Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 1 July 2024 00:26 - - {{hitsCtrl.values.hits}}

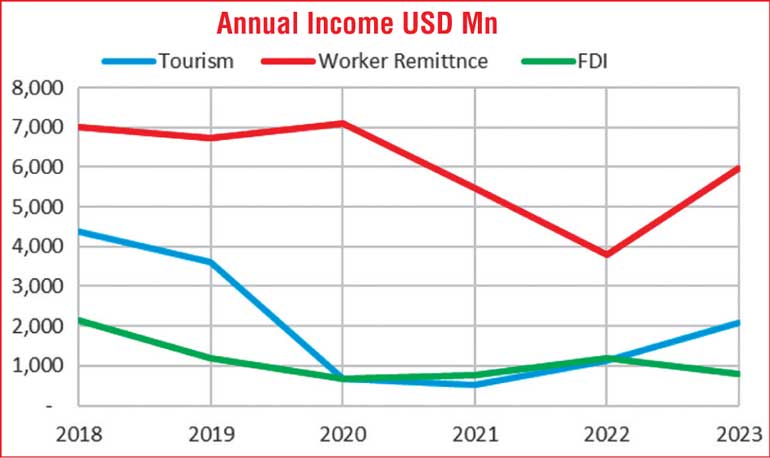

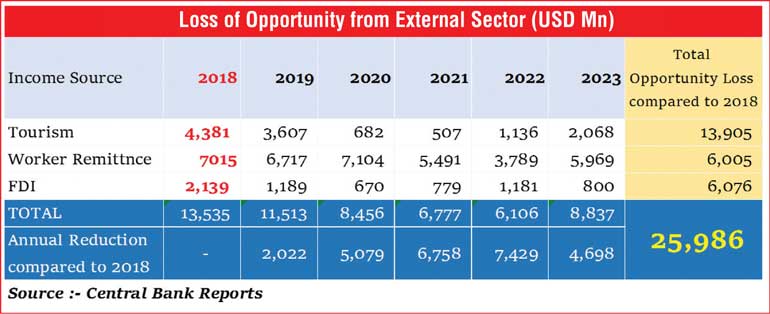

The table illustrates the accumulated foreign currency inflow gap for Sri Lanka over the past five years compared to 2018, the year before the COVID-19 pandemic and the Easter Sunday attacks. To emerge from the current crisis, it is crucial to strengthen and expand these verticals. According to the table, Sri Lanka has experienced a loss of about $ 26 billion over the past five years, compared to if it had maintained the same inflow numbers as in 2018 each year.

The table illustrates the accumulated foreign currency inflow gap for Sri Lanka over the past five years compared to 2018, the year before the COVID-19 pandemic and the Easter Sunday attacks. To emerge from the current crisis, it is crucial to strengthen and expand these verticals. According to the table, Sri Lanka has experienced a loss of about $ 26 billion over the past five years, compared to if it had maintained the same inflow numbers as in 2018 each year.

Tourism

The impact from tourism over the past five years amounts to approximately $ 13.9 billion. During this period, the industry was severely affected due to a global tourism slowdown. Consequently, we failed to maintain hotel standards even at their previous levels. This has resulted in poor conditions of the facilities, pressing room rates down compared to regional competitors.

We possess a rich culture and nature that can be translated into substantial USD revenue, but attracting the right tourists requires the right facilities. Therefore, it is imperative to uplift our standards at least to their previous levels. Tourism is the easiest yet most impactful industry to develop, as tourists prioritise present peace, security, and convenience over economic stability or prosperity.

Worker remittances

Sri Lanka lost about $ 6 billion from the reduction of worker remittances over the past five years compared to 2018. Due to an unregulated foreign exchange policy, workers opted for alternative options that provided additional benefits. This led to a significant decline in foreign currency inflow via legal channels, dealing a huge blow to the balance of payments.

In the past two years, nearly 600,000 workers have left for foreign jobs. Therefore, we can expect higher remittances as most of the workers who left the country in recent years are skilled workers earning significant salaries. Therefore, foreign remittances have the immediate potential to increase up to the $ 8 billion level. However, this will only be possible by building their confidence in the conduct of the Government. Improving worker remittance might not be as easy as tourism, as every worker considers the safety of their money before remitting, even if their families are living in the country.

FDI

Sri Lanka lost the opportunity to attract $ 6 billion worth of FDIs over the past five years compared to 2018. Attracting Foreign Direct Investment (FDI) is the most challenging task among the three verticals in the table. Political and economic stability play a major role in this area. Every investor considers the return on their investment before committing. Reasonable taxes, sound and competitive infrastructure are necessary parameters to consider, alongside sufficient factors such as the availability of skilled labour at a reasonable cost, profit expatriation policies, and close proximity to markets.

Having all above key recovery paths available, we are looking at $ 2.9 billion to be received from IMF over a period of four years under the austerity program. IMF has imposed 10 conditions as below.

The above 10 points mainly focus on internal controls, even though a major part of the solution lies outside as the route cause for the issue was. Among these conditions, there are a few counterproductive ones that have available external solutions. Furthermore, the most critical conditions needed for outsiders to remit their money have not been implemented up to now, as per the recent IMF review.

To sustainably and quickly come out of the current crisis with minimum social damage, we need to improve our income from tourism, worker remittances, and FDI before pressuring the public with IMF policies. This is the 17th time we are approaching the IMF and have obtained $ 4.5 billion during the previous 16 programs showing characteristics of a vicious cycle. Are we on the right focus?

(The writer holds a PhD, MBA, BSc Eng, CMA (AUS), CGBA and could be reached via email at [email protected].)