state of the economy is as follows: the nominal side of the economy, that is, the inflation rate, exchange rate, and the budgetary revenue, has been brought to a stable level by the concerted efforts of the Central Bank and the Ministry of Finance under a stabilisation program – an extended fund facility or EFF – sponsored by IMF. This is necessary but not sufficient to deliver prosperity to people, at least to the level that they had enjoyed in a normal year like 2018. For that, the real sector that provides bread and butter to the people should grow.

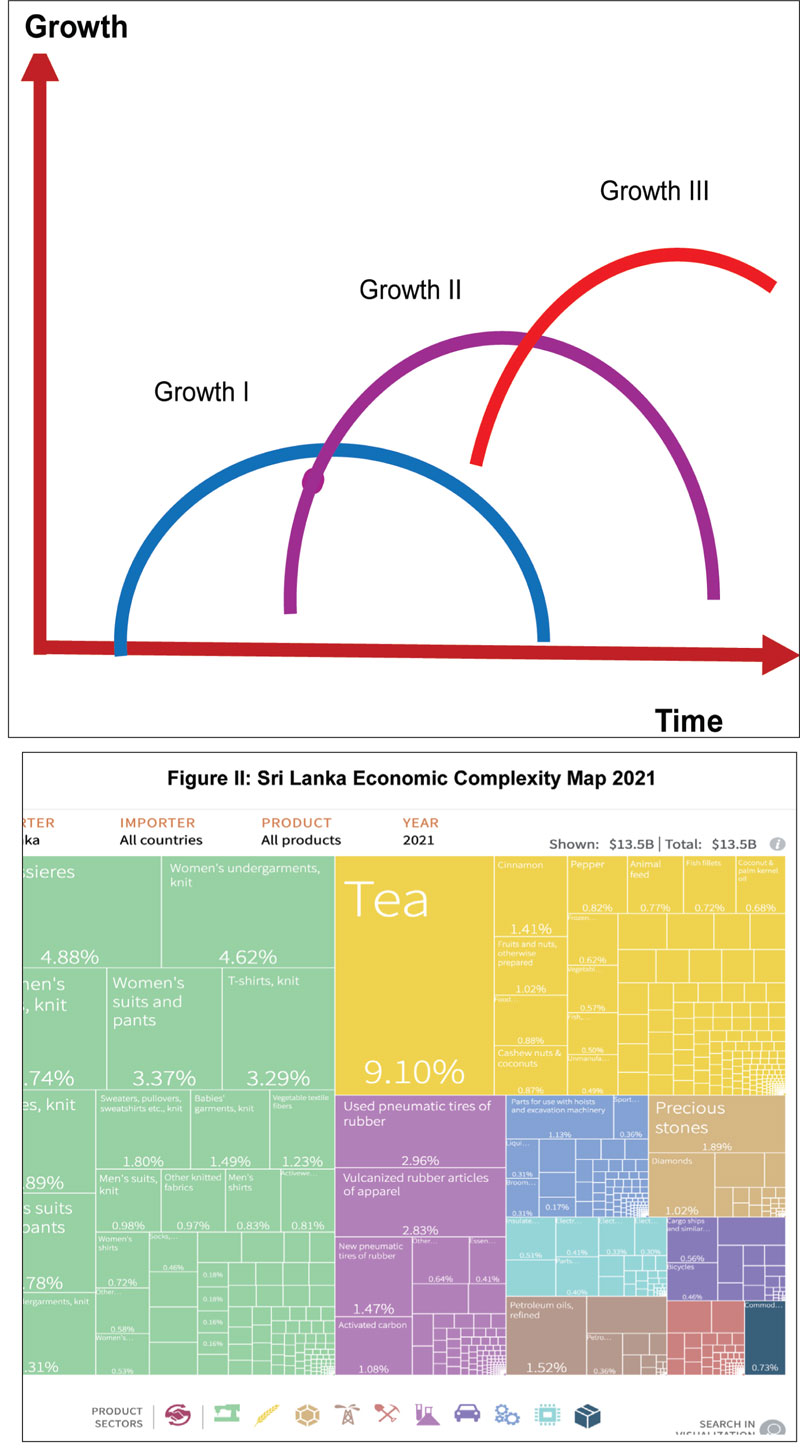

As Figure I shows, the size of the economy, measured as the Gross Domestic Product or GDP, had fallen from $ 94 billion in 2018 to $ 76 billion in 2022 and has started picking up slowly in the period thereafter. It is expected to reach the level of 2018 only by 2027. Any improvement in the real conditions of the people and therefore their actual wellbeing should start from that year.

Even the attainment of the nominal numbers is misleading because it had been done under two restrictive conditions. One is the selective suspension of servicing of external debt from individual countries called bilateral creditors and from commercial sources, mainly, Sri Lanka’s sovereign bond holders or ISB holders and China’s Development Bank. Sri Lanka by suspending the debt service to these two creditor groups promised that the annual interest and maturing debt payments would be added to the principal debt stock at the same interest rates. Accordingly, even if Sri Lanka just sits without borrowing anything from abroad, its debt stock rises by about $ 3 billion every year. The value of such debt accumulated as arrears till end-2023 has been in the region of $ 6.6 billion. Sri Lanka promised to restructure this debt as soon as possible but the progress so far has been below the expectation.

The second restriction is the control of many import items introduced in several stages in 2022. As a result, the normal volume of imports to the country would have risen to a level of about $ 22 billion, but the volume brought to the country in 2023 had shrunk to $ 17 billion. Hence, the improvement shown in the balance of payments, exchange rate, budget of the Government, and the inflation rate has been under these conditions.

The moment these two restrictions are removed, Sri Lanka would fall back to the position it was in mid 2022. Hence, Sri Lanka has not walked through even halfway across the suspension bridge as claimed by the President’s election platform. By any standard, the country is still at the start point of the suspension bridge and the new President will have to design and adopt suitable strategies to fly over to the other side. In this context, attempting at crossing the suspension bridge will be a too risky endeavour.

ETA: the biggest woe

But the biggest problem for the new President is not the crossing of the suspension bridge to safety. It is the statutory compliance he should maintain with the targets set for him over the next five years under the Economic Transformation Act or ETA enacted by Parliament in August 2024. The quantitative targets which should not sit in a legislation concerning the transformation of the economy will virtually bind the hands and legs of the new President over the next five years. This applies even to the incumbent President if he is reelected as President later this month.

Need for transforming the economy structurally

The quantitative targets that have been incorporated into ETA have been drawn from the agreement which Sri Lanka had made with IMF for EFF and some other targets relating to areas like economic growth. Sri Lanka should transform its economy structurally to ensure a high economic growth and deliver prosperity which its people aspire to attain.

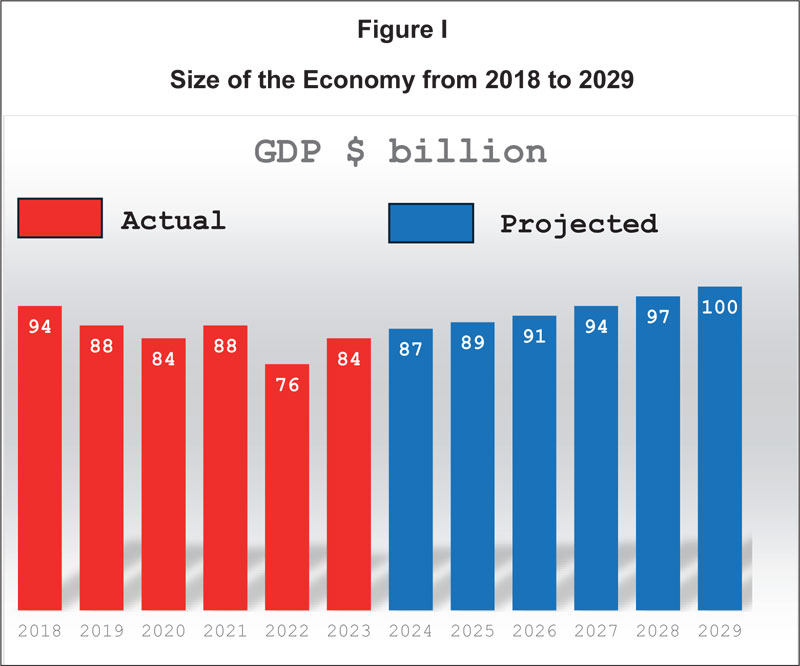

There are three valid reasons for such a structural transformation. One is that Sri Lanka still produces products of simple technology to the global markets. About 95% of the goods and services it exports to the rest of the world fall into this category. This is shown by the Economic Complexity Index which Harvard University’s Center for International Development or CID prepares for individual countries in the world annually. The data in the index are presented in the form of a map and the map for Sri Lanka for 2021 is given in Figure II. It is only the blue area that represents the complex products.

The second reason is that, while the world has now evolved from the first industrial revolution to the fourth industrial revolution and is on the verge of a fifth one now, Sri Lanka is still producing goods and services basically by using electricity driven machinery, a feature of the second industrial revolution. It should leapfrog from the second to the fourth bypassing the third if it should show its presence in the global markets. This involves a quantum leap as shown in Figure III.

The third reason is a more compelling one which is personally attributed to the incumbent President Ranil Wickremesinghe. Addressing Parliament in August 2022, he pronounced that his Government’s goal is to make Sri Lanka a developed country by 2048 when it will celebrate the centenary of independence from Britain. This is a long-term goal to be achieved in about another 25 years, which represents the passage of one generation and is, therefore, practically attainable.

It is important that the new President, no matter whether it is Ranil Wickremesinghe or someone else, should faithfully pursue this goal. Since the present economic structure based on the production methods followed during the second industrial revolution does not permit Sri Lanka to do it, it is necessary, as a matter of utmost priority, the country’s economy should be transformed structurally.

Modi’s approach through NITI

India’s Premier Narendra Modi too made a similar pronouncement about a year before Sri Lanka did so when he made the 2021 Independence Day address. He pronounced that the goal of his government is to make India a developed country, tag named by Viksit Bharat or Developed India, by 2047 when India will celebrate the centenary of independence in that year. This is good news because Sri Lanka could follow the Indian strategy together to make itself a developed country.

India approached the problem by engaging its National Institute for Transforming India or NITI, an outfit created in 2015 replacing its age-old National Planning Commission, to prepare the blueprint for delivering the results. To its credit, NITI did so by having wide consultations with all the stakeholders including state governments. Hence, NITI’s plan is a national plan where ownership will be held by all rather than being a Modi’s plan. Therefore, governments of different hues will also follow the same with perhaps minor modifications to suit the emerging situations.

Sri Lanka’s non-implemented Growth Lab approach

Sri Lanka’s President Ranil Wickremesinghe too promised to come up with a National Transformation Plan prepared by following the Growth Lab approach, a technique developed by CID of Harvard University. According to the milestones he fixed for the process, the lab consisting of private sector leaders, bureaucrats, and Cabinet ministers will be assembled in the third quarter of 2023, the plan will be ready in the fourth quarter to solicit public views, and by early 2024, a national transformation plan would be ready for submission to Parliament for its approval. None of these milestones were followed and therefore it became just a talk without action.

However, while delivering the President’s speech at the opening of the new session in Parliament in early February 2024, he announced that an economic transformation act is ready for submission to Parliament in April 2024 for its approval. The glaring deficiency here was that it was not a national transformation plan but a narrower economic transformation legislation that had been prepared by some unknown bureaucrats and not by following public consultation. It is this legislation which Parliament has approved binding future governments to comply with.

Since it has been prepared without public consultation, its ownership lies with those who prepared it and those who voted for its enactment in Parliament. It is unlikely that such a plan will survive in the long run even if Ranil Wickremesinghe is reelected. That is because the goals which have been set in a scenario of debt suspension and import restrictions will make it tougher when these conditions are removed.

Harder quantitative targets

One goal is to bring the central government debt to GDP ratio below 95% by 2032. The current level of debt with import restrictions and debt suspension is about 119% at end 2023. However, when the external debt in arrears amounting to $ 6.6 billion as at end-2023 is added to the debt stock, the ratio will jump to 127%. If the creditors do not agree to write off these arrears, the new President will have to strain more to comply with this target.

The government’s gross financing requirement, that is the gap in the budget between the revenue and the expenditure without assuming that the maturing debt is not repaid by further borrowing, should be brought down to 13% by 2032. Again, with debt suspension, the requirement proposed in Budget 2024 is 24% of GDP; but without debt suspension, it will jump to 33%.

Again, a more difficult task. A third target is that the foreign debt servicing to GDP should be reduced to 4.5% by 2027 but the current ratio of 1.7% will increase to 10% if debt suspension is not permitted.

A fourth target is to maintain the deficit in the current account of the balance of payments below 1% of GDP. Currently, it is a surplus of 2%, but in a scenario of not having debt suspension, it will be converted to a deficit of 5%, a harder starting position for the new President.

A more controversial target is the conversion of the primary account of the budget to a surplus of 2.3% till 2032 and to 2% thereafter. Primary account balance is the gap between the total net expenditure, that is without maturing debt, and interest payments and the total gross revenue of the government. Since the debt servicing is a non-discretionary expenditure, the objective of the target for a surplus in the primary account is to force the Government to cut all other expenses which are considered discretionary expenses. In 2023, a surplus of 0.6% was recorded to the much praise of IMF and jubilation of the President Ranil Wickremesinghe. But this was recorded by drastically cutting the discretionary capital expenditure from around Rs. 1,220 billion, promised in the Budget 2023, to Rs. 657 billion as reported by Central Bank in its Annual Economic Review for 2023. Cutting capital expenditure was not what was expected of having a surplus in the primary account. Such a cut that denies essential public investments to the economy diminishes the future growth prospects. This is window dressing of data and the new President should not fall into this trap.

Another target is to increase the government revenue to GDP ratio to 15% of GDP by 2027. The current level is 11% of GDP and the new President should run faster to raise the ratio to 15% by fast expansion of the tax net, on one side, and introduction of new taxes like property taxes. The attainment of this goal will be made much more difficult because all the leading presidential candidates have promised to cut the tax rates if they are elected.

The other goals relating to reduction of the poverty head count level to below 15% of population by 2027 is also a hard task with the present level of 26% according to the World Bank which uses a Purchasing Power Parity or PPP Income of $ 3.65 a day. However, a PPP income of $ 6.85 is used, it jumps to 67% meaning that there many marginal income earners who are vulnerable and would fall into poverty if economic conditions become worse.

Further, the real growth in the economy that will increase the prosperity and wellbeing of people should be at least 5% till 2027 and above 5% thereafter. This is why it is necessary for Sri Lanka to transform the economy structurally to attain and sustain a high growth. As Figure I shows, the growth prospects for Sri Lanka till 2027 are very bleak. Since Sri Lanka’s savings are inadequate to meet the investments needed to have the target economic growth rates, it is necessary for the country to make more foreign borrowing to fill the saving-investment gap. It will increase the country’s debt stock to unmanageable levels.

The other important targets like having a net zero carbon emission by 2050 have been set by UN and any future government will have to follow them.

Fate of ETA

What this means is that ETA designed by some unknown bureaucrats has no public ownership. The goals which have been set in a scenario of debt suspension and import restrictions are difficult to be attained once these restrictions are removed. Probably, the new President will have to disregard the targets since it is practically more difficult to comply with and there is no punishment if they are not attained. A similar situation arose when the Fiscal Management (Responsibility) Act was enacted in 2003 by binding future governments to reduce the debt to GDP ratio below 60% by 2013. None of the successive governments could comply with this requirement and in 2013 and 2021, the target dates were postponed as a practical measure. Now the said Act has been repealed under the Public Finance Management Act passed by Parliament earlier. This is what will happen to laws when future governments are bound for certain fixed goals by the present Parliament.

Hence, the biggest woe of the new President will be to comply with the quantitative targets set for him by the previous Parliament.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)