Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 8 July 2024 00:29 - - {{hitsCtrl.values.hits}}

Are we taking the right measures to address the debt problem?

After a disastrous handling of the economy during and in the immediate aftermath of COVID-19 in 2020 and 2021, the then President was unceremoniously (and possibly justifiably) removed from office. But is the economy on the right track since then?

After a disastrous handling of the economy during and in the immediate aftermath of COVID-19 in 2020 and 2021, the then President was unceremoniously (and possibly justifiably) removed from office. But is the economy on the right track since then?

No magic wand that brought about apparent stability

The relative stability of the economy since mid-2022 was broadly due to the following:

1. Introduction of QR code, which eliminated fuel queues.

2. Increase in rainfall in mid-2022, which eased the power cuts. As the rainfall reduced towards the end of 2022, electricity tariff was increased sharply which reduced demand.

3. Halt of service of foreign debt which decreased foreign currency outflows.

4. Exorbitant increase in interest rates and depreciation of currency in mid-2022 which plummeted demand for imports and eased foreign currency outflows. While interest rates have fallen sharply in recent months, Rupee has also strengthened to an extent.

5. Gradual return of tourists since COVID-19 absence, which was bound to happen over time. Gradual return of foreign worker remittances with relative stability, which was also bound to happen. The combination of the two increased foreign currency inflows.

These factors show that both the problem and the solution was centred on foreign currency inflows and outflows. In that light, are we taking the right measures to address the debt problem?

What’s causing the debt pile?

To be clear, Sri Lanka’s problem is with foreign currency debt. Sri Lanka is still servicing its local currency debt and has no problem in dealing with that. The economic crisis in 2022 was a case of a severe shortage of foreign currency, where the country was incapable of importing even the basic necessities. So what has caused the foreign currency debt burden?

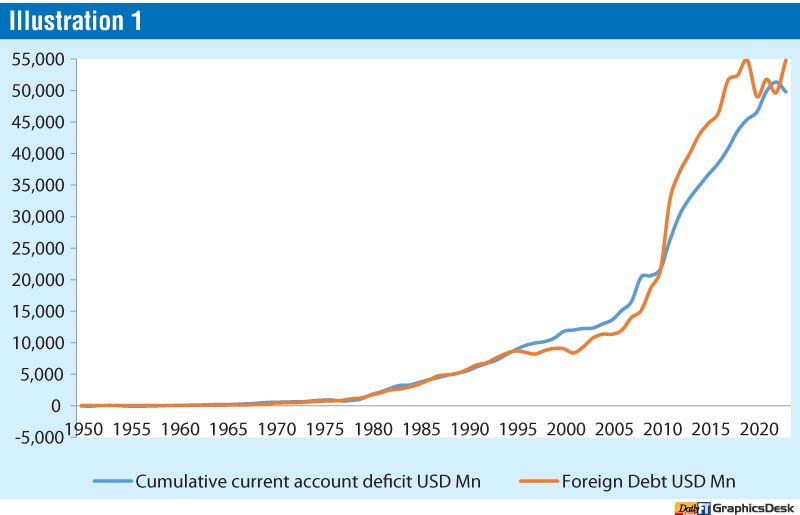

As shown in Illustration 1, the data from 1950 all the way to the present date clearly indicates how the accumulation of deficit in the external current account, (i.e. exports including trade and services being lower than imports) is almost identical to the buildup of foreign debt.

Sole solution is to boost foreign currency earnings

Despite this obvious cause, there is little direct attempt made to bridge this deficit as a solution to the foreign debt problem. While selected import restriction could be an inevitable short-term strategy, it is not a sustainable long-term solution.

The sustainable long-term solution is to increase foreign currency earnings. Although there’s lot of lip service on the subject, to achieve something material, there should be significant investment and incentives for the foreign currency earning segments.

Tourism and worker remittances at best only a part of the solution

While Tourism is the low hanging fruit in terms of foreign currency earnings, on one hand that alone would not be sufficient to pull Sri Lanka out of external current account deficit, while on the other hand it is a very volatile segment (as seen during the pandemic and in the aftermath of Easter attack) and overly dependence on this sector could be disastrous.

Foreign worker remittances at best is just a temporary solution. Hardly any country in the world has developed by exporting people to other countries and depending on what they remit. On the contrary, countries have developed by attracting and retaining people of other countries into their country to boost the economies.

Reform economy from import-based consumption to export oriented

The need of the hour is to convert from import and consumption driven to a more export driven economy. This would be a painful transition as the economy is used to be import and consumption dependent for decades. Nevertheless, it’s a necessary transition to address the foreign debt problem. Some basic measures to implement this transition could include:

1. Reduce taxes for employees in foreign currency earning segments.

2. Provide incentives to both global and local companies including tax concessions to foreign currency earning service segments.

3. Continue prevailing tax structure for other segments as the tax policy is not only a way of generating revenue to the Government but a way of diverting focus from import dependent consumption segments to export segments.

4. Align foreign/geo-political strategy to attract foreign investments into Technology sectors so that Sri Lanka gets connected to the global technology value chain.

5. Government to invest in tertiary/professional education with a view to increase the availability of workforce for foreign currency earning segments.

The rationale is to shift investments and workforce towards foreign currency earning segments gradually over time.

Secret recipe – tapping into global technological value chain

The countries that are thriving and would continue to thrive in the modern economy are the ones that are well connected to the global technology supply chain. Although the most sophisticated areas are artificial intelligence, advanced chips, electric vehicles, etc., the field of technology is large enough that there are second tier areas that a country like Sri Lanka could exploit.

It is the Software and BPM industry with annual earnings of around $ 1 billion that is the leading Technology sector in Sri Lanka. The relevant industry body SLASSCOM has stated in 2023, that the annual graduate output requirement of the industry is 25,000. Yet, the actual annual output meets only around one third of that. This is one area where Government should invest, at least in the form of PPPs (Public Private Partnerships).

Sri Lanka last enjoyed real foreign reserves in 1962

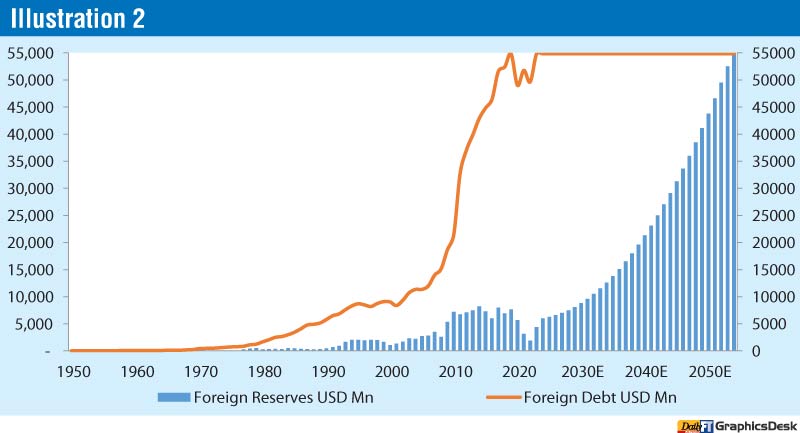

For a country to have real foreign reserves, it should be over and above the size of its foreign debt. This was last recorded by Sri Lanka way back in 1962. It is by achieving this, that Sri Lanka’s foreign debt can become sustainable. Creating a surplus in external current account is the first step towards that goal. As decades of catching up needs to be done, external account discipline should be maintained for 20-30 years to achieve a status of real foreign reserves, as shown in Illustration 2.

When this process starts, the foreign lenders would have confidence that Sri Lanka will be capable of servicing its foreign debt. External discipline should be installed so that whatever new foreign debt would be only to service or repay existing foreign debt, which would ensure that the foreign debt burden wouldn’t grow further.

Addressing both deficits simultaneously is a recipe for failure

The last time Sri Lanka recorded a surplus in the overall fiscal balance (Government revenue being higher than expenditure) was in 1955. The last time Sri Lanka recorded a surplus in the external current account was in 1977. These two were the chronic ailments of the economy for decades.

As solving one of these issues is daunting by itself, trying to rectify both simultaneously is a recipe for failure as we have experienced over the last so many decades. Therefore, once the imbalance in the external account is addressed to an extent only, the attention should shift to bridge the fiscal deficit. Letting domestic debt (or LKR denominated debt) rise in the medium term is not a severe problem, comparatively. Japan is a case in point, which has a domestic debt stock close to 200% of its GDP.

Fiscal discipline should start with expenditure rationalisation

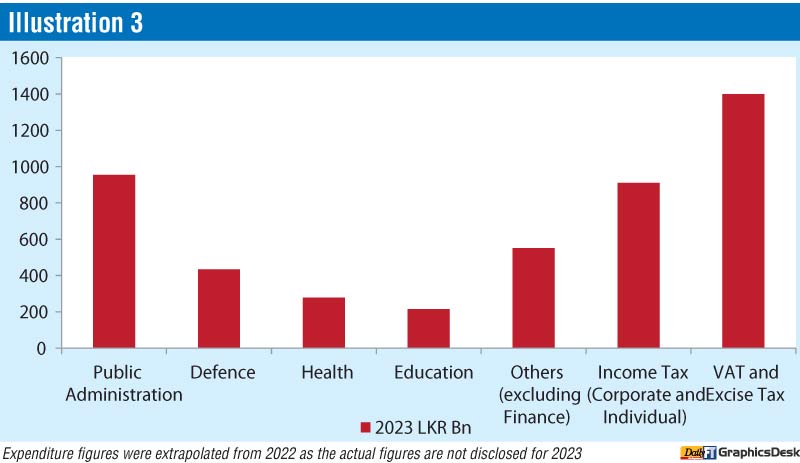

Eventually, in the effort to reduce the difference between Government revenue and expenditure, it is necessary to identify the key causes of Government recurrent expenditure. A staggering allocation around Rs. 400 billion for Defence at a time when there’s no war in the country, defies logic. Almost half of the direct taxes raised from individuals and companies (even after the exorbitant hike last year) is spent on that. With greater efficiency, less wastage and use of technology, the expenditure on Public Administration also should be brought down, which is using up around two thirds of the revenue from VAT and Excise Tax.

It is clear that prior to increasing taxes, the focus should be to rationalize expenditure. The Government expenditure should be limited to key strategic segments and safeguard the most vulnerable bottom 25% of the population.

It is also apparent that hardly any Government expenditure directly boosts foreign currency earnings. This could be a key reason for the lacklustre growth in foreign currency earnings (with the exception of Tourism and worker remittances) over the last several decades.

Current tax policy would not reduce fiscal deficit

The across the board increase in taxes over the last two years would show a temporary, short-term rise in tax revenue and contraction in fiscal deficit. However, as history has repeatedly shown, the ensuing slowdown of the economy would bring down the tax revenue and the fiscal deficit would revert to expansion mode within a year or two. The economic growth is well into low single digits and is unlikely to reach even 3-4% with the current policy environment (let alone 7-8% needed over 20-30 years to make Sri Lanka a developed country).

As a result, taxes would have to be raised further to continue bridging the fiscal shortfall which would further slow down the economy. Hence the country would be trapped in a vicious cycle of decline.

Brain drain to suck the life out of the economy

What would be equally damaging is the impact from the high tax regime on private sector labour force. Official records show well over 200,000 have left the country in 2022. While official data is not available for 2023, it is likely to be even higher. The trend is continuing in 2024. As young professionals feel bleak economic prospects (increase in PAYE tax foremost in their minds) it is likely to continue into 2025.

Around 600,000 people leaving the country from 2022-2024 is actually about 3% of the most productive, young, skilled professionals of the country. A significant proportion could have been in foreign currency earning segments. They are not unionised and do not engage in protests. Yet, they would abandon the country in silence, while successive Governments give-in to pressure from unionised groups which are not earning foreign currency.

Foreign debt burden would expand and remain unsustainable

With no incentives and higher taxes, foreign currency earnings segments could also falter which would expand the external current account deficit. As a result, Sri Lanka would need to resort to further foreign debt to meet the import bill. As shown in Illustration 2, the debt sustainability is based on building net foreign reserves and the present fiscal policy and economic policy does not indicate how this could be achieved.

The entering into FTAs with relatively low per capita GDP competitive countries is likely to expand the external deficit rather than narrow it, as local foreign currency earning segments struggle with migrating labour. If at all to benefit, Sri Lanka should enter into FTAs with high per capita GDP countries which is hardly materialising.

Discriminating local entrepreneur to favour large foreign players

It is logical to provide incentives and attract large Technology entities into the country. However what is not logical is not to provide the same incentives to local entrepreneurs in the same foreign currency earning sectors.

This would discourage local entrepreneurs and wipe them out outright and create unnecessary animosity towards large foreign technology companies.

Not the fault of IMF

While many could feel the above repercussions are caused by the IMF, it is not so. It is Sri Lanka that sought IMF assistance and not the other way around. There was no real alternative after the economic disaster in early 2022.

The role of the IMF is not to set the country on a development path or develop foreign currency earnings. Its role is to put the house in order in terms of Government revenue and expenditure. Developing a country and boosting foreign currency earnings, is up to the country itself depending on the strength of its people, policy makers and a sound strategy. Obviously, the IMF is not in a position to do that for every country in the world.

In that light, it’s up to the policy makers to come up with the strategy of putting the country on a development path (around the strategy of developing foreign currency earnings) and of course a subsequent plan to put the house in order, i.e., bridge the difference between Government revenue and expenditure.

Current path leads to a worse default within 10-15 years

Based on the practicality and soundness of the strategy and the strength of negotiating power of local policy makers, it should be possible to convince the IMF to ease some of the counter-productive measures which could harm the growth in foreign currency earning segments and jeopardise the long-term growth of the country. The stiff negotiations should not be on the size of the haircut with debt providers. In fact, lesser the haircut, the more confident the debt providers would be about the future.

On the other hand, irrespective of the size of the haircut, as mentioned above, if measures are not implemented to boost foreign currency earnings (to record a sustainable surplus in external current account and build up foreign reserves), foreign debt bubble would continue to grow and another default with worse repercussions is inevitable within the next 10-15 years.

UNP and SJB not supportive of exporters

What is unfortunate is none of the political parties seem to be equipped to implement a sound economic program for sustainable development of the country.

The UNP and SJB being the two sides of the same coin, are unlikely to negotiate much with IMF conditions and likely to continue with the higher taxes for foreign currency earning segments. This is clear by their actions in both 2016 and 2022 under the IMF programs.

Their rhetoric on export development is based on FTAs which would not result in a boost in net exports. It is wishful thinking to expect foreign currency earnings could grow by not making any Government investment or not letting go of tax revenue from foreign currency earning segments.

Unpredictable NPP with no track record

In the absence of a track record, the NPP needs to clearly articulate what their economic strategy is. Yet, what’s mostly heard is “an end to corruption and recovery of stolen wealth” etc. This kind of political slogans would generate little results in reality. Developing a country is not an easy one and if one thinks it could happen automatically, it is wishful thinking.

With little experience in governing the country, the outcome is unpredictable at best if the NPP comes into power.

SLPP unlikely to come to power

After the disastrous handling of the economy under President Gotabaya in 2020 and 2021, the people are unlikely to give a mandate to SLPP this time. To their credit, they have been more supportive of the foreign currency earning segments through tax incentives.

Nevertheless, as the party that governed for the most part over the last two decades, they failed to aggressively invest in Education and Technology with a view to boost foreign currency earnings, and instead solely focused on highways and ports. They also failed to reduce the size of the Government which would have reduced Government expenditure.

Plea for political parties to alter vision

The above is the stark reality of the country as of now, with the Presidential election just a few months away. Those of us who are still in this country, refusing to migrate, deserve better options.

Politicians and policymakers, the majority of them, do want the country to succeed. But they need to understand both the past as well as current strategies would not succeed. It may not be too late at least for one of the parties, if not all, to realise it and amend their economic vision for the next five years. The purpose of this article would be accomplished if that materialises.

(The writer could be contacted on [email protected].)